The following content is published by JuCoin Labs Research Institute:

1. Background of Stock Tokenization

Stock tokenization refers to the issuance and circulation of traditional equity or its income rights in the form of tokens on public or permissioned blockchains, making them transferable, programmable, and composable. Each token corresponds to one share or a certain number of shares of the underlying stock and is intended to reflect the value of that stock and its associated rights. Unlike traditional stocks, which can only be traded as a whole on an exchange at limited times, tokenized stocks typically support continuous trading 24/7 and can be purchased in smaller units, lowering the investment threshold. This concept falls under the broader concept of asset tokenization, which uses blockchain to digitize various real-world assets such as real estate and commodities, improving the convenience and transparency of ownership transactions after being put on the blockchain.

Development History:

The concept of stock tokenization isn't new. Security Token Offerings (STOs) were first attempted in the crypto industry around 2017. Essentially, they leveraged blockchain to digitize and on-chain the rights and interests of traditional securities, and were considered a "compliant version of an ICO." However, due to a lack of unified standards, insufficient secondary market liquidity, and high compliance costs, the early development of the STO market was relatively slow.

- The DeFi wave has given rise to on-chain synthetic assets: During the "Summer of DeFi" in 2020, some projects began exploring decentralized equity tokenization. This involves creating on-chain synthetic assets pegged to stock prices through smart contracts and oracles. In this model, investors can collateralize crypto assets to mint tokens pegged to a specific stock price, without having to hold actual shares, thereby gaining direct on-chain exposure to US stocks. Representative projects include the Synthetix protocol on Ethereum and the Mirror Protocol on the Terra chain.

- Early attempts by centralized exchanges: A prime example is the stock token service launched by the crypto derivatives exchange FTX in October 2020. FTX partnered with German financial institution CM-Equity AG and Swiss Digital Assets AG to issue tokens pegged 1:1 to popular US stocks such as Tesla, Amazon, and Facebook, allowing users outside the US and other restricted regions to trade these tokens 24/7. Subsequently, Binance also launched stock token trading in April 2021, initially offering Tesla stock tokens. However, the regulatory environment at the time was unfriendly. Under pressure from various parties, Binance announced in July 2021 that it would delist all stock tokens, ceasing the service just three months after its launch. As for FTX, following its bankruptcy and liquidation in November 2022 due to scandals including the misappropriation of client funds, the platform's stock token service also ceased.

- Resurgence under the RWA Wave: After an initial surge of enthusiasm and a subsequent lull, equity tokenization has regained attention since 2025. In particular, a shift in financial regulatory attitudes in the United States, with greater openness to exploring digital securities innovation, has provided an opportunity for a resurgence in equity tokenization. The industry has begun to utilize the "Real World Asset" (RWA) conceptual framework, emphasizing that equity tokens backed 1:1 by real assets must be issued by licensed institutions under a compliant framework. All token creation, trading, redemption, and underlying asset management must strictly adhere to regulatory requirements.

Market status:

According to the latest data from rwa.xyz, the total market capitalization of the tokenized equity market is currently $360 million, down approximately 11.8% over the past 30 days. Monthly transfer volume is $236 million, down 36.8% month-over-month. The number of monthly active addresses is approximately 29,292, a sharp drop of 61% month-over-month, indicating a decrease in short-term trading activity. In contrast, the number of holders has reached 61,600, a 6.5% increase month-over-month.

Structurally, major tokenized stocks include EXOD, MGL, TSLAx, SPYx, and NVDAX. Market capitalization is dominated by a small number of leading stocks. This reflects the market's early stages, with minimal trading volatility, but the overall user base is steadily expanding.

While the current market capitalization and trading volume of equity tokens are limited, the market remains optimistic about their prospects. With the entry of prominent companies like Robinhood, investor awareness is growing. At the same time, institutional funds are also beginning to test the waters. An increasing number of institutional investors, valuing the faster and more cost-effective access to the US stock market offered by equity tokens, are actively pursuing this sector.

2. Main Models of Stock Tokenization

1. Regulated stock tokens issued in partnership with traditional brokerages

This model achieves compliant stock tokenization through token issuance by licensed financial institutions and liquidity provided by trading platforms. A key feature is the inclusion of traditional brokerages or regulated institutions on the issuance side to ensure 1:1 custody of real shares, while also separating issuance and trading functions. After these tokens are launched, trading channels are provided by multiple platforms. Centralized exchanges like Kraken provide front-end listings and trading services for their non-US users. Furthermore, the tokens can be freely exchanged on the Solana chain through decentralized protocols like Jupiter, enabling on-chain circulation.

In this model, the assets are actually held and the tokens are fully backed, giving investors a high degree of confidence in the rights and interests of the underlying shares. This model balances compliance with efficiency and is considered one of the mainstream approaches to stock tokenization. However, investors still need to trust the integrity of the issuer. Despite independent custody, there is still a certain black box period in information disclosure and redemption, which poses a moral hazard.

2. DeFi protocol model built through on-chain mapping

This model tokenizes stocks through a fully decentralized synthetic asset protocol. Its core approach is to create tokens on the blockchain that are pegged to the value of real stocks, without directly holding the stocks. Essentially, this leverages smart contracts and oracle technology to ensure that the price of on-chain tokens mirrors real-world stock price movements. Typically, users pledge a certain value of crypto assets in the protocol. Based on stock market price data provided by an oracle, synthetic tokens pegged to the target stock price are minted according to an over-collateralization ratio.

The token can be freely traded on decentralized exchanges, with the trading price constantly adjusted by oracles to maintain a close relationship with the actual stock price. However, pure algorithmic anchoring also carries significant risks and drawbacks. While the model of mirroring stock prices through DeFi protocols is technologically innovative, it is currently limited by liquidity and regulatory factors, and a sustainable business model has yet to be found.

3. “Imitative” stock tokens issued without a custodian

This model is essentially a generalization of the aforementioned synthetic asset model, emphasizing the issuance of tokens that merely "mimic" stock performance without the custody of actual stocks. Broadly speaking, over-collateralized synthetic assets like Synthetix fall into this category. "Non-custodial imitation stock tokens" are more of a transitional product, offering a convenient, albeit high-risk, middle path between the pursuit of complete decentralization and fully compliant custody. Currently, with tightening regulations, such products are gradually declining, and the market is favoring the aforementioned asset-backed model.

3. Case Studies of Stock Tokenization

3.1 xStocks

xStocks is a suite of stock tokenization products launched by Swiss fintech company Backed Finance. These products utilize a highly compliant architecture. Backed, as the issuer, has obtained a license from the Swiss Financial Market Supervisory Authority (FINMA), and its stock tokens are regulated financial products.

3.1.1 Equity on-chain model

xStocks's logic is "real shares + on-chain certificates." Backed Finance purchases real shares in the secondary market and holds them in custody with an independent SPV and licensed custodian, ensuring that the shares are not commingled with the issuer's balance sheet, thereby avoiding bankruptcy or operational risks. After confirming the entry into the warehouse, the SPV issues instructions to the on-chain contract to mint SPL tokens on Solana that fully correspond to the holdings. If investors redeem, the tokens must be destroyed, and the SPV will sell or transfer the shares accordingly, maintaining a 1:1 correspondence. During the lifecycle, dividends are collected by the SPV and converted into stablecoins such as USDC and distributed to token holders; company splits or mergers are automatically completed by adjusting the number of tokens. External users can verify the number of custodial shares in real time on the chain through PoR (Proof of Reserves) to ensure that tokens are not over-issued.

3.1.2 Transaction Architecture Design

xStocks adopts a dual-track liquidity strategy: professional market makers maintain trading depth on CEXs (such as Kraken), providing a compliant entry point for retail investors. Simultaneously, tokens can be freely transferred to wallets and used to participate in DeFi, market making on DEXs like Raydium and Jupiter, or used as collateral in lending and leveraged strategies. Transaction cycles are shortened to seconds, with on-chain transfers and matching operating 24/7. This open model means there is no mandatory whitelisting for tokens, allowing them to be freely accessed by any contract or wallet, improving composability and on-chain utilization.

3.1.3 Asset Chain Logic

Step 1: Real stock purchase, Backed Finance buys stocks through traditional brokerages.

Step 2: SPV isolation, the stocks enter an independent SPV to avoid operational risk contamination.

Step 3: Custodian verification: a licensed custodian institution confirms ownership of stock holdings.

Step 4: On-chain minting, SPV authorizes the Solana contract to mint an equal amount of tokens.

Step 5: Token circulation. Tokens can be traded on CEX/DEX and can also be transferred to DeFi protocols for use.

Step 6: Lifecycle management: dividends, stock splits, and consolidations are automatically adjusted through smart contracts.

Step 7: Redemption and destruction. Investors destroy tokens when they exit the market, and SPV returns cash by selling stocks.

3.1.4 Core Advantage Machine Revenue Sources

xStocks' core advantage lies in its high on-chain transparency and openness. Its Proof of Reserve (PoR) ensures that tokens will not be over-issued. It can also be directly embedded in DeFi, expanding its application scenarios. Its revenue streams include the following:

- Transaction fees: CEX platforms charge Maker/Taker fees.

- Minting/Redemption Service Fee: Backed Finance charges institutional investors.

- B2B Tokenization Service: Provides “asset tokenization as a service” to other financial institutions. xStocks itself is both a product and a showcase.

- DeFi liquidity mining income: By cooperating with DeFi protocols, the platform can extract part of the liquidity incentives or protocol income.

3.1.5 Market Operation Data

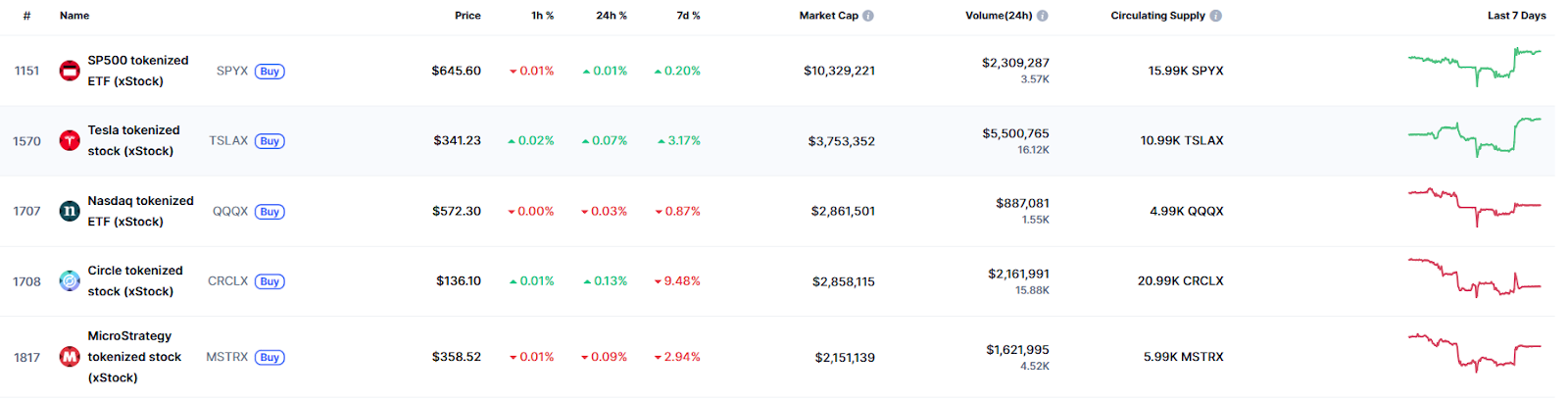

Currently, the total market capitalization of tokenized assets in the xStocks ecosystem is approximately $34.34 million, with a 24-hour trading volume of $42.99 million. Trading volume is primarily concentrated in Tesla tokenized stock (TSLAX) and Circle tokenized stock (CRCLX), with daily trading volumes reaching $5.74 million and $2.17 million, respectively. Liquidity performance for the remaining tokens is generally average. This demonstrates the high concentration of trading volume in a small number of assets, with relatively low liquidity for long-tail tokens, demonstrating the fragility of the early-stage market.

3.2 Robinhood

3.2.1 Equity on-chain model

Robinhood's stock tokens are essentially digital representations of derivative contracts, not direct stock ownership. When users purchase the tokens, they sign a price-tracking contract with Robinhood Europe UAB, earning returns based on the underlying stock price and simulated dividends, but without voting or governance rights.

This model is regulated by the EU's MiFID II, which classifies tokens as financial derivatives, avoiding the stricter rules for securities issuance. For private equity, Robinhood uses an SPV to hold a portion of its shares and then issues tokens on the blockchain to link their value.

3.2.2 Transaction Architecture Design

Robinhood issued its token on the Arbitrum blockchain, leveraging its low cost and Ethereum's security. The contract incorporates whitelisting and permission controls, requiring verification that the recipient's wallet is compliant with KYC/AML procedures. This means transactions are limited to Robinhood-vetted users. This creates a closed ecosystem, restricting users to the Robinhood platform or controlled on-chain environments, with little ability to interact with open DeFi protocols. In the future, Robinhood plans to develop its own Robinhood Chain based on the Arbitrum technology stack, fully integrating clearing and tokenization into its own internal network.

3.2.3 Asset Chain Logic

Step 1: Contract setup. Robinhood defines the token as a price-tracking derivative.

Step 2: On-chain minting, deploy the contract on the Arbitrum chain to generate tokens at low cost.

Step 3: Permission control. All token transfers must verify whether the receiving wallet is in the whitelist.

Step 4: Profit distribution. Users receive profits from price changes and the distribution of Robinhood simulated dividends; however, the underlying shareholder equity still belongs to Robinhood or its SPV.

Step 5: Redemption and Exit. Users can only buy and sell through the Robinhood platform and cannot independently redeem or directly cash in stock assets.

3.2.4 Core Advantages and Revenue Sources

Robinhood's core strengths lie in its compliance, security, and user-friendliness. Leveraging the MiFID II framework and mature interface, it's particularly well-suited for traditional investors to quickly get started. Its revenue streams include the following:

- FX Conversion Fee: A 0.1% FX Conversion Fee is charged to non-Eurozone users.

- Potential payment for order flow: Although restricted in the EU, it may be possible to draw on its US stock business model in the future.

- Private equity tokenization value-added services: Through non-listed company tokens, Robinhood has the opportunity to provide information, matchmaking and other services for a fee.

- Membership and value-added services: A tiered charging model may be introduced for high-frequency traders or institutions.

3.1.5 Market Operation Data

Robinhood has launched tokenized trading for over 200 US stocks and ETFs to users in the European Union. Token trading supports zero commissions and 24/5 trading. The platform even attempted to tokenize equity in private companies such as OpenAI and SpaceX, but OpenAI subsequently denied any cooperation, leading Robinhood to delist the OpenAI tokens. Robinhood's current equity tokens are extremely low-cost to deploy on Arbitrum, facilitating rapid expansion. However, due to strict whitelisting restrictions, secondary liquidity is largely confined to Robinhood's internal ecosystem, lacking interoperability with open DeFi, resulting in limited on-chain trading depth. While this closed-loop strategy enhances compliance and security, it also limits external liquidity and market vitality.

3.3 Others

In addition to stock tokenization platforms, there are also some "coin-stock projects" that are worthy of our attention. This article sorts out the most representative projects.

3.3.1 Circle Internet Group (Stock Code: CRCL)

- Latest market value: approximately US$18.5 billion.

- Business model: A leading global stablecoin company that issues USDC. Its business covers cross-border payments, DeFi settlements, and institutional clearing. Its revenue mainly comes from reserve interest and ecological cooperation.

- Stablecoin circulation: approximately US$31.25 billion.

Circle successfully listed on the New York Stock Exchange in June 2025. Its core business is the USDC stablecoin, and its market capitalization reached nearly $63 billion at one point. To date, USDC's on-chain circulating supply has increased by nearly 90% year-over-year to $61.3 billion, further increasing to $65.2 billion as of August 10th. While the company reported a net loss of $482 million (primarily due to non-cash expenses incurred prior to its IPO), total revenue increased by 53% year-over-year (to $658 million).

As a benchmark for mainstream crypto stablecoins, Circle's enhanced regulatory framework following its IPO further strengthens its business model. The company also launched the Circle Payments Network and its proprietary Arc blockchain, actively pursuing DeFi settlement and cross-border payment solutions. Circle's greatest strength lies in its stablecoin issuance business, built on a foundation of compliance and transparency, while leveraging policy incentives to rapidly expand its ecosystem and applications.

3.3.2 MicroStrategy (Stock Code: MSTR)

- Latest market capitalization: approximately $103 billion

- Holdings: As of now, it holds approximately 629,376 BTC, with a market value of approximately US$72.63 billion, accounting for nearly 3% of the global circulating Bitcoin supply.

MicroStrategy originally began as a traditional technology company providing business intelligence and data analytics software, but it truly caught Wall Street's attention thanks to its Bitcoin strategic reserve program, launched in 2020 under the leadership of CEO Michael Saylor. This aggressive asset allocation strategy has completely transformed MSTR from a software company into a "Bitcoin-like ETF" target.

MicroStrategy's stock price is highly correlated with the price of Bitcoin, making it the most direct channel for institutional investors to indirectly hold BTC in a restricted environment. From a mere $12 in 2020, its share price surpassed $360 by 2025, reaching a market capitalization exceeding $103 billion, a more than 30-fold increase. Its core advantage lies in its continued accumulation of Bitcoin holdings and its commitment to long-term holding. MSTR has become the purest Bitcoin exposure tool in the traditional financial market, providing institutional investors with an alternative path to circumvent the barriers to direct crypto investment.

3.3.3 BitMine Immersion Technologies (Stock Code: BMNR)

- Latest market value: approximately US$9.28 billion.

- Business model: The former mining company has transformed into an ETH treasury enterprise and has become the world's largest Ethereum corporate treasury.

- Holdings: approximately 1,523,373 ETH, with a total value of approximately US$6.6 billion.

BitMine has transformed itself from a traditional mining company into the world's largest enterprise-grade Ethereum treasury. BitMine's business logic draws on MicroStrategy's Bitcoin reserve framework, but with an Ethereum-based approach, making it a model for an enterprise Ethereum treasury. While rapidly expanding its holdings, the company's stock maintains exceptional liquidity, with an average daily trading volume of $6.4 billion, ranking it the tenth most active US stock. Its core advantage lies in its centralized holdings of ETH, providing external investors with indirect access to tradable Ethereum assets. Furthermore, its stock price is highly correlated with the value of its ETH holdings.

IV. Compliance

- United States (SEC): The U.S. Securities and Exchange Commission (SEC) generally considers any token representing company equity or an investment contract to be a security. Therefore, equity tokens issued or traded to U.S. investors must comply with securities laws. To date, the United States has not approved any services offering equity token trading to retail investors. Coinbase is currently seeking an SEC exemption to comply with regulations and launch equity token trading.

- European Union (MiCA): The EU adopted the Markets in Crypto-Assets (MiCA) Directive in 2024, establishing a unified regulatory framework for digital assets. Within the EU, equity tokens are generally considered transferable securities. EU regulatory requirements for equity tokens are nearly identical to those for traditional stock offerings: they must have an approved prospectus or qualify for an exemption and be traded on a regulated venue. Platforms seeking to legally offer equity token trading in the EU have two options: first, obtaining an investment firm or multilateral trading venue license and listing equity tokens as a new type of security (regulated by MiFID and securities law); second, partnering with a licensed issuer to offer token issuance and over-the-counter trading within a limited scope (such as private placements to qualified investors or a small number of investors). It's worth noting that although Switzerland is not part of the EU, as a European financial center, it has an open policy towards security tokens. Backed's xStocks has received approval from Switzerland's FINMA and can offer its services to EU investors through European partners. EU member states such as Germany and France are also exploring legal amendments to recognize DLT-based securities records.

- Hong Kong (SFC): Hong Kong explicitly treats equity tokens as regulated securities. The Securities and Futures Commission (SFC) issued a statement in 2021 stating that equity tokens marketed as being backed by overseas-listed stocks are likely securities within the meaning of the Securities and Futures Ordinance. Therefore, any promotion or sale of equity tokens to the public in Hong Kong may constitute an unregistered offering of securities and requires SFC authorization; failure to do so is illegal.

5. Investment Opportunities

As a financial innovation, stock tokenization presents both new opportunities and risks for global retail investors. The following analysis focuses on potential benefits, industry opportunities, and risk considerations.

Potential benefits for retail investors

For ordinary investors, stock tokenization promises several attractive advantages:

- Extended trading hours: 24/7 uninterrupted trading is one of the biggest highlights of stock tokenization, which enables retail investors to adjust their positions in a timely manner according to global market dynamics.

- Lower investment barriers: Stock tokens support fractional ownership. Investors with just a few dozen dollars can purchase a fraction of a stock worth thousands of dollars. This significantly lowers the barrier to entry for small and medium-sized investors to participate in well-known, high-priced stocks, helping a wider audience share in the opportunities for high-quality asset appreciation.

- Efficient Settlement: Transfers of equity tokens change ownership within seconds or minutes, while traditional stock transactions can take up to two days. This increased efficiency is expected to reduce transaction costs, allowing platforms to save on clearinghouse and custodian fees, which can be passed on to users.

6. Future Outlook

Based on the current state of technological and regulatory development, stock tokenization is expected to usher in the following trends and prospects in the next few years:

- Inclusion in Mainstream Exchanges: Traditional financial markets are gradually embracing blockchain technology, and in the future, mainstream stock exchanges may directly participate in the stock tokenization process. Crypto giants like Coinbase are seeking regulatory approval to enter the stock trading space. Meanwhile, major exchanges like Nasdaq and the New York Stock Exchange are actively researching applications in securities trading (such as faster clearing and digital custody). It's not ruled out that these exchanges will launch official digital securities sections or platforms in the future, migrating some stock trading and settlement to blockchain.

- International Regulatory Collaboration and Standard Harmonization: Currently, regulatory requirements for equity tokens vary significantly across countries. However, in the long term, the development of unified industry standards and regulatory frameworks is crucial for the scalability of equity tokenization. In the coming years, international securities regulators and other organizations may issue guidelines to foster consensus on the definition of digital securities, cross-border mutual recognition, and investor protection. This will help alleviate the aforementioned liquidity fragmentation and compatibility issues, ultimately achieving a global equity token market where "one token is universal."

- Market Size and Institutional Participation: Equity tokenization has significant growth potential based on market size. Many institutional investors (hedge funds, family offices, and others) have expressed strong interest in using tokenization to more efficiently allocate assets. Once regulatory clarity and infrastructure are established, large asset managers may utilize tokenization to manage portions of their portfolios.

VII. Conclusion

Stock tokenization, a product of the intersection of traditional finance and blockchain technology, is demonstrating burgeoning vitality worldwide! For retail investors, it offers a new investment path, allowing them to participate in the growth of top global companies, regardless of location or time, and achieve global and diversified asset allocation. Furthermore, the efficient settlement and low-threshold transactions enabled by tokenization significantly enhance the investment experience, aligning with the trend toward convenience in the digital age.

While the potential of stock tokenization has garnered widespread attention, we must remain calm and rational. Currently, this field is still in its exploratory and nascent stages, with immature market infrastructure and a need for further development of the relevant legal and regulatory frameworks. In practice, it will serve more as an extension and supplement to existing financial channels rather than a complete and disruptive replacement. While embracing new opportunities, investors should also fully understand the inherent uncertainties and potential risks, and avoid blind optimism. Only then can they strike a balance amidst the coexistence of opportunities and challenges.