“In this market cycle, Berachain is gradually showing its potential as a new fertile ground for DeFi growth.”

In this round of DeFi restart cycle, Berachain is gradually showing its potential as a high capital efficiency battlefield.

As a new generation of Layer1 with chain-level performance and mechanism innovation advantages, it is centered on the PoL (Proof of Liquidity) consensus mechanism, subverting the linear distribution logic of the traditional PoS model of "printing coins is rewarding", and breaking the old paradigm of traditional consensus mechanisms that simply rely on inflation incentives or short-term subsidies to drive liquidity accumulation.

In fact, compared to traditional PoS consensus, which solely relies on inflationary incentives or static staking weights, the core of PoL lies in directly linking on-chain native incentives with the protocol's actual liquidity contribution. Unlike the traditional model of "even distribution" based on staking weight, Berachain requires that protocols must first attract user participation through effective incentives and generate verifiable on-chain liquidity before they can be eligible for block reward distribution.

The key to this mechanism is to build a multilateral game structure between the protocol, liquidity providers, and governance voters through modular designs such as "bribing validators + LP equity binding":

- The protocol “bribes” validators by offering more attractive returns, guiding them to support their own liquidity pools;

- LPs decide whether to provide liquidity after evaluating returns and risks, which further affects the competitiveness and incentive weight of the protocol.

We have seen that the above mechanism not only effectively improves the efficiency of incentive distribution, prompting different protocols to compete for incentives, but also indirectly improves the capital utilization rate and user activity of the entire Berachain network. This in turn forms a closed loop between the protocol incentive structure, capital utilization efficiency and governance mechanism on Berachain, ultimately achieving dynamic adaptation and self-optimization between incentive distribution within the ecosystem and project quality.

Practice has proven that the entire Berachain system has demonstrated stable self-organizing characteristics, whether in terms of capital inflow, protocol incentives, token lock-up, user participation, governance activity, or resource redistribution. This has created a fertile ground for explosive growth for early-stage projects.

Dolomite is a prime example. Since migrating to the Berachain mainnet in February of this year, Dolomite has attracted over $3.3 billion in stablecoin loans, achieving a nearly 20-fold increase in TVL, making it one of the most representative lending protocols in the ecosystem. By deeply integrating Berachain's incentive model and underlying architecture, Dolomite has achieved a simultaneous surge in market attention, user growth, and protocol revenue.

The Dolomite example not only verifies the effectiveness of the PoL model, but also becomes an important benchmark for Berachain to attract high-value protocols and user migration.

Likewise, Berachain is providing unprecedented expansion opportunities for emerging stablecoins.

USDT0's expansion path under the support of PoL

USDT0 is an Omnichain stablecoin powered by LayerZero that uses the OFT (Omnichain Fungible Token) standard, enabling 1:1 minting and bridge-free transfer capabilities.

In January 2025, USDT0 was officially expanded to Berachain and deployed around the launch of the latter’s mainnet. This new integration is not only an extension of the USDT0 asset distribution path, but also a key node for its “native integration” in the new chain ecosystem.

On Berachain, USDT0 has rapidly expanded its functionality and revalued its value, leveraging the Proof of Liquidity (PoL) mechanism and DeFi architecture. Through the OFT model, users can migrate across chains without the need for synthesis or bridging. Combined with Berachain's inherent EVM compatibility and underlying bridging capabilities with LayerZero, USDT0's role as an "interchain token" has become increasingly clear.

In August 2025, Bybit announced native support for USDT0 on Berachain and provided a zero-fee withdrawal path, further unlocking the asset's capital efficiency in a multi-chain environment, reducing technical friction, and broadening the depth of circulation.

On the other hand, the PoL incentive mechanism gives USDT0 a more profitable role.

On Berachain, it is not only a "stable payment tool", but also a yield-generating asset that can be used for liquidity mining and protocol mortgage.

Users can earn BGT (governance token) rewards by participating in stable liquidity pools like USDT0-HONEY, with an annualized yield of up to 100%. This incentive far exceeds the passive holding returns of traditional USDT on other major chains, significantly driving LP growth and protocol integration. DEX protocols such as Kodiak have also integrated this pool, further expanding USDT0's on-chain use cases and capital efficiency.

At this stage, USDT0 has gradually established its core position on Berachain.

It has been chosen as collateral for HONEY by multiple mainstream protocols, penetrating core processes such as lending, trading, and asset minting. In August 2025, its supply on Berachain exceeded $100 million, dominating the chain's total stablecoin supply. Its peak TVL also exceeded $600 million, providing a strong funding entry point for USDT0 and forming a stable growth flywheel.

From "native integration" to "multi-chain access", USDT0's Berachain route is becoming a typical paradigm for the deep binding of on-chain liquidity, incentive paths and ecological value.

It opens up the value capture logic of stablecoins, evolving from a payment tool to an income asset, and also reflects Berachain's own competitiveness in native asset integration capabilities as a new generation of DeFi chain.

The next round of competition among stablecoins will no longer be limited to a fight for market share, but will also depend on whether they can truly integrate into the chain-level ecosystem and bring about systemic value enhancement.

The growth of the stablecoin ecosystem may accelerate the growth of Berachain

In fact, with the expansion of USDT0, it has also brought significant benefits to the development of the Berachain ecosystem.

USDT0, as the collateral for HONEY minting, directly drove Berachain's TVL from $700 million in pre-deposits before the mainnet to $3.2 billion in February 2025, and reached a peak of $6.3 billion in March.

Stablecoins account for over 80% of the total TVL in the ecosystem, with USDT0 contributing between 20% and 25%, making it a key pillar of the liquidity structure. For example, on DEXs like Kodiak, the establishment of the USDT0-HONEY liquidity pool has significantly increased trading depth, optimized asset matching efficiency, and reduced fragmentation.

The user level also shows a synchronous growth effect. We see that after USDT0 expanded to Berachain, the number of active users jumped from less than 100,000 before the mainnet to 200,000-250,000, and the daily transaction volume reached a peak of US$100 million in March 2025.

In fact, the new growth is partly due to the cross-chain expansion of USDT0 and the zero-fee deposit experience brought by Bybit integration, which also led to a 47% month-on-month increase in transaction fee rebates.

On the yield side, USDT0 combined with the PoL incentive mechanism has enabled multiple pools to achieve an APR in the range of 25–300% (such as USDC.e-HONEY reaching 25%), and has been successfully integrated into lending and staking platforms such as Dolomite and BeraHub, improving capital efficiency and protocol reuse.

It is worth mentioning that the growth of the stablecoin ecosystem on Berachain does not rely solely on USDT0.

Usual's stablecoins, such as USD0 and USDT0++, were recently expanded to Berachain. Their structural design and compliance paths better align with the requirements of RWA asset custody, and they are forming a synergistic closed loop of on-chain asset mapping, clearing and settlement, and derivatives expansion. These stablecoins not only fill the gaps in mainstream stablecoins but also provide the Berachain network with more diverse basic options for cross-border clearing and institutional access.

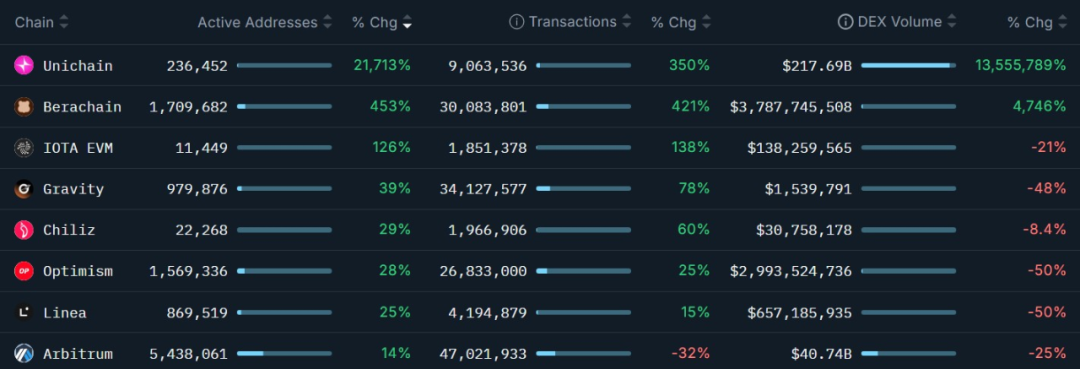

Since its launch, the Berachain network has rapidly climbed to become the sixth largest DeFi chain globally, surpassing both Arbitrum and Base in terms of TVL. Peak capital bridge volume has reached $3.55 billion per month, bringing Berachain a steady inflow of funds and institutional attention.

The growth of the stablecoin ecosystem has also enhanced Berachain's cross-chain capabilities. For example, its integration with TAO led to a 47% increase in the pool's TVL, resulting in higher TPS and lower transaction costs for the network. Improvements to the ecosystem's asset structure have further solidified Berachain's pursuit of mass adoption, with protocol revenue exceeding $25 million in a short period of time.

Notably, Berachain's total bridge inflow has also seen explosive growth, currently exceeding $880 million. Driven by both stablecoins and RWA assets, on-chain liquidity fragmentation has been alleviated, significantly improving the TVL/FDV ratio. Using a reasonable valuation multiple (e.g., 12–15x), Berachain's potential FDV could reach $7–10 billion.

Compared to Solana's 35% TVL growth during the same period, Berachain's performance in capital-efficient sectors like stablecoins, derivatives protocols, and liquidity hubs stands out. Conservative estimates suggest Berachain's annualized on-chain GDP (including revenue from DEX, lending, and RWA protocols) is expected to exceed $500 million.

Network effects take shape

According to official data, over 400 projects have been deployed in the Berachain ecosystem since the mainnet launch, with over 70 of these being native projects. The developer community has grown 2.5 times, with the number of active developers reaching 160. The ecosystem's GitHub commit count ranks among the top ten emerging public chains.

At the transaction level, Berachain, with its parallel execution architecture and liquidity engine design, possesses the high-performance potential to handle large-scale DeFi and NFT scenarios, with its on-chain transaction throughput steadily increasing. Furthermore, leveraging interoperability protocols such as LayerZero and Union, Berachain has become a key hub for multi-chain liquidity migration, with its bridging usage and Layer 1 interoperability rankings rapidly rising.

Against the backdrop of a global DeFi market growth rate of approximately 41% throughout Q3 2025, Berachain achieved a chain-level growth performance of over 50%, significantly outperforming the industry average and demonstrating strong competitiveness among emerging chains.

From a global perspective, the stability of RWA assets, supported by stablecoins like USD0 and Usual, has significantly enhanced Berachain's appeal to institutional investors. On an infrastructure level, Berachain has completed integration with Google Cloud's cloud services and the Chainlink network, enabling compatibility with over 1,100 oracle data sources. This paves the way for expansion into the EU/APAC markets and alignment with US compliance regulations.

Furthermore, Berachain integrates with on-chain data networks like SEDA, supporting the on-chain mapping and value circulation of RWA-type assets, tapping into the potentially $50 billion tokenization market. Regarding macroeconomic indicators, the on-chain systemic risk index has dropped from 35% at the beginning of the year to 21% currently, providing a safer entry environment for compliant funds.

As the stablecoin ecosystem becomes a key node in cross-chain stable assets, Berachain is also connecting with emerging ecosystems such as TON through LayerZero, further expanding the reach and depth of stablecoin usage. This is expected to further boost overall user adoption within the Berachain ecosystem by the end of 2025, making it a key growth driver in this DeFi recovery cycle.

The market currently predicts that Berachain has an 80% probability of becoming the primary public chain driving DeFi growth in 2025, pushing its potential annual TVL cap to $1.5 billion. Against the backdrop of continued strengthening of the ecosystem's fundamentals, steadily increasing on-chain data, and growing institutional attention, Berachain's native token, $BERA, has recently shown a steady upward trend, with its price exceeding $2.7.

Combined with the recovery in risk appetite brought about by the expectation of a potential interest rate cut by the Federal Reserve in September, market sentiment has gradually warmed up, which is expected to catalyze the start of a new round of "altcoin season" and bring stronger valuation elasticity and upside space to Berachain and $BERA.

From "liquidity as consensus" to "stablecoin as infrastructure," Berachain is accelerating its transition from architectural innovation to an ecosystem flywheel. In this new trend, stablecoins like USDT0 and USD0 are becoming the intrinsic driving force behind protocol growth, user migration, and TVL growth.

It is these new generation stable assets that further constitute the key springboard for Berachain to cross the threshold of ecological cold start.