Investors often view exchange reserves data as one of the key indicators for assessing long-term holding demand. A decrease in exchange reserves can help drive price increases by reducing available supply.

Several altcoins saw a notable decrease in exchange reserves during the first week of August, coinciding with a recovery in altcoin market capitalization.

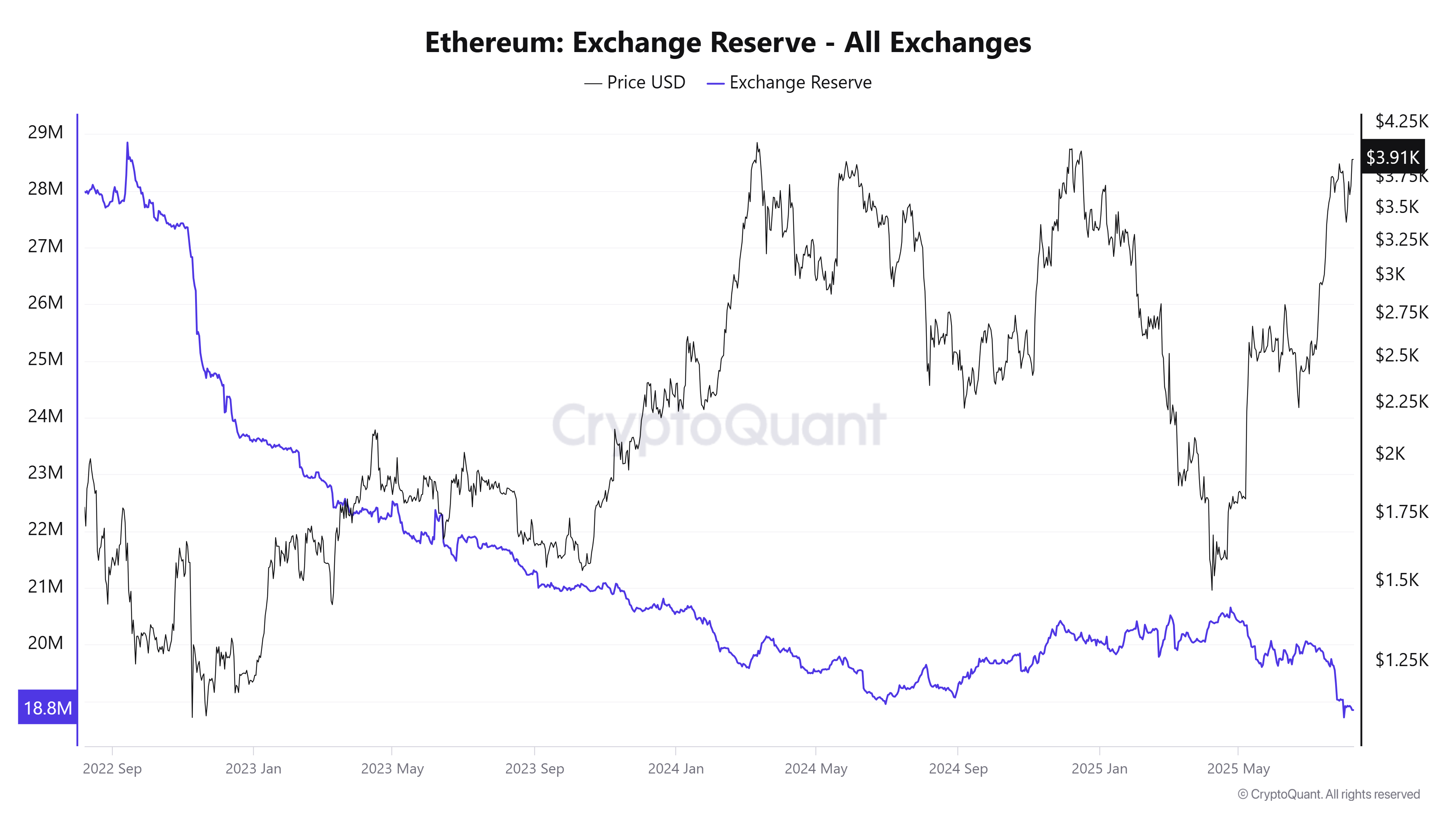

1. Ethereum (ETH)

According to CryptoQuant data, Ethereum's exchange reserves dropped below 19 million ETH, reaching a three-year low in early August.

On August 8th, ETH price approached $4,000. However, this price increase did not prompt more investors to move ETH to exchanges, suggesting holders are not rushing to realize profits.

Currently, institutional demand appears to be ETH's strongest driver. Strategic ETH holdings statistics show that by the end of July, the total value of strategic Ethereum holdings exceeded $10 billion, with 2.7 million ETH. In the first week of August, this figure increased to $11.8 billion, surpassing 3 million ETH.

This demand helped withstand potential selling pressure such as large amounts of unstaked ETH and Ethereum Foundation sales.

"As ETH price rises, exchange reserves are decreasing. This shows more people are holding ETH outside exchanges, which is generally a sign of confidence in long-term price." – Investor BullishBanter said.

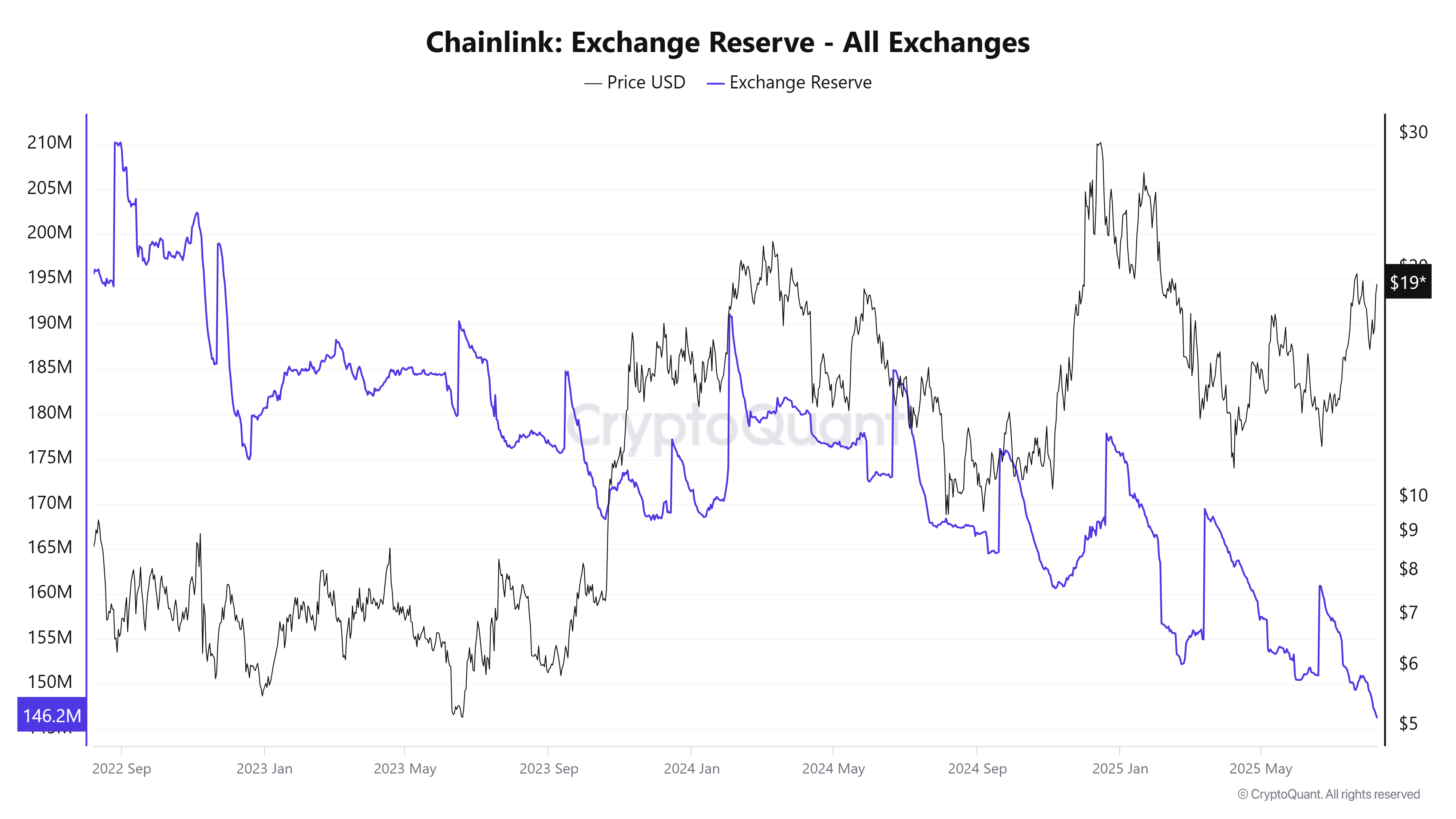

2. Chainlink (LINK)

According to CryptoQuant data, Chainlink's (LINK) exchange reserves also hit a new low in the first week of August. Approximately 146.2 million LINK are on exchanges, a 16% decrease compared to the beginning of the year.

The decrease in LINK supply on exchanges occurred when the price rebounded by 15%, rising from $15.5 to over $19, reflecting a recovery in long-term accumulation sentiment for altcoins.

"Now think about Chainlink holdings. A massive LINK supply shock is coming." – Investor Quinten said.

Additionally, recent Santiment data showed that when LINK price exceeded $18.40, on-chain data recorded a 4.2% increase in wallets holding between $100,000 and $1 million LINK. Cumulative supply increased by 0.67% in August alone.

This coincided with Chainlink's data stream release (real-time US stock/ETF data) and the adoption of Chainlink holdings on August 7th, which converts protocol revenue into LINK purchases.

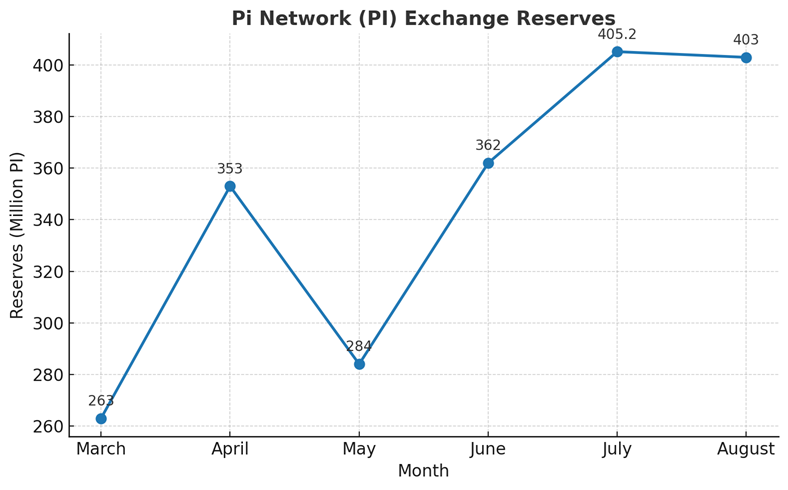

3. Pi Network (PI)

A BeInCrypto report at the end of July warned that Pi Network (PI) holdings on exchanges exceeded 405 million PI. However, according to Piscan data, this figure slightly decreased to 403 million PI after the first week of August.

Though the decrease is small, it is a positive signal after several months of continuous increase in Pi's exchange supply.

Notably, the decrease of Pi on exchanges occurred while the price dropped 10% in the first week of August to $0.366. This suggests Pi accumulation may restart as investors begin to see buying opportunities at prices much lower than the open network stage.

However, exchange data should be monitored closely, as the decrease is not strong enough to draw definitive conclusions.