Ondo Finance (ONDO) is emerging as one of the leading names in the crypto trend, especially in US treasury bonds.

However, the price of ONDO Token is still showing some stagnation. Will this Token see a breakout in the future?

Positive Outlook for Ondo Finance

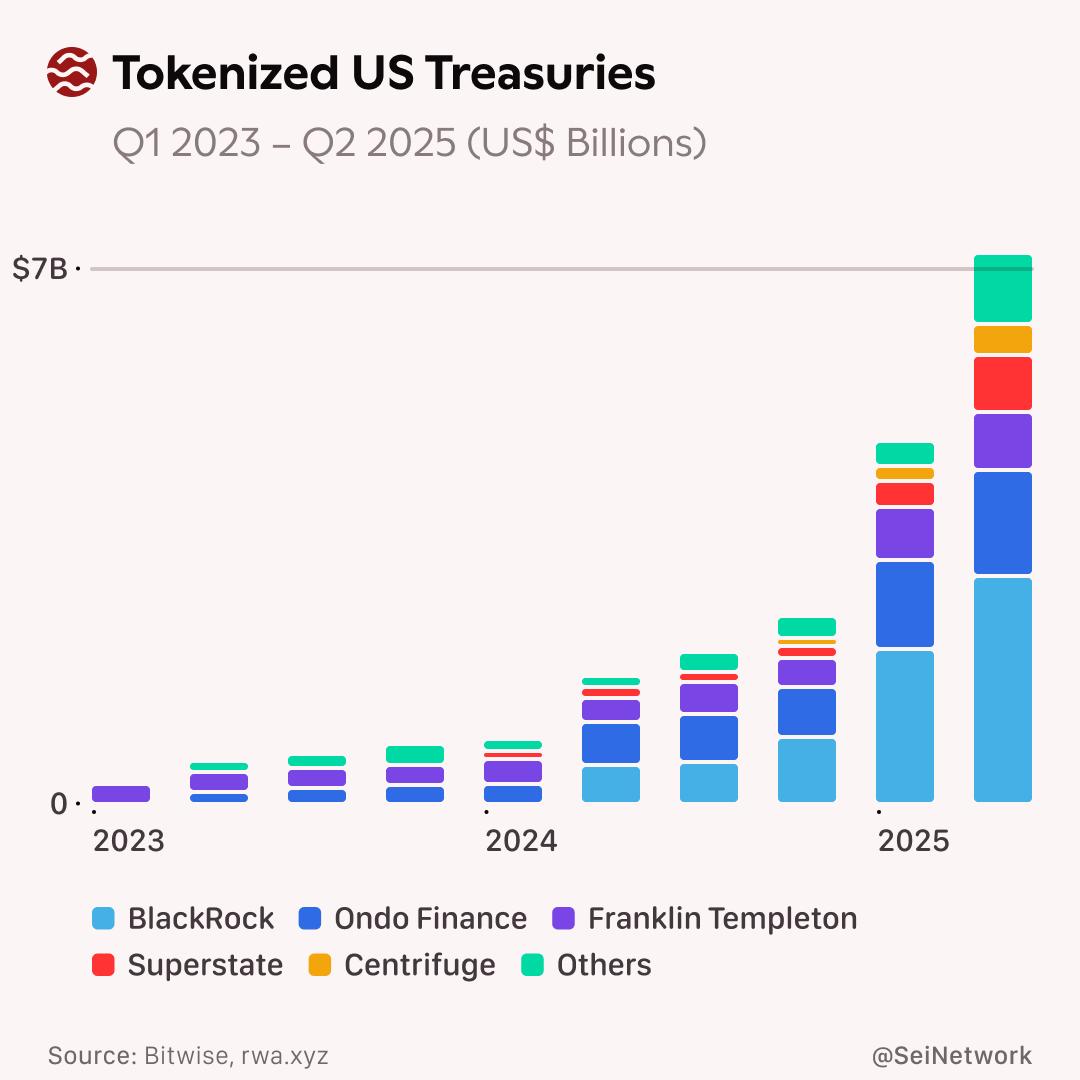

The crypto treasury bond market has exploded by 6,880% over the past two years, led by giants like BlackRock and Ondo Finance. Notably, Ondo Finance focuses on providing yields on US Treasury bonds and is expanding into new markets.

Ondo Leads in Crypto US Treasury Bonds. Source: Sei

Ondo Leads in Crypto US Treasury Bonds. Source: SeiOndo recently launched a tokenized treasury bond product on the Sei network , where institutional-grade assets can be traded with sub-second transaction completion times. This is a major milestone, allowing Ondo to reach institutional and retail investors in the RWA space .

Additionally, Ondo Global Markets is experimenting with groundbreaking features. Ondo Finance issues crypto shares like Spotify, ASML, or Sharplink via the USDon stablecoin and instantly redeems them for USDon. This supports the claim that the most compelling value of crypto in the short term lies in expanding access. This access is to global financial markets.

“The most compelling short-term value of crypto is access. That’s where we started with Ondo Global Markets,” Chia the CEO of Ondo Finance.

From a technical perspective, the ONDO Token is showing a positive price structure . Analysts consider the $0.85 zone as a key support level on the daily chart. A bounce from this zone could push the price to $1.25–$1.30 in the short term. Conversely, if the market breaks the $0.85 level, ONDO could retreat to around $0.60. This pullback could allow it to consolidate in preparation for the next rally.

At the time of writing, ONDO is trading at $0.9269 , down 1.6% over the past 24 hours and 56.7% below its All-Time-High in December 2024.

ONDO/USD 1D chart. Source: Dark Knight on X

ONDO/USD 1D chart. Source: Dark Knight on XThe overall market sentiment remains positive, with many opinions supporting an optimistic outlook. These opinions argue that ONDO “remains significantly undervalued” relative to its long-term potential. Expectations for the ONDO ETF could be a price driver going forward.

However, short-term risks remain, especially if the broader market experiences high volatility. These risks could increase if selling pressure from short-term investors increases around $1.00. That said, the long-term outlook for Ondo Finance and the ONDO Token remains positive.

This optimism is supported by solid fundamentals, expansion into other blockchain ecosystems, and Vai in the crypto treasury bond space.