Introduction

Building financial applications on-chain involving non-native assets (such as US stocks and indices) has traditionally been limited by the lack of accurate and consistent data sources. The diversification of mainstream oracle providers like Chainlink and Pyth, along with the proliferation of internal solutions, has enabled protocols like Gains Network and Ostium to achieve seamless trading of traditional markets that were previously difficult to access on the blockchain. However, perpetual futures contracts, despite their undeniable utility, are not the ideal choice for most users to gain exposure in this field. Since the catastrophic collapse of Mirror Protocol in 2021 (which once supported minting synthetic stock exposure through over-collateralized debt positions), there has been an obvious gap in spot products for such assets.

Although such models are undoubtedly a step in the right direction (some even call it better than nothing), they still have many shortcomings, especially in terms of capital efficiency. After all, providing $200 collateral for a $100 nominal position while facing redemption risks due to algorithmic anchor deviation is hardly exciting. If this were to become the industry standard, we should have seen numerous Liquity forks competing to launch NVIDIA oracles and custom aggregators based on push mechanisms - something that those familiar with Solidity and indexers could build in less than a month. In fact, the wisest approach currently is clearly to ride the tokenization wave and issue asset-backed structured products.

From Stock Tickers to Tokens

Before anyone begins preparing financing plans or contacting local regulators, we want to point out that this new paradigm has already been pioneered by Backed Finance (also known as BackedFi). This licensed and regulated tokenized securities issuer primarily focuses on bonds, ETFs, and stocks. Founded in 2021, the company has actively promoted its "b" suffix assets across multiple EVM chains over the past year, achieving varying degrees of success and adoption.

As of November 2023, the total value locked (TVL) peak for all its products reached $48.3 million, currently at $22.2 million, with most funds concentrated on the Ethereum mainnet and Gnosis.

Their latest flagship product line, xStocks, has launched 61 tokens on Solana, covering major US listed companies (such as Robinhood, Apple, Microsoft, etc.) and ETFs like S&P 500 and Nasdaq. Each xStock is 1:1 backed by the underlying asset, meaning 1 token = 1 share of the corresponding stock. This support mechanism is implemented through Chainlink's Cross-Chain Interoperability Protocol (CCIP) and Proof of Reserve, ensuring transparency and sufficient collateralization. xStocks are strictly designed for price exposure, thus not granting shareholder meeting voting rights, but dividends will be distributed to xStock holders through an automatic rebasing mechanism.

Since its launch on June 30th, the total market cap of xStocks (covering 23 tokens) has approached $32.33 million (according to multiple sources), quickly surpassing the company's previous similar products.

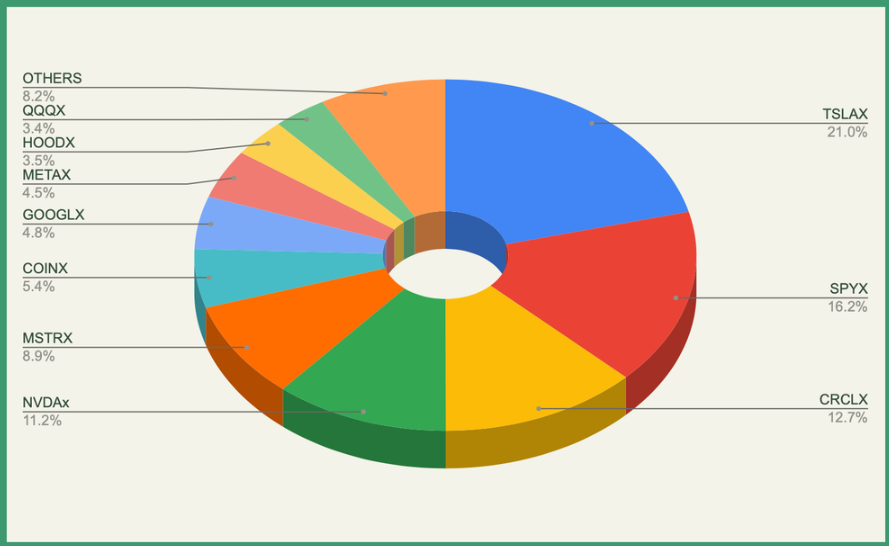

xStocks Market Cap Distribution (by Asset) - defillama

Unsurprisingly, the majority of market cap is concentrated in tech stocks, likely due to their consistently strong returns, revenue growth, and potential. Data indicates that despite the wide range of choices, the market currently shows no obvious interest in retail, commercial service providers, and physical consumer goods manufacturers typically favored by value investors.

It is currently unclear whether xStocks minting and redemption are open to the public, but they are already circulating on decentralized (DEX) and centralized exchanges (CEX) with good liquidity. According to CoinGecko data, the ecosystem's 24-hour trading volume is approximately $53.48 million, showing momentum for accelerated growth.

xStocks on Kamino Finance

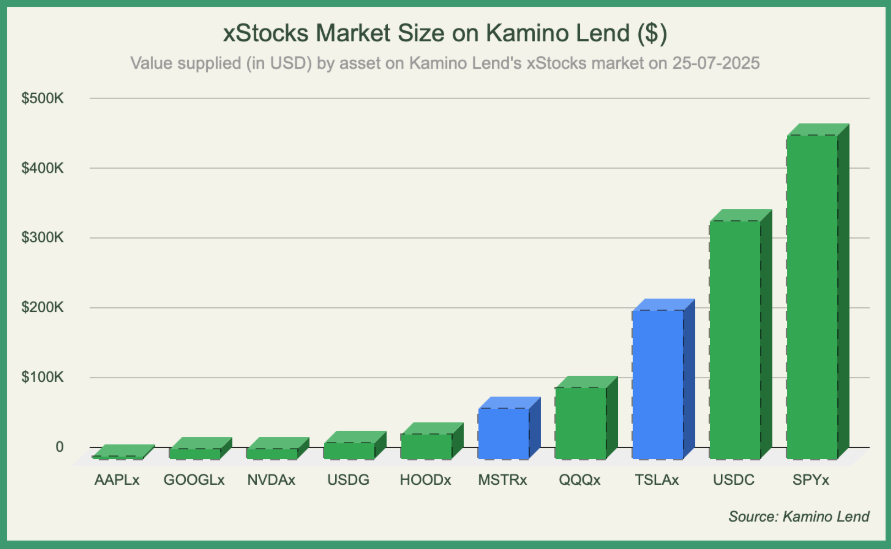

As briefly mentioned earlier, lending platform integrations have begun, with the most notable strategic partner being Kamino Lend, which has launched a dedicated custom market for xStocks. Whitelisted assets primarily include popular tech stocks, ETFs, and stablecoins. Currently integrated xStocks on Kamino Lend include:

SPYx

TSLAx

NVDAx

MSTRx

AAPLx

QQQx

GOOGLx

HOODx

Through this integration, Kamino becomes the first market in the crypto space supporting lending using tokenized stocks and indices as collateral. The maximum loan-to-value (LTV) for these assets ranges between 35%-50%, with SPYx and QQQ index offering the highest LTV. Currently, users can use these assets as collateral to borrow USDC or USDG. As the xStocks market is still in its early stages and liquidity is gradually growing, the current total borrowed amount is approximately $304,000. Therefore, borrowing annual percentage yield (APY) is also volatile, but the average over the past 30 days was 5.74%, currently around 7.87%. Considering the high funding rates in the current bull market and numerous yield opportunities in DeFi, being able to borrow against stock and stock index exposure can enhance capital efficiency and unlock additional portfolio returns.

USDC Borrowing APY on Kamino xStocks Market

To accurately price these assets and reduce liquidation risks for xStocks holders, Kamino collaborated with Chainlink to develop a custom oracle solution that uses price data from multiple US stock exchanges for these assets. Since some xStock tokens have been listed for a short time with relatively insufficient liquidity, this solution can prevent sudden price fluctuations that could lead to liquidations on the Kamino market. Additionally, Kamino has implemented a price range mechanism for low volatility periods like weekends and stock market holidays. During these periods, Kamino only accepts oracle prices from Chainlink that fall within a percentage range of the last closing price.

Market Performance

As shown in the chart below, the most frequently deposited assets are also the most in-demand, with SPYx, TSLAx, and NVDAx (excluding USDC and USDG) dominating the market. The utilization rates for the two stablecoins remain between 70%-90%, with historical data showing multiple instances of short-term near 100% utilization.

Since launching last week, xStocks have shown steady growth in the Kamino market. As the penetration rate of tokenized stocks continues to improve in the future, Kamino is poised to be a major beneficiary of this trend.

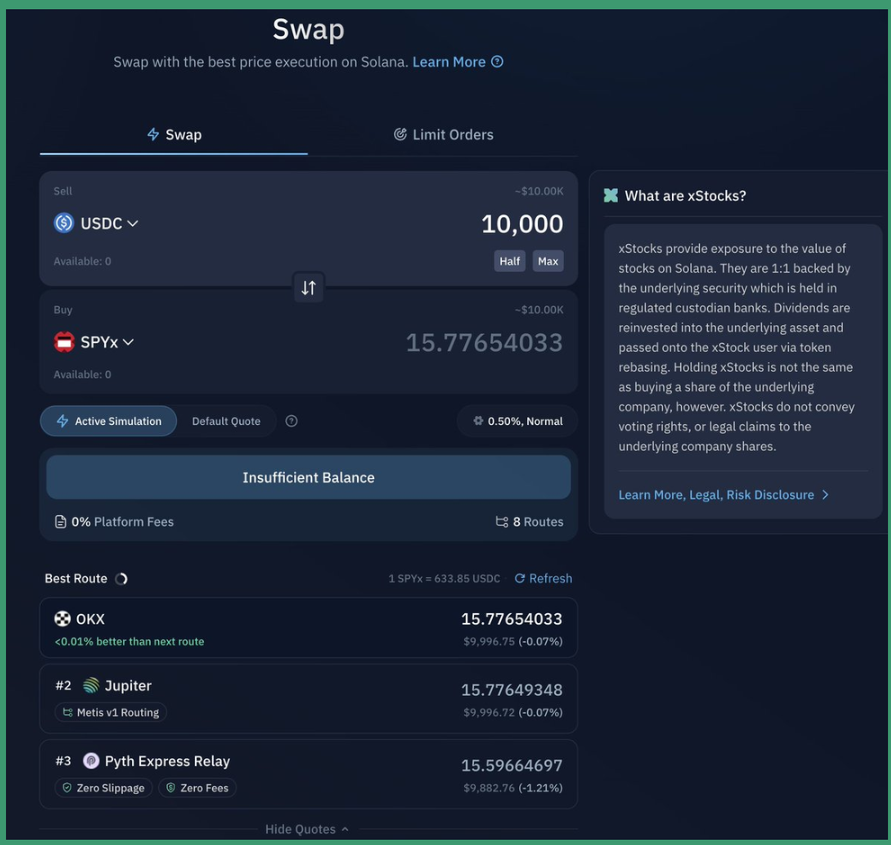

The best way to obtain xStocks currently is through Kamino Swap - an aggregator that integrates all high-liquidity trading paths on Solana without charging additional fees:

In addition to tokenized stock integration, Kamino has recently launched several new features and mining rewards, including the latest EUR incentive activity (85,000 EURC rewards will be distributed over the next three months):

Users depositing EURC can earn 4.44% yield or borrow the asset at just 3.52% interest. Given the US dollar's poor performance compared to the euro this year, investors may seek diversified fiat exposure, and Kamino offers the most cost-effective euro-collateralized borrowing solution. Since most DeFi protocols still only support US dollar stablecoin deposits, borrowing USDC against EURC and using it in the DeFi ecosystem has become one of the best strategies for earning interest on euros.

Innovation Frontier

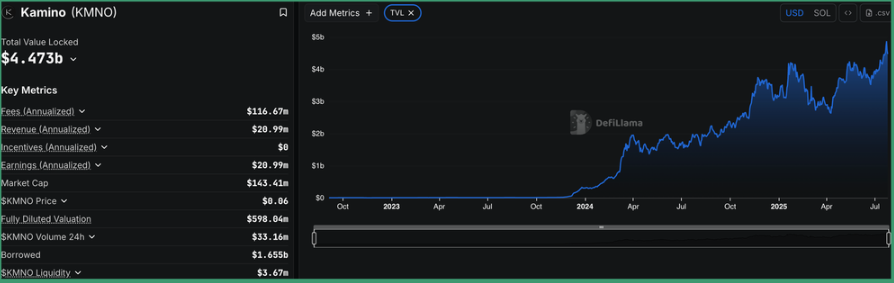

Overall, as the first lending protocol supporting tokenized stocks, Kamino continues to lead the DeFi innovation wave. Through recent integrations and collaborations, its Total Value Locked (TVL) has broken through $4.5 billion, reaching a historical high, with more breakthrough developments still in the works.