Original Title: 'The Story of Pudgy Penguins CEO Luca Netz'

Written by: Thejaswini M A

Translated by: Block unicorn

Preface

The boxes at the Ring distribution center won't pack themselves, but 16-year-old Luca Netz was always distracted. Around him, his colleagues skillfully and efficiently completed their shifts. But Netz was thinking about how to turn a startup into a billion-dollar acquisition company.

He dropped out of school for this warehouse job, spending most of his childhood sleeping wherever his mother could find a place. Now, he was witnessing firsthand how a company truly creates wealth.

This experience taught him how startups scale, how they burn through capital, and how they strive to survive to reach escape velocity.

Years later, when Netz bet $2.5 million on a group of cartoon penguins considered worthless by most, this lesson proved invaluable. Today, these penguins are on Walmart shelves, and the once-homeless Los Angeles teenager has become one of the most influential builders in the crypto space, worth over $100 million by age 25.

"We were basically homeless for about ten years," Netz recalled calmly. "We lived all over the world, from South Africa to Paris, London, New York, and then Los Angeles. As long as my mom could muster the courage, we kept living like that."

Growing Up Hustling

Netz's mother, an undocumented immigrant from France who barely spoke English, struggled to find stable work. They moved constantly, staying with friends, acquaintances, and sometimes even strangers willing to temporarily shelter them. For young Luca, home was wherever they happened to sleep that week.

Most would view such a upbringing as a handicap. Netz learned to see it as an education. Constant displacement taught him adaptability. Uncertainty trained him to spot opportunities others overlooked. Hunger taught him to act quickly when opportunities arose.

By middle school, Netz discovered a simple truth: his classmates would pay more for convenience than walk to Burger King. So he began buying chicken sandwiches and snacks, then selling them from his backpack at a markup. Simple math, but effective.

At twelve, Netz's family finally settled in mid-Los Angeles. There, he first tasted stability, at least for a few years.

At sixteen, Netz dropped out of high school, printed a hundred resumes, and walked through Santa Monica's tech corridor, visiting every startup he could find, as if campaigning for something.

Ring hired him. In 2015, the smart doorbell company had just twenty employees and grand dreams. Netz started in the warehouse—packing boxes, processing orders—work most would do without much thought. But he was paying attention to things far beyond: funding rounds, hiring waves, and how problems were (or weren't) solved.

He witnessed Ring grow from an unremarkable startup to Amazon's billion-dollar acquisition target. While he packed boxes, venture capital flooded in. While he processed orders, the company expanded. He received an education in startup mechanics that typical MBA courses couldn't provide.

"I was able to witness firsthand a company's journey from million-dollar funding to becoming a billion-dollar company," Netz recalled.

Gold Chain Epiphany

While working at Ring, 16-year-old Netz noticed a peculiar phenomenon in hip-hop culture. Rappers would spend tens or even hundreds of thousands of dollars on gold chains and diamond jewelry. But upon careful observation, he found most fans couldn't distinguish a $100,000 gold chain from a $200 gold-plated replica.

This observation became the basis for his first real business. Netz found suppliers of gold-plated chains and cubic zirconia diamonds that looked almost identical to expensive versions. Then he devised a simple yet clever marketing strategy: he would pay $50 to $100 to popular rappers' fan pages to promote his jewelry.

"Every time I paid them, they posted my promotion, we would make back $1,000 to $2,000, or even $5,000," he recalled. The return on investment was so high that he could immediately reinvest profits and expand aggressively.

Nine months after launching a dropshipping business on Shopify, Netz achieved his first million-dollar revenue. He was 18 years old. Eventually, he sold the jewelry business for $8 million, providing capital to pursue larger goals.

With money in the bank, Netz began diversifying, leveraging his social media marketing experience from the jewelry business. He became the Chief Marketing Officer for the iconic clothing brand Von Dutch, gaining experience managing an established brand.

Subsequently, he became the Chief Marketing Officer and primary investor in Gel Blaster, a toy company producing Orbeez-based toy guns. Under his marketing leadership, Gel Blaster achieved significant market success, being dubbed the "fastest-growing toy company in North America" by industry publications.

But the universe had something more adorable in store for him.

Penguin Rescue

In early 2022, the Non-Fungible Token market was still riding high from the previous year's boom. Digital artworks sold for millions, celebrities changed their avatars to cartoon apes, and new projects launched daily, promising to build the next Disney.

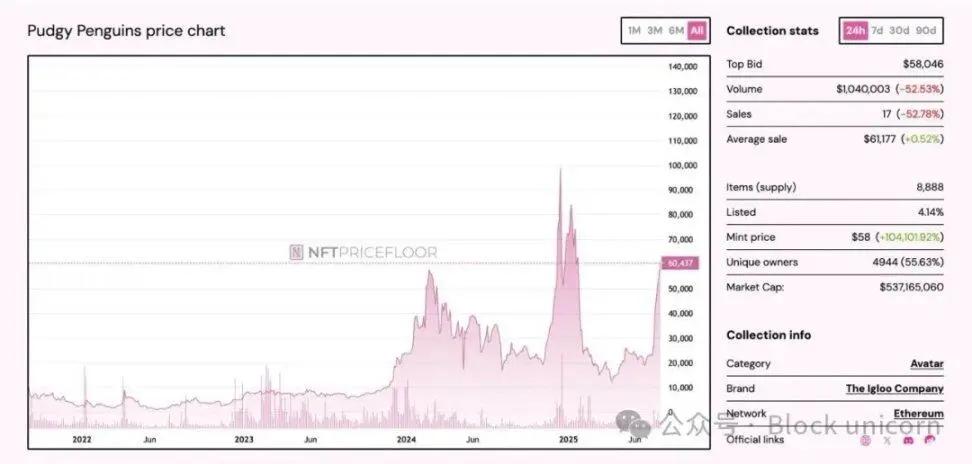

One of these was Pudgy Penguins, a collection of 8,888 cartoon penguin Non-Fungible Tokens that attracted attention with its cute design and strong community. But by January 2022, the project was in crisis. The original founders had promised more than they delivered, and roadmap projects went unfulfilled. There were allegations of financial mismanagement, and community trust had collapsed.

On January 6, 2022, the community voted to remove the initial founders. On the same day, Netz publicly proposed buying the entire Pudgy Penguins series and its intellectual property for 750 ETH (approximately $2.5 million at the time).

This was not an easy decision. The acquisition happened just a week before the Non-Fungible Token market entered a two-year bear market. Netz and his executive team raised funds for the acquisition and worked without salary for a year, while investing an additional $500,000 of personal funds to keep the project alive.

What attracted him was the potential to build an enduring brand. "If I can't close my eyes and imagine Pudgy Penguins becoming a billion-dollar brand, I would never buy it," he said.

Beyond Digital Collectibles

Most people thought Netz would flip Pudgy Penguins, clean up the mess, raise the floor price, and then sell to the next buyer. However, he completely ignored the Non-Fungible Token market.

Under Igloo Inc.'s leadership, Pudgy Penguins became an unprecedented brand: a crypto brand operating in the real world. Netz established six revenue streams: digital experiences, physical products, licensing deals, content creation, film and TV development, and gaming. These penguins were no longer just avatars, but characters in a larger story.

The physical product strategy initially seemed crazy. Would crypto enthusiasts buy cartoon penguin plush toys? But Netz's target wasn't crypto enthusiasts; it was parents at Walmart.

Each plush toy comes with a QR code leading to "Pudgy World," a digital space where users can obtain a crypto wallet and claim Non-Fungible Token wearables.

Pudgy World is a free 3D browser game where players can customize penguin avatars, explore virtual worlds using their Non-Fungible Tokens and physical toys, seamlessly integrating Web 3 ownership with an accessible game. Parents think they're buying their children a plush toy, but unknowingly, they're entering Web 3.

This strategy's success was unexpected. Pudgy Penguins toys are now on shelves at Walmart, Target, Chuck E. Cheese, Amazon, and Walgreens. Over 1.5 million toys have been sold, generating more than $10 million in revenue within a year.

While other Non-Fungible Token projects collapsed or desperately pivoted, Pudgy Penguins quietly became a crypto brand that can survive without relying on cryptocurrency.

Token Issuance

On December 13, 2024, Netz airdropped PENGU tokens worth $1.5 billion to millions of user wallets in the crypto ecosystem. This was the largest airdrop in Solana history. He chose Solana due to its lower transaction fees and higher throughput to maximize accessibility.

25.9% of tokens were allocated to the Pudgy Penguin community, 24.12% to other communities and new joiners, with the remainder distributed among team members (with lock-up periods), liquidity providers, and company reserves.

This issuance sparked intense debate in the crypto community. Some praised the broad distribution as democratizing the project's success. Others criticized distributing tokens to millions of wallets instead of concentrating rewards on long-term holders.

Netz defended this strategy: "I'm not trying to launch a $2 billion token and stop there. I'm chasing real giants. I'm chasing Dogecoin." He believed PENGU needed a launch story that could resonate with mainstream audiences to reach the scale of a mature meme coin like Dogecoin.

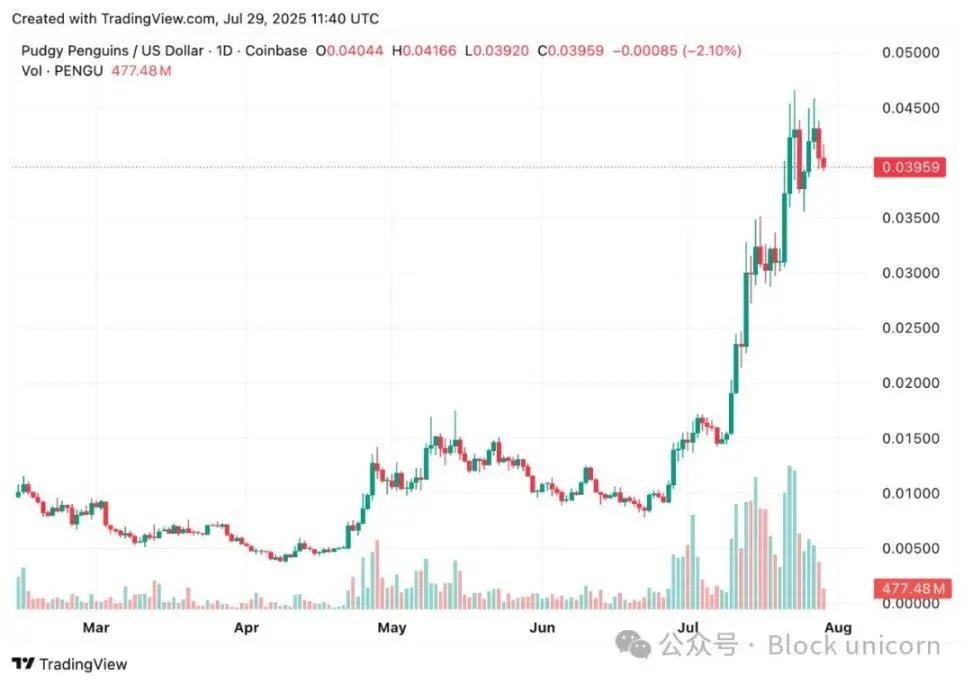

Since its launch, PENGU's performance has validated some of Netz's bold predictions. PENGU debuted with a market cap of around $2.3 billion, experiencing typical token issuance volatility with a significant initial drop before finding support. The token consolidated for months between key price levels, laying the groundwork for a subsequent major rally.

By mid-2025, with increasing whale accumulation and daily trading volume exceeding $2.5 billion, PENGU surged over 300% in just a few weeks, with its market cap exceeding $2.5 billion.

This rally was driven by multiple catalysts, demonstrating the ecosystem's growing mainstream appeal. The most significant driver was Canary Capital's groundbreaking PENGU/NFT-themed ETF application to the SEC. This institutional validation triggered massive FOMO in the market, indicating traditional finance's growing interest in the Pudgy Penguins ecosystem. Whale accumulation provided a technical basis for the rise, with over 200 million PENGU tokens acquired since July, reflecting intense institutional and retail investor interest.

Strategic partnerships with mainstream brands, including NASCAR, Lufthansa, and Suplay Inc., brought unprecedented exposure beyond the crypto sphere. Ongoing rumors about Pudgy Penguins potentially acquiring OpenSea further fueled speculation, though the team later denied these rumors.

Meanwhile, the original Non-Fungible Token series maintained strong performance, with floor prices stabilizing at 15-16 ETH, significantly recovering from bear market lows, validating Netz's strategy of building enduring value beyond short-term hype.

Building a Consumer Blockchain

In January 2025, Abstract launched as Netz's boldest bet yet: a blockchain that doesn't feel like a blockchain. No wallet setup. No seed phrases to store. No gas fees to calculate. Users can start trading without knowing they're using blockchain technology.

Netz believes the blockchain itself is the least interesting part of Abstract. In his view, consumers won't go on-chain unless they have a reason and friction disappears. Most importantly, he wants Abstract to be fun, allowing people to play games, collect digital items, and interact with apps without thinking about the underlying technology.

This vision attracted $11 million in investment from Founders Fund and other top investors. Abstract launched with over 100 applications, with more than 400 in development. These are not DeFi protocols or trading platforms, but games, music, sports, and fashion apps running on the blockchain.

This ambition reflects the person behind it. Netz works six days a week, 12 hours a day, from 8 am to 8 pm, with no holidays. His only break is from 6 pm to 8 pm, which he calls "critical thinking time," used to process the day's events and plan tomorrow's execution.

Abstract might become the platform that finally brings cryptocurrency to mainstream consumers. Or it could be another expensive lesson in the gap between vision and reality. For Netz, the discomfort of not knowing the outcome is the point.

Future Vision

Netz has his own theory about the future. Traditional brands sell products to consumers, with transactions ending at the checkout. Non-Fungible Tokens completely reverse this model. You don't get customers, but participants; not buyers, but stakeholders who share in the brand's success.

This mechanism creates unprecedented synergy. When Pudgy Penguin holders promote the brand, they're by default investors protecting their assets. When these toys hit Walmart shelves, every Non-Fungible Token holder wins. It's a form of capitalism that involves all participants.

But Netz isn't thinking about quarterly earnings. He's planning for decades. Pudgy World's complete experience, developed over 18 months, has tens of thousands of accounts created and is about to launch. He plans to actively expand into the Asia-Pacific market, betting that the next crypto wave will emerge from the East.

25-year-old Luca Netz stands at the intersection of two worlds that shouldn't collide. On one side is the chaotic speculative world of cryptocurrency, where fortunes can evaporate in minutes; on the other, the slow-moving machinery of traditional retail, where gaining shelf space at Walmart requires months of negotiation and a proven track record.

Most would choose one side, but Netz built a bridge.

He knows the future isn't about choosing between digital and physical, community and business, innovation and accessibility, but proving they were never opposites.

Every Pudgy Penguin toy sold at Target comes with a QR code unlocking a digital world. Every traded PENGU token represents brand ownership existing simultaneously in blockchain code and retail goods. Every user who registers with just an email is unknowingly entering the future of finance.

This is Netz's revolution. Making the impossible inevitable. He didn't disrupt industries; he taught them to speak to each other.

In cryptocurrency's brief history, most success stories follow a familiar arc: technological breakthrough, venture capital, explosive growth, and eventual decline. Netz wrote a different script. He turned the industry's biggest weakness—opacity to ordinary people—into his competitive advantage.

Some entrepreneurs create companies. Others create movements. Netz created a new category of existence. Where digital ownership feels as natural as holding a plush toy, global communities form around shared joy rather than shared interests, and the most complex technology is hidden behind the simplest experiences.