Welcome to the US Crypto News Morning Brief—where we provide the most important cryptocurrency information for today.

Enjoy a cup of coffee while financial markets are sending warning signals similar to those before the largest collapses in modern history. This time, analysts and traders are debating whether Bitcoin (BTC), trading above 120,000 USD, can escape the pull of a potential stock market collapse.

Cryptocurrency News of the Day: Stock Market Collapse Warnings Increase — Will Bitcoin and Ethereum Surge or Plummet?

Robert Kiyosaki, who recently appeared in a US Crypto News publication, warns that stock market collapse indicators are signaling a major downturn. According to him, this could be good news for gold, silver, and Bitcoin owners but a major shock for Baby Boomers with significant dependence on 401(k) plans.

Some of these indicators were found in the bond market, with Financelot, a market commentator, emphasizing the historical correlation between the rise in US 3-month Treasury bond yields and major market crashes.

Today, this yield pattern reflects peaks before collapses, including March 2002, September 2008, and February 2020. This has raised concerns that history might repeat itself.

Meanwhile, not everyone believes the narrative that Bitcoin will appreciate if traditional markets weaken. Commentator Beka challenges Kiyosaki's optimism, arguing that Bitcoin has been absorbed into the traditional financial system (TradFi) and is unlikely to decouple during a stock market collapse.

Gold, typically considered a safe asset, has also struggled. It has declined most significantly in the past three months due to reports that the US might clarify tariff policies on gold bullion.

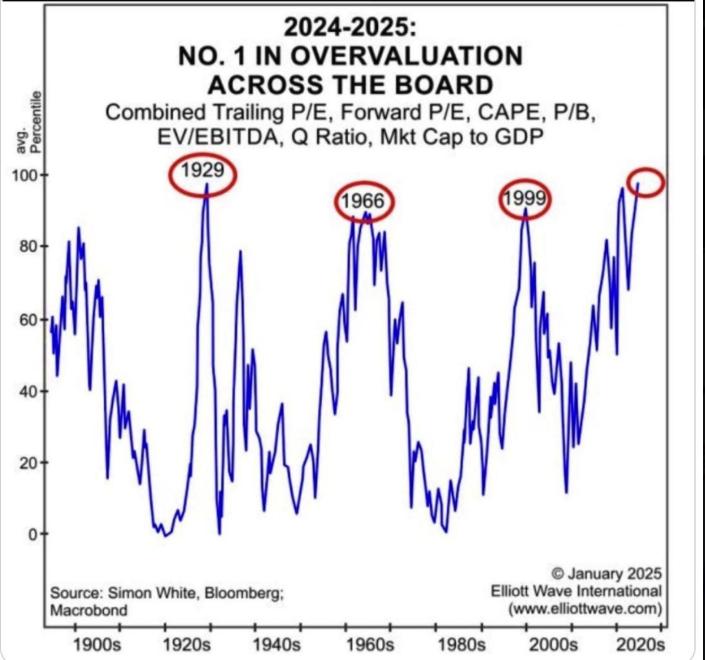

In this context, US stocks are at their most expensive valuation since the Great Depression, adding another layer of risk.

US Stock Market Valuation Reaches 1929 Levels. Source: Barchart on X

US Stock Market Valuation Reaches 1929 Levels. Source: Barchart on XHowever, cryptocurrency traders are still focusing on short-term stimuli, with Bitcoin regaining the 122,000 USD mark. Analyst Ted Pillows notes that altcoins dominated the previous week, but a lighter-than-expected CPI report tomorrow could trigger a Bitcoin price surge to new all-time highs.

Global Market Volatility Challenges Crypto's Safe Haven Status

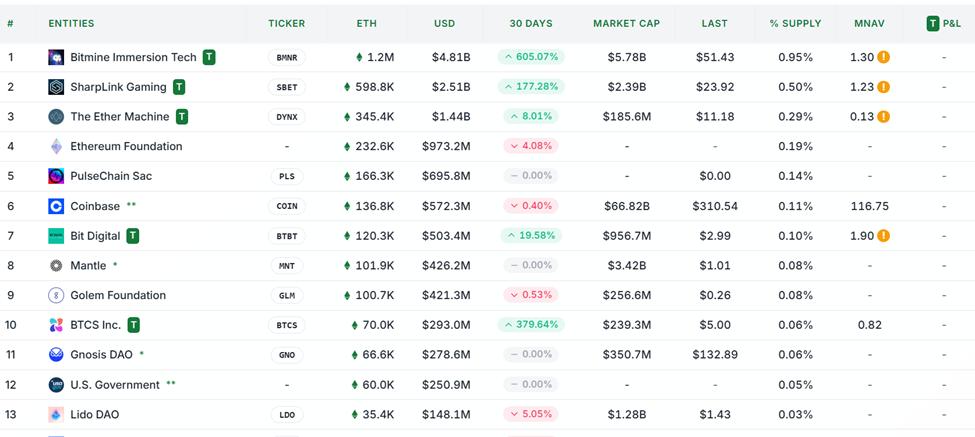

Meanwhile, Ethereum continues to attract institutional attention. Investment company BitMine has doubled its ETH holdings in a week, now controlling 1.2 million ETH valued at 4.96 billion USD.

Ethereum Holding Companies. Source: Strategic ETH Reserve XYZ

Ethereum Holding Companies. Source: Strategic ETH Reserve XYZThe company's stock has increased, and Wall Street's liquidation rankings reflect strong investor interest in the second-largest cryptocurrency.

Globally, market instability is not limited to the US. Iran's stock market has lost over 75% of its dollar value since 2020, highlighting the fragility of emerging markets.

The central question now is whether Bitcoin will follow previous market recession scenarios or ultimately break free. History shows that even alternative assets can be swept into sell-offs when fear engulfs Wall Street.

But with inflation data, Fed policy changes, and increasing institutional cryptocurrency acceptance, the stage is set for a significant test of Bitcoin's resilience.

Chart of the Day

US 3-Month Yield Signals Before Previous Crashes. Source: Financelot on X

US 3-Month Yield Signals Before Previous Crashes. Source: Financelot on XThis chart shows the technical indicators of US 3-month Treasury bond yields before stock market crashes in June 2002, September 2008, and February 2020. The current yield pattern is very similar to previous peaks, raising concerns about another potential market recession.

40-Year Pattern in US 3-Month Yield and Market Crashes. Source: Financelot on X

40-Year Pattern in US 3-Month Yield and Market Crashes. Source: Financelot on XA long-term view of US 3-month yields reveals a recurring trend over 40 years, with sudden increases preceding major market crashes. The recent increase aligns with historical pre-crash levels, suggesting the cycle might be repeating in the current market.

Notable US Crypto News Today

Here is a summary of some notable US crypto news today:

- Ethereum Developer Reportedly Detained in Turkey.

- Four US Economic Indicators to Watch This Week as Bitcoin Recovers to $122,000.

- Lido Price Increases 58% in Five Days as LDO Active Addresses Reach Two-Year High.

- BNB Price at $1,200 After Surpassing Nike in Market Capitalization.

- Bitcoin's Next All-Time High May Be Approaching as Two Indicators Show Upward Trend.

- Two Factors Suggest Solana Could Soon Exceed $190.

- Unlocking $3.28 Billion Ripple Escrow Interrupts XRP Price Increase.

- Three Altcoins at Risk of Major Liquidation in the Second Week of August.

Crypto Stock Market Opening Overview

| Company | Closing on 08/08 | Pre-Market Overview |

| Strategy (MSTR) | $395.13 | $406.00 (+2.75%) |

| Coinbase Global (COIN) | $310.54 | $320.50 (+3.31%) |

| Galaxy Digital Holdings (GLXY) | $27.78 | $28.90 (+4.03%) |

| MARA Holdings (MARA) | $15.38 | $15.86 (+3.12%) |

| Riot Platforms (RIOT) | $11.08 | $11.46 (+3.43%) |

| Core Scientific (CORZ) | $14.41 | $14.23 (-1.25%) |