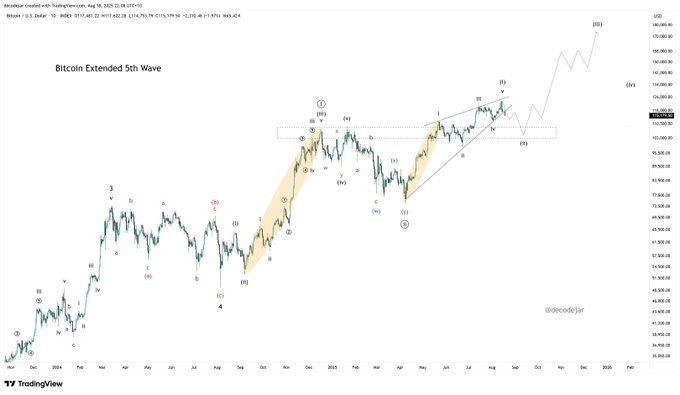

Bitcoin Elliott Wave Update. The HTF trend remains strong and the macro picture suggests we still have further to go, so I remain overall bullish and am sticking with the idea of an extended 5th wave. I'm seeing a lot of ending diagonals in my feed, drawn from a couple of different points, however, the moves highlighted in orange are impulsive structures, so that idea doesn't work for me, nor does it align with my macro view. A leading diagonal in a wave 1 position as shown here would imo more accurately account for the impulsive wave structures that we see, and it also fits well in an extended 5th wave, nested as a lesser degree impulse to the prior move. A deeper correction here in a wave 2 that takes us back perhaps towards the January highs makes some sense to me, is supported by the RSI divergence story, and also by typical seasonal market conditions. There are other available counts, some more bullish, others more bearish, so let's wait and see if this ends up playing out. Longer term I still expect BTC to find its way up towards 170k or thereabouts by the end of the year.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content