Author: Nancy, PANews

Currently, various cryptocurrencies are competing for market attention with spectacular rallies. Unlike the front-stage players' open competition, Galaxy Digital is one of the behind-the-scenes operators of this treasury narrative. In fact, from asset management services to infrastructure building, from direct investments to structured support, Galaxy is accelerating its compliance transformation and diversification strategy after entering the traditional capital market.

Launching Two Customized Services, Galaxy Becomes the Behind-the-Scenes Promoter of Crypto Treasury

Currently, more and more companies are allocating part of their assets to mainstream cryptocurrencies like Bitcoin and Ethereum, for asset reserves, inflation hedging, and even creating financial returns.

Although the market has concerns about the leverage levels and debt repayment capabilities of some crypto financial companies, Galaxy Digital's research head Alex Thorn recently pointed out that these concerns are clearly exaggerated. He stated, "In terms of overall scale, the debt volume of these companies is relatively limited, and most debts have maturity dates more than two years away."

Behind Galaxy's confidence in the evolution trend of crypto treasury, it is the driving force behind this reserve wave. Whether for new entrants making their first crypto asset allocation or mature enterprises optimizing existing allocations, Galaxy is providing comprehensive support from trading, investment, structural design to technical deployment for major institutions to initiate and expand crypto treasury business.

It is understood that Galaxy mainly provides services for two types of enterprise treasury participants: (1) Self-managed enterprises: Can use Galaxy's institutional-level technology platform to conduct trading, lending, and pledging operations independently; (2) Enterprises seeking custody management: Can collaborate with Galaxy Asset Management to obtain comprehensive management strategies and infrastructure support.

According to official disclosure, in the past few weeks, Galaxy has become the preferred partner for crypto treasury projects of over 15 leading enterprises, such as SharpLink, BitMine, GameSquare, GameStop, AMC, Bit Digital, K Wave Media, TLGY Acquisition Corp, and ReserveOne, providing them with infrastructure, professional services, and end-to-end support. Some partners have committed to investing over $4 billion in crypto assets. In some cases, Galaxy has also invested directly from company balance sheets to support these enterprises' digital asset strategies.

Customized services for crypto treasury are also becoming one of Galaxy's important income sources. Taking SharpLink Gaming as an example, Galaxy not only invested in the company but also signed an asset management agreement to manage its Ethereum treasury. According to US SEC files, SharpLink needs to pay Galaxy and ParaFi Capital an annual fee rate ranging from 0.25% to 1.25%, with a minimum of $1.25 million per year. As SharpLink continues to expand its ETH treasury size, Galaxy will also obtain continuous and substantial income returns.

More notably, with increasing institutional staking needs, Galaxy is also optimizing related services to achieve more revenue. For instance, Galaxy recently announced a collaboration with Fireblocks to directly introduce its staking services to over 2,000 institutional clients on the Fireblocks platform. Additionally, Galaxy has collaborated with institutional-level custody institutions like Zodia Custody, BitGo, and Liquid Collective this year to further expand its staking business. According to official sources, by the first half of this year, Galaxy's staking asset scale reached $3.15 billion.

First Quarter Loss Consumes Annual Profits, Accelerating Diversification Strategy After Listing

"Whether institutions or innovators, they need a trustworthy partner to meet the needs of a globally and digitally connected financial system. Galaxy aims to become the one-stop platform of choice for financial services in the crypto economy," said Galaxy founder Mike Novogratz in the prospectus.

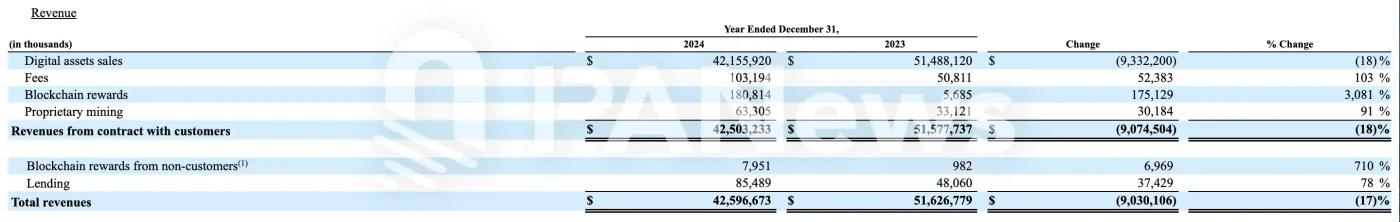

In fact, Galaxy is trying to address the high-volatility and high-uncertainty crypto market environment with a more diversified structural strategy. Currently, Galaxy's business architecture mainly revolves around three core sectors: global markets (covering trading and investment banking), asset management, and digital infrastructure solutions (including mining, staking protocol support, and self-custody technology). Among these, trading business is the revenue cornerstone of Galaxy. According to the prospectus, Galaxy's total revenue in 2024 approached $42.6 billion, with about 99% coming from digital asset trading business. However, this single structure exposes significant risks during market downturns.

This year, with the continued decline in trading activity of non-Bitcoin crypto assets, Galaxy has been directly impacted. By the first quarter, Galaxy experienced a net loss of $295 million, mainly due to crypto asset price drops and the shutdown of the Helios data center mining business. The quarterly loss almost consumed the nearly $350 million net income for the entire year of 2024. Additionally, by the end of the first quarter, Galaxy's asset management scale had sharply shrunk by 29% from the previous quarter, dropping to $7 billion, further demonstrating the pressure of crypto market volatility on its asset management business.

Despite short-term performance pressure, Galaxy still holds ample ammunition. By the end of the first quarter of 2025, the institution held $1.1 billion in cash and stablecoins, as well as $1.9 billion in equity reserves.

Besides the crypto treasury business, Galaxy is currently expanding its other ecological layouts, promoting revenue diversification, and striving to break free from dependence on trading business.

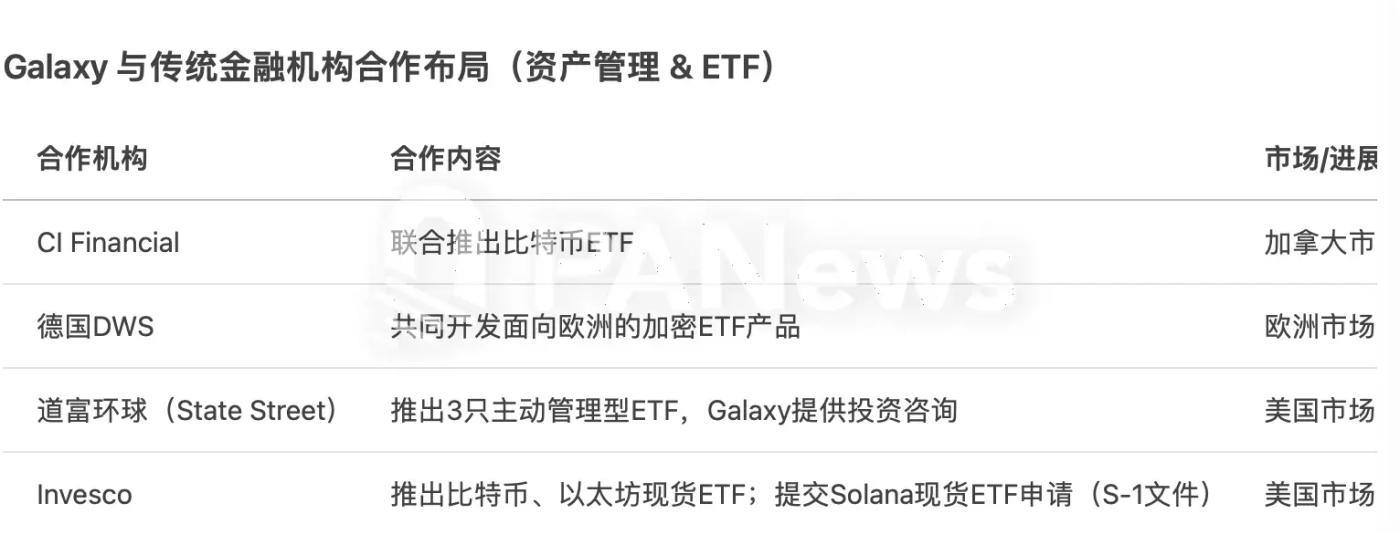

For instance, in asset management, Galaxy is expanding its crypto ETF layout through deep collaboration with multiple global financial institutions. Early in the Canadian market, Galaxy partnered with CI Financial to launch a Bitcoin ETF, helping North American compliant crypto investment products quickly land; in Europe, Galaxy reached a strategic collaboration with German asset management giant DWS to jointly develop crypto asset ETF products for the European market; in the US market, Galaxy has even collaborated with State Street Global to launch three actively managed ETFs, with Galaxy Asset Management providing core investment consulting services. Simultaneously, Galaxy has also collaborated with Invesco to launch Bitcoin and Ethereum spot ETFs and submitted a Solana spot ETF S-1 filing to the US SEC in June, further expanding its product line. Additionally, Galaxy's new fund successfully raised $175 million last month, providing retail investors with a rare opportunity to participate in crypto venture investment portfolios.

For another example, in the digital infrastructure sector, Galaxy is building the next-generation AI infrastructure Helios. In late May, Galaxy issued 29 million Class A common shares after listing, planning to use the net proceeds from this issuance to acquire its subsidiary Galaxy Digital Holdings LP, thereby continuing to expand the AI and high-performance computing infrastructure at its Helios data center campus in West Texas. Previously, Rittenhouse Research gave GLXY a "strong buy" rating, reasoning that its strategy of fully transitioning from Bitcoin mining to AI data centers. Rittenhouse expects Helios will bring $1.7 billion in EBITDA and $32 billion in equity value, far exceeding the volatility and high input of mining business.

Moreover, as the crypto industry gradually moves towards compliance and institutionalization, Galaxy has chosen to embrace the US market in its compliance process. In May, Galaxy, originally listed in Canada, completed a reorganization from the Cayman Islands to the US, officially listing on Nasdaq with the stock code GLXY. Market data shows that GLXY has risen 55.87% in the past month.

Galaxy is working hard to earn money while also paying "tuition fees" for compliance. Previously, to clear compliance obstacles and achieve a smooth transformation, Galaxy spared no expense in settling old cases. In late March this year, Galaxy reached a $200 million settlement with the New York Attorney General's Office (NY AG) regarding the LUNA token manipulation case (where they obtained hundreds of millions of dollars in profits before the LUNA crash). The agreement stipulates that Galaxy Digital must pay $200 million in fines over three years, with the first installment of $40 million to be paid within two weeks.

Whether as a behind-the-scenes beneficiary of crypto treasury or in actively expanding products like ETF and AI infrastructure, Galaxy demonstrates its intention to address market uncertainty through diversified and compliant layouts.

Recommended Reading:

Crypto Beast Operates $ALT Plummeting, KOL Collapse Story Adds Another Stroke