Deng Tong, Jinse Finance

On September 1, 2025, WLFI will face a major test—multiple cryptocurrency exchanges will list WLFI for trading. The US president has long been a major player in the cryptocurrency market. What are the controversies surrounding this? Is the market willing to pay for the "Trump premium"?

1. WLFI landed on multiple trading platforms and unlocked 27 billion at one time

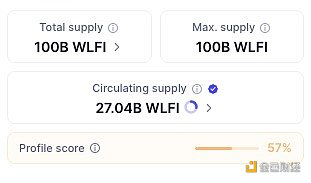

On August 23, WLFI released information on the X platform: WLFI tokens will be launched on the Ethereum mainnet and open for trading on September 1. Early supporters (0.015 and 0.05 US dollar rounds) will unlock 20%, and the remaining 80% will be decided by community voting.

Tokens for the founding team, advisors, and partners will not be unlocked. Trading will open and 20% of the tokens will be available for redemption at 8:00 PM Beijing time on September 1st. The redemption process is two-step and must be completed on the official website: Step 1 (before September 1st): Activate the lock-up contract on the official website (this transfers WLFI to the unlocking contract). Currently, there are 17.02 billion WLFI in the unlocking contract . Step 2 (8:00 PM on or after September 1st): Claim 20% of the unlocked tokens (approximately 3.44 billion) .

However, CoinMarketCap's CEO tweeted on September 1st, confirming official confirmation from World Liberty Financial that WLFI's circulating supply is 27.34 billion , out of a total supply of 100 billion. This equates to 27.34% of the tokens in circulation. Based on WLFI's pre-market price of $0.32, this means WLFI's circulating market capitalization has reached nearly $9 billion overnight.

In the following week, several cryptocurrency exchanges announced their respective coin listing announcements: OKX platform WLFI/USDT spot trading will open at 9:00 PM (UTC+8) on September 1, 2025; Binance will list World Liberty Financial (WLFI) and apply the seed tag. The WLFI deposit channel will open at 12:00 PM on the same day, and withdrawals are expected to open at 9:00 PM on September 2, 2025; MGBX will list WLFI spot trading at 8:00 PM (SGT) on September 1, 2025; In addition, Huobi HTX, Kraken, Bithumb, etc. have also announced the upcoming launch of WLFI.

Donald Trump Jr., the eldest son of President Trump, recently posted on X that he is working with his brother Eric Trump to promote the development of WLFI. Once the WLFI token is launched, it will be available on major CEXs and decentralized platforms, ensuring global governance coverage and liquidity. He stated, "We look forward to WLFI changing the rules of the game in the crypto space."

2. The President has become a major player in the crypto market. Are retail investors facing a trap?

1. Will Trump’s roller coaster ride repeat itself?

Analysts at investment bank Compass Point warn that the upcoming listing of World Liberty Financial tokens (WLFI) could pose significant risks to retail investors. "This could make the token's paper value appear inflated, as over 20% of the supply is held by family members of US President Trump. While these tokens cannot be traded, WLFI's resale price will be estimated based on these holdings, which could be another catalyst that could devastate retail traders."

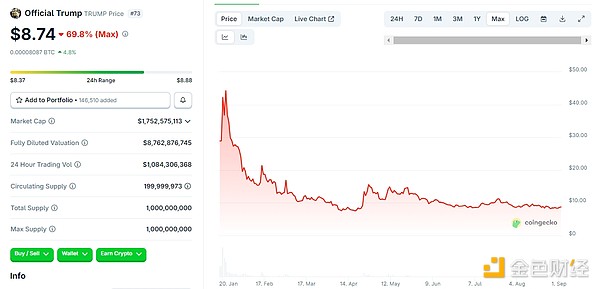

The roller-coaster ride of the Trump token may serve as a cautionary tale. Officially launched on January 17th of this year, Trump was enthusiastically embraced by the market. Within just 48 hours, Trump vaulted into the top 20 cryptocurrencies, with its total market capitalization soaring to $15 billion. This was just three days after Trump took office as US President on January 20th.

However, like most meme coins, even the TRUMP coin issued by the US President cannot escape the fate of rapid rise and fall. Since January of this year, the TRUMP token has not seen any improvement, and most retail investors have been trapped.

With the presidential halo, the launch of WLFI could also stir up the crypto market. In a Discord group survey of holders of at least 1 million WLFI, many small holders indicated they would sell if the price reached $0.47. Group operator Vincent Deriu revealed that large holders are targeting a price above $1. Many plan to sell some of their 20% allocation. Even a modest sell-off by large holders could overwhelm liquidity in the initial trading phase. Long-term growth in WLFI's price will be limited by mere hype.

2. Is political power rewriting the financial market?

In June of this year, Trump disclosed that he had earned $57.4 million from WLFI. In the 2025 public financial disclosure document submitted to the Office of Government Ethics, Trump reported holding 15.75 billion WLFI tokens.

“WLFI’s debut is a test of whether political power can rewrite (not just reinterpret) U.S. encryption laws in real time,” said Andrew Rossow, a public affairs lawyer and CEO of AR Media Consulting.

He believes that the fact that WLFI has avoided formal SEC designation as a securities firm "despite concentrated ownership and political connections" sets a precedent that could "hollow out long-standing investor protection standards." "It suggests that if you have strong enough capital, user base, and brand, and are politically friendly, you may be able to obtain exemptions."

“By backing off, regulators risk normalizing conflicts of interest and undermining public trust.” This could prompt some institutions to move beyond strict compliance checklists and place greater emphasis on “narrative warfare” and preemptive strategies shaped by investor experience.

But WLFI "is not limited to simple financial instruments; it is also WLFI's first experiment in combining political capital with digital infrastructure." This move may "set the standard" for innovation in the crypto industry. "From the dual-token structure to the large number of institutional investors, it suggests that it may be trying to monopolize the 'compliance-friendly DeFi' market, but it raises questions from a constitutional and ethical perspective."

3. Is WLFI just making BTC promises?

WLFI's product architecture, built around the WLFI governance token and the USD1 stablecoin, aims to bridge traditional finance and DeFi. Its core is comprised of the institutional-grade USD1 stablecoin and the community-driven WLFI governance token. The product architecture features multi-chain deployment, compliance management (including KYC and third-party audits), and community governance mechanisms. It provides transparent and secure digital asset services through the USD1 stablecoin, which is backed by US dollar reserves.

However, since its debut last September, WLFI has not achieved impressive results. On March 25th, WLFI announced the launch of USD1, a stablecoin pegged to the US dollar. On September 1st, USD1 announced that WLFI is backed 1:1 by reserve assets and integrated with Raydium, BONK.fun, and Kamino on its first day on Solana. Over the past year, WLFI's product development has been slow, relying largely on hype to gain attention. The "decentralized financial platform" has only enabled token transfers, while core DeFi scenarios such as borrowing, lending, and liquidity pool creation have yet to be launched.

3. Is the market willing to pay for the “Trump premium”?

1. Taunting from the California Governor

The California governor obviously won't buy it.

California Governor Gavin Newsom is planning to launch a "Trump Corruption Coin" in direct response to Trump's involvement in the crypto space.

He said the planned Meme coin, explicitly named after Trump's alleged scandal, is part of his broader "Democracy Movement" initiative and that proceeds from the coin will be used for redistricting and voter outreach efforts.

"We're just trying to turn up the heat and make people realize this is ridiculous. This is one of the biggest scams of our time. None of this is normal."

Last week, the California governor used his official press office account on Platform X to imitate Trump's signature all-caps tweet: "EXCEPT WHAT IS WRITTEN AND BROADCAST IN THE FAKE NEWS, I NOW HAVE THE HIGHEST POLL NUMBERS I'VE EVER HAD, SOME IN THE 60'S AND EVEN 70'S. THANK YOU. MAKE AMERICA GAVIN AGAIN!!! — GCN."

He also launched an online store selling "Make America Great Again"-style merchandise, including red hats with the words "NEWSOM WAS RIGHT ABOUT EVERYTHING!"

2. Short-term speculators are already in place

Data from CoinGlass shows that open interest in WLFI token derivative contracts reached nearly $950 million in early trading Monday, before falling to $887 million, but still up 45% over the past 24 hours. WLFI derivatives trading volume jumped more than 535% to $4.54 billion over the past day, making it the fifth-most traded crypto derivative in the past 24 hours. The token trades at around 34 cents on most exchanges, down from a peak of over 40 cents a week ago.

Open interest refers to the number of active, open contracts that have not yet been settled, which shows that investors are showing strong interest in WLFI when approximately 5% of its token supply unlocks in a few hours.

If WLFI’s price continues to hover around 34 cents, the token could have a fully diluted market capitalization of $34 billion based on its total supply of 100 billion tokens. This total market capitalization would make it the ninth-largest cryptocurrency.

Prediction market Myriad shows that more than 77% of speculators are betting that WLFI will be priced above $0.20 on the first day.

3. Institutional investors are still waiting and watching

On June 26, WLFI co-founder Zak Folkman said at the crypto industry conference "Permissionless" that several listed companies are "very interested" in the platform, and these companies hope to use their token WLFI as a company reserve asset.

However, only ALT5 Sigma Corporation announced a $1.5 billion registered direct offering and concurrent private placement on August 11th to launch World Liberty Financial's (WLFI) treasury strategy. Interest in WLFI among major institutions is limited: B2C2 Group has invested $80 million in WLFI, while Aqua1 Fund has subscribed to $80 million in WLFI tokens. There has been no news of top crypto institutions like Grayscale and Ark Capital entering the market. Even a company affiliated with Trump expressed a lack of confidence in WLFI, having reduced its stake in the company from 60% to 40% in June.

IV. Summary

After WLFI is launched on major trading platforms tonight, WLFI may repeat the surge that TRUMP experienced in the short term. After all, many retail traders will pay for "presidential sentiment."

There are two core issues that determine whether the market is willing to pay for the "Trump premium": whether WLFI can be truly put into practical application and whether it has real practical value in the long run; and whether US regulators will take action against "Trump", this trump card.

After all, Trump, who comes from a businessman background, knows how to use emotions and narratives for commercial hype. If investors only regard the "Trump" brand as a label that is more valuable than the long-term value of the project, then they will eventually not be able to escape the fate of the bubble bursting.