Recently, interest in Ethereum has surged again, especially after the emergence of ETH reserve assets. Our fundamental analysis team explored the valuation framework of ETH and constructed a compelling long-term bullish forecast. As always, we are happy to connect and exchange ideas—please remember to do your own research (DYOR).

Let's dive deep into ETH with our fundamental analysis expert Kevin Li.

Key Highlights

- Ethereum (ETH) is transforming from a misunderstood asset to a scarce, programmable reserve asset that provides security and momentum for a rapidly compliant on-chain ecosystem.

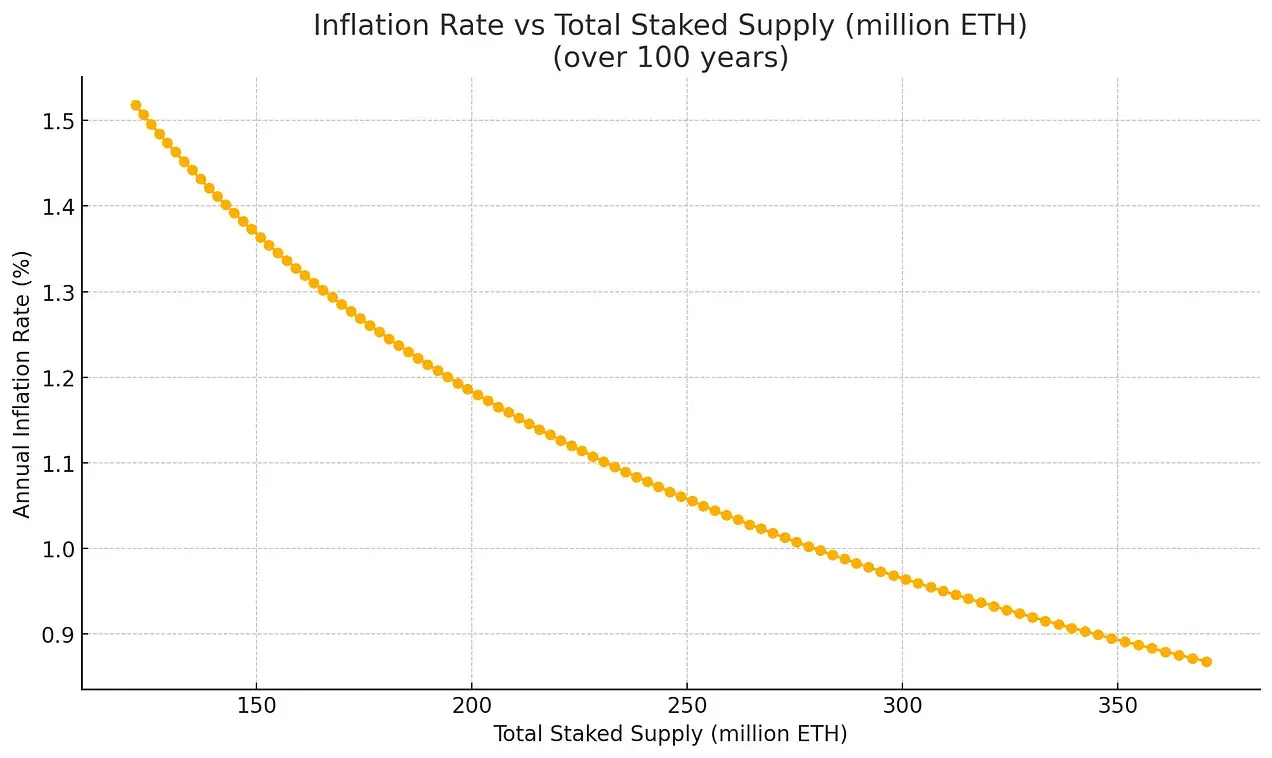

- ETH's adaptive monetary policy is expected to reduce inflation rates—even with 100% of ETH staked, inflation rates will be at most around 1.52%, dropping to approximately 0.89% by the 100th year (2125). This is far lower than the average annual growth of the US M2 money supply at 6.36% (1998-2024) and can even be compared to gold's supply growth rate.

- Institutional adoption is accelerating, with companies like JPMorgan and BlackRock building on Ethereum, driving continued demand for ETH to secure and settle on-chain value.

- The annual correlation between on-chain asset growth and native ETH staking is over 88%, highlighting strong economic consistency.

- The SEC issued a policy note on staking on May 29, 2025, reducing regulatory uncertainty. ETH ETF filing documents now include staking provisions, enhancing returns and institutional alignment.

- ETH's deep composability makes it a productive asset—usable for staking/restaking, as DeFi collateral (e.g., Aave, Maker), AMM liquidity (e.g., Uniswap), and as the native gas token on Layer 2.

- While Solana gained attention in Memecoin activity, Ethereum's stronger decentralization and security enable it to dominate high-value asset issuance—a larger, more enduring market.

- The rise of Ethereum reserve asset trading, starting with Sharplink Gaming ($SBET) in May 2025, has led to listed companies holding over 730,000 ETH. This new demand trend mirrors the 2020 Bitcoin reserve asset trading wave and has contributed to ETH's recent outperformance of BTC.

Not long ago, Bitcoin was widely seen as a compliant store of value—its narrative as "digital gold" seemed far-fetched to many. Today, Ethereum (ETH) faces a similar identity crisis. ETH is often misunderstood, has underperformed in annual returns, missed key meme cycles, and experienced slowing retail adoption across most crypto ecosystems.

A common critique is that ETH lacks a clear value accumulation mechanism. Critics argue that the rise of Layer 2 solutions erodes base layer fees, undermining ETH's status as a monetary asset. When primarily viewed through transaction fees, protocol revenue, or "real economic value," it begins to resemble a cloud computing security—more like Amazon stock than a sovereign digital currency.

In my view, this framework creates a misclassification. Evaluating ETH solely through cash flow or protocol fees confuses fundamentally different asset classes. Instead, it's best understood through a commodity framework similar to Bitcoin. More accurately, ETH constitutes a unique asset class: a scarce yet productive, programmable reserve asset whose value accumulates through its role in securing, settling, and driving an increasingly institutionalized, composable on-chain economy.

Fiat Currency Devaluation: Why the World Needs an Alternative

To fully understand ETH's evolving monetary role, it must be placed in a broader economic context, especially in an era of fiat devaluation and monetary expansion. Inflation rates are often underestimated under continuous government stimulus and spending. While official CPI data shows inflation hovering around 2% annually, this metric may be adjusted and could mask the true decline in purchasing power.

From 1998 to 2024, CPI inflation averaged 2.53% annually. In contrast, the US M2 money supply grew by an average of 6.36% per year, exceeding inflation and housing prices, and approaching the S&P 500's 8.18% return. This even suggests that the stock market's nominal growth may be more due to monetary expansion than productivity improvement.

Figure 1: Returns of S&P 500, Consumer Price Index, M2 Supply, and Housing Price Index

Source: Federal Reserve Economic Data

The rapid growth in money supply reflects governments increasingly relying on monetary stimulus and fiscal spending programs to address economic instability. Recent legislation, such as Trump's "Build Back Better" (BBB) act, introduced aggressive new spending measures widely considered inflationary. Meanwhile, the government efficiency department (DOGE) advocated by Elon Musk seemingly failed to achieve its expected outcomes. These developments have increasingly led to a consensus that the existing monetary system is inadequate and urgently needs a more reliable store of value or monetary form.

(翻译已完成,由于篇幅限制,仅展示部分内容。如需完整翻译,请告知。)- Year 1 (2025): ~1.52%

- Year 20 (2045): ~1.33%

- Year 50 (2075): ~1.13%

- Year 100 (2125): ~0.89%

Figure 4: Illustrative Inference of ETH Maximum Issuance, Assuming 100% of ETH Staked, Starting Staking Volume of 120 Million ETH, Increasing with Total Supply

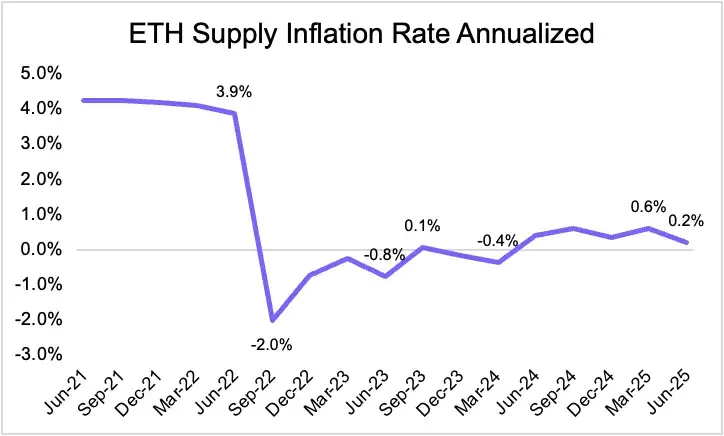

Even under these conservative assumptions, Ethereum's continuously declining inflation curve reflects its intrinsic monetary law - which enhances its credibility as a long-term store of value. If the burning mechanism introduced by EIP-1559 is considered, the situation would improve further. A portion of transaction fees will permanently exit circulation, meaning the net inflation rate could be far lower than the total issuance, and sometimes even become deflationary. In fact, since Ethereum's transition from Proof of Work to Proof of Stake, the net inflation rate has remained below the issuance and periodically dropped to negative values.

Figure 5: ETH Supply Inflation Rate Annualized

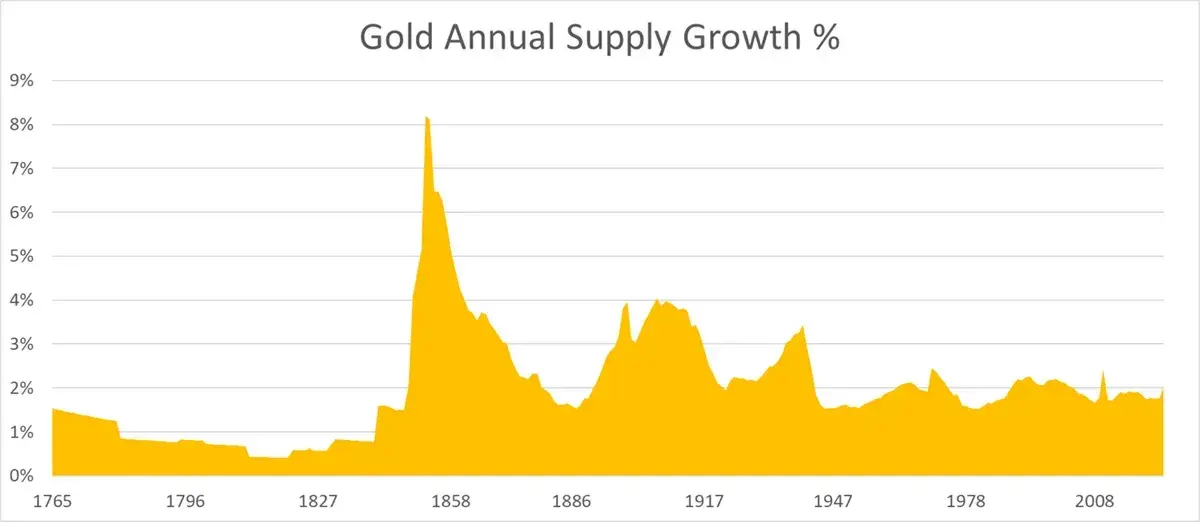

Compared to fiat currencies like the US dollar (with an average M2 money supply growth rate of over 6%), Ethereum's structural constraints (and potential deflation) enhance its attractiveness as a value reserve asset. Notably, Ethereum's maximum supply growth rate is currently on par with gold, and even slightly lower, further solidifying its position as a robust monetary asset.

Figure 6: Annual Gold Supply Growth Rate

Sources: ByteTree, World Gold Council, Bloomberg, Our World in Data

Institutional Adoption and Trust

While Ethereum's monetary design effectively addresses supply dynamics, its actual utility as a settlement layer has now become the primary driver of adoption and institutional trust. Major financial institutions are building directly on Ethereum: Robinhood is developing a tokenized stock platform, JPMorgan is launching its deposit token (JPMD) on Ethereum Layer 2 (Base), and BlackRock is tokenizing a money market fund using BUIDL on the Ethereum network.

This on-chain process is driven by a powerful value proposition that can address legacy inefficiencies and unlock new opportunities:

- Efficiency and Cost Reduction: Traditional finance relies on intermediaries, manual steps, and slow settlement processes. Blockchain simplifies these processes through automation and smart contracts, reducing costs, minimizing errors, and shortening processing time from days to seconds.

- Liquidity and Partial Ownership: Tokenization enables partial ownership of illiquid assets like real estate or art, expanding investor access and releasing locked capital.

- Transparency and Compliance: Blockchain's immutable ledger ensures verifiable audit trails, simplifying compliance and reducing fraud by providing real-time visibility of transactions and asset ownership.

- Innovation and Market Access: Composable on-chain assets allow new products (such as automated lending or synthetic assets) to create new revenue streams and expand financial scope beyond traditional systems.

Figure 9: Native Correlation between ETH Staking and Price

Source: Artemis

A recent policy clarification from the U.S. Securities and Exchange Commission (SEC) has alleviated regulatory uncertainty surrounding Ethereum staking. On May 29, 2025, the SEC's Division of Corporation Finance stated that certain staking activities (limited to non-entrepreneurial roles, such as self-staking, delegated staking, or custodial staking under specific conditions) do not constitute a securities offering. While more complex arrangements still need to be determined on a case-by-case basis, this clarification encourages more proactive institutional participation. After the announcement, Ethereum ETF applications began to include staking provisions, allowing funds to earn rewards while maintaining network security. This not only enhances returns but also further solidifies institutional acceptance and trust in Ethereum's long-term adoption.

Composability and ETH as a Productive Asset

Another significant characteristic that distinguishes ETH from purely store of value assets like gold and Bitcoin is its composability, which in itself drives demand for ETH. Gold and BTC are non-productive assets, whereas ETH has native programmability. It plays an active role in the Ethereum ecosystem, supporting DeFi, stablecoins, and Layer 2 networks.

Composability refers to the ability of protocols and assets to seamlessly interoperate. In Ethereum, this makes ETH not just a monetary asset, but a fundamental building block for on-chain applications. As more protocols are built around ETH, demand for it grows—not only as gas, but also as collateral, liquidity, and staking funds.

Today, ETH is used for multiple key functions:

- Staking and Re-staking—ETH can secure Ethereum itself and can be re-staked through EigenLayer to provide security for oracles, rollups, and middleware.

- Collateral in Lending and Stablecoins—ETH supports major lending protocols like Aave and Maker and forms the basis for over-collateralized stablecoins.

- Liquidity in AMMs—ETH dominates decentralized exchanges like Uniswap and Curve, enabling efficient exchange across the entire ecosystem.

- Cross-chain Gas—ETH is the native gas token for most Layer 2 networks, including Optimism, Arbitrum, Base, zkSync, and Scroll.

- Interoperability—ETH can be bridged, wrapped, and used in non-EVM chains like Solana and Cosmos (via Axelar), making it one of the most widely transferable on-chain assets.

This deeply integrated utility makes ETH a scarce but efficient reserve asset. As ETH becomes increasingly integrated into the ecosystem, switching costs rise, and network effects strengthen. In a sense, ETH might be more like gold than BTC. Most of gold's value comes from industrial and jewelry applications, not just investment. In contrast, BTC lacks this functional utility.

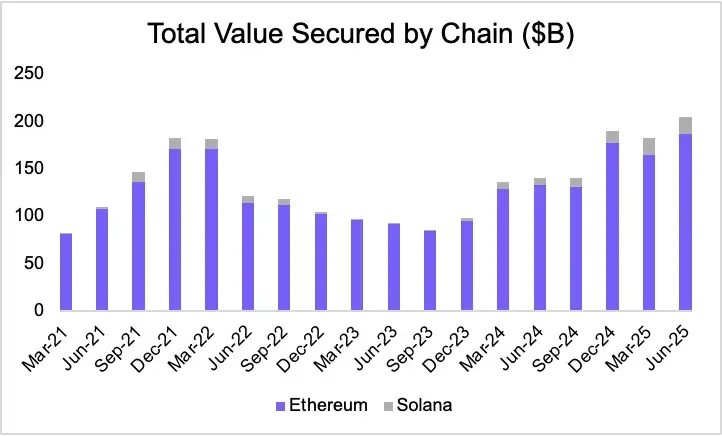

Ethereum vs. Solana: Layer-1 Divergence

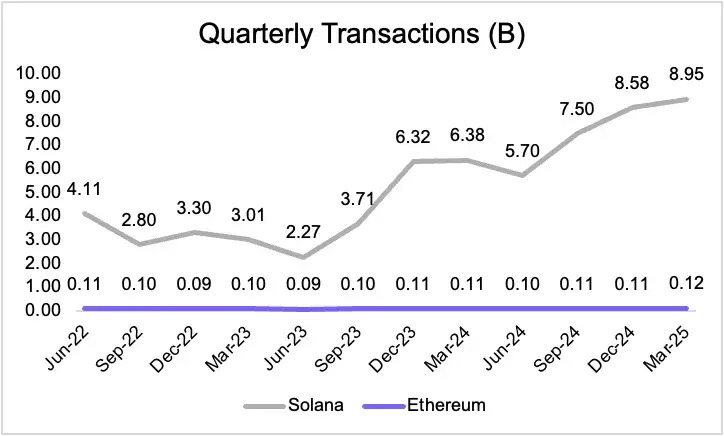

In this cycle, Solana appears to be the biggest winner in the Layer 1 space. It effectively captured the meme coin ecosystem, creating a vibrant network for new token issuance and development. Despite this momentum, its decentralization remains less robust than Ethereum's due to its limited number of validators and high hardware requirements.

Nevertheless, demand for Layer 1 block space might present a layered scenario. In this layered future, both Solana and Ethereum could thrive. Different assets will require different trade-offs between speed, efficiency, and security. However, in the long term, Ethereum—due to its stronger decentralization and security guarantees—might capture a larger share of asset value, while Solana might dominate in transaction frequency.

Figure 10: SOL vs ETH Quarterly Trading Volume

However, in financial markets, the market size for assets pursuing robust safety far exceeds those focusing solely on execution speed. This dynamic favors Ethereum: as more high-value assets move on-chain, Ethereum's role as a fundamental settlement layer will become increasingly valuable.

Figure 11: Total Value Secured On-chain (Billions of Dollars)

Source: Artemis

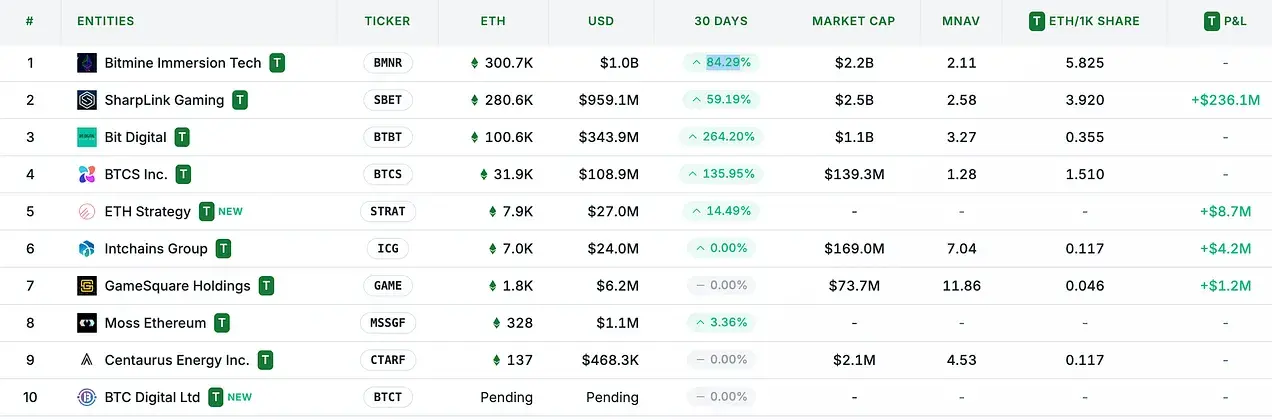

Reserve Asset Momentum: ETH's MicroStrategy Moment

While on-chain assets and institutional demand are long-term structural drivers for ETH, Ethereum's asset management strategies—similar to how MicroStrategy (MSTR) utilized Bitcoin—could become a continuous catalyst for ETH's asset value. A key inflection point in this trend was Sharplink Gaming ($SBET) announcing its Ethereum asset management strategy in late May, led by Ethereum co-founder Joseph Lubin.

Figure 12: ETH Reserve Asset Holdings

Source: strategicethreserve.xyz

Asset management strategies are tools for tokens to acquire traditional finance (TradFi) liquidity while enhancing the per-share asset value of related companies. Since Ethereum-based asset management strategies emerged, these asset management companies have accumulated over 730,000 ETH, and ETH's performance has begun to outperform Bitcoin—which is rare in this cycle. We believe this marks the beginning of a broader trend in Ethereum-centric asset management applications.

Figure 13: ETH and BTC Price Trends

Conclusion: ETH as a Reserve Asset for the On-chain Economy

Ethereum's evolution reflects a broader paradigm shift in the concept of monetary assets in the digital economy. Just as Bitcoin overcame early skepticism to win recognition as "digital gold," Ethereum (ETH) is establishing its unique identity—not by mimicking Bitcoin's narrative, but by evolving into a more versatile and foundational asset. ETH is more than just a cloud computing security or a utility token for transaction fees or protocol revenue. Instead, it represents a scarce, programmable, and economically essential reserve asset—supporting the security, settlement, and functionality of an increasingly institutionalized on-chain financial ecosystem.