This article is machine translated

Show original

@Pendle_fi sub-protocol @boros_fi, with total open positions reaching $15 million within 24 hours 💥

♦️ @boros_fi creates a new market using "funding rate" as a trading target, where users can trade or hedge funding rates by going long or short on Yield Units 👀

♦️ @boros_fi 24-hour data

🔹 Total open positions reached $15 million

🔹 Nominal trading volume reached $36 million

🔹 $BTC/$USDT - #Binance market has reached full position limit (recently increased from $10 million to $15 million)

🔹 $ETH/$USDT - #Binance market has used 52% of open position space

🔹 Liquidity pools for $BTC/$USDT and $ETH/$USDT are fully funded

♦️ @boros_fi breakthrough: Making funding rates controllable, converting to fixed income

♦️ @boros_fi target audience: Retail investors, institutions, Delta neutral strategy projects

@boros_fi's value is more reflected in institutions and Delta neutral strategy projects.

Taking @ethena as an example: Total amount on CEX for $BTC/$ETH exceeds $4 billion, adopting delta neutral strategy to earn income.

To avoid @ethena's losses from negative funding rates, it can use @boros_fi to hedge rate risks and ensure stable returns.

👇 How @boros_fi brings value back and @Pendle_fi's ecosystem landscape

TN | Pendle

@tn_pendle

08-07

In 24 hours since launch, @boros_fi has achieved:

• $15M in Open Interest

• $36M in Notional Trading Volume

• BTCUSDT-Binance market at full capacity (with OI cap recently being raised $10M → $15M)

• ETHUSDT-Binance reached 52%

• Both BTCUSDT and ETHUSDT Liquidity Vaults

♦️ @boros_fi Value Repatriation

@boros_fi will not issue new tokens. Revenue distribution:

🔹 $vePENDLE Holders: 80%

🔹 Protocol Treasury: 10%

🔹 Protocol Operations: 10%

According to @tn_pendle, @boros_fi is expected to generate $2 million in annualized revenue in its first year.

Revenue repatriation will increase the value of $Pendle. Last year, the APY for $vePENDLE was approximately 40%, and this figure is likely to be even higher after the repatriation.

♦️ @Pendle_fi's next project, Citadel, expands @Pendle_fi to:

🔹 Non-EVM chains

🔹 Institutional-grade products

🔹 Compliant markets

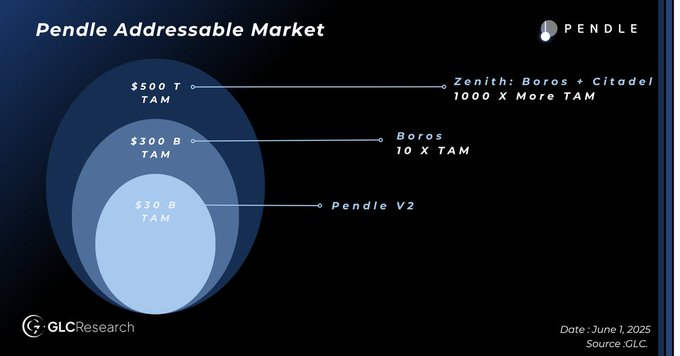

@Pendle_fi's revenue flywheel continues to expand, reaching a potential market size of hundreds of trillions of dollars.

GLC

@GLC_Research

08-06

📢 Boros is Live || @pendle_fi

Boros is Pendle’s next major product, built to tokenize and trade perpetual funding rate, the largest untapped source of yield in crypto.

▫️Boros introduces active yield trading, unlocking a market estimated to be 10x larger than $PENDLE current x.com/boros_fi/statu…

🔥 Join the Biyan community to discuss more market opportunities:

• Chinese Telegram community: bit.ly/3YmFBrN

• Hong Kong Telegram community: bit.ly/HK-TG-Group

• Subscribe to the Daily Coin Research Telegram channel:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content