[Performance by Period]

Mantle (MNT/KRW) has risen by +46.79% in the past week, and Pendle (PENDLE/KRW) also showed a strong short-term trend with a +39.87% increase during the same period. Chainlink (LINK/KRW) rose by +31.79% in a week, reflecting the recovery trend of major large-cap tokens. Based on Upbit's top-performing tokens, SOON (SOON/BTC) surged by +187.69% weekly, and BTC market tokens like GO and ACS also showed a 100% increase.

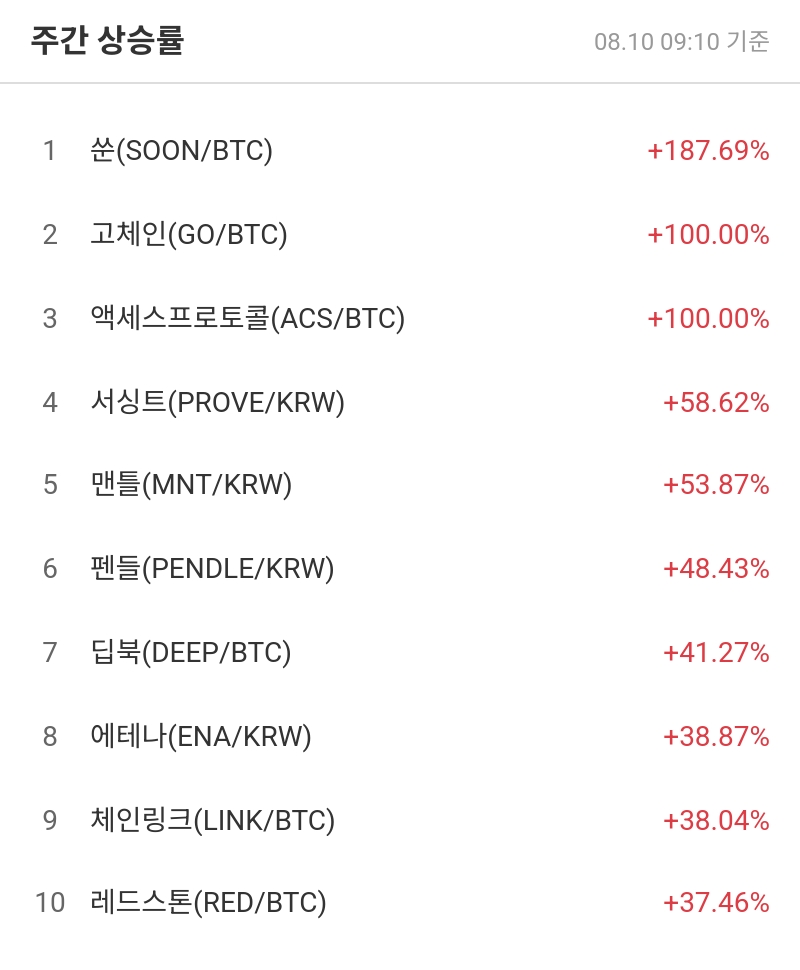

[Weekly Performance TOP 10]

1st SOON (SOON/BTC) +187.69%

2nd GO Chain (GO/BTC) +100.00%

3rd Access Protocol (ACS/BTC) +100.00%

4th Sursing (PROVE/KRW) +58.62%

5th Mantle (MNT/KRW) +53.87%

6th Pendle (PENDLE/KRW) +48.43%

7th DeepBook (DEEP/BTC) +41.27%

8th Etena (ENA/KRW) +38.87%

9th Chainlink (LINK/BTC) +38.04%

10th RedStone (RED/BTC) +37.46%

The top weekly performer was SOON (SOON/BTC) with an outstanding increase of +187.69%. Following that, Bitcoin market tokens like GO Chain and Access Protocol more than doubled, while KRW-listed tokens such as PROVE, MNT, and Pendle recorded mid-40% to 60% returns, proving an overall recovery of investor sentiment.

[Daily Purchase Settlement Intensity TOP 5]

1st Axie Infinity (AXS/KRW) 500.00%

2nd Adventure Gold (AGLD/KRW) 500.00%

3rd MVL (MVL/KRW) 500.00%

4th Cosmos (ATOM/KRW) 500.00%

5th Aptos (APT/KRW) 500.00%

Multiple tokens recorded a purchase settlement intensity of 500%, capturing an extreme buying trend. Axie Infinity (AXS), MVL, and AGLD all recorded the same figure, showing signs of concentrated short-term trading power. This could be due to chasing buy orders at the beginning of an uptrend or a sudden increase in trading pair volume.

[Daily Sell Settlement Intensity TOP 5]

1st ICON (ICX/KRW) 0.00%

2nd Orbs (ORBS/KRW) 0.00%

3rd DeepBook (DEEP/KRW) 0.13%

4th Astar (ASTR/KRW) 2.29%

5th JUST (JST/KRW) 2.93%

In contrast, in terms of sell settlement intensity, ICX and ORBS recorded 0.00% each, showing an extreme selling advantage, and tokens like DEEP and ASTR recorded low values within 5%, indicating significant downward pressure. Some of this could be due to profit-taking sells after a price increase.

This week's market simultaneously observed a short-term rally and extreme trading ratio concentration, suggesting entry into a high volatility period. Investors need to check token-specific news and events and adjust profit-taking strategies.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>