In the Base Chain ecosystem, a Web3 football fantasy game called Football.Fun is generating unprecedented wealth. When a KOL shared a screenshot of his earnings, claiming "100,000 RMB turned into 200,000 RMB in 5 hours, and 300,000 RMB in 11 hours," the entire crypto community was stunned. In just two weeks, the total market capitalization of player tokens on the platform soared to a peak of $150 million, with cumulative trading volume exceeding a single-day record of $14.85 million. Over 10,000 wallet addresses have flocked to this virtual-realistic football finance experiment.

1. Breaking the Circle Logic: When Stars Become Tradable “Meme Coins”

Football.Fun positions itself as an “on-chain fantasy sports platform,” with its core gameplay appealing to both traditional sports fans and crypto investors:

- Player Assetization: The platform includes top players from the top five European leagues, with each player issuing up to 25 million shares. Players can freely buy and sell player tokens, just like trading Meme coins on the AMM market.

- Event Automation: The system automatically calculates player points every week (weekend games and midweek games) based on real football match data, and the reward pool is distributed to holders of outstanding players

- Economic Model Innovation: Mike Dudas, partner at 6th Man Ventures, likened it to "Sorare plus liquidity"—the traditional fantasy sports platform Sorare's collectible card model has been upgraded to instantly tradable on-chain assets, allowing fans' interest to be directly converted into financial transactions.

This design deeply ties football culture to financial liquidity. When Mbappé scores in the Champions League, the price of his on-chain token can skyrocket; if Haaland is injured, holders face selling pressure. The game transforms fans' knowledge advantages into investment advantages, fostering natural user engagement.

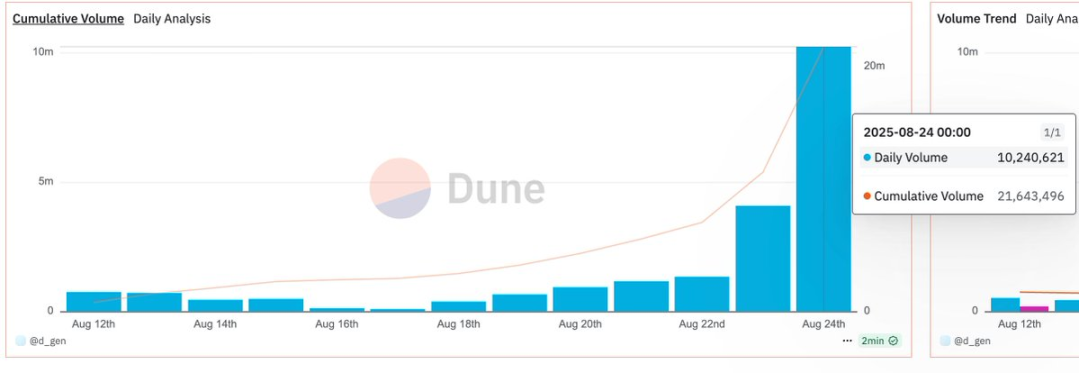

2. Data Explosion: The Growth Flywheel Behind 10 Million TVL

On-chain data from two weeks after going online reveals its outbreak trajectory:

- The value locked (TVL) exceeded $10 million, and the accumulated transaction fees reached $1.5 million.

- Social fission effect: #FootballFun discussion on Twitter surged, with players spontaneously sharing their strategies and screenshots of their earnings, leading to virality.

- Player market value differentiation: A single share of a star player can cost several dollars, while a rookie's share is only a few cents, forming a pyramid-shaped investment echelon.

Notably, the wealth effect was concentrated among early adopters. The initial release of player packs raised $2.5 million, of which $2 million was injected into the liquidity pool, providing initial market depth. Early adopters employed a strategy of "grabbing newly released players and building positions at low prices before matches," then profited by selling at high prices after the results were announced, driving the data upwards.

3. Mechanism Analysis: The Gold Currency System and the 5% Handling Fee Game

The economic cycle of the game relies on a set of sophisticated designs:

- Dual-track participation

- → Free Trial (FTP): 300 season points + 3 player packs, 1100 gold coins for the novice mission

- → Professional Edition (Pro): Deposit Base Chain USDC to exchange for an equal amount of Gold, 1 Gold = 1 USDC rigid anchor

- Transaction cost mechanism

- Basic handling fee: 5% per transaction

- Dynamic tax adjustment: The tax rate rises to 25% during large-scale sell-offs to curb market manipulation.

- Contract Consumption Rules

- Players come with a four-game contract, which must be renewed after it runs out. This approach controls circulation while creating a continuous consumption scenario.

However, the core contradiction of this profit model lies in its complete reliance on latecomers to generate revenue. The reward pool is funded by new players' investment in packs and transaction fees, with no external revenue flowing back. This structure, nicknamed a "football Ponzi scheme" by the community, depends on whether user growth can maintain a positive cycle.

IV. Team Layout: $2 Million Seed Round Financing and Base Ecosystem Ambition

Although founder Adam (@AdamFDF_) has not disclosed his detailed background, his capital movements have revealed his ambitions:

- On July 18, 2025, the project completed a $2 million seed round of financing, led by 6th Man Ventures (6MV), a sports-focused firm, with participation from Devmons, Zee Prime Capital, and others.

- The strategic intention behind choosing Base Chain is clear: leveraging the Coinbase ecosystem's compliance and user base to lower the barrier for traditional fans to enter Web3.

- The player data partner has not yet been disclosed, but the real event points system shows that it may have access to official data channels.

Participation Guide: Building a Trading Strategy from Scratch

Actual combat players need to master three levels of skills:

- Basic Operations

- Connect MetaMask wallet and switch to Base network

- Professional version users deposit USDC to exchange for Gold through the contract address

- Player screening dimensions

- Match weighting: Players in high-scoring competitions like the Champions League can receive a 30-point win bonus (only 10 points in lower-level leagues)

- Shareholding concentration: Players with fewer shareholders receive higher dividends per share if they perform well.

- Trading Timing

- Pre-match ambush: Buy potential players based on odds and avoid highly sought-after players (e.g., Real Madrid vs. Barcelona "El Clásico")

- Post-match cashing out: Selling winning players before points are settled to avoid contract consumption.

6. Controversy and Challenges: Questioning Sustainability Amidst the Carnival

As the wealth effect spreads, community disputes become increasingly acute:

- Fairness concerns: Rewards are distributed based on shareholding ratios, allowing large investors to manipulate returns by monopolizing unpopular players.

- Model sustainability: Some players have calculated that if the weekly increase in new users is less than 5%, the reward pool will shrink after 8 weeks.

- Regulatory Risk: Whether player tokens are securities remains to be determined, and European and American regulators have yet to comment.

The project has not yet directly addressed the concerns, but its update log indicates that it is currently optimizing its scoring algorithm. Its white paper emphasizes that "the primary goal of the game is fun, and investment is a derivative behavior," attempting to balance financial attributes with the essence of sports entertainment.

Conclusion: Between Bubble and Innovation

Football.Fun's TVL curve continues to fluctuate wildly. Its $150 million market cap reflects both the real yield of early adopters and the fear of FOMO among latecomers. Its true value may lie not in the current wealth distribution but in validating a hypothesis: sports fans are willing to pay for deeply engaging experiences, even at the risk of financial loss.

As one community player joked: "There is no match-fixing here, but there are bookmakers with bad news." When the suspense of the football field meets the on-chain liquidity, the story of GameFi has just opened a new chapter.