Ethereum and Solana dominate the conversation in Web3. Ethereum, launched in 2015, pioneered smart contracts and decentralized finance (DeFi). Solana, introduced in 2020, disrupted the space with lightning-fast throughput and minimal fees.

For Web3 entrepreneurs, the blockchain you choose defines the user experience, development costs, and scalability of your project. For investors, it determines exposure to either a time-tested leader (Ethereum) or a high-performance disruptor (Solana).

📊 According to Messari (2025), Solana apps generated $571M in revenue compared to Ethereum’s $200M, highlighting Solana’s rapid ecosystem growth.

This guide breaks down Ethereum and Solana across technology, performance, adoption, and investment potential.

Ethereum: The Established Leader

Overview

Ethereum introduced the Ethereum Virtual Machine (EVM), enabling smart contracts that power DeFi, NFTs, and enterprise blockchain applications. Its transition to Proof of Stake (PoS) in 2022 cut energy use by 99.5% and set the stage for scaling upgrades.

Advantages

- Mature ecosystem: Ethereum still dominates DeFi, with $45B+ in total value locked (DeFiLlama, 2025).

- Institutional trust: ETH ETFs approved in 2024 boosted mainstream legitimacy.

- Strong security: Over 1M validators contribute to its decentralization.

- Developer support: Solidity, Hardhat, and OpenZeppelin remain the most widely used blockchain dev tools.

Disadvantages

- Scalability bottlenecks: Base layer processes ~15–30 TPS; relies on Layer 2 rollups (Arbitrum, Optimism, zkSync).

- High fees: Median transaction fee ~$3; complex dApp interactions can spike >$50.

- Slower upgrades: Governance and decentralization slow Ethereum’s ability to experiment compared to Solana.

Market Snapshot (2025)

- ETH is trading at $4,254 in 2025 with a market cap above $500B. For a deeper outlook on where ETH could be headed next, check out our detailed Ethereum prediction.

- Major upcoming upgrade: Danksharding + Pectra, aimed at reducing fees and boosting throughput.

Solana: The High-Performance Challenger

Overview

Solana uses an innovative Proof of History (PoH) combined with Proof of Stake. This enables thousands of transactions per second (TPS) at extremely low cost (<$0.01 per transaction).

Its ecosystem includes thriving NFT marketplaces like Magic Eden, DeFi platforms such as Serum, and new payments solutions for crypto-native payroll.

Advantages

- Scalability: Capable of >65,000 TPS under ideal conditions.

- Ultra-low fees: Transactions consistently < $0.01.

- Growing adoption: Solana Pay is integrated by merchants, and Visa is piloting USDC settlement on Solana (2024).

- Upcoming upgrades: Firedancer validator client (by Jump Crypto) promises 10x throughput increases.

Disadvantages

- Network reliability: History of outages, though stability improved in 2024–2025.

- Smaller developer ecosystem: Rust is powerful but has a higher learning curve compared to Solidity.

- Less institutional adoption: ETFs and regulated financial products are still Ethereum-focused.

Market Snapshot (2025)

- Price: $148

- Market Cap: $67B

- Ecosystem revenue: $571M (Messari 2025) — showing faster monetization than Ethereum.

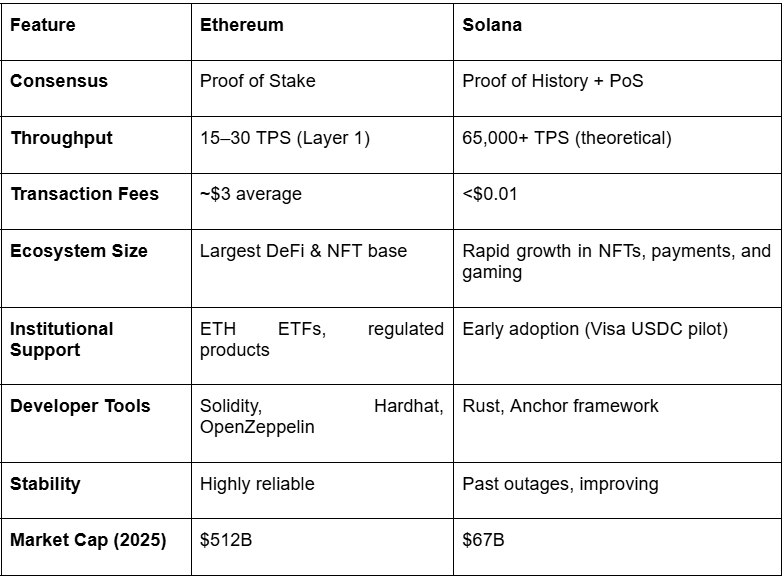

Head-to-Head Comparison

Use Cases for Entrepreneurs

When to Choose Ethereum

- Enterprise-grade DeFi apps need liquidity.

- Projects requiring Layer 2 scaling for mass adoption.

- NFT platforms targeting institutional users.

- Developers who prefer the largest open-source codebase.

When to Choose Solana

- Gaming and social apps that need high-speed, low-cost transactions.

- Payments and payroll solutions where micro-transactions are critical.

- Startups seeking faster go-to-market with cheaper fees.

- Web3 products are experimenting with mobile-first adoption (e.g., Solana Mobile Stack).

Investor Perspective

Ethereum as an Investment

- Seen as the “blue-chip” of Web3, second only to Bitcoin.

- Institutional adoption (ETFs, staking services) anchors long-term stability.

- ETH’s role as collateral in DeFi ensures consistent demand.

- Risks: Slower innovation and competition from faster chains.

Solana as an Investment

- Represents a high-risk, high-reward bet.

- Ecosystem monetization outpaces Ethereum (Messari 2025).

- SOL token demand driven by DeFi, NFTs, and payments adoption.

- Risks: Lower institutional support and history of outages.

Future Outlook

- Ethereum: With upgrades like Danksharding, it aims to cut costs dramatically and retain its dominance in institutional DeFi. Its long-term bet is on Layer 2 scaling + institutional adoption.

- Solana: Betting on speed, cost-efficiency, and consumer applications. If Firedancer succeeds, Solana could process hundreds of thousands of TPS, securing a niche in gaming, payments, and social dApps.

👉 Both chains are likely to coexist, serving different segments: Ethereum as the institutional backbone, Solana as the consumer-grade high-performance layer.

Resources

- https://cleartax.in/s/ethereum-vs-solana

- https://www.gemini.com/cryptopedia/solana-vs-ethereum-pros-cons-and-key-differences

- https://builtin.com/articles/solana-vs-ethereum

- https://messari.io/compare/ethereum-vs-solana

- https://blog.servermania.com/solana-vs-ethereum-developer-guide

- https://www.onesafe.io/blog/ethereum-vs-solana-future-of-crypto-payroll-solutions

- https://www.mexc.com/en-GB/news/ethereum-vs-solana-in-2025-which-smart-contract-platform-wins/68742

- https://www.geeksforgeeks.org/computer-networks/difference-between-ethereum-and-solana/

- https://tradersunion.com/interesting-articles/what-is-solana-sol/