Author: Ignas

Translated by: Luffy, Foresight News

Original Title: 6.05 Billion SOL in Circulation, Where Are They Exactly?

This is a simple question born out of curiosity. Last year, I wrote an article about "Where Did Ethereum Tokens Go". Later, @0xEekeyguy created an excellent public dashboard to query Ethereum token distribution.

So, what about SOL?

Where Are SOL Tokens Hidden?

Disclaimer: This article is still being refined. I need everyone's help to verify the data and provide new information about SOL's current status and ownership.

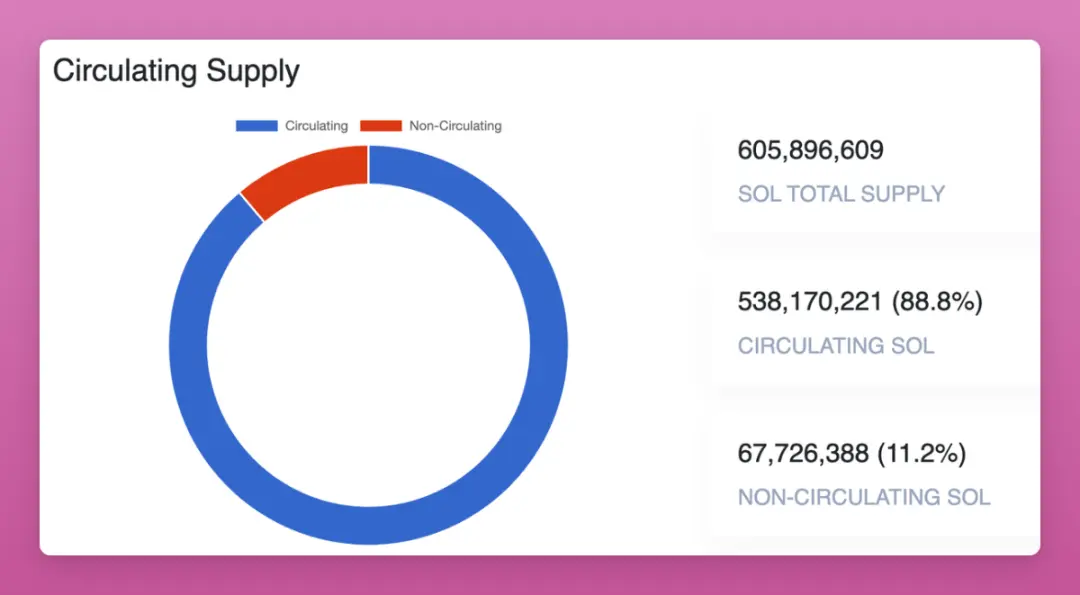

88% of SOL's total supply is in circulation.

Source: https://solanacompass.com/tokenomics, https://coinmarketcap.com/currencies/solana/

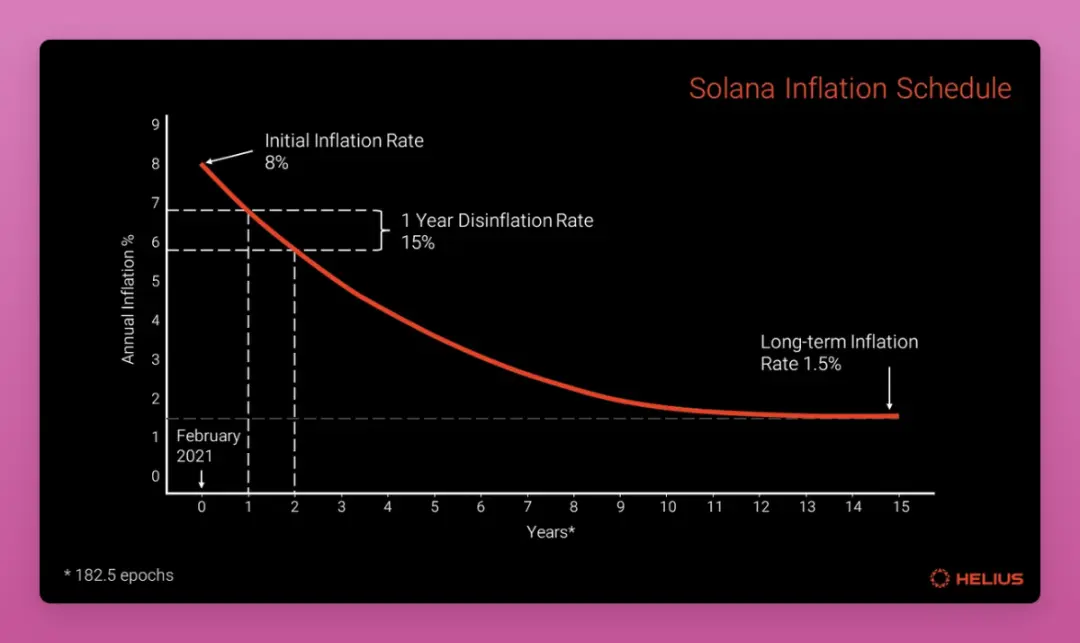

Solana has no supply cap, with a current inflation rate of 4.395% that decreases by 15% annually. The final inflation rate should stabilize at 1.5%.

Source: https://www.helius.dev/blog/solana-staking-simplified-guide-to-sol-staking

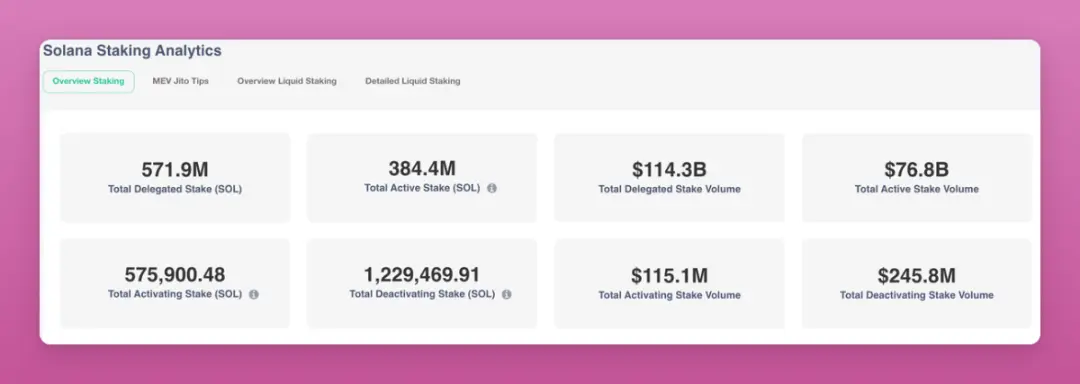

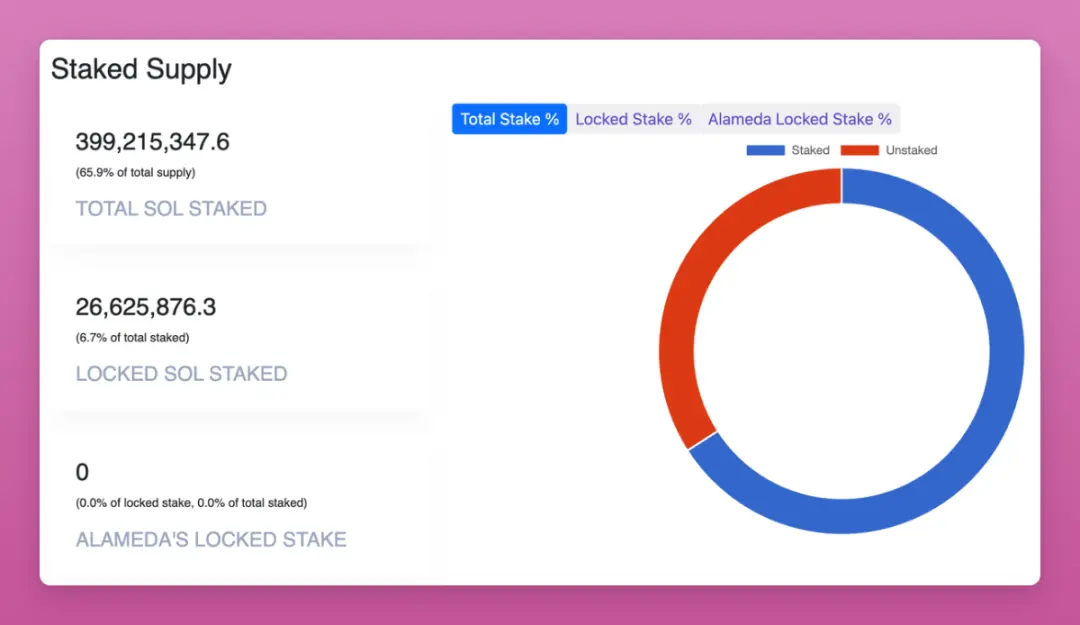

Notably, 71% of SOL's circulating supply is in active staking, compared to 30% for ETH.

Source: https://solscan.io/analysis/solana_staking

However, according to Solanacompass.com, 6.7% of this staking amount is locked SOL (held by venture capitalists, insiders, and team)?

Source: https://solanacompass.com/tokenomics

However, I find it difficult to clarify what these locked tokens are and who they belong to.

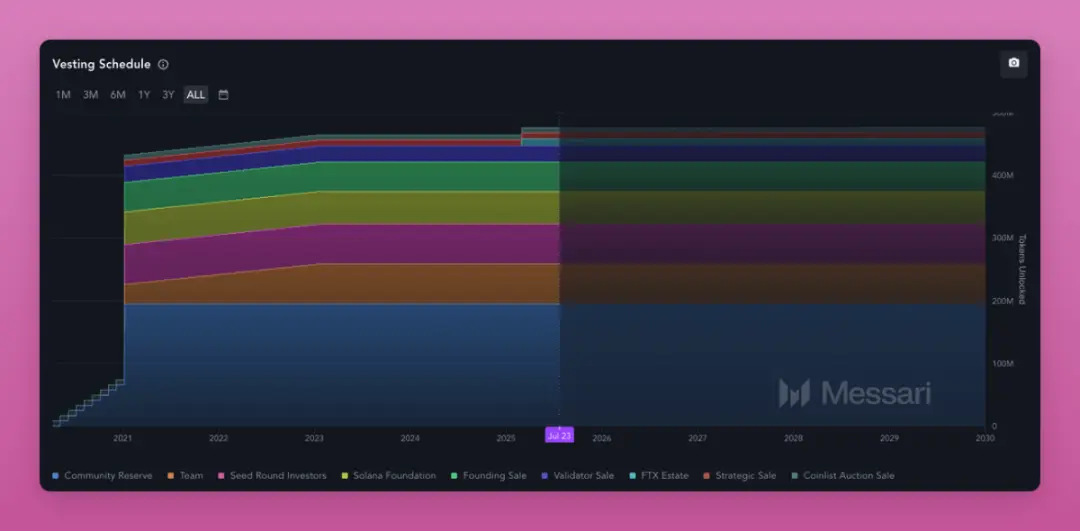

According to Messari, 99.88% of SOL tokens have been unlocked. The only "locked" tokens are 600,000 SOL held by FTX (possibly already sold over the counter).

Source: https://solana.messari.io/token-unlocks

So, what are the 11.2% locked tokens reported by Solanacompass and CoinMarketCap? It's currently unclear.

Who Holds SOL?

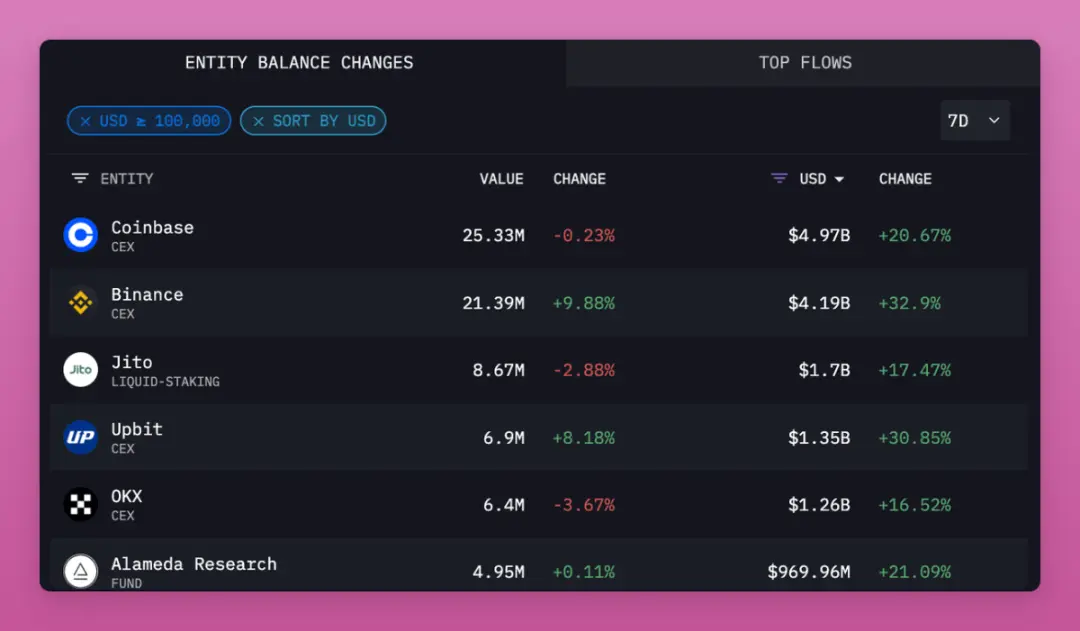

According to Arkham Intelligence, Coinbase holds SOL worth $5 billion, representing 4.7% of SOL's total supply.

Source: https://intel.arkm.com/explorer/token/solana

Here are other major holders sorted by circulating supply percentage:

Binance—3.97%

Jito—1.61%

Upbit—1.28%

OKX—1.19%

Alameda—0.92% (possibly belonging to the locked tokens marked by Messari?)

Marinade Finance—0.79%

Robinhood—0.74%

Kraken—0.53%

Bybit—0.49%

Jump Crypto—0.33%

Crypto.com—0.33%

Wintermute—0.14%

Bitstamp—0.13%

Overall, the top holders tracked by Arkham account for over 20% of the circulating supply, which is not bad.

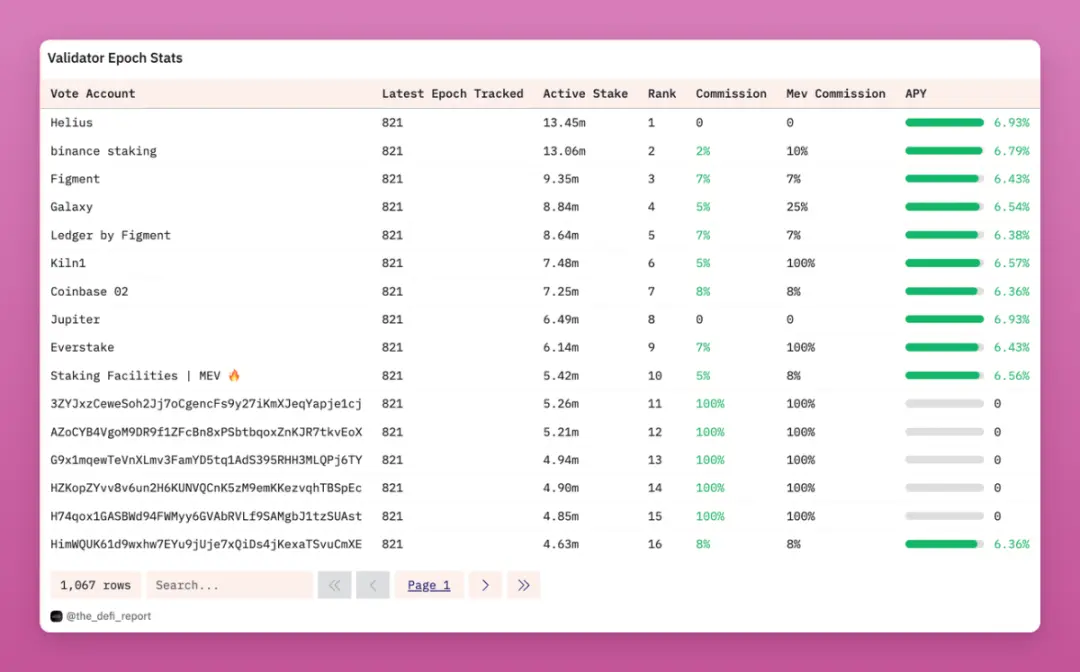

We can also find more related institutions on Dune by querying staking entities.

Source: https://dune.com/the_defi_report/solana-staking-and-validators

Besides the mentioned institutions (Binance, Coinbase), we also see Helius holding 2.5% of active staking supply.

Galaxy holds a considerable amount of SOL, around 8.8 million, along with other institutions like Ledger, Figment, Kiln1, and Everstake.

Many top-ranked wallets remain unattributed.

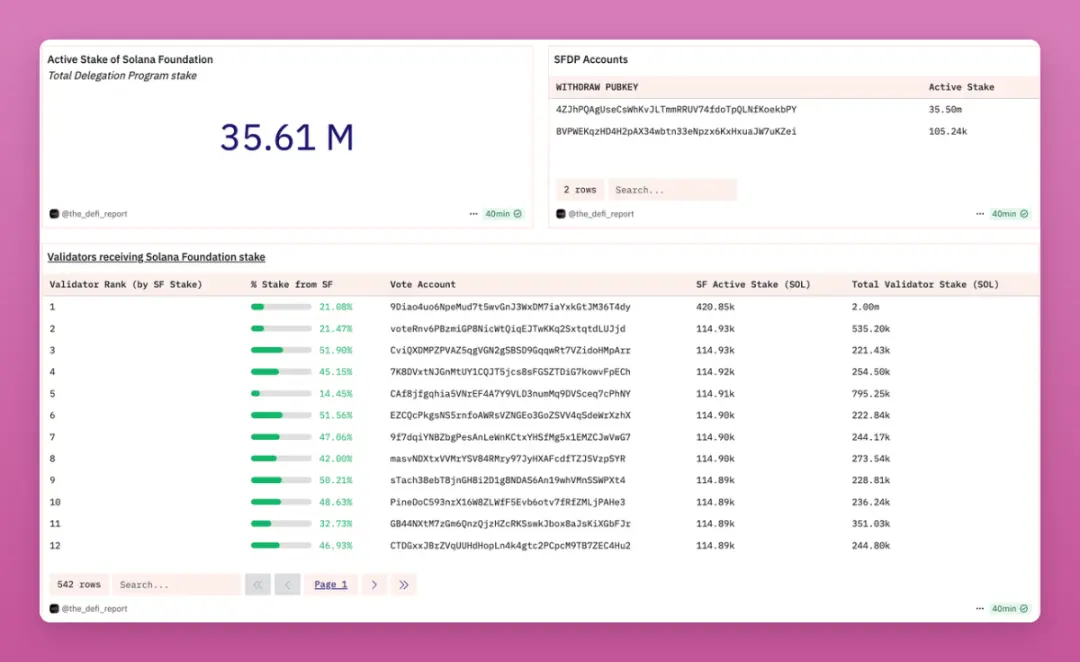

To achieve network decentralization, the Solana Foundation has delegated 35.6 million SOL (6.6% of circulating supply) to 542 validators.

According to @0xEekeyguy, validators need to stake at least 50,000 to 75,000 SOL to be profitable.

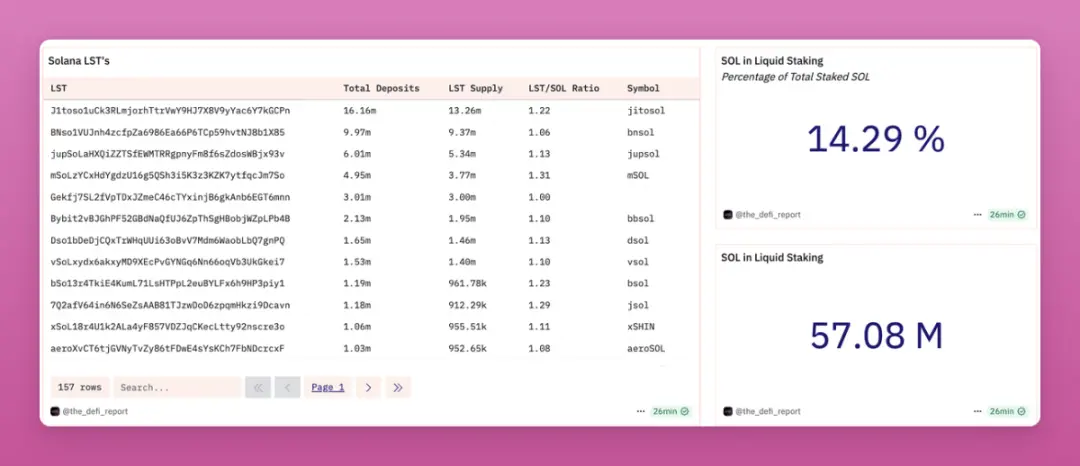

Surprisingly, only 14.3% of staked SOL comes from Liquid Staking Tokens (LST) (representing 10.5% of circulating supply). Jito leads in this area.

This limits the growth potential of DeFi on Solana. If a few more percentage points of native staked SOL move to LST, Solana's DeFi ecosystem could grow by billions of dollars.

Individual Holders

Disclaimer: I attempted to analyze data using AI to count individual holders, and these data are likely inaccurate.

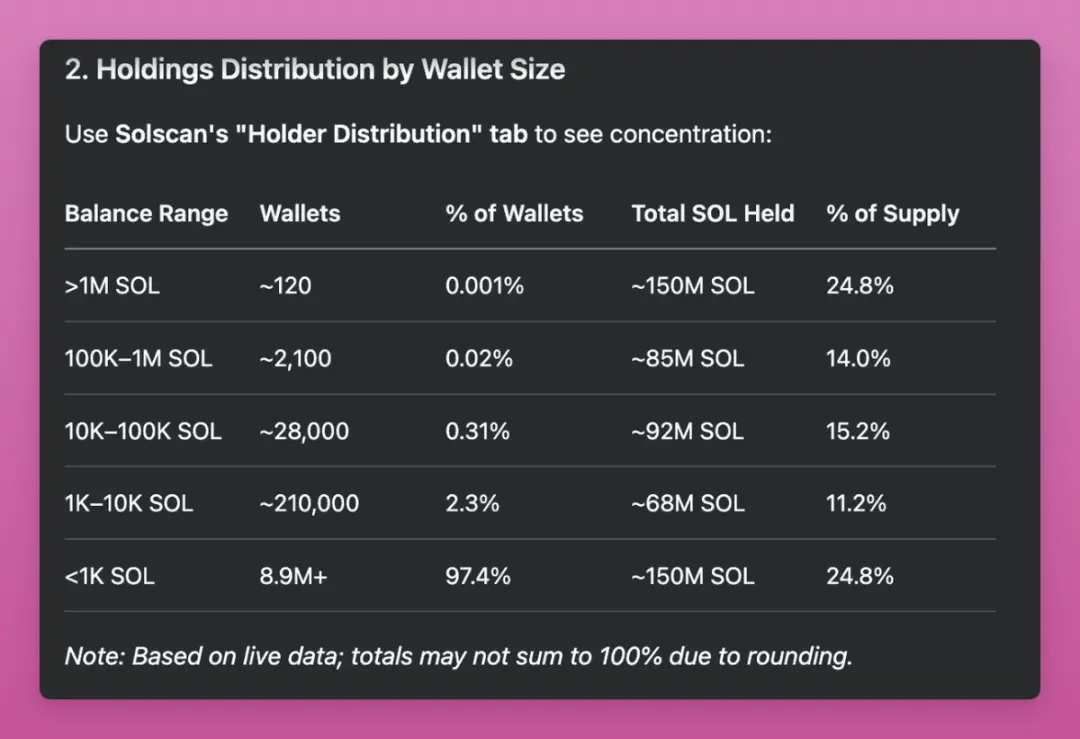

Based on this experimental data, 120 wallets hold an amount of SOL equivalent to the total holdings of 8.9 million users with less than 1,000 SOL.

The average SOL wallet balance is: 16.8 SOL (skewed by small holders).

Overall:

Concentration: 0.33% of wallets (30,220) control 54% of SOL supply (including centralized exchanges, custodial institutions, etc.).

Retail Dominance: 97.4% of wallets hold less than 1,000 SOL, collectively holding 24.8% of the supply.