Author: Lex, ChainCatcher

Translated by: Fairy, ChainCatcher

In July, a project called Graphite Protocol (GP) gained nearly 30 times growth in a short period, with its circulating market value once reaching $190 million. Since July 23rd, it has been reaching new all-time highs almost every day.

What exactly is this GP that came out of nowhere? Is it a flash in the pan or a stock with real potential? Today, we'll dive deep into the story behind this project.

Image source: CoinGecko

Is Graphite Protocol the "Tax Collector" of Bonk.fun?

Graphite Protocol positions itself as a multi-chain infrastructure project aimed at lowering the development threshold for Web3 applications through no-code tools.

However, this grand vision is still in progress. Currently, Graphite Protocol's true "hard currency" comes from its deep connection with Bonk.fun, the top MEME launchpad in the Solana ecosystem.

In just 73 days, Bonk.fun quickly surpassed the once-dominant Pump.fun through explosive user growth and revenue performance, capturing 55% of the MEME sales market.

Graphite Protocol provides underlying technical support for the Bonk.fun platform and receives 7.6% of its protocol revenue, which is automatically used to repurchase and burn GP tokens in the secondary market.

This design elevates Graphite Protocol from a mere tool supplier to a "tax collector" in the Bonk ecosystem. It no longer needs to build a massive user base but instead directly shares growth dividends by parasitizing a mature ecosystem with huge traffic and activity.

GP's Double Ace: Hardcore Founder and Deflationary Mechanism

Besides its deep collaboration with Bonk.fun, the team behind Graphite Protocol is also a significant advantage. The project leader, Tom Solport, enjoys a good reputation in the Solana community and is a pragmatic founder and builder. He is best known for acquiring and successfully reviving the blue-chip Non-Fungible Token project Taiyo Robotics on Solana.

Taiyo Robotics was first minted in November 2021 but fell into trouble after the original development team withdrew. In December 2021, Tom Solport took over the project and quickly developed and executed a detailed roadmap, including creating a custom market for Taiyo Robotics.

Even during the bear market, the Taiyo project continued to build, winning the community's trust. The industry generally evaluates Tom as a "doer who doesn't run away," and this powerful personal IP provides a strong trust endorsement for Graphite Protocol.

Additionally, GP designed a powerful deflationary mechanism: whether from Bonk.fun's protocol share or user service fees (SOL, ETH, Matic), they will ultimately be converted to GP tokens and burned. Under the constraint of a fixed total supply, this deflationary flywheel provides solid mathematical support for the GP token price.

Image source: Graphite Protocol Whitepaper

Above the Trend, Undercurrents Below: GP's Concerns and Uncertainties

Despite GP's rapid rise through strong partnerships and mechanism design, its growth logic also presents non-negligible risk exposures.

Currently, most of GP's value remains highly dependent on its relationship with Bonk.fun. Whether it's the decline of Bonk's popularity, adjustment of cooperation terms, or rumors of ecosystem fractures, any negative signals could directly impact GP's revenue base and market narrative.

GP's token history has also embedded complex variables.

GP's predecessor was $SCRAP, originally planned for linear release over 4-5 years starting from 2023. As Graphite Protocol became more developed, $SCRAP was phased out, replaced by $GP. Old holders could convert $SCRAP to "Graphite fragments" for staking and receive $GP in installments, but this conversion channel has been closed.

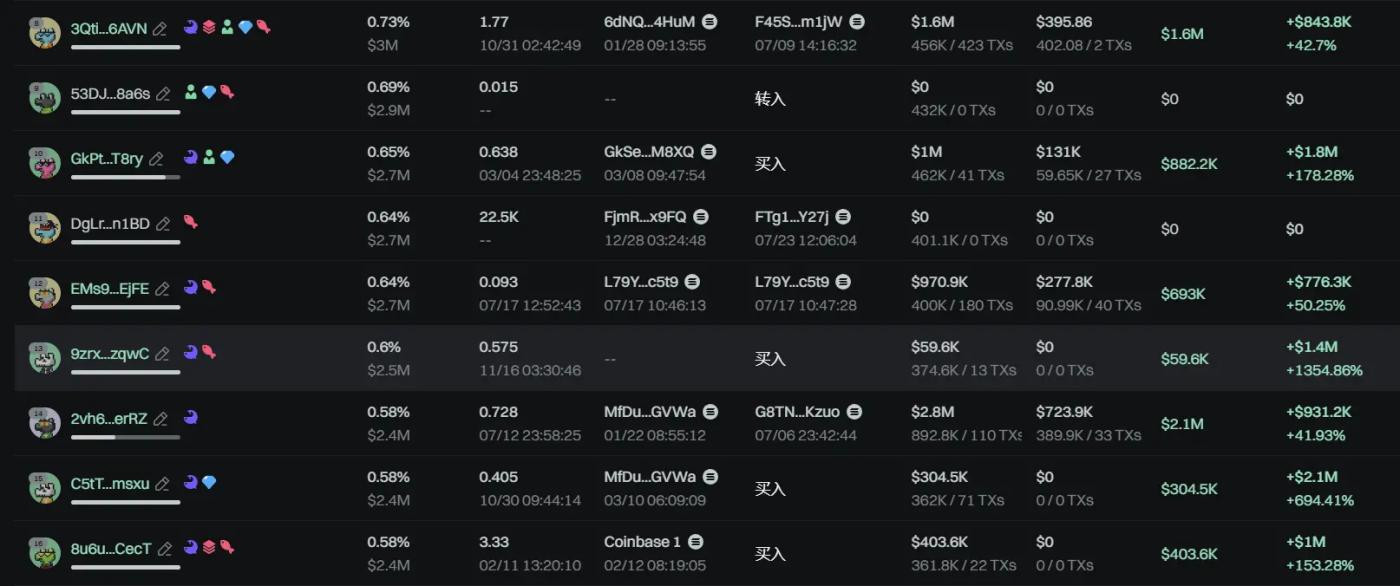

As of late July 2025, the total supply of $GP is 150 million, with only 30 million in circulation, accounting for about 20%. This means that up to 80% of tokens remain unlocked, and its unlock schedule and specific allocation structure (team holdings ratio, lock-up mechanism, etc.) have not been fully disclosed, making potential selling pressure difficult to estimate.

More importantly, the short-term violent rise has accumulated a large number of profit-taking positions. Once market sentiment turns, price correction could be extremely dramatic.

GP token top 20 holdings profit chart, source: GMGN

Graphite Protocol is supported by a hardcore founder, real income, and a deflationary mechanism, but from a primary market dark horse to a long-term blue-chip, it still faces many challenges.

How to reduce dependence on a single ecosystem, gradually disclose more transparent token economic structures, and expand diverse growth engines will determine whether it can truly break through to the next stage of growth.

(This article is for reference only and does not constitute investment advice)