BTC price is currently trading near $113,600, declining 1.3% over the past 24 hours. While many traders are worried about continued price drops, some investors are showing signals that a short-term rebound could occur.

These buyers are quietly increasing their holdings and accepting losses. This is a pattern that has previously triggered price rebounds. Their actions once again suggest that the worst of this decline may have already passed.

Short-term holders still buying at the bottom

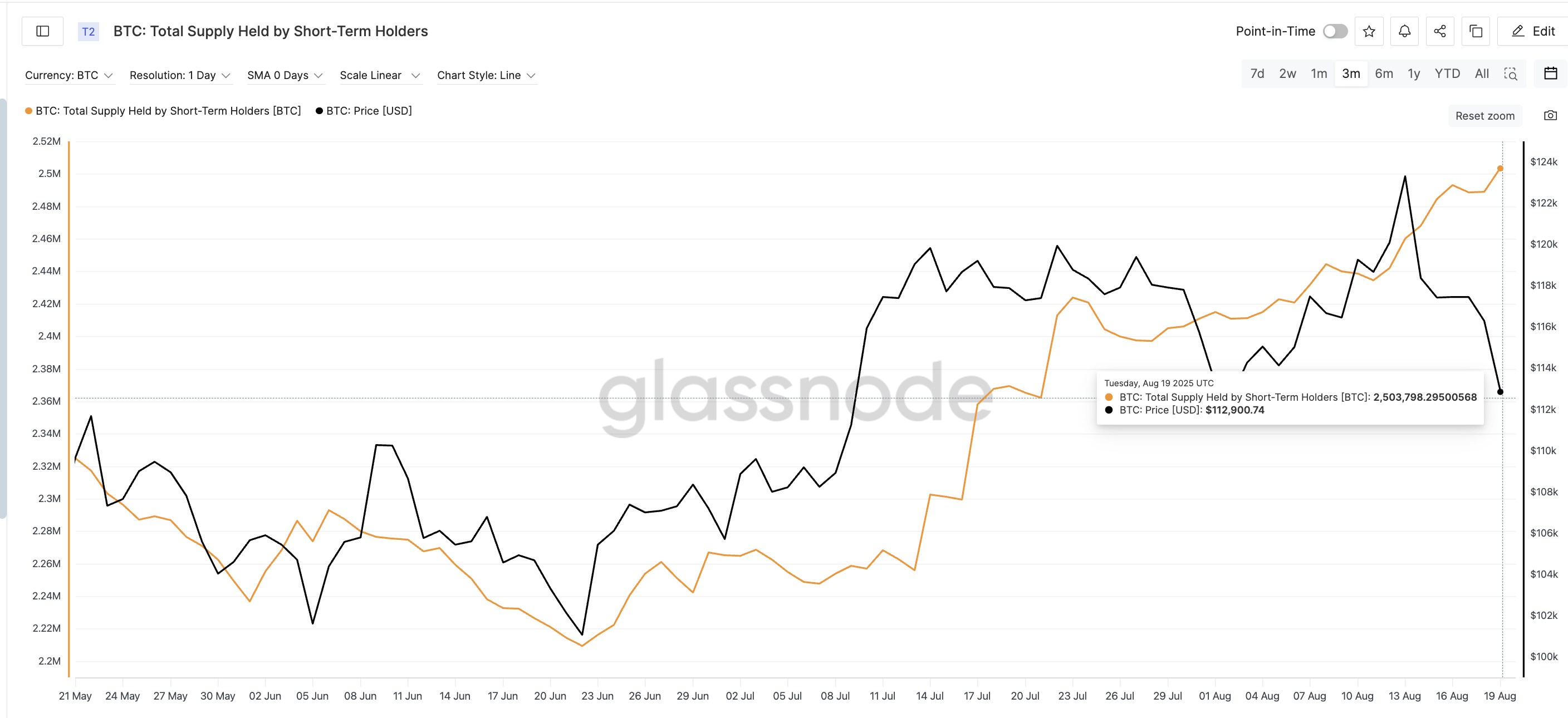

Over the past few days, short-term holders who acquired BTC within 155 days have increased supply despite price declines. Currently, this group holds 2,503,798 BTC, up from 2,460,514 BTC seven days ago.

This represents accumulating over 43,000 BTC during a sharp price adjustment from $123,000 to $112,000. Interestingly, short-term holder supply has now reached a three-month high.

This trend reflects a similar pattern seen in early June. At that time, when BTC price dropped from $105,900 to $104,700, short-term holders increased supply from 2,275,000 BTC to nearly 2,287,000 BTC. Subsequently, BTC price rose to $110,000.

This repeated behavior, where new holders increase exposure during price drops, is often considered a sign of confidence in a short-term rebound.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

Buying despite realizing losses

Simultaneously, short-term holders showed willingness to accept losses to buy new BTC dips. This is an action rarely done unless expecting a rebound.

The Short-Term Holder Spent Output Profit Ratio (SOPR) dropped to a monthly low on August 18th. This means the group, on average, sold coins at prices lower than their acquisition price. Simply put: they are selling at a loss.

Currently, SOPR remains below 1.

SOPR, or Spent Output Profit Ratio, is an indicator comparing the selling and buying prices of Bitcoin. When short-term holder SOPR falls below 1.0, it indicates the group is realizing losses on average.

This is often considered a bottom signal. In early August, a similar SOPR drop (from 1.00 to 0.99) occurred just before Bitcoin reversed to a new high near $114,000 to $123,000. At that time, selling at a loss showed capitulation by short-term holders. This was the necessary consolidation before a rally.

Even as some holders realize losses, the total supply in short-term wallets continues to increase. This indicates more buyers are entering while accepting losses, suggesting a shift in sentiment. This is not a panic sell.

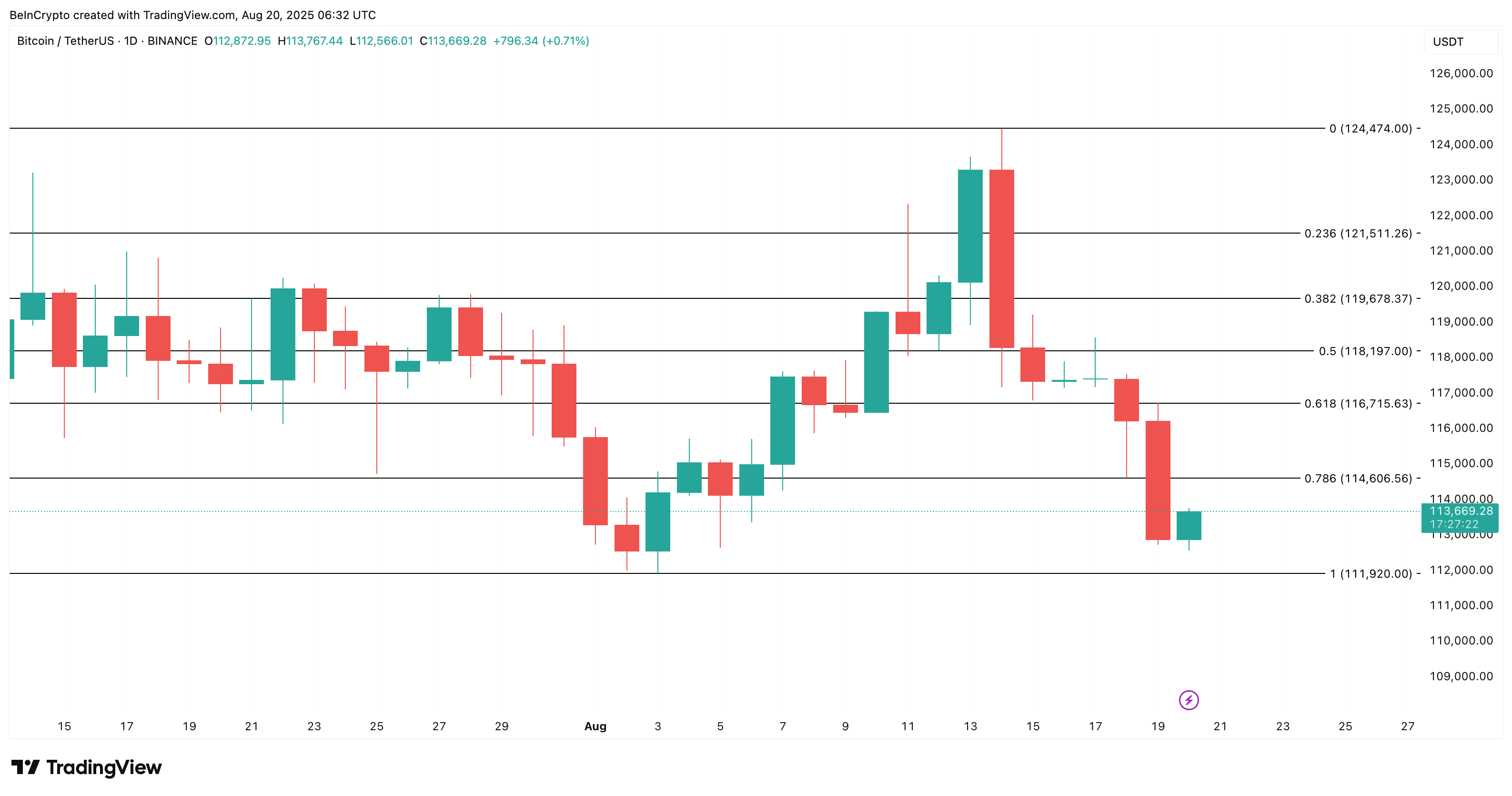

Bitcoin price recovery depends on $111,900 support

BTC price remains under pressure but shows signs of potential reversal. Today's price slightly rebounded to $113,600, though still down 1.3% on the 24-hour chart. The strongest nearby support is at $111,900. If this level holds, recovery could begin soon.

On the upside, immediate resistance is near $114,600. The next major obstacles are at $116,715 and $118,197. If BTC price clearly breaks above $118,200, it could be considered a signal that an uptrend has returned.

In the past, such short-term holder setups, involving increasing short-term supply and negative SOPR, often marked a local bottom. Previous instances led to rallies over $10,000 within days.

If the current pattern repeats, BTC price might be preparing for another rise. However, if it drops and loses the $111,900 level, a deeper correction could follow, potentially invalidating the bullish hypothesis.