In the past 24 hours, a significant number of short positions were liquidated in the cryptocurrency market. According to 4-hour data, approximately $41.3 million (about 60 billion won) worth of leveraged positions were liquidated.

Based on the currently aggregated data, short positions accounted for $340,600, representing 82.5% of the total liquidations, while long positions were $72,400, accounting for 17.5%, indicating an overwhelming number of short position liquidations.

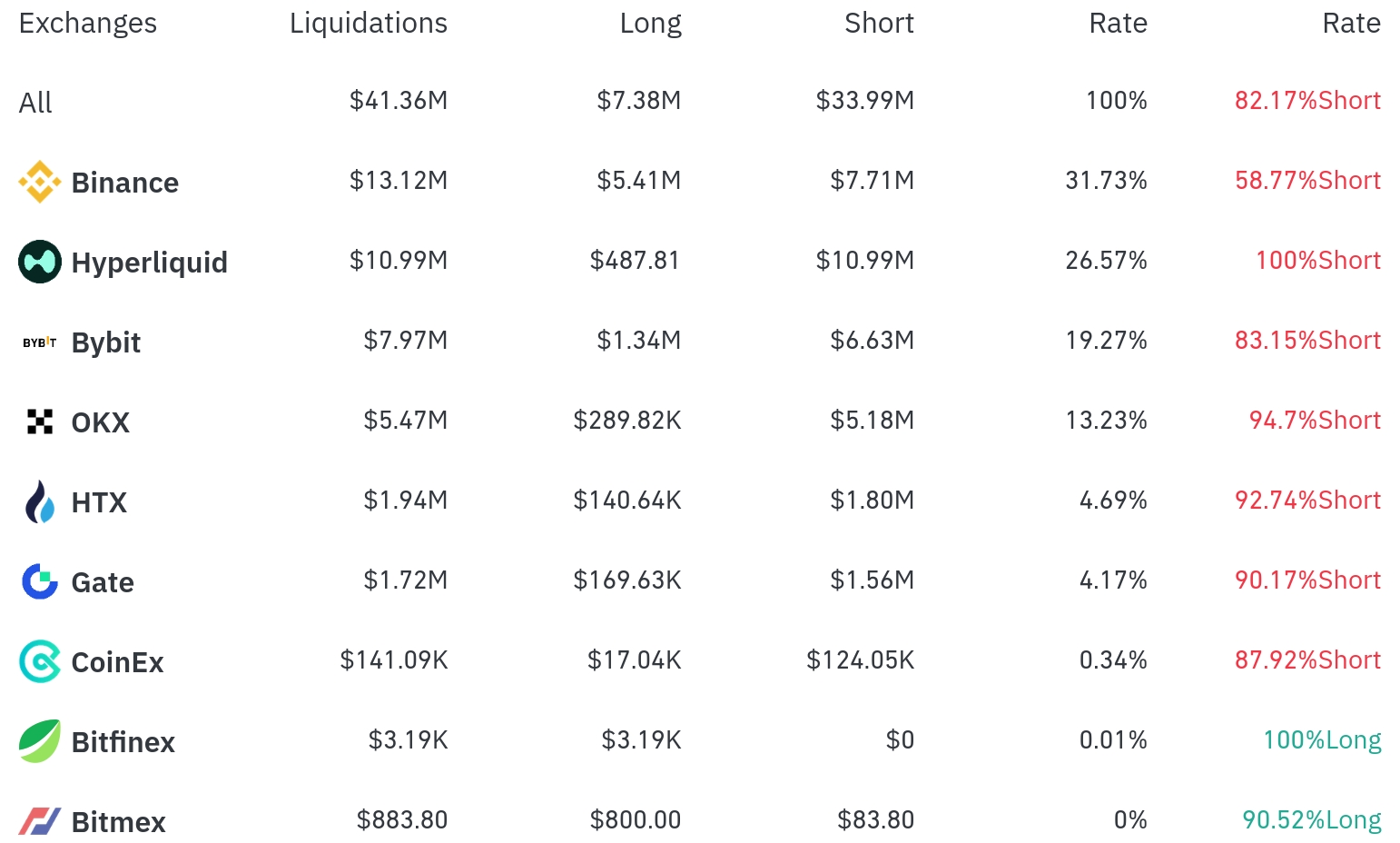

Binance experienced the most position liquidations over the past 4 hours, with a total of $13.12 million liquidated (31.73% of the total). Among these, short positions accounted for $7.71 million, or 58.77%.

HyperLiquid was the second-highest exchange with liquidations, with $10.99 million (26.57%) of positions liquidated, almost entirely consisting of short position liquidations.

Bybit saw approximately $7.97 million (19.27%) in liquidations, with a high short position ratio of 83.15%.

Notably, on OKX, 94.7% of the total liquidation amount of $5.47 million was from short positions. HTX and Gate exchanges also showed high short position liquidation rates of 92.74% and 90.17%, respectively.

By coin, Ethereum (ETH) recorded the most liquidations. Approximately $49.36 million in Ethereum positions were liquidated over 24 hours, with $4.1 million in long positions and $18.56 million in short positions liquidated over 4 hours.

Bitcoin (BTC) had about $4.76 million in positions liquidated over 24 hours, with nearly equal liquidations of $2.27 million in long positions and $2.33 million in short positions over 4 hours.

Solana (SOL) saw approximately $6.45 million liquidated over 24 hours, followed by other major altcoins such as ADA ($6.37 million) and Doge ($6.30 million).

Notably, LINK experienced $2.73 million in liquidations alongside a significant 10.90% price increase, with $1.64 million in short position liquidations over 4 hours.

The FARTCO Token, known for Pancoin, saw substantial liquidations of $630,000 in long positions and $480,000 in short positions over 24 hours.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leveraged position when a trader fails to meet margin requirements. This large-scale short position liquidation suggests an overall market uptrend, particularly showing a strong rebound in the Ethereum and altcoin markets.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>