This article was published jointly by Aquarius Capital and K1 Research

introduction

Since 2024, Real-World Assets (RWAs) have re-emerged as a core narrative in the crypto market. From stablecoins to US Treasury bonds, and now to stocks and non-standard assets undergoing trial runs, the on-chain integration of real-world assets is moving from a validation phase to a scaling phase. This momentum is driven not only by technological maturity but also by a clearer global regulatory environment and the proactive embrace of blockchain infrastructure by traditional finance. This wave of RWA enthusiasm is no accident. It represents the convergence of multiple factors:

- Macroeconomic background: Global interest rates remain high, and institutional capital is re-evaluating on-chain income tools;

- Policy evolution: Major regulatory bodies such as the US and Europe are gradually establishing a framework for "regulated tokenized assets," expanding the scope for project compliance.

- Technological evolution: Infrastructure such as on-chain settlement, KYC modules, institutional wallets, and permission management are becoming increasingly mature;

- DeFi integration: RWA is no longer a "package" of off-chain assets, but an integral part of the on-chain financial system, with liquidity, composability and programmability.

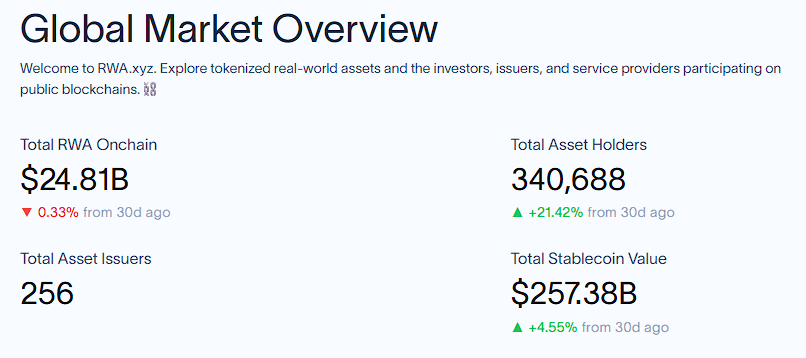

Data shows that as of August 2025, the total size of global RWA on-chain assets (excluding stablecoins) has reached over 25 billion, with stablecoins reaching a market capitalization of over 250 billion. RWA has been recognized as the core interface for the integration of Web3 and Web2 finance, and a key track for the mainstream adoption of on-chain finance.

1. Tokenization of Real Assets: Motivations and Implementation Paths

1.1 Why RWA? Why do real-world assets need to be “on-chain”?

The traditional financial system is based on centralized registration institutions and multiple layers of intermediaries. This structure is inherently structurally inefficient and has become a bottleneck restricting asset circulation and financial inclusion:

- Limited liquidity: Real estate, private equity, long-term bonds and other real assets generally face high transaction thresholds (such as a minimum investment of millions), long holding periods (several years or even decades), and limited circulation channels. As a result, a large amount of capital is "locked up", making it difficult to achieve efficient allocation.

- Cumbersome settlement and custody processes: Asset issuance, trading, and clearing rely on multiple intermediaries such as securities firms, clearing houses, and custodial banks. The process is complex and time-consuming (for example, cross-border bond settlement takes 3-5 days), which not only increases transaction fees but also increases operational risks and the probability of delays.

- Insufficient data transparency: Asset valuation relies on fragmented offline data (such as real estate appraisal reports and corporate financial statements), and transaction records are scattered across different institutional systems, making real-time synchronization and cross-verification difficult. This leads to pricing lags and inefficient portfolio management.

- The participation threshold is too high: high-quality assets (such as private equity and high-end art) are mostly open to institutions or high-net-worth individuals. Ordinary investors are excluded due to restrictions such as capital amount and compliance qualifications, exacerbating inequality in the financial market.

As a decentralized distributed ledger system, blockchain reconstructs asset records and transaction logic through "disintermediation," resolving the pain points of traditional finance from a fundamental technical perspective. Its core advantages and the value of tokenizing real assets are reflected in the following:

The underlying support of blockchain technology

- Decentralized resilience: Asset ownership records are jointly maintained by nodes across the entire network, without relying on a single centralized organization. This reduces single-point risks such as data tampering and system crashes, and improves the fault resistance of the entire system.

- Immutability and traceability: Once a transaction is confirmed on the chain, it is permanently recorded and can be traced back through the timestamp, providing an immutable "digital certificate" for the transfer of asset ownership, reducing fraud and disputes.

The concrete value of tokenization

- Liquidity innovation: By splitting high-value assets into smaller tokens through "fractional ownership" (e.g., a $10 million property can be split into 1,000 $10,000 tokens), combined with a 24/7 decentralized market and automated market makers (AMMs), this significantly lowers the investment threshold and increases trading flexibility.

- Process automation and disintermediation: Smart contracts automatically execute processes such as asset issuance, dividend distribution, and maturity redemption, replacing the manual operations of traditional intermediaries; Oracles access offline data (such as real estate valuations and corporate revenue) to support automated triggering of complex scenarios such as insurance claims, significantly reducing operating costs.

- Compliance and audit upgrades: KYC/AML rules are built into the chain to automatically verify investor qualifications; all transaction data is uploaded to the chain in real time, facilitating efficient verification by regulators and auditors, which is estimated to reduce compliance costs by 30%-50%.

- Atomic settlement and risk elimination: Atomic settlement of "simultaneous delivery of assets and funds" is achieved through smart contracts, completely eliminating the counterparty risk of "delayed delivery of money and goods" in traditional transactions, and shortening settlement time from T+3 to seconds.

- Global circulation and DeFi collaboration: Tokenized assets break through geographical restrictions and can flow seamlessly across the global blockchain network. At the same time, they can be used as collateral in DeFi protocols such as lending and liquidity mining, achieving "one asset, multiple uses" and unleashing higher capital efficiency.

- Overall, RWA is a Pareto improvement to the traditional financial industry. Based on technological innovation, it optimizes the efficiency of traditional finance.

Success Path Verification: The Experience of Stablecoins

As a stepping stone for real-world assets to be put on the blockchain, stablecoins have fully verified the feasibility of blockchain technology in connecting off-chain value with the on-chain ecosystem:

- Prototype of the model: Stablecoins such as USDT and USDC, by anchoring off-chain US dollar reserves at a 1:1 ratio, have realized the standardized mapping of fiat currency assets to blockchain tokens for the first time, becoming the initial practice of "putting real assets on the chain."

- Market verification: As of August 2025, the market value of stablecoins has exceeded US$256.8 billion, occupying an absolute dominant position in the RWA market, proving the scalability potential of off-chain assets on-chain.

- Value Implications: The successful operation of stablecoins verifies the security, transparency, and efficiency of the “off-chain assets-on-chain tokens” mapping, and provides technical standards and compliance specifications for the tokenization of more complex RWAs (such as real estate and bonds).

Through blockchain technology, real assets are able to break free from the limitations of traditional finance and achieve a paradigm upgrade from "static holding" to "dynamic circulation" and from "exclusive to a few" to "accessible to all."

1.2 How to RWA? RWA implementation path and operation structure

The essence of RWA is to transform valuable real-world assets into on-chain programmable digital certificates through blockchain technology, achieving a closed loop of "off-chain value-on-chain flow." Its core operational path can be divided into four key steps:

a) Off-chain asset identification and custody:

- Identification and Investigation of Off-Chain Assets: The legality, ownership, and value of assets must be verified by third-party institutions (law firms, accounting firms, and valuation agencies). For example, real estate requires verification of title certificates, rental income rights require confirmation of lease contracts, and gold must be stored in LBMA-certified vaults and regularly audited. For accounts receivable, the authenticity of the debt must be confirmed by the core enterprise and documented on the blockchain.

Classification and practice of hosting models:

Central Hosting

a. Advantages: Strong compliance, suitable for financial assets (such as government bonds and corporate bonds). For example, MakerDAO's bonds are held in bank custody, and the on-chain contract records the collateral status, with data updated quarterly.

Risk: There is a possibility of misappropriation of assets by the custodian. In 2024, a real estate project in Singapore failed to synchronize ownership changes on-chain, resulting in NFTs becoming “ownerless assets,” highlighting the information lag problem of centralized custody.

Decentralized hosting

Technical Implementation: Automated revenue distribution through DAO governance and smart contracts. For example, the DeFi protocol Goldfinch puts loan assets on-chain, with smart contracts managing repayments and default resolution.

Challenges: Lack of legal support, and code vulnerabilities can lead to asset losses. Some projects attempt to incorporate zero-knowledge proofs (ZKP) to verify ownership consistency, but this has yet to be implemented on a large scale.

Hybrid hosting

The key to a balance: Off-chain assets are held by a trusted third party, while on-chain data is verified by nodes. For example, in the node system of the Huamin Data RWA consortium chain, institutional nodes (banks, trust companies) are responsible for asset custody, regulatory nodes (accounting for 30%) set compliance standards, and industrial nodes (such as ports) provide logistics data.

Case: The carbon credit tokenization project Toucan Protocol is hosted by an environmental organization, and transaction and destruction information is recorded on the chain to ensure transparency.

b) Legal structure establishment:

Through legal structures such as SPV (Special Purpose Vehicle) and trust agreements, on-chain token holders have legal ownership or income rights, while establishing an enforceable legal bridge with the off-chain judicial system to ensure that "tokens = equity certificates"

Due to differences in regulatory frameworks, legal structure designs vary significantly across regions:

- The United States: This system focuses on "SPV isolation + securities compliance." A common structure involves registering a Delaware LLC (Limited Liability Company) as the SPV, which holds the underlying assets (such as US Treasury bonds or equity). Token holders indirectly enjoy asset rights through their LLC equity holdings. Furthermore, the SEC regulatory framework must be adapted to the asset type. If the token represents bonds or equity, it must comply with the Reg D (for accredited investors) or Reg S (for non-US investors) registration exemptions. If the token involves splitting income rights, the creditor-debtor relationship must be clarified through a "tokenized note" structure to avoid being classified as an "unregistered security."

- Europe: Leveraging the MiCA (Markets in Crypto-Assets Regulation) framework, this system is based on a trust or EU-approved SPV. For example, a Luxembourg-registered SICAV (Société des Investissements Variables) can be used as an SPV to hold assets and issue asset-referenced tokens (ARTs). The peg between the token and the underlying asset must be governed by both smart contract terms and legal agreements. MiCA explicitly requires token issuers to disclose asset custody details, equity distribution rules, and submit to regular audits by EU regulators to ensure the legal binding of on-chain tokens and off-chain equity is enforceable across the EU.

c) Tokenization issuance:

The above-mentioned off-chain assets are minted into tokens (usually ERC-20) as a carrier for on-chain circulation and combination

- 1:1 Full Conversion: Each token represents the full equity interest in an equivalent underlying asset. For example, in Paxos Gold (PAXG), one token represents one ounce of physical gold, which holders can redeem at any time. The token's value is fully synchronized with the gold price. A US Treasury token like $OUSG represents a 1:1 conversion to shares of a short-term US Treasury ETF, including full equity interest and principal.

- Partial equity mapping: Tokens represent only specific interests in the underlying asset (such as income streams and dividend rights), not full ownership. For example, in real estate tokenization, a project might issue "rental income tokens," where holders receive only a proportionate share of the property's rent, but not ownership or disposal rights. In corporate bond tokenization, "interest tokens" could be issued, representing only the interest income from the bond, while the original holder retains the principal. This model is suitable for fragmenting high-value assets and lowering the investment barrier.

d) On-chain integration and circulation:

Tokens enter the DeFi ecosystem and can be used for mortgage lending, market making, re-staking, structured asset design, etc., and support compliant user participation through permission management and on-chain KYC system.

The on-chain KYC system is the core tool for achieving compliant circulation. Its operating logic is "on-chain identity verification + dynamic authority management and control":

- Core function: Connecting with third-party identity verification service providers (such as Civic and KYC-Chain) through smart contracts. Users need to submit their identity information (passport, proof of address, proof of assets, etc.). After verification, an "on-chain KYC credential" (not the identity data itself, but the hash value of the verification result) is generated.

- Access control: Smart contracts restrict trading permissions based on KYC credentials - for example, only "qualified investors" (with assets exceeding US$1 million) are allowed to participate in private credit token transactions; for US debt tokens, non-US investors (Reg S framework) are restricted to redemption only within a specific time window.

- Privacy Protection: Zero-knowledge proof (ZK-proof) technology allows users to be verified as qualified by the smart contract without revealing their identity, balancing compliance with privacy requirements. For example, a user's KYC certificate may simply indicate "EU Anti-Money Laundering Verification Passed" without revealing their name or address.

Through the closed-loop design of the above four links, RWA realizes the transformation from "real assets" to "on-chain programmable assets", which not only retains the value foundation of traditional assets, but also gives them the efficient circulation and combination characteristics of blockchain.

2. Type Classification: RWA’s Mainstream Asset Class and the Rise of the US Treasury Narrative

Off-chain assets (Real World Assets, or RWAs) are migrating to the blockchain world at an unprecedented pace, extending beyond the core categories of traditional finance to encompass the broader real economy. From standardized financial instruments like government bonds, corporate bonds, and stocks, to physical assets like real estate, gold, and crude oil, to non-standardized equity like private equity, intellectual property, and supply chain receivables, virtually all real-world assets that generate value or possess ownership characteristics are being explored for tokenization and integration into blockchain networks.

2.1 Seven Mainstream Asset Classifications of RWA

Currently, the mainstream asset classes within the RWA (Real World Assets) ecosystem include stablecoins, tokenized US Treasury bonds, tokenized global bonds, tokenized private credit, tokenized commodities, institutional alternative funds, and tokenized equities. As of August 2025, on-chain RWA assets reached $25.22 billion. Stablecoins and US Treasury bonds remain the dominant players, with the stablecoin market reaching $256.82 billion and tokenized Treasury bonds reaching $6.80 billion. (Source: RWA.xyz | Analytics on Tokenized Real-World Assets )

2.1.1 Stablecoins

- Although stablecoins are not typical "off-chain assets", their core anchoring mechanisms are mostly based on off-chain fiat currencies or bond reserves, and therefore occupy the largest share in broad RWA.

- Representative assets: USDT, USDC, FDUSD, PYUSD, EURC

- Motivations for on-chain integration: payment composability, on-chain financial infrastructure, and fiat currency settlement alternatives

- Extension direction: KRW, JPY and other local currency stablecoins are accelerated to serve the local encryption ecosystem and reduce dependence on the US dollar; traditional banks pilot on-chain currencies for deposit tokenization to improve transaction efficiency and scenario adaptability; many countries promote CBDC simulation pilots (such as Hong Kong's "Digital Hong Kong Dollar") to accumulate technical and policy experience for formal issuance.

2.1.2 US Treasuries

- U.S. Treasury bonds have become the most mainstream on-chain asset, accounting for more than 60% of the market capitalization, introducing a low-risk yield curve for DeFi.

- Representative protocols: Ondo, Mountain Protocol, Backed, OpenEden, Matrixdock, Swarm

- Motivation for on-chainization:

- Market demand side: In the context of declining Crypto-native returns, the introduction of a stable and composable "risk-free interest rate benchmark"

- Technology-driven side: Infrastructure such as on-chain packaging, KYC whitelist, and cross-chain bridges are becoming increasingly complete

- Compliance structure: achieve asset penetration and regulatory compliance through legal structures such as SPV, tokenized note, and BVI fund

- Typical product structure:

- $OUSG (Ondo): Tracks short-term US Treasury bond ETF and pays daily interest

- $TBILL (Mountain): 1:1 with short-term T-bill, stable redemption, and strong composability

- $USDM (Mountain): The first stablecoin benchmarked to US Treasury yields

2.1.3 Global Bonds

- In addition to US bonds, government bonds and corporate bonds in Europe, Asia and other regions have also begun to be tokenized.

- Representative protocols: Backed, Obligate, Swarm

- On-chain motivations: Expanding geographical and currency coverage; Serving the issuance of non-USD stablecoins (such as EURC); Forming a global interest rate curve

- Challenges: Complex cross-border legal structures and inconsistent KYC standards

2.1.4 Private Credit

- Connect with off-chain SMEs, micro loans, real estate loans, working capital financing and other real yield assets

- Representative agreements: Maple, Centrifuge, Goldfinch, Credix, Clearpool

- Motivation for on-chain: Creating a real yield for on-chain capital; improving credit transparency and composability

- Typical structure:

- SPV manages the underlying assets, DeFi provides capital liquidity, and investors enjoy on-chain interest rates

- Chainlink Proof of Reserve / Attestation Enhances Data Credibility

- Main contradictions: transparency vs. privacy protection, returns vs. risk control quality

2.1.5. Commodities

- Tokenization of physical assets such as gold, carbon credits, and energy

- Representative protocols: Tether Gold (XAUT), Pax Gold (PAXG), Toucan, KlimaDAO

- On-chain motivation: Providing commodity exposure to on-chain investors; physical custody + on-chain transactions

- Hot topics: green finance, carbon market, sustainable development scenarios

2.1.6 Institutional Funds

- On-chain issuance of closed-end fund shares such as private equity, hedge funds, and ETFs

- Representative protocols: Securitize, ADDX, RedSwan, InvestX

- Motivation for on-chain: Improve share liquidity, lower entry barriers, and expand the global base of qualified investors

- Development restrictions: high compliance barriers, limited to Reg D / Reg S investors

2.1.7 Stocks

- Benchmarking off-chain stock assets through token/synthetic forms

- Representative protocols: Backed (xStock), Securitize, Robinhood, Synthetix

- On-chain motivation: support on-chain trading strategies, cross-chain arbitrage, and fractional share investment

- Development stage: mainly early trials, and the compliance path is still under exploration

Among all RWA asset classes, bonds are the benchmark for adaptability. Bonds are inherently highly standardized. Whether they are US Treasuries, corporate bonds, or personal bonds, they all rely on clear contract structures and redemption mechanisms, providing an efficient path for large-scale on-chain integration. In contrast, offline physical assets have diverse forms and complex ownership verification processes, while the standardized nature of bonds makes the on-chain mapping process more certain and streamlined. Furthermore, bond yields are relatively predictable, and the efficiency of on-chain capital interaction and off-chain revenue realization is significantly superior to other asset classes. This allows for the rapid establishment of an "on-chain-off-chain" value loop, precisely meeting the core demands of digital and efficient RWA assets.

2.2 US Treasury RWA lays the foundation for industry development

The reason why US Treasury bond RWAs have quickly become a "traffic gateway" for on-chain assetization is not only due to their strong financial attributes, but also because they hit the "gap" and "rigid demand" of the current crypto market on both the supply and demand sides. The following points are particularly critical:

Supply side: structural safety and clear compliance path

- U.S. Treasury bonds are inherently risk-free (in theory) and are the most trusted asset in the world.

- ETF and bill markets already have mature secondary markets with high liquidity

- Compared to equity, credit, etc., the legal structure of US debt tokenization is more stable and clear (such as BVI fund + token wrapper)

Demand side: Alternatives after Crypto-native benefits dry up

- Since the liquidity peak in 2021, a large number of DeFi profit models have collapsed, and the market has entered a "no-profit" cycle.

- Investors are beginning to turn their attention to on-chain composable real yield assets, and US debt tokens are the most natural choice.

- The demand for “on-chain interest rate anchors” has increased, especially after the rise of interest rate protocols such as LayerZero, EigenLayer, and Pendle.

Technology side: Standardized packaging asset structure gradually matures

- Typical structure:

- Tokenized Note (e.g. Ondo, Backed): linked to the underlying ETF, with daily interest payments

- Real-time redeemable stablecoin (eg USDM): redeemable at any time, composable

- Improved supporting tools such as Oracle, auditing, Proof of Reserve, and token-ETF NAV tracking

Compliance side: relatively easy to penetrate regulatory scrutiny

- Most US debt agreements use the Reg D / Reg S path and are only open to qualified investors.

- The financing structure is clear, and tax and regulatory risks are relatively controllable

- Suitable for institutional participation, promoting the intersection of TradFi and DeFi

3. RWA Development and Market Landscape

Real-World Assets (RWA) are gradually moving from a narrative phase to structural growth, with market participants, asset categories, technical architecture, and regulatory approaches all entering a period of substantial evolution. This chapter systematically examines the current state and evolution of the on-chain RWA market, analyzing it from four perspectives: asset development trends, ecosystem participation, regional regulation, and institutional adoption.

3.1 Market Progress and Key Trends

Judging from its current development trends, RWAs demonstrate strong momentum. Globally, its market size continues to expand rapidly. By the first half of 2025, the total value of on-chain RWA assets worldwide exceeded $23.3 billion, a nearly 380% increase from the beginning of 2024, making it the second-largest growth sector in the crypto space. Numerous institutions are entering the market, with Wall Street institutions accelerating their efforts. Tether has launched an RWA tokenization platform, Visa is exploring asset tokenization, and BlackRock is issuing tokenized funds, driving the market towards standardization and scale. Different types of RWA assets are also continuously exploring their respective paths. U.S. Treasury bonds, with their stability and mature systems, continue to lead growth. Private credit, driven by high returns, is actively expanding its market and optimizing risk management. Commodity tokenization is gradually expanding its application scope, and equity tokenization is striving to break through regulatory restrictions.

US Treasury bond market (T-Bills): the dominant growth engine under the structural interest rate attraction

- As of August 2025, the market capitalization of on-chain U.S. Treasury bonds exceeded $68 billion, a year-on-year increase of over 200%. This sector has become the largest sub-asset of RWAs outside of stablecoins.

- Mainstream platforms such as Ondo, Superstate, Backed, Franklin Templeton, etc. have achieved distributed mapping of US Treasury ETFs/money market funds on the chain.

- For institutions, U.S. Treasury RWAs provide the infrastructure for on-chain risk-free rates of return; for DeFi protocols, they become a source of income for stablecoins and DAO reserves, building an "on-chain central bank" model.

- U.S. debt products are highly mature in terms of compliance, liquidation, and legal structure, and are currently the type of RWA with the greatest potential for scalability.

Private Credit: High Returns and High Risks

- Protocols such as Maple, Centrifuge, and Goldfinch focus on on-chain credit expansion and explore areas such as SME loans, revenue sharing, and consumer finance.

- While offering high returns (8–18%), risk management is challenging, requiring off-chain due diligence and asset custody. Some projects, such as TrueFi and Clearpool, are also transitioning to institutional services.

- Goldfinch and Centrifuge expanded new credit pilots in the African and Asian markets in 2024, improving financial inclusion.

Commodity Tokenization: On-chain Mapping of Gold & Energy Assets

- Representative projects such as Paxos Gold (PAXG), Tether Gold (XAUT), Meld, 1GCX, etc., map precious metal reserves through on-chain tokens.

- Gold is the first choice for tokenization of mainstream commodities because of its clear reserve logic and stable value, and is often used as a collateral asset for stablecoins.

- Energy commodities (such as carbon emission certificates and spot oil) have higher regulatory thresholds and are still in the experimental stage.

Tokenized Equities: Early Breakthroughs Still Limited by Regulation

- The current market capitalization of on-chain equity tokens is only approximately $362 million, accounting for 1.4%, with Exodus Movement (EXOD) being the main one (accounting for 83%).

- We represent platforms such as Securitize, Plume, Backed, and Swarm in conducting compliant equity mapping for US stocks, European listed companies, and startups.

- The biggest challenge facing such assets is secondary market transaction compliance and KYC management. Some projects have responded by combining permissioned chains or restricted address whitelist strategies.

Looking ahead, RWAs are expected to become a multi-trillion dollar market. Citibank believes that virtually any valuable asset can be tokenized, and by 2030, the scale of private asset tokenization could reach $4 trillion. BlackRock predicts that by 2030, the RWA tokenization market could reach $16 trillion (including private blockchain assets), accounting for 1% to 10% of global asset management. On a technical level, advancements in blockchain technology, such as the further optimization of smart contracts and the development of cross-chain technology, will improve the efficiency and security of asset on-chain transactions and reduce operating costs. The Internet of Things (IoT) allows for real-time asset data collection, AI optimizes valuation models, and zero-knowledge proof technology enhances privacy protection, all of which will provide technical support for the development of RWAs. Application scenarios will also continue to expand, with tokenization accelerating in emerging areas such as carbon assets, data assets, and intellectual property. On a global policy front, if countries can further improve their regulatory frameworks and establish relatively unified standards, it will greatly promote the global circulation and development of RWAs. RWAs will become a core link between the traditional economy and Web3, profoundly changing the global asset allocation landscape.

3.2 Ecological Structure and Participant Pattern

3.2.1 Participation Distribution of On-Chain Protocol Layer

Public chain ecology | Mainstream projects | Features |

Ethereum | Ondo, Superstate, Franklin, Plume | Mainstream institutions are concentrated, compliance paths are complete, and the stablecoin and fund ecosystems are the most mature. |

Stellar | Franklin Templeton FOBXX | Transparent operation for institutional custody, efficient payment and issuance |

Solana | Maple, Zeebu, Clearpool | Low transaction costs are suitable for high-frequency credit operations, but security and infrastructure are still imperfect. |

Polygon | Centrifuge, Goldfinch | Supports off-chain asset mapping and DAO credit governance, with low cost and strong scalability |

Avalanche / Cosmos | Backed, WisdomTree | Exploring multi-chain interoperability and fund governance compliance, more for experimental deployment |

Trend observation: The Ethereum ecosystem is still the main battlefield for RWA assets, especially suitable for high-compliance assets such as funds and bonds; while credit-related RWAs are beginning to migrate to low-cost, high-throughput chains.

3.2.2 Comparison of regional policies and regulatory friendliness

area | Regulatory attitude | Representative Policy | Key Impacts |

USA | Strong regulation, different paths | SEC/CFTC Compliance Review + Reg D/S/CF Framework | Large institutions prefer the Reg D model, such as Securitize and BlackRock |

European Union | Open and unified | MiCA regulations implemented (2024) | Clearly distinguishing between electronic currency tokens and asset-referenced tokens is beneficial for compliance institutions |

Singapore | Highly friendly | MAS Sandbox + RMO License | Supports RWA product pilot and multi-currency clearing, Circle and Zoniqx have already settled in |

Hongkong | Gradual opening | SFC VASP Mechanism + Virtual Asset ETF Policy | Support the launch of compliant tokenized funds and promote local TradFi-Web3 integration |

Dubai (VARA) | Most active | Multi-layer license plate framework + project sandbox | Becomes the RWA experimental hub in the Middle East, attracting deployments such as Plume and Matrixdock |

Parts of Asia (Singapore, Hong Kong, and Dubai) are at the forefront of RWA regulatory design and innovation, and are gradually becoming centers for capital and project aggregation.

3.2.3 Analysis of Institutional Participation

Institutional participation in RWA is moving from "observation and pilot" to "substantial deployment." According to market tracking, the current major institutional players include:

type | Institution Name | Participation Path |

asset management giant | BlackRock, Franklin Templeton, WisdomTree | Issue on-chain funds and money market products; release stable income tools through Ethereum/Stellar |

Brokerage firms/issuance platforms | Securitize, Tokeny, Zoniqx | Supports compliant stock/bond/fund issuance, integrating traditional securities accounts with on-chain holdings |

Crypto-native protocol | Ondo, Maple, Goldfinch, Centrifuge | Build RWA native structure to serve DAOs, Treasuries, and DeFi ecosystems |

Trading Platform/Synthetic Protocol | Backed, Swarm, Superstate | Provide secondary liquidity of tokenized assets and explore LP equity portfolio and compliance trading mechanisms |

The roles of institutions are gradually diversified, expanding from "issuers" to "clearing service providers", "custodian platforms" and "secondary transaction matchmakers". RWA will become a bridge connecting Web3 and TradFi.

4. Typical Project Analysis

The following selects representative RWA projects in sectors such as US Treasury bonds, private credit, commodities, and equities, and analyzes their token models, investor structures, product mechanisms, and profit logic:

4.1 US Treasury Bond Track: Ondo Finance

Ondo Finance is a platform focused on tokenizing traditional financial assets, particularly U.S. Treasury bonds. The platform is dedicated to introducing low-risk, high-yield assets to the crypto market, providing investors with a stable and composable source of income. Through compliant means, it builds a bridge between traditional finance and decentralized finance (DeFi), enabling the on-chain trading and use of U.S. Treasury bonds in a tokenized form.

• Token Model: Issue ERC-20 tokens, anchor off-chain US Treasury bond ETFs (such as $OUSG corresponding to short-term US Treasury bond ETFs), map the underlying asset value 1:1, and automatically settle interest daily.

• Investor structure: Mainly institutions (family offices, asset management companies) and qualified investors, with access through the Reg D/S compliance path. Some retail users can participate indirectly through DeFi protocols.

Product Mechanism: Build an "on-chain fund" structure, SPV (special purpose vehicle) holds U.S. Treasury assets, smart contracts manage subscription, redemption and interest distribution, and support on-chain pledge lending (such as access to Aave and Compound).

• Profit logic:

• Underlying Asset Returns: The fundamental returns of tokens like $OUSG are derived from the interest income of the underlying U.S. Treasury bonds. U.S. Treasury bonds inherently offer low risk and relatively stable interest returns. These returns are distributed to token holders according to specific rules, after deducting platform management fees (e.g., a 0.15% to 0.3% management fee).

• DeFi Ecosystem Income: When tokens like $OUSG are used within the DeFi ecosystem, additional income can be generated. For example, $OUSG can be used as collateral to borrow other assets in lending agreements, and then the borrowed assets can be invested in liquidity mining or other DeFi applications to generate income; or $OUSG can be used to participate in the liquidity pool of related tokens to earn transaction fees.

4.2 Private Lending Track: Maple Finance

Maple Finance is a multi-chain DeFi platform focused on institutional-grade on-chain lending and RWA investments. Operating on the Ethereum, Solana, and Base blockchains, its core services include institutional clients such as hedge funds, DAOs, and crypto trading firms. By simplifying the complexities of traditional finance, it offers products such as low-collateralized loans, tokenized US Treasury bonds, and trade receivables pools. By June 2025, its assets under management (AUM) exceeded $2.4 billion, making it a leading private lending platform in the face of growing institutional investment.

- Token Model:

- Core token: SYRUP (ERC-20 standard), with a total supply of 118 million and a current circulation of approximately 111 million, which is almost fully circulated, reducing potential selling pressure.

- Core features:

- Staking mechanism: SYRUP holders can stake tokens to become “risk sharers”, which will be used first to compensate for losses in the event of loan defaults, and share platform rewards (such as commission sharing) in the event of no defaults.

- Value capture: The platform charges a 0.5%-2% handling fee for each loan, 20% of which is used to repurchase SYRUP and distribute it to pledgers, forming the value support of the token.

- Investor structure: Institutional investors (hedge funds, crypto VCs) provide large amounts of funds, DeFi vaults (such as Alameda Research's early participation) supplement liquidity, and borrowers need to pass off-chain due diligence (KYC, credit rating).

- Product Mechanism: Utilizing a decentralized credit pool model, smart contracts match borrowing needs (e.g., SME working capital, crypto mining loans) with funding supply, automatically executing repayments and default liquidations (using off-chain repayment data verified by Chainlink oracles).

- Profit logic:

- Basic income: Lenders earn interest on loans by providing liquidity, and the income is linked to the risk of the product (for example, High Yield has a higher yield than Blue Chip because it invests in high-risk assets).

- Platform share: Pledgers receive a share of platform fees by staking SYRUP (20% of the fees are used to repurchase SYRUP and distribute it), while also bearing the responsibility for compensation for default risks.

- Ecological synergy: Institutional borrowers can quickly obtain liquidity at low cost to support their crypto trading, arbitrage and other businesses, indirectly driving the growth of platform lending demand and forming a closed loop of "borrowing-lending-profit distribution".

4.3 Commodity Track: Paxos Gold ($PAXG)

Paxos Gold is a gold tokenized product issued by Paxos, a regulated fintech company. It aims to enable on-chain circulation and efficient management of physical gold through blockchain technology. Its core value lies in combining the value-preserving properties of traditional gold with the programmability of blockchain. This allows investors to conveniently participate in gold investment without the storage and transportation costs of physical gold, while also supporting 24/7 global trading and collaborating with the DeFi ecosystem.

- Token Model:

- Core token: $PAXG (ERC-20 standard), strictly follows the 1:1 anchoring rule. Each token corresponds to 1 ounce of standard physical gold certified by the London Bullion Market Association (LBMA), and is stored and secured by top global custodians such as Brink's.

- Issuance and destruction mechanism: When users subscribe to $PAXG, Paxos simultaneously increases its holdings of an equivalent amount of physical gold; when redeeming, the tokens are destroyed and the corresponding gold is released, ensuring that the total amount of tokens on the chain is fully matched with the off-chain gold reserves, eliminating the risk of over-issuance.

- Investor structure: retail investors (subscribing through crypto exchage and wallets), institutions (asset management companies with gold exposure), and DeFi protocols (used as collateral to supplement stablecoin issuance reserves).

- Product Mechanism: The smart contract links to a custodian’s gold reserve certificate (verified via Chainlink’s PoR oracle), allowing for redemption of physical gold at any time (subject to minimum balance and fee requirements), and free trading on DEXs like Uniswap.

- Profit logic: Long-term value appreciation of gold (to combat inflation) + liquidity income from on-chain transactions/collateralization (such as staking $PAXG to generate $DAI, which is then invested in DeFi mining); Paxos charges redemption fees, custody fees, and transaction service fees to cover gold storage, auditing, and technical maintenance costs, forming a sustainable operational closed loop.

4.4 Equity Track: xStocks (Backed Finance US Stock Tokenization Platform)

xStocks, a US stock tokenization platform launched by Swiss fintech company Backed Finance, uses the Solana blockchain to convert US stocks like Tesla (TSLAx) into on-chain tradable tokens. Its core goal is to break the time zone constraints and liquidity barriers of the traditional stock market while integrating with the DeFi ecosystem to achieve programmability of stock assets. As of July 2025, its tokens are listed on exchanges like Bybit and Kraken, as well as decentralized exchanges like Raydium, becoming a representative example of "24/7 trading + on-chain reuse" in the equity tokenization space.

- Token Model:

- Core Tokens: Issued based on Solana’s SPL standard (e.g., $TSLAx corresponds to Tesla stock), 1:1 anchored to the underlying stock on the chain, and each token is backed by one real share of stock held in custody by Backed’s joint compliance institutions (e.g., Alpaca Securities in the United States, InCore Bank in Switzerland, etc.).

- Price Mechanism: US stock prices are synchronized in real time via Chainlink oracles. When traditional markets are closed (e.g., weekends and holidays), the trading price is determined autonomously by on-chain supply and demand, using the last closing price as a reference, thus enabling a “prediction market”.

- Investor structure: No strict restrictions on qualified investors (must pass exchange KYC), covering individual investors (subscription through Bybit, Kraken or Solana wallets) and small asset management companies (allocating fragmented US stock exposure).

- Product Mechanism:

- Issuance and Custody: Backed pre-purchases the underlying shares, which are held in custody by compliant brokers and banks, and mints corresponding tokens on the Solana chain at a 1:1 ratio. Upon redemption, the tokens are destroyed and the off-chain shares are released, ensuring reserve transparency (regularly verified through the Proof of Reserve mechanism).

- Equity treatment: Shareholder voting rights and shareholder meeting participation rights are not supported, but dividend income is realized through "token airdrops" - after the underlying stock dividends are distributed, Backed will issue a corresponding number of tokens to token holders based on their shareholding ratio, indirectly transferring economic benefits.

- On-chain circulation: supports 24/7 trading (breaking the time constraints of traditional stock markets), can be traded on centralized exchanges (Bybit, Kraken) and decentralized platforms (Raydium, Jupiter), and has cross-chain potential (planned to connect to a cross-chain bridge in the future).

- Profit logic: appreciation and dividend income of the underlying stock + liquidity premium of on-chain transactions (fractional trading, 24/7 market); Backed charges token issuance fees, custody fees and transaction channel fees to cover compliance and technical costs.

4.5 RWA Infrastructure Track: Plume Network

Plume Network is a full-stack blockchain platform focused on real-world assets (RWA). It aims to build a bridge between traditional finance and the crypto sector, efficiently bring various real-world assets on-chain and integrate them with the DeFi ecosystem, solving the compliance, liquidity, and user experience challenges faced by RWA projects in the process of on-chain asset transfer.

- Token Model:

- Core Token: $PLUME (ERC-20 standard), with a total supply of 10 billion, 59% of which is allocated for community incentives and ecosystem development. Token functions include paying on-chain fees, participating in governance voting, staking for revenue sharing, and serving as a settlement medium for asset transactions within the ecosystem.

- Incentive design: When users configure RWA assets (such as real estate tokens and credit certificates) through the platform, in addition to the basic income (10%-20% annualized), they can receive additional rewards. The reward ratio is linked to the asset holding period and pledge amount, thereby improving the ecological stickiness.

- Investor structure: On the institutional side, leading capitals such as Brevan Howard Digital and Haun Ventures have invested and promoted the pilot of their assets on the chain; retail and crypto-native users participate in transactions and mining through the Passport wallet, mainly individual investors who pursue a combination of "traditional assets + crypto returns", focusing on compliance and cross-chain opportunities.

- Product Mechanism:

- Asset classification management: covers multiple asset types such as collectibles (such as sneakers, Pokémon cards, watches, wine and artworks), alternative assets (private equity credit, real estate or green energy projects), financial instruments (stocks or corporate bonds), etc., to meet the needs of users with different risk preferences and investment needs.

- Suite support system:

- Arc: A tokenized token issuance system that helps assets be on-chain in flexible forms such as NFTs, tokens, or combined assets, optimizing asset issuance structure and improving liquidity.

- Nexus: A dedicated oracle for the RWA track, ensuring accurate synchronization of on-chain information and off-chain asset data, providing a reliable data foundation for transactions and revenue calculations.

- Passport: An aggregated asset management tool, a smart wallet that integrates different token standards and on-chain DeFi composability. Through this wallet, users can easily participate in various RWA asset operations and DeFi applications, such as yield farming.

- SkyLink: A cross-chain bridge that allows users to obtain institutional-level RWA returns without permission by mirroring YieldToken, breaking down inter-chain barriers and expanding the scope of asset circulation.

- Compliance Assurance: We leverage partners in various regions, flexibly switching licenses to meet local regulatory requirements, and provide a comprehensive compliance solution from development to operations, safeguarding the security and legality of asset on-chain transactions. For example, our support for the ERC 3643 standard leverages ONCHAINID, a built-in decentralized identity system, to ensure that only users who meet specific criteria can hold tokens, maintaining regulatory compliance.

- Profit logic:

- User Benefits: Users can participate in various asset projects on the platform and earn returns on the assets themselves, such as the stable income from green energy projects. Furthermore, by staking $PLUME, they can share in platform transaction fees and other income, and can also earn capital gains through trading during asset price fluctuations. For example, in the collectibles asset category, users can participate in asset scavenging, mortgage lending, and asset synthesis transactions to capture profit opportunities brought about by price fluctuations.

- Platform Revenue: Plume covers platform operating costs and generates profitability by charging asset issuance fees, transaction fees, and fees for providing services to institutions, thereby forming a sustainable business model. Furthermore, as the ecosystem prospers, the demand and value of $PLUME tokens are expected to increase, generating additional token appreciation for the platform.

5. Challenges and Considerations

The explosive growth of RWAs hasn't been a smooth journey. Its essence lies in the collision and compromise between "traditional asset logic" and "blockchain decentralized philosophy." The following examines the core contradictions from five perspectives, revealing the industry's inevitable "structural challenges":

5.1 Law and Regulation: A Dynamic Balance of Rule Adaptation

- The double-edged sword of regulatory arbitrage: Currently, many RWA projects choose an "offshore registration + onshore operation" model (e.g., issuance by a BVI company with US user participation). While seemingly compliant with the Reg D/S framework, this actually creates the potential for "conflicts of legal jurisdiction." For example, while the EU's MiCA considers US Treasury tokens "asset-referenced tokens," the US SEC may define them as "securities." If disputes arise in cross-regional transactions, investors will face a dilemma of having nowhere to defend their rights.

- Gray areas in the definition of ownership: The SPV architecture claims that "tokens = equity certificates," but the legal connection between on-chain token transfers and offline asset transfers remains unclear. If a real estate token holder is sued for a debt dispute, can the court directly freeze the offline property rights corresponding to the on-chain tokens? Currently, there is no global legal precedent to support this, and this "legal gap" has reduced RWA to a "digital IOU that proves its compliance."

5.2 Valuation and Transparency: The Limits of Data Credibility

- A hidden door to data manipulation: While oracles like Chainlink claim to be "decentralized," the off-chain data they capture (such as corporate bond ratings and real estate valuations) still relies on centralized institutions like S&P and Jones Lang LaSalle. If a private credit agreement colludes with a ratings agency to manipulate default rate data, the on-chain smart contract will execute liquidations based on the false information, creating a "systemic digitally endorsed fraud."

- There is a trade-off between the timeliness and accuracy of dynamic valuation: standardized assets (such as US Treasuries) can be accurately priced through high-frequency data updates, but the valuation cycle of non-standard assets (such as private equity) is longer, and the price of on-chain tokens may lag behind the actual asset value. This "mismatch" may trigger arbitrage or liquidation risks.

5.3 Liquidity and Composability: Real Constraints on Ecosystem Collaboration

- The liquidity of RWA tokens shows obvious stratification characteristics: standardized assets such as US Treasury bonds and gold have a certain trading depth in DEX and CEX due to their high market acceptance, but secondary trading of non-standard assets such as private credit and equity is still relatively light, mainly relying on the redemption mechanism within the agreement, which is somewhat different from the original intention of "blockchain to enhance asset liquidity".

- Cross-chain and cross-ecosystem composability faces both technical and trust challenges: While cross-chain bridges and Layer 2 solutions attempt to address the issue of asset circulation between different public chains, the asset custody, transaction fees, and potential security risks involved in the cross-chain process may undermine the synergy between RWA and the DeFi ecosystem. For example, if a US Treasury bond token on one chain needs to be pledged to a lending agreement on another chain, the trust costs of the intermediary link may offset the benefits of the on-chain combination.

5.4 Implementation of the Risk Control System: Risk Transmission Online and Offline

- On-chain risk control rules are difficult to fully cover off-chain risks: Smart contracts can control on-chain risks through parameters such as collateral ratios and liquidation thresholds. However, for actual defaults of off-chain assets (such as bankruptcy of corporate bond issuers or damage to real estate collateral), on-chain mechanisms can often only respond passively and are unable to proactively intervene and deal with them. This "risk control gap" may lead to losses for investors.

- The cross-contamination of systemic risks warrants attention: RWAs are strongly correlated with traditional financial markets (e.g., U.S. Treasury RWAs are influenced by interest rate policies), and the leverage mechanism of the DeFi ecosystem may amplify this correlation. Whether price fluctuations in RWA tokens during traditional market fluctuations trigger on-chain liquidity crises through channels such as staking and lending remains to be seen in the market over a longer period of time.

5.5 Technical Infrastructure and Trust Bridge: Gradual Decentralization

- There is a gap between the performance of existing blockchains and the scale requirements of RWA: the throughput and gas fee issues of public chains such as Ethereum make it difficult for large-scale institutional funds to participate in RWA transactions. Although Layer2 and new public chains have made breakthroughs in performance, the maturity and security of the ecosystem have not yet been fully recognized by institutions.

- The construction of the trust mechanism is still a hybrid model: Although RWA emphasizes "disintermediation", its actual operation still relies on centralized roles such as custodian institutions (such as gold warehouses and bond custodian banks) and audit institutions (such as reserve verification). This hybrid model of "technological decentralization + trust centralization" is a realistic choice at the current stage, but whether it will evolve into "traditional finance enabled by blockchain" in the long run has not yet been clearly answered.

The development of RWA is essentially a cross-system integration experiment. Its challenges stem from both the objective limitations of technological implementation and the in-depth integration of financial logic and technological philosophy. Solving these issues will likely require the joint evolution of the industry, regulation, and technology, rather than a single-dimensional breakthrough. Its ultimate form remains to be explored and verified by the market.