This article is machine translated

Show original

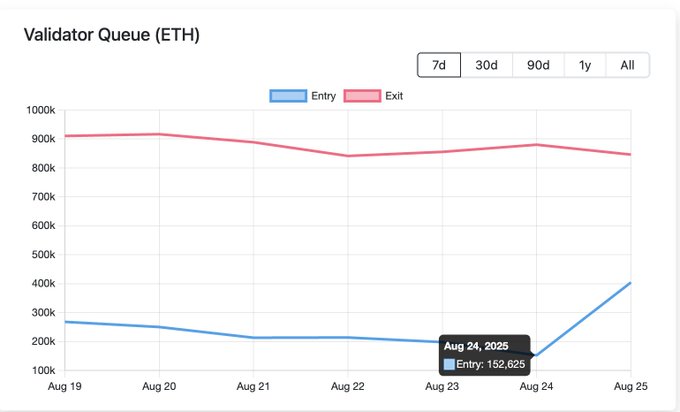

Yesterday was probably the peak in the inflow and outflow of ETH staking. Today, over 200,000 ETH rushed in, filling the Entry Queue to 400,000, signaling a rebound!

Optimists believe ETH prices are undergoing a routine correction near their previous high (or new high), so don't run away! We agreed to target 8,000 or 15,000.

Neutralists believe this is all due to the recent interest rate anomalies and arbitrage in stETH revolving loans. It's normal deleveraging and shouldn't be over-interpreted.

Pessimists believe the daily gas usage of 0.1-0.2 Gwei reflects on-chain stagnation. Furthermore, stablecoin chains like Plasma, Arc, Tempo, Stable, and Codex are poised to compete for the stablecoin and RWA narrative that is ETH's future. Otherwise, why are they unlocking and selling?

Will the pessimists be right this time, and will the optimists prevail? 🤔

OKX Ventures

@OKX_Ventures

08-24

Based on recent data from the Ethereum Beacon Chain, the staking queue has shown a significant imbalance, with the exit queue far exceeding the entry queue. As shown in the attached figure, the exit queue is approximately 870,521 ETH with a waiting time of 15 days and 3 hours,

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content