Berachain is a typical Layer 1 blockchain that embeds DeFi thinking into its consensus mechanism. Its core is the Proof of Liquidity (PoL) consensus . PoL requires validators to import liquidity into a whitelisted protocol before receiving block rewards, with the market determining the flow of funds. As a result, a validator's weight depends not only on their staked amount but also on their ability to introduce real liquidity into the ecosystem.

In this model, liquidity both ensures network security and drives application growth. Protocols continuously optimize incentives to attract capital, leading validators to allocate rewards to higher-performing protocols. LP users, on the other hand, actively participate because they benefit from both protocol benefits and native incentives. Thus, Berachain seamlessly integrates security, liquidity, and application, avoiding the dilemma of choosing between security and liquidity in traditional PoS.

Berachain recently upgraded and launched PoL v2, featuring the introduction of the BERA incentive module. Users can stake BERA on Berahub to earn native returns, eliminating the need for third-party protocols. This significantly improves the entry barrier and user experience. This income comes from the protocol's incentives for competing for BGT emissions, 33% of which is repurchased as WBERA and distributed to stakers, providing real financial backing rather than simple inflation. Furthermore, the staking certificate, sWBERA, imbues BERA with LST-like properties, allowing for secondary use within the ecosystem, improving capital efficiency and enhancing its financial attributes.

This mechanism not only accelerates the operation of the ecological flywheel, but also provides BERA tokens with a clear and auditable source of income, meets the requirements of compliance and institutional adoption, and lays a more solid foundation for the long-term development of Berachain.

In fact, since the launch of the Berachain mainnet on February 6, 2025, its ecosystem has rapidly entered a phase of accelerated growth. Leveraging large-scale early airdrops and initial funding, it has accumulated approximately $2.5 billion in DeFi TVL in just three months, catapulting it into the forefront of global DeFi public chains.

Meanwhile, Infrared Finance locked in approximately $1.5 billion in TVL in a short period of time through one-click PoL staking. Kodiak DEX also contributed over $1.1 billion in liquidity, driving efficient capital rotation through high-frequency trading. In terms of user activity, the on-chain daily active users peaked at 175,000, and the annualized transaction volume exceeded 219 million. Similarly, leveraging the RFA ecosystem support program and a series of hackathons, the ecosystem has now seen over 200 mainnet launches, covering multiple sectors including DeFi, NFT, GameFi, RWA, and stablecoins, and the ecosystem is rapidly maturing.

This article will review the main projects in the Berachain ecosystem.

List of major projects in the Berachain ecosystem

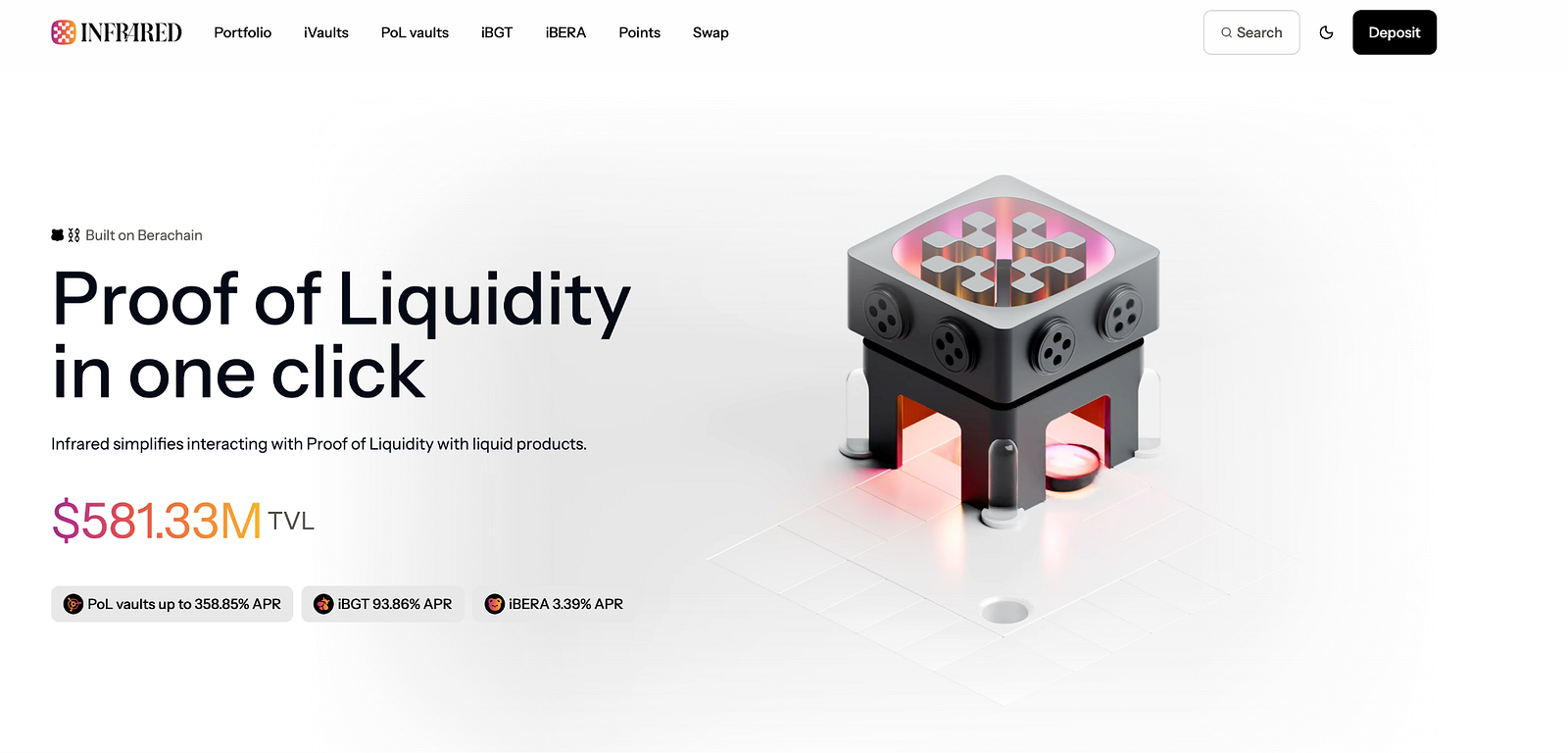

Infrared Finance

Infrared Finance is the core liquid staking protocol in the Berachain ecosystem. Its goal is to facilitate user participation in Berachain's PoL consensus mechanism. Through Infrared, users can stake BERA or BGT directly into the PoL reward pool and receive derivative assets, iBERA or iBGT. These tokens not only inherit the governance and income rights of the native assets but can also be freely used in DeFi protocols, effectively adding a layer of "liquidity packaging" to funds. In this model, Infrared effectively becomes a hub connecting users, validators, and application protocols, significantly improving the capital efficiency of the Berachain ecosystem.

With the launch of the Berachain V2 testnet, Infrared pioneered support for iBGT and contract testing. That same month, with Berachain governance approval, the first PoL reward pool officially launched. The protocol launched a points program in April of this year, providing additional incentives for staking and liquidity providers. These points are expected to be converted into native tokens in the third quarter, adding another layer of hope for user engagement in the ecosystem. Following the governance upgrade and approval of RFRV Batch 22, Infrared further expanded its Charm management pool to strengthen liquidity provision for blue-chip asset pairs.

As of August 2025, Infrared's TVL reached $580 million , firmly placing it at the forefront of the Berachain ecosystem, having previously peaked at over $1.5 billion . The protocol's annualized fees are approximately $2.57 million , with cumulative revenue exceeding $7.3 million , demonstrating its high efficiency in capital utilization and user engagement.

It is particularly worth mentioning that the design of the PoL reward library allows users to participate with one click without complicated operations or reliance on third-party protocols, thereby promoting the overall improvement of Berachain's liquidity.

Dolomite

Dolomite is the largest decentralized lending protocol in the Berachain ecosystem, accounting for approximately 90% of the ecosystem's lending TVL. The protocol utilizes a highly modular architecture, anchoring core functionality in an immutable layer while continuously introducing new assets and features through an extensible modular layer. This ensures strong adaptability while maintaining security and stability.

Unlike traditional lending platforms like Aave and Morpho, Dolomite introduces two key innovations: a virtual liquidity system that allows users to leverage their lending and borrowing simultaneously, accumulating returns; and a dynamic collateralization mechanism that supports over 1,000 assets as collateral while retaining their governance and revenue attributes within the ecosystem. Since migrating to the Berachain mainnet in February 2025, Dolomite has deeply integrated the Proof-of-Law (PoL) consensus mechanism, allowing users to simultaneously participate in the PoL reward pool while borrowing and lending, earning multiple levels of returns and significantly improving capital utilization and the protocol's appeal.

In the summer of 2025, Dolomite became one of the most anticipated projects on Berachain. Its native token, DOLO, soared from a low of approximately $0.03 in June to $0.3 in August, a nearly tenfold increase in two months, making it the ecosystem's most prominent asset. Leveraging Berachain's technological innovations and economic model, Dolomite secured significant liquidity and market attention. Its TVL (TVL) increased nearly 20-fold, attracting over $3.3 billion in stablecoin loans. This boosted Berachain's TVL from $1 billion to $2.5 billion within three months of its mainnet launch.

This surge in prices is driven not only by the protocol's own development but also by external collaborations. In particular, Dolomite's potential collaboration with World Liberty Financial (WLFI) has garnered significant market attention. The two parties are exploring a strategic partnership for treasury-linked vaults and plan to introduce WLFI's stablecoin, USD1, into the Dolomite lending system. Furthermore, Dolomite co-founder Corey Caplan has been invited to serve as a technical advisor to WLFI, further strengthening the partnership's prospects. These developments not only create new liquidity opportunities for Dolomite but also strengthen the DOLO narrative with external resources and political backing, potentially helping Berachain reach a wider user base and institutional audience.

As of August 2025, Dolomite's TVL reached approximately $94 million, with cumulative trading volume exceeding $1 billion. The protocol supports over 115 asset types, and its monthly active users continue to grow. DOLO has risen over 560% in the past 60 days and currently has a FDV of approximately $230 million, making it a core asset in the Berachain ecosystem.

Kodiak Finance

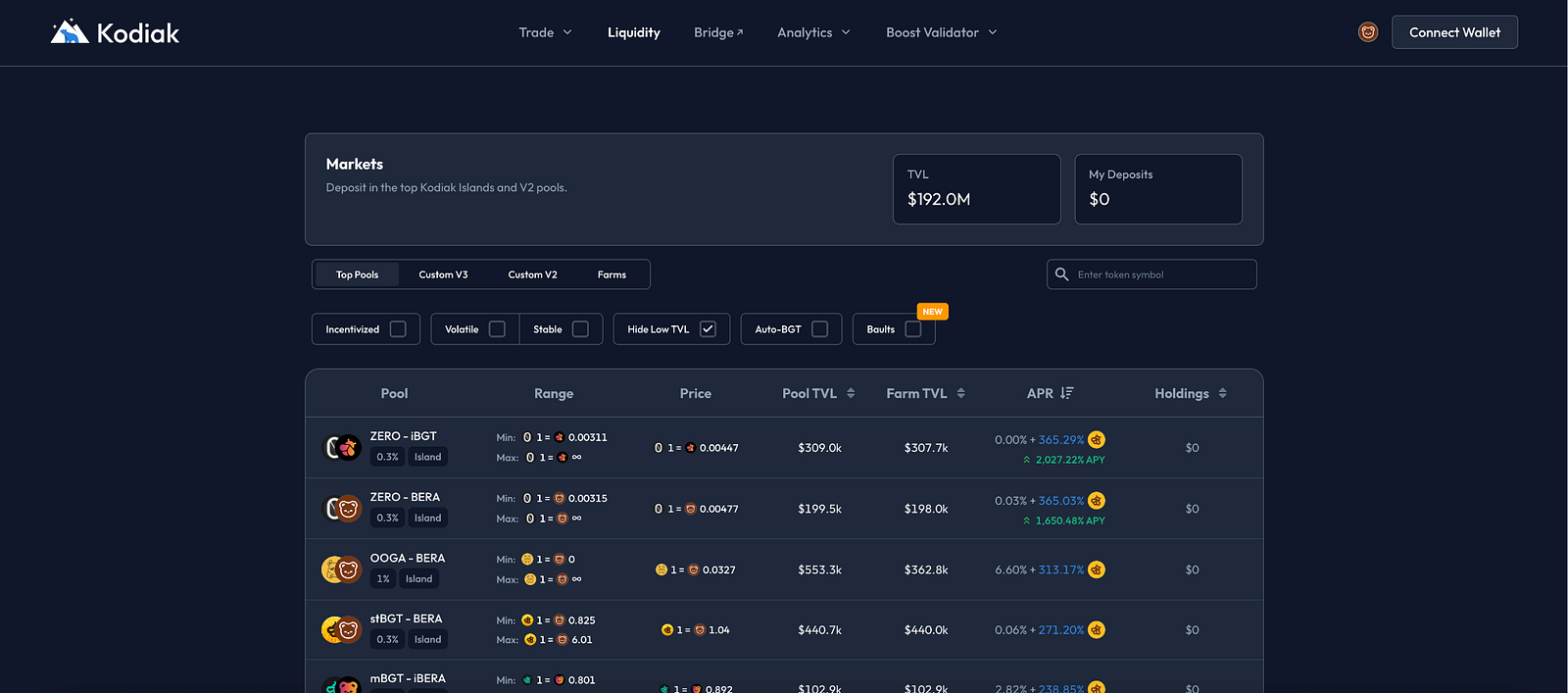

Kodiak Finance is the core DEX and native liquidity hub of the Berachain ecosystem, focusing on centralized liquidity, automated management, and efficient trading tools. The protocol utilizes a vertically integrated design, enabling users to launch tokens, trade assets, and provide liquidity all on the same platform. Supported assets include BERA, HONEY, BGT, and RWAs (such as rUSD). Kodiak is deeply integrated with Berachain's Proof-of-Live (PoL) mechanism, allowing users to earn PoL rewards while providing liquidity, thereby improving capital utilization and bringing deeper liquidity and improved trading depth to the ecosystem as a whole.

As Berachain's "liquidity hub," Kodiak streamlines token issuance and liquidity management processes and seamlessly collaborates with native dApps like Infrared Finance and Dolomite, driving capital circulation and DeFi growth within the ecosystem. Kodiak is also the only DEX incubated project in the Build-a-Bera accelerator program, aiming to build a community-native liquidity platform that supports centralized liquidity pools and automated rebalancing to maximize user returns and capital efficiency.

Entering 2025, with the launch of Berachain's mainnet, Kodiak completed mainnet deployment and quickly attracted liquidity providers. In the first half of the year, the protocol significantly boosted TVL growth by launching the rUSD liquidity pool, gradually expanding to more blue-chip asset pairs. As of June, the rUSD pool had locked over $14 million, playing a key role in Berachain's RWA use case. Meanwhile, Kodiak continues to launch new automated trading and liquidity management tools to further enhance the user experience and strengthen its position as the core liquidity provider for the ecosystem.

According to DeFiLlama data as of August 2025, Kodiak's TVL has reached $192 million, all concentrated on the Berachain blockchain, pushing the ecosystem's total locked-in value to over $3.2 billion. In terms of fees and revenue, the protocol's annualized fees are approximately $12.24 million, with cumulative fees exceeding $10.86 million; annualized revenue is approximately $4.28 million, with cumulative revenue reaching $3.75 million. Trading activity is also outstanding, with DEX trading volume reaching $373 million over the past 30 days and cumulative trading volume exceeding $4.3 billion. In the second quarter of 2025 alone, Kodiak's fee revenue reached $5.63 million, demonstrating steady growth.

As Berachain's core DEX, Kodiak not only accounts for a significant share of the ecosystem's trading volume but also provides users with a sustainable profit path through set-and-forget strategies such as the rUSD liquidity pool. With further integration of PoL and the inclusion of more RWA assets, Kodiak's influence is expected to continue to grow.

Ooga Booga

Ooga Booga is the decentralized exchange aggregator and liquidity platform for the Berachain ecosystem, known as the ecosystem's "liquidity broker." The protocol integrates liquidity from multiple DEXs, including Kodiak, Bex, Honeypot, Beradrome, Izumi, and Berps, through Smart Order Routing, providing users with optimal trading paths, reducing slippage, and optimizing pricing. It supports multi-asset swaps, gas-free trading, limit orders, and Direct Investing (DCA), allowing users to seamlessly access most AMMs and liquidity pools on Berachain without having to compare prices individually.

As a native liquidity hub, Ooga Booga is deeply integrated with Berachain's PoL mechanism, improving capital efficiency while interoperating with protocols such as Infrared Finance and Dolomite, promoting efficient capital flow within the ecosystem. Its native token, $OOGA, is used for user incentivization and governance. Holders can stake $sOOGA, share platform fees, and participate in decision-making. The protocol also offers a developer API that supports real-time pricing and trading access, further strengthening its role as infrastructure within the ecosystem.

Ooga Booga, launched in 2024 and rapidly evolving, initially evolved from Arbitrum's Gridex and deployed simultaneously with the Berachain mainnet launch. Following its TGE in April, it further expanded its aggregation sources and partnered with RedStone Oracles to improve data accuracy. In the near future, the team plans to launch batch trading and cross-chain aggregation tools, expanding its capabilities in the DeFi aggregation space.

As of August 2025, Ooga Booga has integrated over 90% of Berachain's liquidity sources, with cumulative trading volume reaching hundreds of millions of dollars. Its low slippage mechanism and high adoption rate have made it a key platform in the ecosystem in terms of trading volume and fees.

Wizzwoods

Wizzwoods is a pixel farming-style GameFi project within the Berachain ecosystem, integrating interchain capabilities with SocialFi elements for both Web2 and Web3 users. The game combines traditional farming simulation gameplay with DeFi mechanics. Players can earn income through planting, harvesting, and social interaction, and use assets such as BERA, BGT, and HONEY for cross-chain operations. The protocol introduces NFT land and props, supports liquidity mining, and accesses the BGT reward pool, giving it dual features of gamification and financialization.

As Berachain's first interchain pixel farm application, Wizzwoods amassed early users and gradually built a strong community during its testnet phase through whitelisting and airdrops. Following the formation of mainnet ecosystem, the project launched its native token, $WIZZ, and listed it on a DEX. This integration of NFTs and token markets quickly boosted trading activity. With the integration of the BGT incentive program and cross-chain collaboration with the Tabi ecosystem, Wizzwoods further amplified its "gaming + DeFi" model, offering users a staking path with an annualized return of 20–50% and driving sustained user growth. Leveraging its community activities and expanded airdrop mechanism, Wizzwoods has steadily established itself as a core player in Berachain's GameFi landscape.

As of August 2025, Wizzwoods has accumulated over $1.5 million in NFT trading volume and over 2 million transactions, ranking it among the top GameFi projects. Leveraging BGT incentives and token rewards, the protocol has attracted a large number of on-chain players and DeFi users, resulting in continued growth in its user base. The community has also grown to become one of the largest gaming communities on Berachain, with monthly activity continuing to rise.

With the combination of gamified interaction and DeFi incentives, Wizzwoods has become Berachain's representative application in the GameFi direction, and has expanded the channels for capital and user inflow through linkage with ecological protocols.

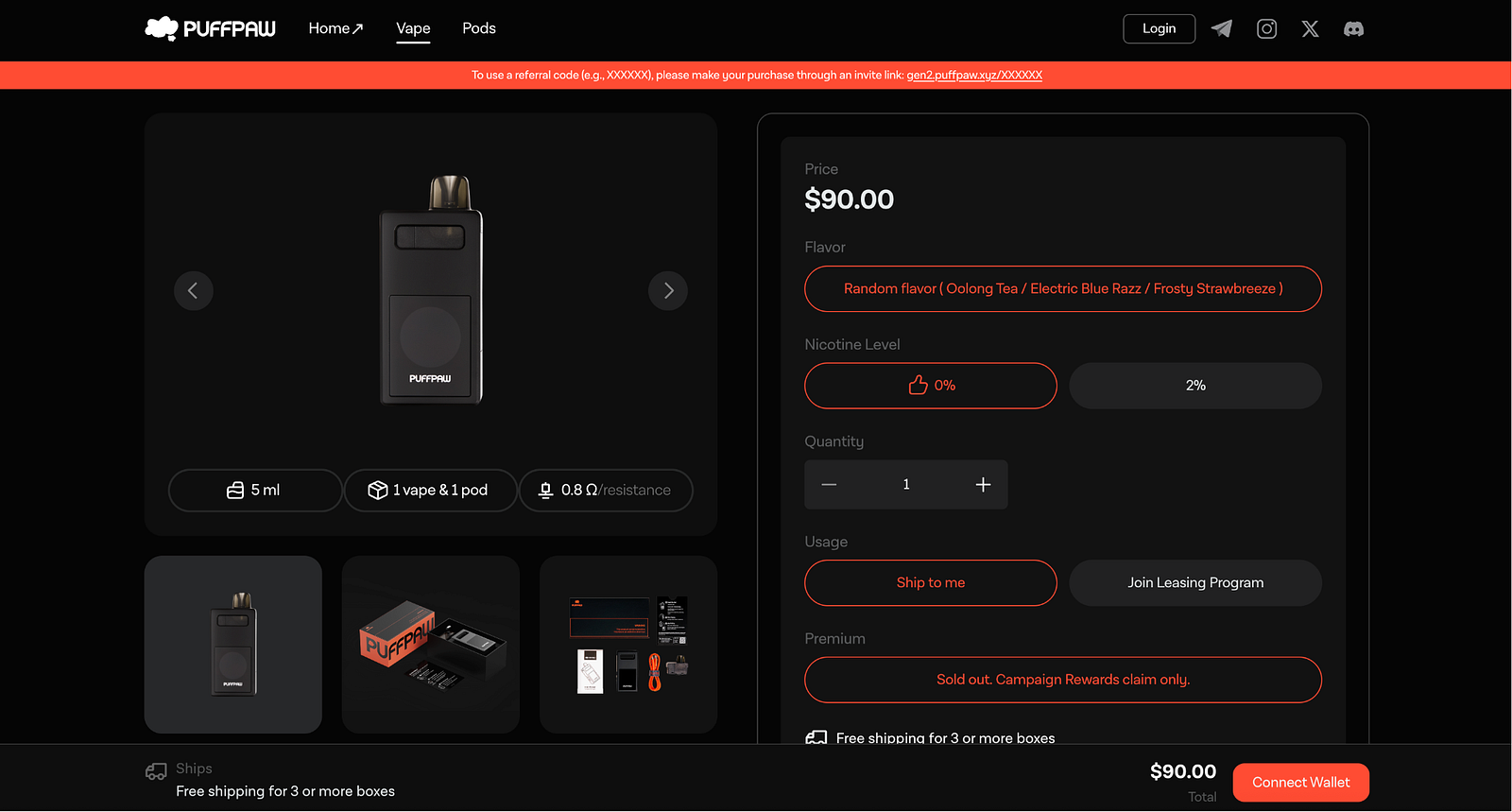

Puffpaw

Puffpaw is a Decentralized Physical Infrastructure Network (DePIN) project within the Berachain ecosystem. It utilizes a "Vape to Earn" model, integrating e-cigarette usage data with on-chain incentives. Users use smart e-cigarette devices and apps to record puff count, frequency, and nicotine levels. This data is encrypted and stored on the blockchain, ensuring privacy and verifiability. A key aspect of the protocol design is that as users gradually reduce their nicotine intake, they receive $VAPE rewards. Furthermore, the system integrates a Proof-of-Law (PoL) mechanism, tying incentives to ecosystem liquidity. This allows users to not only receive token rewards but also indirectly participate in Berachain's liquidity distribution.

In addition to offering quit incentives for smokers, Puffpaw also supports device leasing, allowing non-smokers to participate and earn rental income. The protocol plans to expand the model to other consumer product scenarios, such as heat-not-burn (HNB/IQOS) and cannabis, gradually expanding the boundaries of hardware applications. Puffpaw is also collaborating with dApps such as Kodiak Finance and Infrared Finance to ensure the circulation of rewards and liquidity within the ecosystem.

Regarding application development, Puffpaw launched the Genesis Puff Pass NFT in 2025, providing holders with access to equipment, consumables, and token rewards, as well as supporting governance participation. Within 14 hours of the NFT's release, 30,000 Genesis Pods were sold across 45 countries. Users can combine NFTs with the $VAPE reward pool to further maximize returns. According to ecosystem data, Puffpaw currently has over 27,000 active vape nodes and, through its BGT incentive pool and leasing program, achieves high APRs (approximately 20–50%), attracting significant on-chain user participation.

As of August 2025, Puffpaw's NFT sales and incentive mechanism have driven rapid project expansion, with cumulative distributed rewards exceeding millions of dollars, and $VAPE token FDV valued at approximately $100 million. Furthermore, NFT holders receive a share of the protocol's revenue (approximately 5% of token distributions), combining token incentives with hardware usage.

As one of Berachain's first consumer-focused DeFi applications, Puffpaw combines hardware, on-chain incentives, and liquidity mechanisms, advancing Berachain's exploration of health incentives and consumer scenarios. Its development provides a key example of Berachain's expansion from DeFi infrastructure to a wider range of consumer applications.

Deek Network

Deek Network (formerly Zeek Network) is a SecretFi collaboration platform within the Berachain ecosystem. Its core mechanism is a "Wishes" social bounty system, where users can anonymously publish or verify information and earn rewards in the form of tokens and NFTs. The protocol establishes an on-chain reputation system, standardizing the production, verification, and monetization of information. This system, coupled with PoL incentives, integrates the intelligence economy directly into Berachain's liquidity distribution logic.

Currently, users can submit requests through the "Wishes" feature, encouraging others to submit or verify secret information. Once the information is confirmed, it is settled through a bounty. To incentivize participation, Deek has issued a native token, $DEEK, and Big Deek NFT, allowing holders to participate in reward distribution and governance. The protocol also supports interoperability with ecosystem DEXs (such as Kodiak Finance and Ooga Booga), combining information trading with liquidity pools and PoL incentives to create application scenarios that combine the characteristics of SocialFi and DeFi.

As of August 2025, Deek's testnet "Wishes" feature has attracted thousands of users, with over a hundred Big Deek NFT holders, and early incentive distributions totaling hundreds of thousands of dollars. Through the RFA funding mechanism, Deek has secured support from the BGT reward pool, allowing users to achieve an annualized return of 20–40% by staking, further enhancing community activity and engagement.

As the first SecretFi application on Berachain, Deek Network combines anonymous information flow, social bounties and liquidity incentives, bringing a new interaction model to the ecosystem and laying an early foundation for the SocialFi track.

Shogun

Shogun is an intent-centric DeFi protocol within the Berachain ecosystem, developed by Intensity Labs and positioned as a "cross-chain broker." Through application-layer abstraction and cross-chain functionality, the protocol allows users to simply express their "intention" (such as cross-chain swaps, lending, or liquidity operations), and a network of solvers automatically executes the optimal path, eliminating the need for manual bridging, gas management, or multi-step signatures. Currently, Shogun supports trading any asset on major chains, including Ethereum, Base, Arbitrum, Solana, Berachain, and Cosmos, providing users with a unified multi-chain interactive experience.

Through deep integration with the PoL mechanism, Shogun enables users to earn ecosystem incentives while completing cross-chain transactions. Its Telegram bot, Shogun Oakmont, provides one-click trading and wallet management, incorporating Passkey technology for security. For developers, Shogun has launched an SDK that allows for the integration of modular features such as cross-chain swaps and liquidity routing. Shogun has also been integrated with applications such as Kodiak Finance and Infrared Finance, becoming a key infrastructure linking DeFi with multi-chain liquidity within the ecosystem.

Currently, the Oakmont NFT launched by Shogun combines transaction fees with a revenue sharing mechanism, giving holders profit sharing and governance rights, further enhancing user participation and community stickiness.

As of August 2025, Shogun's cross-chain transaction volume has exceeded $500 million, with a TVL of approximately $250 million and accumulated transaction fees exceeding $15 million. The protocol's annualized fees are approximately $5 million, with revenue of approximately $400,000 in the past 30 days. It has over 100,000 monthly active users, covering over 80% of Berachain's liquidity sources.

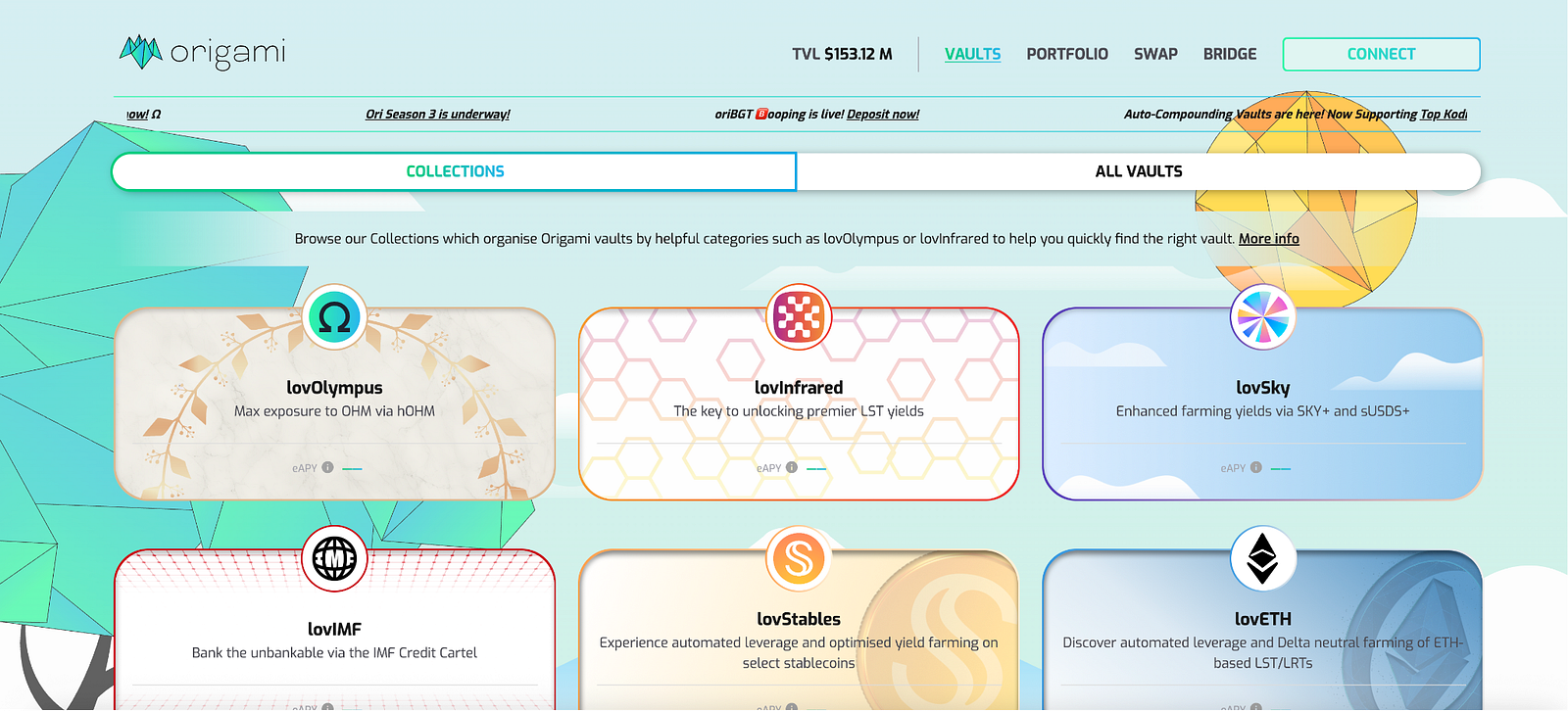

Origami Finance

Origami Finance is an automated leverage protocol within the Berachain ecosystem, focused on providing one-click leverage strategies for yield-bearing assets, helping users maximize returns without manually managing positions. Through deep integration with lending platforms like Dolomite, the protocol enables folded leverage exposure, maximizing capital efficiency and mitigating liquidation risk. As Berachain's "leverage engine," Origami integrates with Infrared Finance, supporting automated leverage and compounding for assets like iBGT and oriBGT. It also introduces vaults like hOHM-HONEY, integrating yield logic with the PoL mechanism, allowing users to simultaneously earn BGT emissions and liquidity incentives through leveraged operations.

Origami's tools, such as auto-compounders and auto-stakers, enhance DeFi's composability and capital utilization, enabling users to more efficiently cycle between lending, liquidity mining, and governance. The protocol also interoperates with applications like Kodiak Finance and Ooga Booga, forming a sustainable network of yield and liquidity.

As of August 2025, Origami's TVL reached $153 million, of which $22.18 million was contributed by Berachain. Its hOHM vault held a TVL of $108 million, representing approximately one-third of the total gOHM supply. The oriBGT vault locked up approximately $15 million, representing 50% of staked iBGT. Infrared LP auto-compounders and stakers contributed $13 million. Furthermore, Origami is a major SKY staking platform, with $69 million in USDC locked up in its Boyco vault.

Meanwhile, oriBGT’s compound APR has remained above 50% on average over the past 30 days, the protocol’s cumulative transaction volume has reached hundreds of millions of dollars, and it ranks among the top five on Berachain in terms of Gas usage metrics.

With the combination of automated leverage and PoL incentives, Origami Finance has become one of the core infrastructures of the Berachain ecosystem.

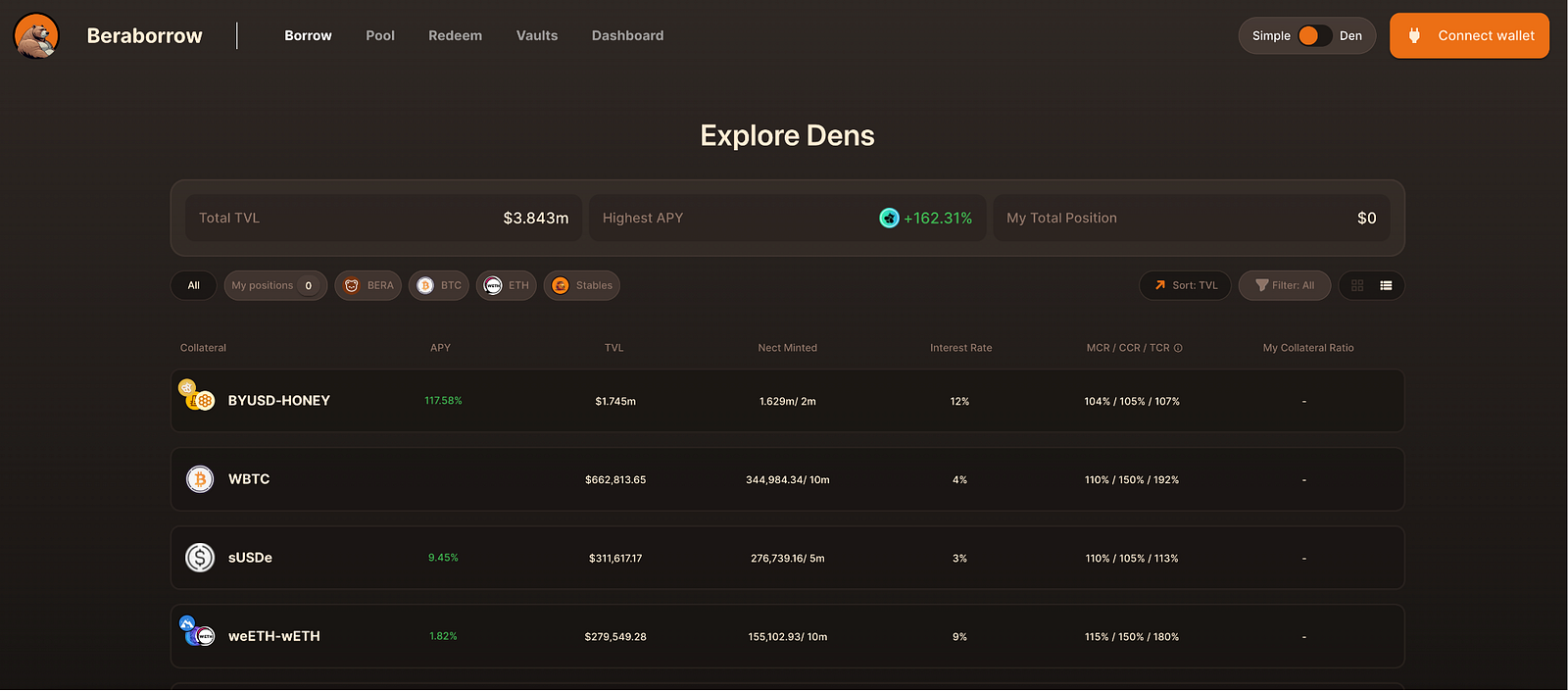

Beraborrow

Beraborrow is a CDP (Collateralized Debt Position) protocol within the Berachain ecosystem. It provides users with instant liquidity for their collateralized assets by issuing the stablecoin NECT. Users can pledge BERA, BGT, and other ecosystem assets to mint NECT, enabling them to borrow with low slippage, utilize leveraged strategies, and access liquidity. The protocol is deeply integrated with Proof-of-Law (PoL), enabling the lending process to not only generate stablecoins but also generate additional PoL rewards and governance rights, improving capital efficiency.

Beraborrow uses NECT to combine stablecoin issuance, leverage, and profit distribution, becoming Berachain's "stablecoin engine." Borrowed NECT can be directly used within the ecosystem's DEXs (such as Kodiak Finance) and liquidity pools (such as Infrared Finance), as well as leveraged through interoperability with Gearbox Protocol, forming an efficient DeFi capital cycle. The protocol also introduces cross-chain bridging, enabling NECT to be used on chains like Ethereum and Arbitrum, expanding the application boundaries of Berachain assets.

As of August 2025, Beraborrow's TVL exceeded $390 million, ranking among the top three CDP protocols in the Berachain ecosystem. The minting volume of the NECT stablecoin exceeded $100 million, and the yield on leveraged BERA has averaged 40–50% APR over the past 30 days. The protocol has accumulated hundreds of millions of dollars in lending volume, controlling over 20% of the Berachain lending market and generating over $5 million in fee revenue.

Eden

Eden is a SexualFi DePIN protocol within the Berachain ecosystem. Based on the "Yearn2Earn" model, it combines sexual wellness products with blockchain incentives. Users can earn EDEN tokens by generating interactive data through Forbidden Fruits smart devices, unlocking features such as remote interaction, AI companions, and healer services. The protocol also integrates with PoL, allowing users to not only earn token rewards but also receive liquidity incentives and governance rights.

Currently, Eden serves as Berachain's "intimacy economy engine." By combining NFTs, token rewards, and liquidity mechanisms, the protocol directly links user interaction data with on-chain incentives. Eden also interoperates with protocols like Puffpaw, Kodiak Finance, and Infrared Finance, connecting personal behavioral data to the DeFi ecosystem. This model not only expands Berachain's application boundaries but also provides a new entry point for attracting users from consumer and social scenarios.

As of August 2025, Eden's TVL has exceeded $120 million, placing it at the forefront of Berachain's DePIN protocols, with cumulative EDEN minting exceeding $50 million. Its Yearn2Earn model offers an annualized yield of 25–30% APR, with cumulative engagement reaching hundreds of millions of dollars and significant growth in monthly active users. Eden holds over 15% of the Berachain SexualFi market share and has generated over $2 million in cumulative fee revenue, demonstrating the effectiveness of its Proof-of-Law (PoL) distribution and incentive mechanisms.

Through the combination of hardware devices, token incentives, and liquidity mechanisms, Eden is also further opening up new consumption and social scenarios for Berachain.

Summarize

Overall, the introduction of Berachain's unique PoL mechanism significantly fueled the ecosystem's early explosive growth, demonstrating its robust effectiveness in building network effects and promoting ecosystem expansion. Simultaneously, the Berachain ecosystem is continuously fueling its growth engine through a number of ecosystem support programs, including large-scale airdrops for testnet users, community contributors, project developers, and NFT holders, as well as the Build-a-Bera incubation program for early-stage projects, the Request for Application (RFA) program, and the Boyco liquidity platform support strategy. Driven by these mechanisms, the Berachain ecosystem continues to expand.

In the future, with the upgrade of PoL v2, the entry of more native protocols, and the enhancement of cross-chain interoperability, Berachain is expected to further attract developers and users and steadily establish its unique competitive advantage in the DeFi multi-chain system.