Table of Contents

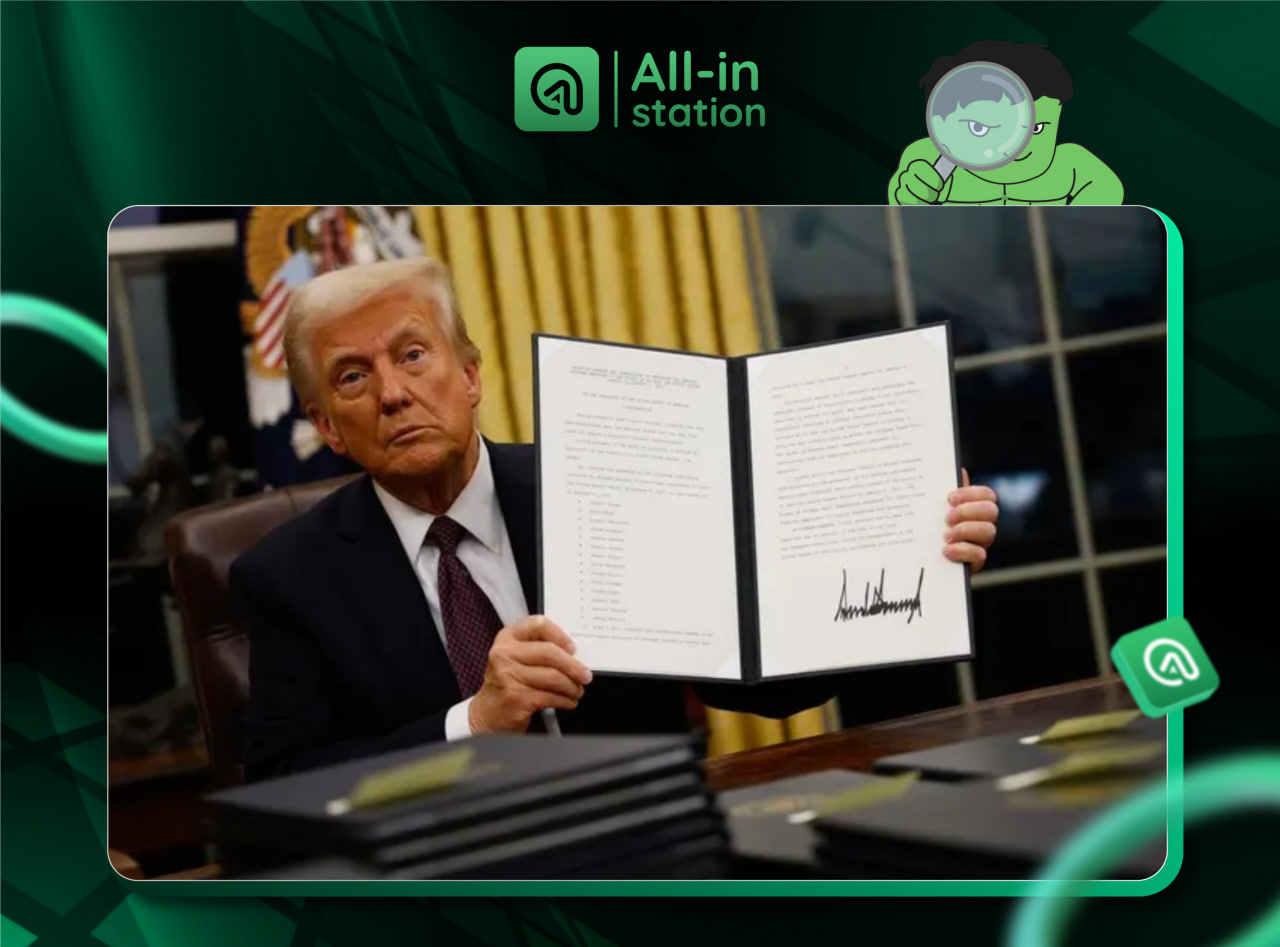

ToggleUS President Donald Trump is reportedly about to sign an important executive order, directing banking regulators to investigate allegations related to "debanking" – the practice of banks refusing to serve or terminating relationships with customers in the cryptocurrency sector and individuals/groups with conservative views.

According to a draft order obtained by the Wall Street Journal, the order will require agencies such as the Federal Reserve (Fed), FDIC, and OCC to investigate whether financial institutions have violated antitrust laws, consumer financial protection, or fair lending regulations. Institutions found to be in violation may face financial penalties or legal prosecution.

Executive Order to Protect Financial Access for the Cryptocurrency Industry

The crypto industry has long accused previous administrations – especially under President Joe Biden – of using financial supervisory agencies to pressure banks, causing them to refuse cooperation with businesses operating in the digital asset sector. This move was dubbed by the community as "Operation Choke Point 2.0", reminiscent of a campaign previously launched by the US Department of Justice in the 2010s to restrict "sensitive" industries from accessing the financial system.

President Trump's new order is expected to completely reverse this policy, requiring regulators to eliminate any internal regulations that might cause banks to cut ties with cryptocurrency businesses.

Additionally, the order directs the Small Business Administration (SBA) to review lending guarantee policies, ensuring that small and medium-sized enterprises – including crypto startups – are not discriminated against.

The "Debanking" Wave That Once Enraged the Crypto Community

Following FTX's collapse in late 2022, the Biden administration was accused of secretly launching a crypto industry crackdown through rigorous inspections by the FDIC and other supervisory agencies. Paul Grewal, Coinbase's Chief Legal Officer, testified before Congress that banks were forced to "surrender to pressure" from the government when asked to cease cooperation with crypto or stablecoin businesses.

Coinbase also filed a lawsuit against the FDIC under the Freedom of Information Act (FOIA), revealing that the agency had secretly instructed some banks to temporarily suspend crypto services, raising concerns that this was not just a conspiracy theory but a systematic campaign.

Trump Also Targets Service Refusal for Political Reasons

Beyond the crypto sector, the President's order also requires investigating cases where banks refuse to serve organizations or individuals with conservative political views. While the draft does not name specific banks, it mentions financial institutions that cooperated with federal investigations of the January 6, 2021 Capitol riot, leading to concerns about banks being "weaponized" for political purposes.

Many conservatives have publicly accused that their bank accounts, credit cards, or financial services were canceled without clear reasons, solely due to disagreements with the previous administration.

Meanwhile, financial institutions describe this as a "derisking" policy – aimed at avoiding legal, financial, or reputational risks – and assert their right to refuse customers if risk indicators are detected.

However, amid waves of criticism, the US Federal Reserve (Fed) has declared a halt to evaluating "reputational risks" in bank inspections, following the FDIC and OCC – a clear sign of changes in financial supervision policy under Trump.