ENA, the native token of Ethena, an Ethereum-based synthetic dollar protocol, is today's top-performing cryptocurrency asset. Currently trading at $0.60, its price has risen by 11% in the past 24 hours.

This rally is due to the significant increase in the circulating supply of Ethena's synthetic dollar-pegged stablecoin USDe. With bullish technical indicators, ENA is expected to continue rising in the short term.

ENA Surges…USDe Supply Reaches All-Time High of $873 Million

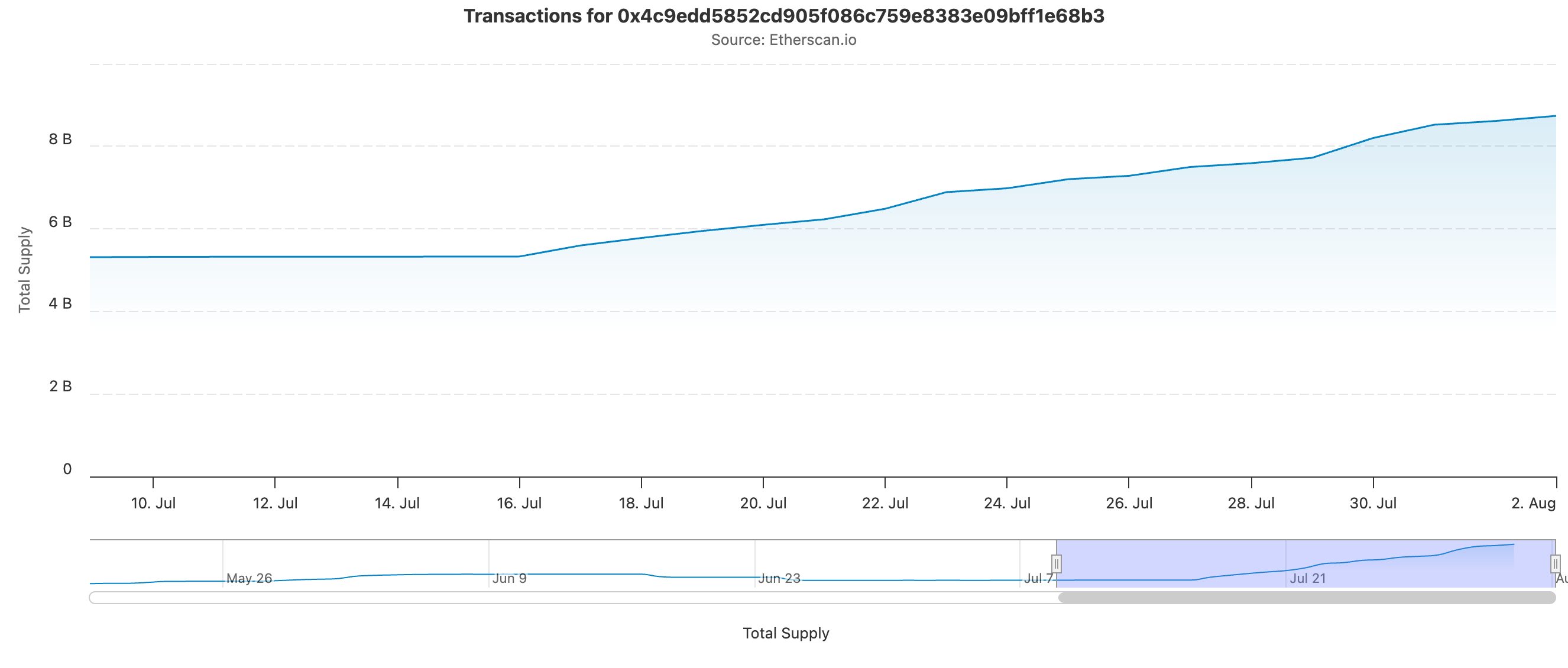

According to Etherscan data, USDe's circulating supply has reached an all-time high of $8.73 billion, increasing by over $3.4 billion since July 16th.

Token TA and Market Update: Want more of these token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

This increase reflects growing user adoption and capital inflow into the protocol as more investors seek stable, yield-generating dollar exposure.

The stablecoin supply increase has reinforced a positive sentiment towards ENA. Amid uncertain and volatile market conditions, the price has risen in double digits today. Key technical indicators point to an increase in upward momentum.

ENA Gains Momentum Despite Recent Decline

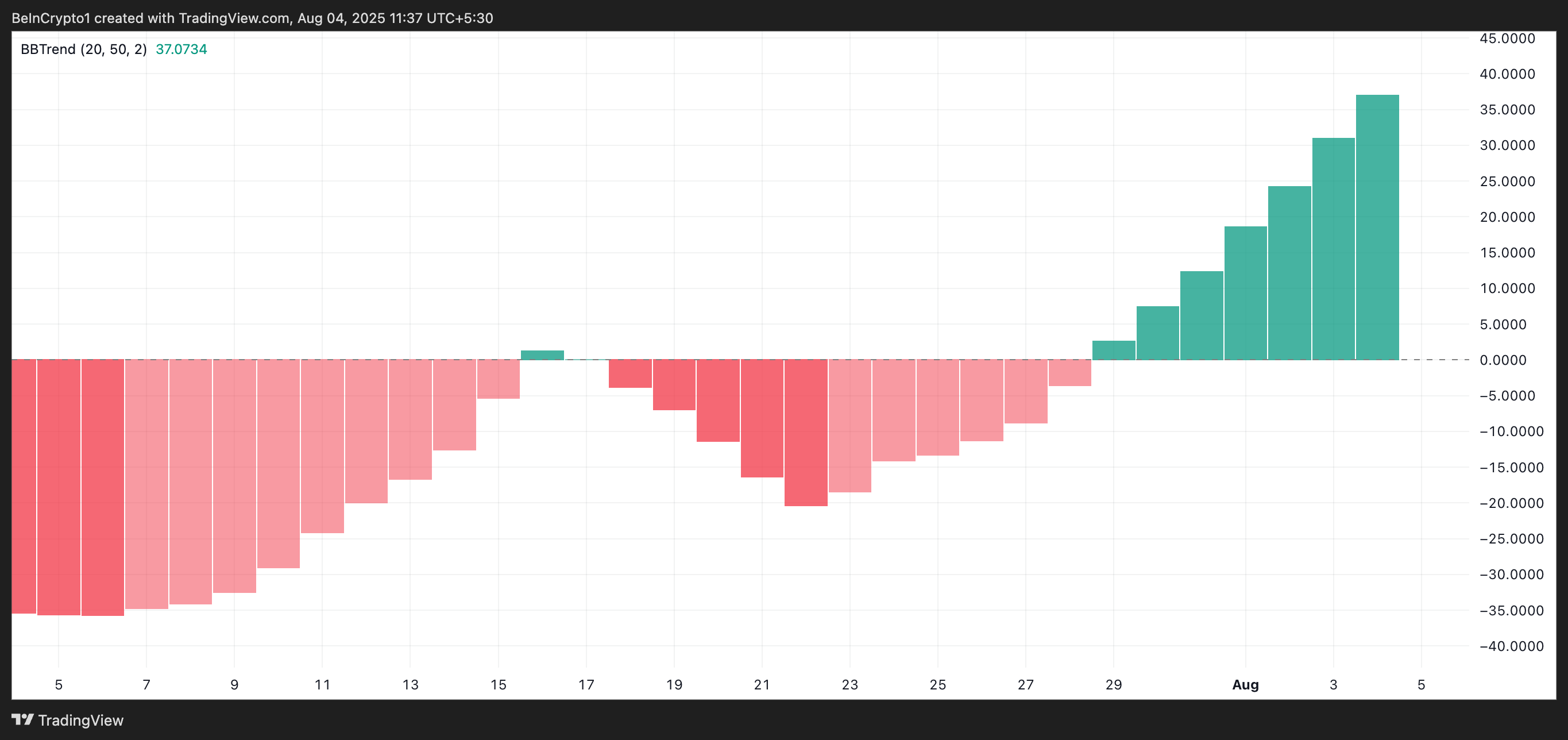

Technical analysis of the ENA/USD daily chart shows the token's BBTrend (Bollinger Bands Trend) indicator displaying a series of green bars steadily increasing in size since June 29th.

This steady increase occurred despite ENA's price decline over the past week. Today's rally represents the largest price improvement during that period, suggesting a potential reversal.

As the BBTrend bars expand while the price consolidates, this reflects potential upward pressure. If this momentum is maintained, ENA could see further increases.

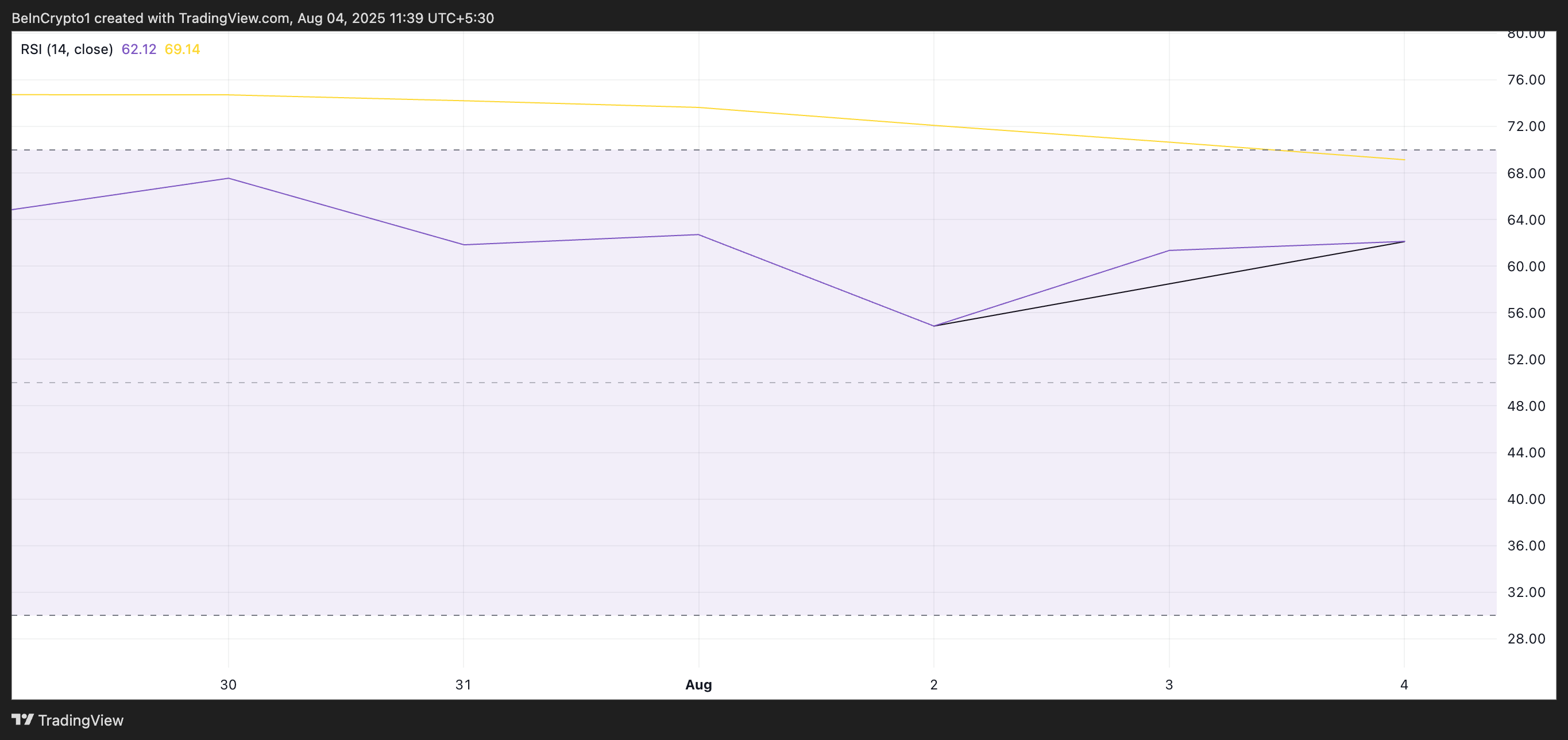

Moreover, the token's Relative Strength Index (RSI) confirms this bullish outlook. The momentum indicator is currently at 62.12 and showing an upward trend.

The RSI indicator measures an asset's overbought and oversold market conditions, with values between 0 and 100. Values above 70 indicate an overbought asset and expected price decline, while values below 30 suggest an oversold asset that may rebound.

ENA's RSI reading indicates market participants prefer accumulation over distribution. If this trend continues, the price could continue rising in the short term.

ENA's Uptrend, Targeting $0.77…Will It Break the Important Barrier?

At the current price, ENA is just below a key resistance level of $0.64. This critical price point could determine the altcoin's next move.

If the upward momentum strengthens and buying pressure continues to increase, breaking this level could push ENA towards the next major resistance around $0.77.

However, if demand weakens or market sentiment changes, ENA could drop to the $0.48 support zone.