The price of Pi has not experienced much volatility in recent weeks. It has attempted to increase but could not maintain any significant upward momentum.

With August approaching, this altcoin faces pressure from a significant Token Lockup that could further impact its already fragile market capital structure.

156 million PI tokens are about to flood the market as the price nearly collapses

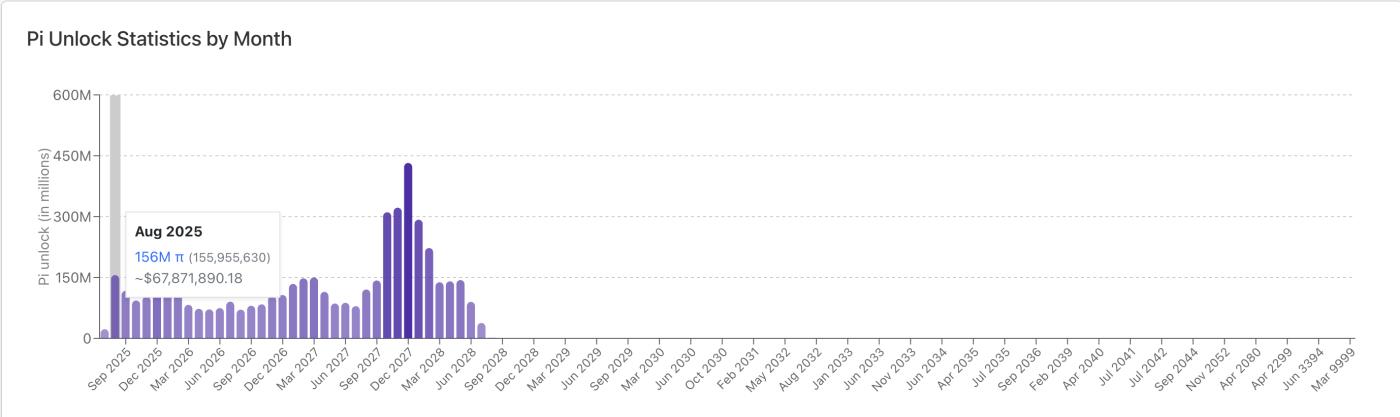

Pi will face a large Token Lockup event in August. According to data from PiScan, 156 million tokens—valued at around $68 million at current prices—are expected to be unlocked over 31 days.

This unlocking event creates severe price drop risks for a token already under pressure, with little optimistic sentiment to support recovery.

For TA and token market updates: Want more detailed information about such tokens? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

Pi Monthly Unlock. Source: PiScan

Pi Monthly Unlock. Source: PiScanCurrently trading at $0.43, PI has not kept pace with the broader crypto market's growth, where many assets have reached new All-Time-Highs. This altcoin has been pressured by strong supply, with over 250 million tokens released into circulation just this month.

With minimal buying demand to balance this supply, PI has been unable to gain momentum. It remains locked in a narrow range and is dangerously close to its All-Time-Low of $0.40.

PI faces a gloomy August as buying interest gradually declines

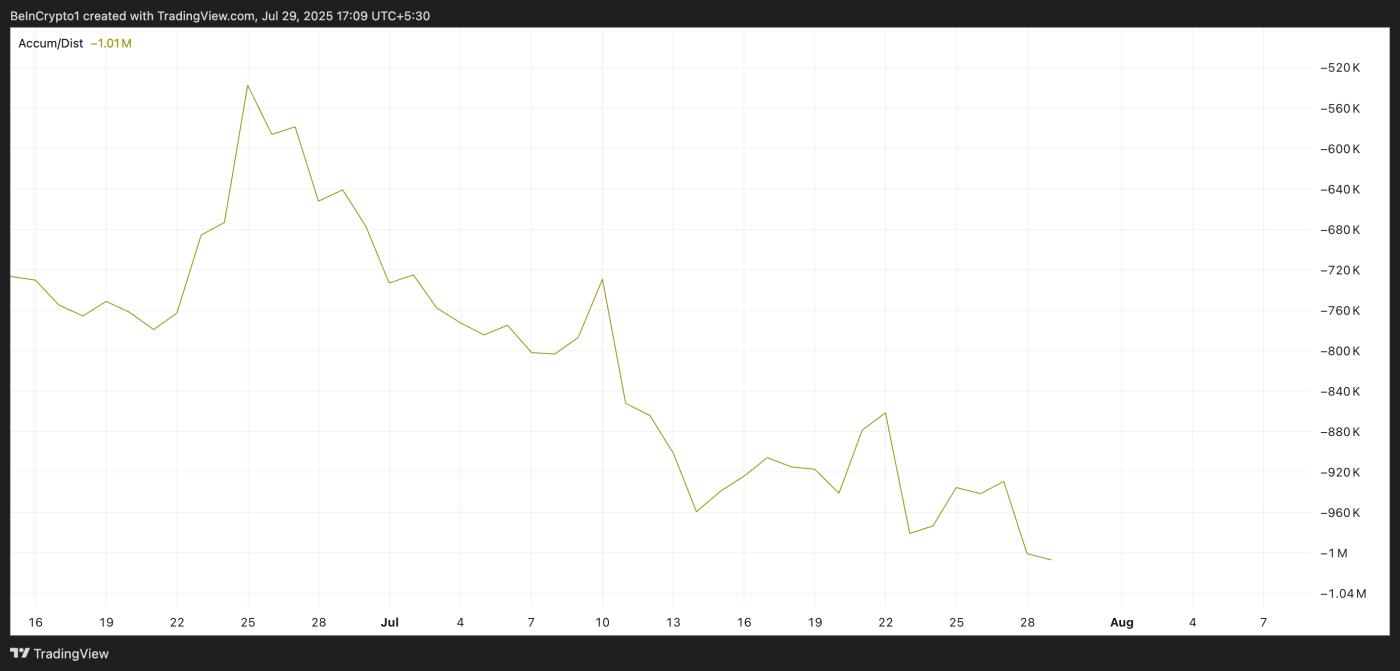

Readings from the daily chart show technical indicators are signaling price declines, with no clear reversal signs. For example, PI's Accumulation/Distribution (A/D) line, a measure of buy versus sell volume, has been steadily declining since June 26.

PI A/D Line. Source: TradingView

PI A/D Line. Source: TradingViewCurrently at -1.01 million, its value has dropped over 85% since then, indicating gradually diminishing interest from market participants.

When an asset's A/D line declines this sharply, sell volume outweighs buying pressure. This trend suggests continuous weakening demand for PI and hints at potential further price drops in August.

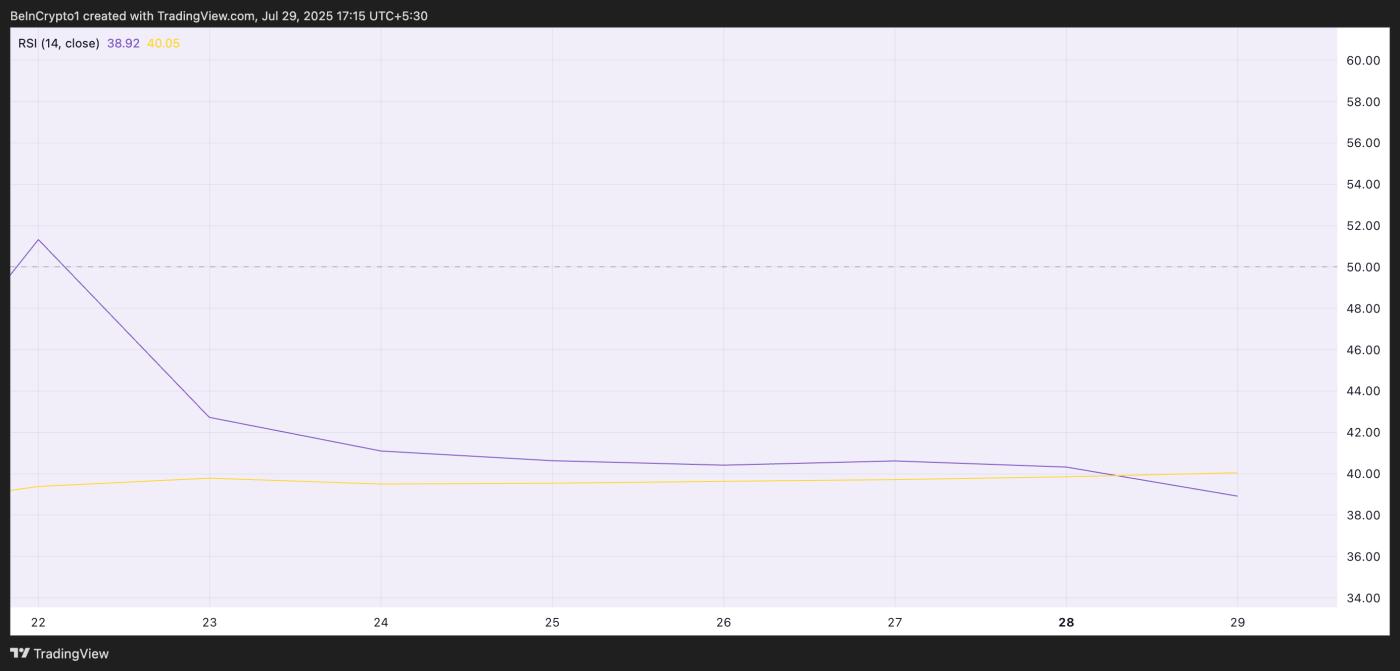

Moreover, after failing to rise above the neutral 50 line on July 22, PI's Relative Strength Index (RSI) has been trending downward. Currently standing at 38.92, it reflects seller strength in PI's spot markets.

PI RSI. Source: TradingView

PI RSI. Source: TradingViewThe RSI indicator measures an asset's overbought and oversold conditions. It oscillates from 0 to 100. Values above 70 indicate an asset is overbought and might decline, while values below 30 suggest an asset is oversold and might recover.

At 38.92 and declining, PI's RSI signals increasing downward momentum as August approaches. This suggests the token might face further price drops unless an early reversal occurs.

Can Pi survive the $68 million supply flood in August?

Without sufficient new demand to absorb the 156 million PI tokens expected to be released next month, this altcoin could drop to its All-Time-Low of $0.40. An even deeper decline below this level remains possible if downward momentum continues to increase.

PI Price Analysis. Source: TradingView

PI Price Analysis. Source: TradingViewHowever, if the current trend reverses and buyers return to the market, they could help stabilize PI's price in August and attempt to push it back above the $0.46 resistance level.