Undoubtedly, this crypto bull market was first launched in the US stock market.

When the "crypto treasury reserve strategy" becomes a trendsetter in US stocks, and crypto and stocks are interconnected, how should we evaluate the quality of a stock? Is it by looking at who has a larger amount of reserved crypto assets, or who keeps buying crypto assets?

If you have been frequently analyzing crypto US stocks recently, you should have repeatedly seen a term - NAV, which stands for Net Asset Value.

Some use NAV to analyze whether crypto stocks are overvalued or undervalued, while others use NAV to compare the stock prices of a new crypto reserve company with MicroStrategy's stock price. The more critical wealth code is:

If a publicly listed US company implements a crypto reserve strategy and holds 1 dollar of cryptocurrency, its value is greater than 1 dollar.

These crypto asset reserve companies can continue to increase their asset holdings or buy back their own stocks, often causing their market value to far exceed their NAV (Net Asset Value).

However, for ordinary investors, most projects in the crypto market are rarely evaluated with serious indicators, let alone using them to assess the value of stocks in traditional capital markets.

Therefore, the editor also plans to popularize the NAV indicator to help players focusing on crypto-stock linkage better understand the operating logic and evaluation methods of crypto and stocks.

NAV: How Much Are Your Stocks Really Worth?

Before delving into crypto US stocks, we need to first clarify a basic concept.

NAV is not an indicator specifically designed for the crypto market, but one of the most common methods in traditional financial analysis for measuring a company's value. Its essential function is to answer a simple question:

"How much is a company's stock per share really worth?"

The calculation of NAV is very straightforward: the value per share that shareholders can receive after subtracting the company's liabilities from its assets.

To better understand the core logic of NAV, we can use a traditional example. Suppose there's a real estate company with the following financial situation:

Assets: 10 buildings, total value of $1 billion; Liabilities: $200 million in loans; Total share capital: 100 million shares.

Then the company's net asset value per share would be: $80/share. This means that if the company liquidates its assets and pays off all debts, each stockholder can theoretically receive $80.

NAV is a very universal financial indicator, especially suitable for asset-driven companies like real estate companies and investment fund companies. These companies usually have relatively transparent assets and easier valuation, so NAV can well reflect the intrinsic value of their stocks.

In traditional markets, investors usually compare NAV with the current market price of a stock to judge whether a stock is overvalued or undervalued:

- If stock price > NAV: The stock may have a premium, and investors are confident about the company's future growth potential;

- If stock price < NAV: The stock may be undervalued, the market lacks confidence in the company, or there are uncertainties in asset valuation.

When NAV is applied to crypto US stocks, its meaning undergoes some subtle changes.

In the crypto US stock field, the core function of NAV can be summarized as:

Measuring the impact of crypto assets held by a publicly listed company on its stock value.

This means NAV is no longer just the traditional "assets minus liabilities" formula, but needs to specially consider the value of crypto currency assets held by the company. The price fluctuations of these crypto assets will directly affect the company's NAV and indirectly affect its stock price.

Companies like MicroStrategy will particularly emphasize the value of their Bitcoin holdings when calculating NAV, as this part of assets occupies the vast majority of the company's total assets.

As ETH increasingly becomes an asset reserve for listed companies, understanding their mNAV can provide certain reference significance for identifying whether the corresponding US stocks are overvalued or undervalued.

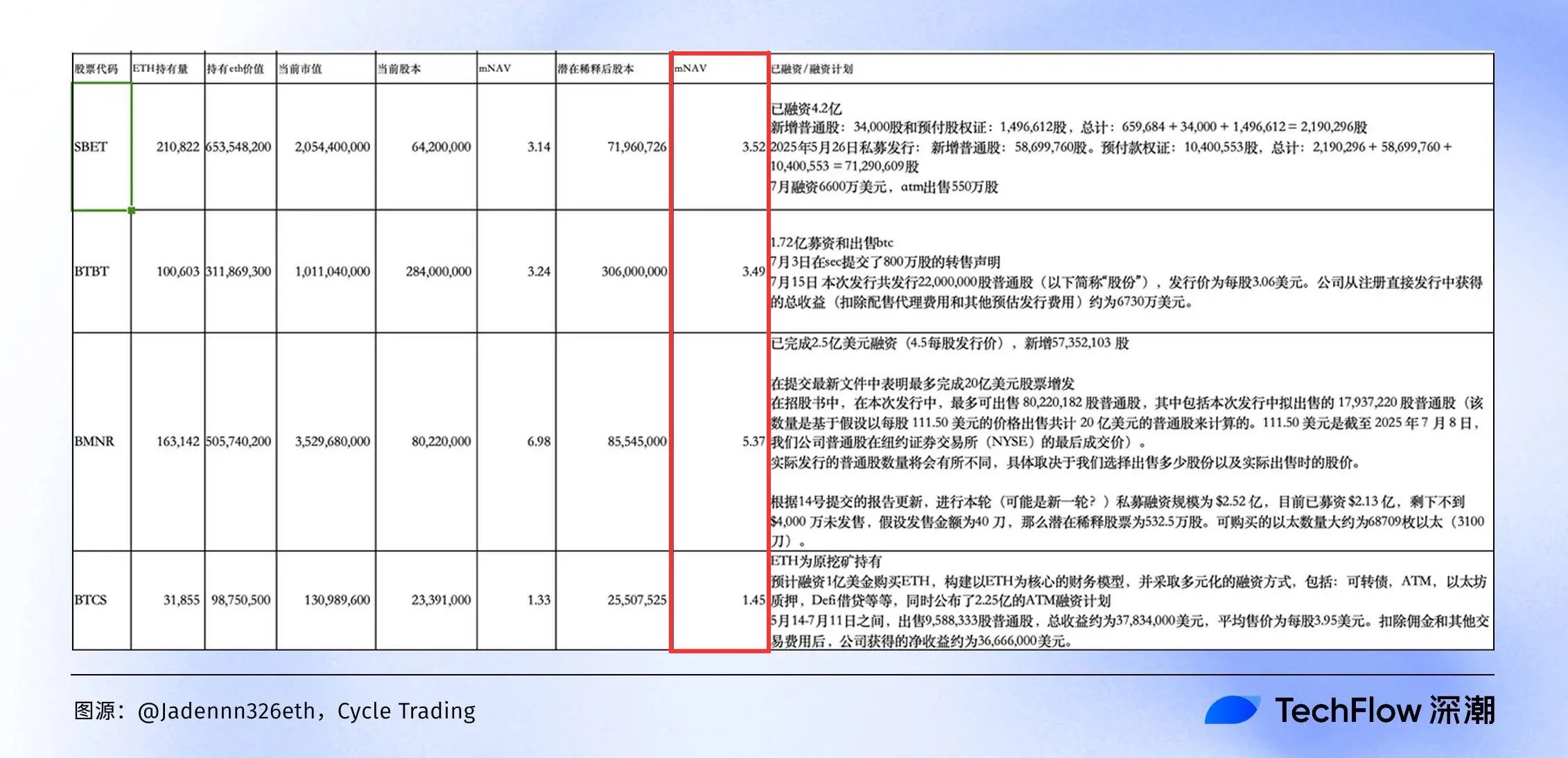

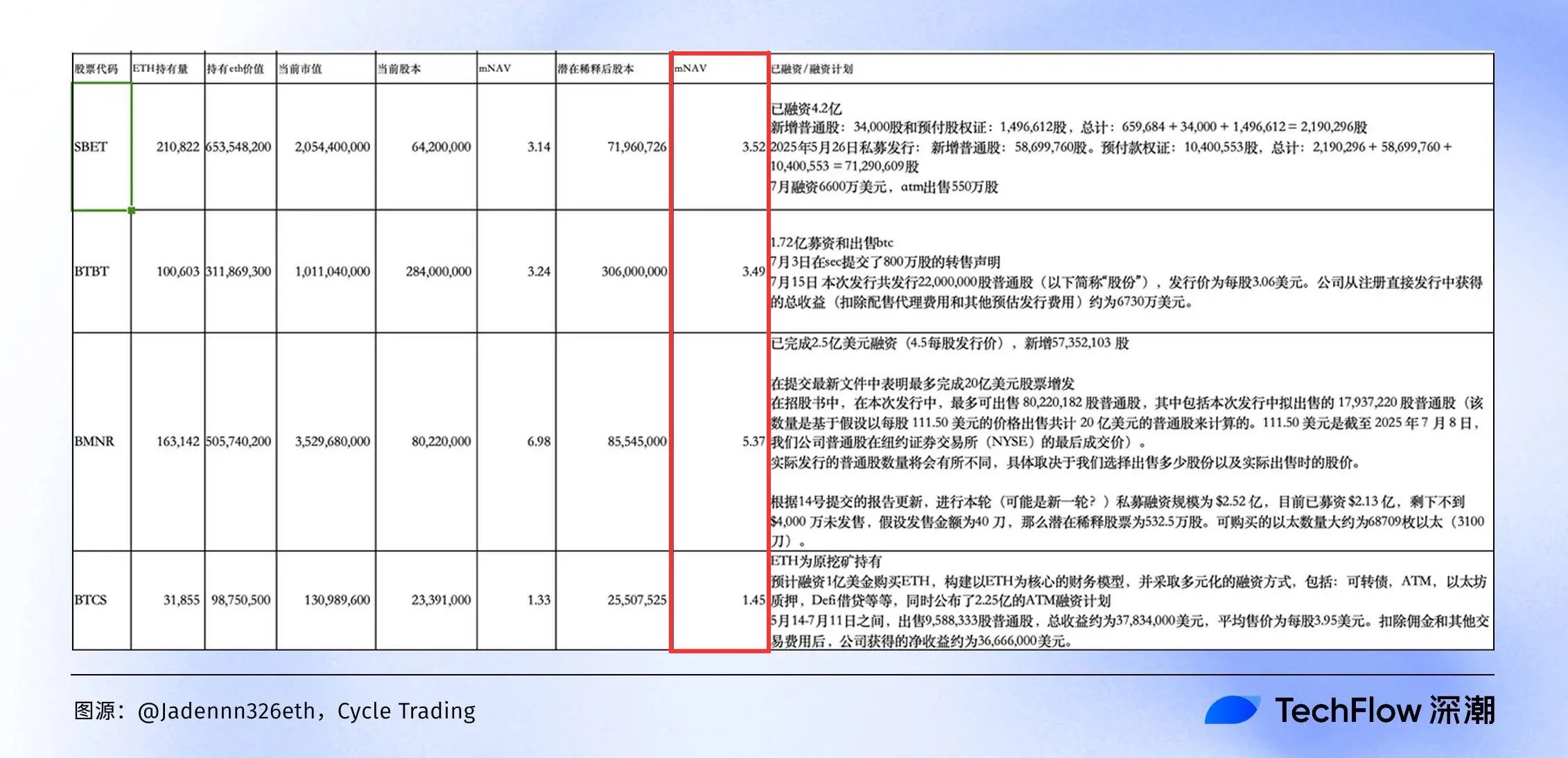

Analyst @Jadennn326eth from Cycle Trading has compiled a quite comprehensive table, intuitively displaying the asset and liability situations and mNAV values of major ETH reserve companies (data as of last week).

From this ETH reserve company mNAV comparison chart, we can see at a glance the "wealth map" of crypto and stock linkage in 2025:

BMNR tops the list with a 6.98x mNAV, with market value far exceeding its ETH holdings value, but this may hide an overvaluation bubble - once ETH pulls back, stock prices will be the first to be damaged. BTCS, with only 1.53x mNAV, has a relatively low premium.

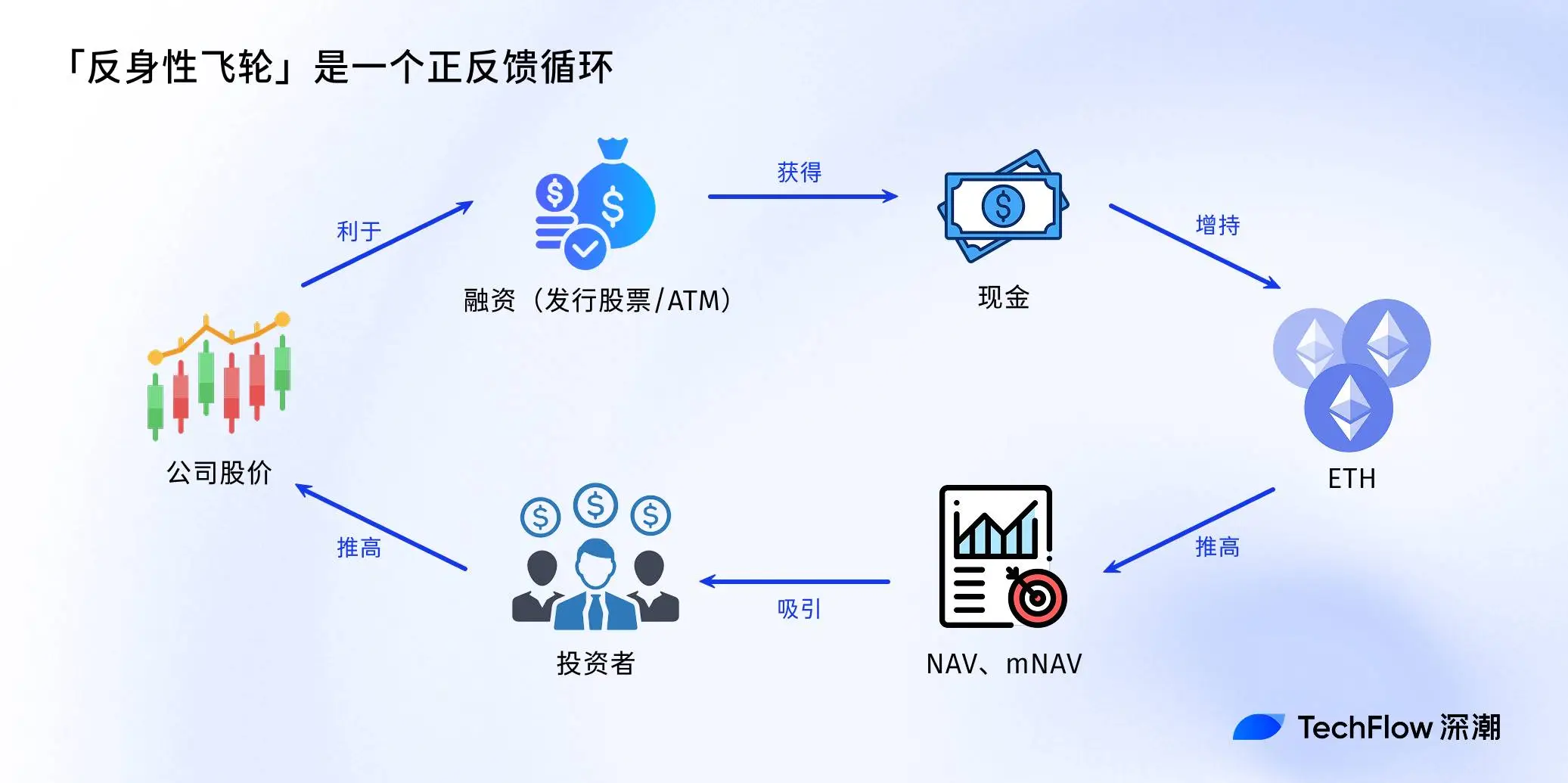

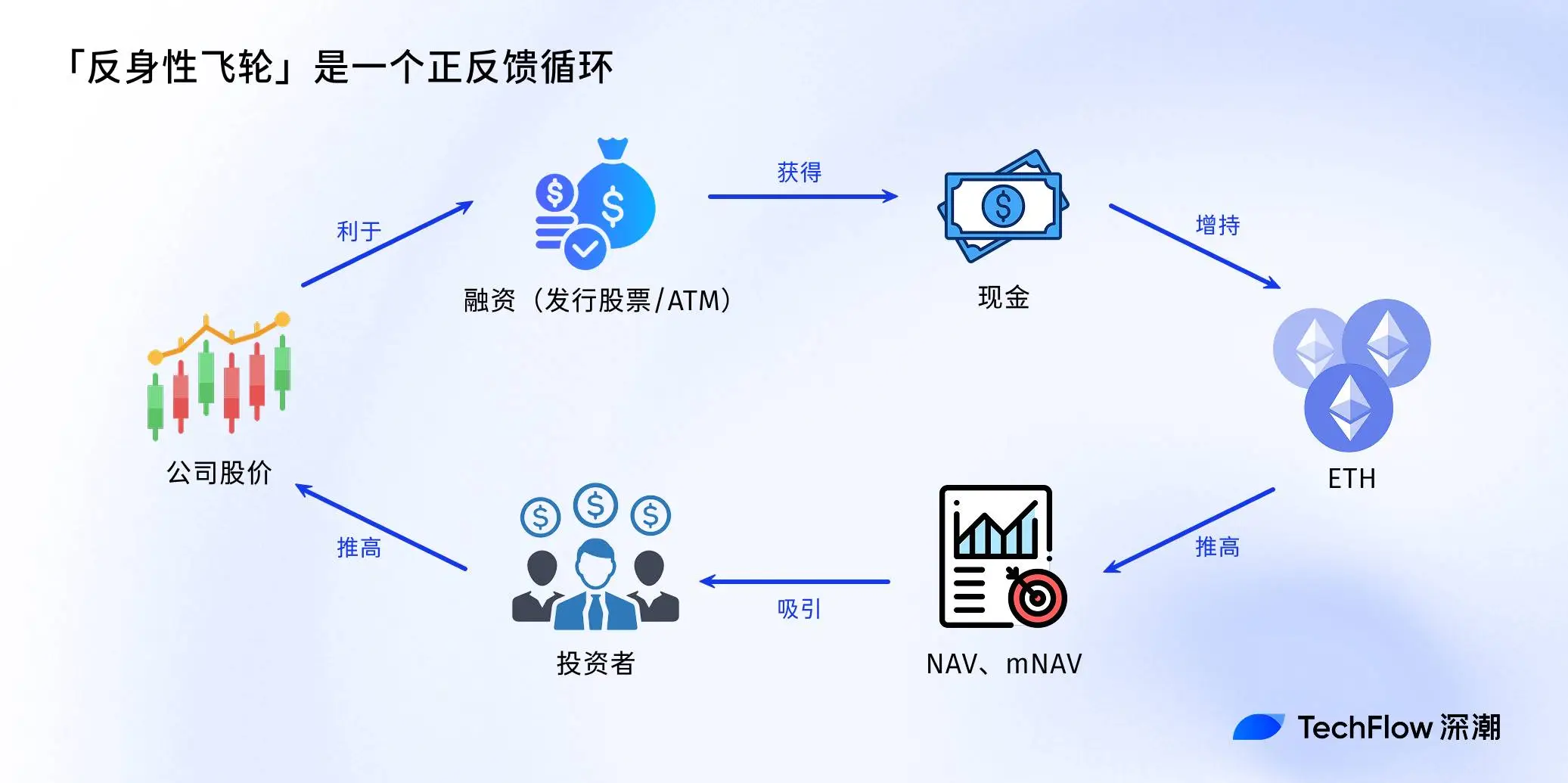

Since we've seen these companies' data, we can't help but discuss the "Reflexivity Flywheel".

This concept originates from financial giant Soros's reflexivity theory, which became the "secret engine" for these companies' stock price surge in the 2025 crypto and stock linkage bull market.

Simply put, the reflexivity flywheel is a positive feedback loop: companies first issue stocks or ATM financing, exchanging cash to massively buy ETH; increased ETH holdings push up NAV and mNAV, attracting more investors, causing stock prices to soar; higher market value then makes it easier for companies to refinance and continue accumulating ETH... thus forming a self-reinforcing, snowball-like flywheel effect.

However, once ETH prices pull back, regulation tightens (such as SEC's review of crypto reserve models), or financing costs surge, the ascending flywheel might reverse into a death spiral: stock market crash, mNAV plummeting, and ultimately, stock market investors might be the ones getting hurt.

Finally, after reading this, you should understand:

NAV and similar indicators are not a panacea, but tools in the toolbox.

When chasing crypto and stock linkage, players should rationally assess opportunities by combining Bitcoin/Ethereum's macro trends, company debt levels, and growth rates to find their own opportunities in a seemingly opportunity-filled but actually dangerous new cycle.