How special are the assets of the new platform? Where does the "traffic" that can attract real money actually come from?

Written by: Squid | drift

Compiled by: Saoirse, Foresight News

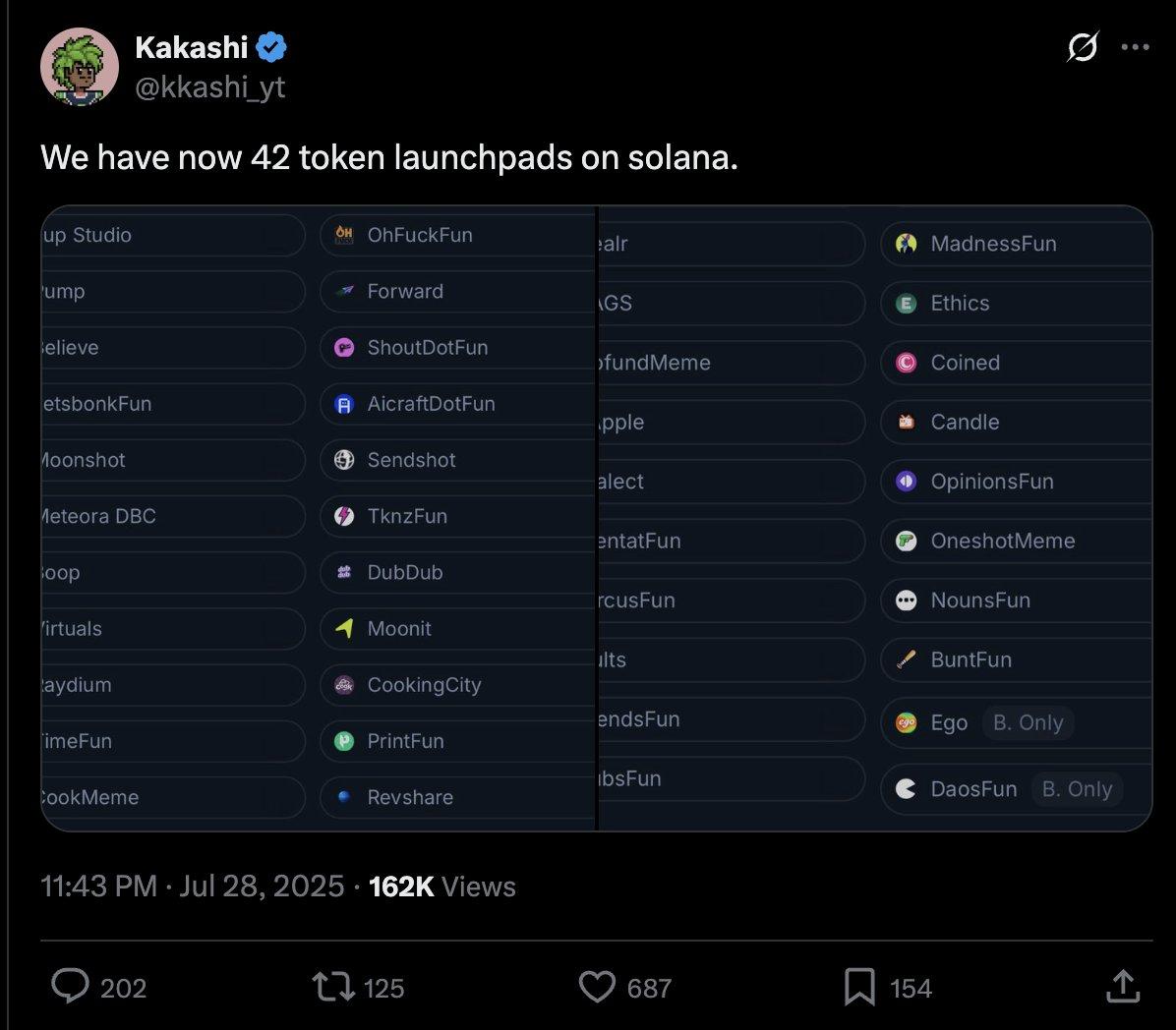

There are already dozens of homogeneous Launchpads on Solana, and new ones are constantly being added every day.

This article aims to provide a simple framework to help sort out industry chaos and provoke thinking. We start from the core issue:

Why would users choose a new Launchpad instead of Pump.Fun (or now Bonk)?

Users can be divided into two categories: bidders and deployers. Although these two groups are highly related, since funds are scarce resources, bidders are the core group we first focus on.

If we analyze why buyers choose a new platform over top platforms, the answer is simple: they believe the new platform offers more opportunities to make money. However, many of these factors are beyond the platform's control, so this article focuses on two major driving factors that platforms can control:

- Assets: Can the platform create assets with significantly differentiated value?

- Flows: Does the platform have a differentiated deployment process?

Let's dive in.

Assets

People buy tokens for two main reasons: speculation (believing the token will appreciate) and utility (the token has practical use).

- Speculation level: The driving factors for speculation are diverse, mainly including meme (such as meme coins) and fundamentals (value brought by fund reserves, cash flow, etc.).

However, Launchpad cannot differentiate itself at the speculation level. Memes are spontaneous and depend on the market, while fundamental factors such as returns are ultimately determined by the project party or product.

- Utility level: Utility is more flexible, which is "Why do people buy tokens besides speculation?" (Of course, utility is closely related to speculation because utility can drive speculation). For example, token access permissions, fee discounts, governance rights, etc., all fall under utility.

Launchpad can form an advantage in utility by providing differentiated supporting infrastructure and tools, allowing deployers to access from the first day of launch. These support forms are diverse, but competition may be concentrated on platforms that are more focused on vertical fields. It's worth noting that supporting infrastructure not only needs to give tokens a unique utility but also create "valuable utility", that is, give users a reason why they must buy.

Social Token Case: Ego vs Time.Fun

Both attempt to tokenize social influence, with each creator able to issue only one "soul-bound token" linked to their Twitter account.

- Although Ego's token is owned by the creator, it lacks direct utility. This "flexibility" leads to creators lacking motivation to build utility, ultimately making its token no different from tokens on the Pump platform.

- Time.Fun is different. It has built-in utility functions for tokens, allowing creators to quickly create and profit from value through tokens, thus achieving sustained user activity.

(Note: I acknowledge the Ego team and choose this case because I believe they will continue to optimize.)

Moreover, "providing utility" does not equal "creating value". For example, many tweet-based tokenization platforms integrate tweets into supporting infrastructure, forming a "value-based curated social flow". While this is a form of utility, if no one uses this social flow, its value is zero. Such platforms often struggle to create real value.

It's worth noting that creating value is not easy and requires careful assessment of whether the supporting infrastructure or design truly has value. At the same time, differentiation is relative. Currently popular industry features like "token buyback tools" and "binding project economics with token flywheel" may have short-term value but will quickly become standardized technologies. Once they lose differentiation, they will no longer be attractive.

In summary, when evaluating new platforms from an "asset" perspective, we need to think: Where is the token's differentiation? Does this differentiation add value to the token?

The areas I'm currently focusing on include: incentive-based distributed training, next-generation decision markets (with some interesting mechanisms), niche real-world assets (with some novel designs), and initial token issuance mechanisms (ICM, which is in early stages and has great potential).

Flows

Next, we'll explore another differentiation factor: exclusive deployer "traffic". This is similar to venture capital's "deal flow", with the core being whether the platform can attract the hottest projects to launch.

From a limited partner (LP) perspective, a key factor in evaluating a venture capital firm is whether it has high-quality exclusive deal flow. This logic also applies to Launchpad. The return structures are similar (top projects contribute most of the transaction volume/income), and the essence is "making value creators choose you over homogeneous competitors".

For example, one contrarian view is that Believe's early success was not due to mechanism design (which I actually disagree with), but because its founder Pasternak could attract Web2 entrepreneurs who would not have issued tokens otherwise - this is the value of traffic.

Large platforms naturally have traffic advantages: they have users, ecosystem integration capabilities, and distribution channels. However, user attention is a scarce resource, and new platforms must rely on substantial differentiation to attract traffic.

Here are several common factors of traffic differentiation:

- Founder influence: The crypto industry is small, and social connections are crucial. Can the platform's founders have enough social resources to attract deployers? Can they fight for social support for tokens after launch? (e.g., Pasternak)

- Momentum: Has the platform successfully launched cases? For example, Bonk's Launchpad, due to successful token issuance, incentivized more people to issue and bid tokens, forming a "social flywheel effect". Early platforms should screen quality projects to provide in-depth support, as a few failed launches could destroy a platform, since the flywheel effect works both ways.

- Specialized positioning: If a platform focuses on a specific sub-field, having a specialized community can enhance project exposure. For example, in AI agent and virtual asset fields (despite token homogeneity), especially when the platform targets non-crypto native users, the specialized advantage is more obvious.

- Capital formation ability: For projects with more commercial attributes, the financing capability in the early launch stage might influence the final outcome. Does the platform's issuance mechanism and coverage help form a higher level of capital?

- Utility: As mentioned earlier, the utility of assets can directly attract traffic.

In summary, when evaluating new platforms from a "traffic" perspective, we need to think: Why do deployers choose this platform? What are their current reasons for choosing? Is this differentiation sticky and scalable?

Market Perspectives

Here is my analysis of the trends of mainstream Launchpads in the market (non-Solana platforms are marked with their respective chains):

- BonkFun: Industry leader with significant meme advantages. Its leading position is more stable than imagined, and it would be difficult to shake unless an entirely new incentive mechanism platform emerges.

- Raydium, Jup, Orca (coming soon): Assets lack differentiation, technology has been standardized, but they can still maintain traffic through brand and capital advantages. The competitive focus is on business expansion, who can attract more platform collaborations, and who can better support popular tokens.

- Pump.fun: Lacking differentiation before launching more streaming features, traffic is flowing away. Unless incentive measures are launched or new products are released, it will be difficult to return to its peak in the short term. Aggressive acquisitions or capital operations may become variables.

- Block: Has differentiation at the asset level due to collaboration with WLFI.

- Zora: (Deployed on Base chain) Becoming a top platform with Base ecosystem traffic, but due to asset homogenization, its market share may decline as more platforms enter (though Base camp support might reverse this trend).

- Doppler: As a "Launchpad for Launchpads", it has high industry recognition and good development prospects.

- MetaDAO: Asset creation is differentiated, but needs to prove the value of its governance mechanism.

- Vertigo: Assets lack differentiation (anti-sniping technology has been standardized), but still has a chance to attract deployers.

- Believe: (Deployed on BNB Smart Chain) Core advantage is traffic, but deployers are currently leaving, and market sentiment is unclear. I still have expectations for the project and need to assess its health through newly launched projects.

- heaven: (Deployed on BNB Smart Chain) Excellent design, with the core issue being how to attract high-quality deployers, and its investors may provide assistance.

- The Metagame(Deployed on BNB Smart Chain), Trends: Details are unknown, but the team consists of veteran crypto-native players (which is crucial), and they are expected to break through in the social domain.

Summary

- Verticalization is an important opportunity, but actual value must be created.

- Early layout is more likely to yield returns than betting on "defensive" or market growth.

- Novelty should be valued.