Pi Coin (PI) price has returned to negative territory after a brief surge. At the time of writing, it is trading at a little over $0.35, down nearly 8% over the past 24 hours.

The sharp drop has erased most of its recent gains, leaving it up just 2.3% over the past seven days. But even those modest gains could soon disappear, as the Token faces new lows.

Cash Flows Dry Up, Bears Take Over

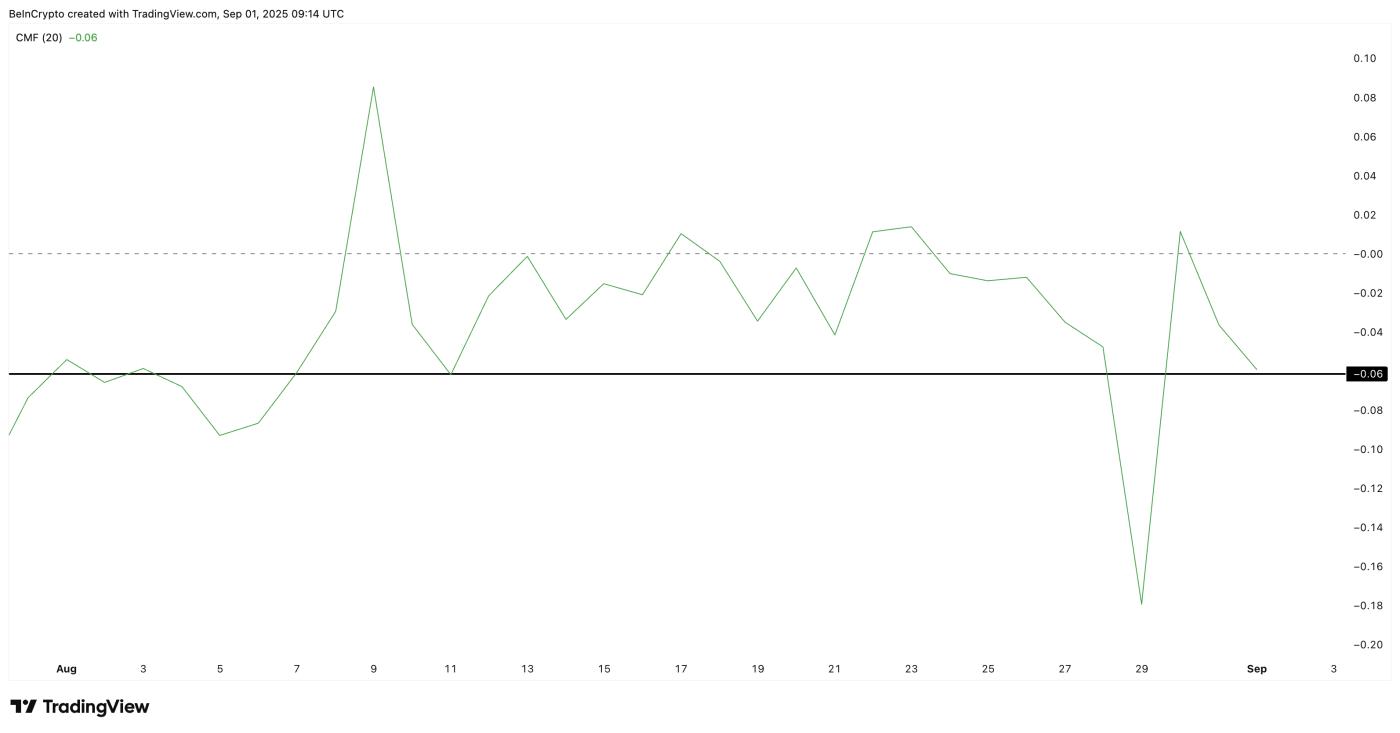

Chaikin Money Flow (CMF) measures XEM money is flowing into or out of an asset. It spiked above zero as Pi Coin rose from $0.32 to $0.39, indicating buyers were stepping in.

But now it has dropped to -0.06, near the August 11 low, signaling that Capital flows have dried up and sellers are back in control.

Pi Coin Inflows Are Slowing: TradingView

Pi Coin Inflows Are Slowing: TradingViewBull Bear Power (BBP) also contributes to this negative picture. BBP compares buying pressure to selling pressure. When it turns negative, it shows that bears are in control.

The last time BBP turned negative, right after the high from August 9 to August 11, the Pi Coin price dropped from $0.46 to $0.32, a drop of more than 30%. The same transition happened again, warning of another potential drop.

Bears Are in Control of Pi Coin: TradingView

Bears Are in Control of Pi Coin: TradingViewPi Coin’s short-lived rally has lost momentum. With outflows increasing and selling pressure dominating, the Token looks vulnerable to further declines. Unless the $0.34 support holds, Pi Coin’s price could revisit $0.32 — and possibly fall further.

Currently, the bulls are struggling, and the bears seem ready to take complete control.

To stay updated on TA and the Token market: Want more Token insights like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Crossover occurs as important Pi Coin price support level is tested

To capture smaller price movements, the focus shifts from the daily chart to the 4-hour chart.

Here, the short-term 20-day Exponential Moving Medium (EMA) or red line is on the verge of crossing below the longer-term 100-day EMA (blue line). The EMA gives more weight to recent prices, making it more responsive to changes than a simple moving Medium .

Pi Coin Price Analysis: TradingView

Pi Coin Price Analysis: TradingViewWhen a short-term EMA falls below a long-term EMA, it is called a bearish “Death” cross. This typically signals that selling momentum is intensifying and the asset may be at risk of setting new lows.

Pi Coin is trading near $0.35, just above the important support level of $0.34. If that level is broken, PI price could slide to $0.32, the late August low. Any deeper decline could expose new lows below $0.32.

On the other hand, the bulls need a strong daily close above $0.36 to regain momentum. But with both CMF and BBP moving against them, the odds remain in favor of the bears.

Pi Coin’s short-term rally has lost momentum. With outflows increasing and selling pressure dominating, the Token looks vulnerable to further declines. However, if Pi Coin can somehow reclaim $0.36 and then $0.38, we can expect the short-term downside risk to be delayed.