Each week, we share a data-driven snapshot of the most compelling trends in digital assets through our “Chart of the Week” series on social media. Drawing from first-in-class Chainalysis data, these visualizations capture key moments and movements that are shaping the crypto ecosystem. Below are the charts we featured in August 2025.

If you want to see these charts as they go live each week, follow us on LinkedIn, X, and Telegram.

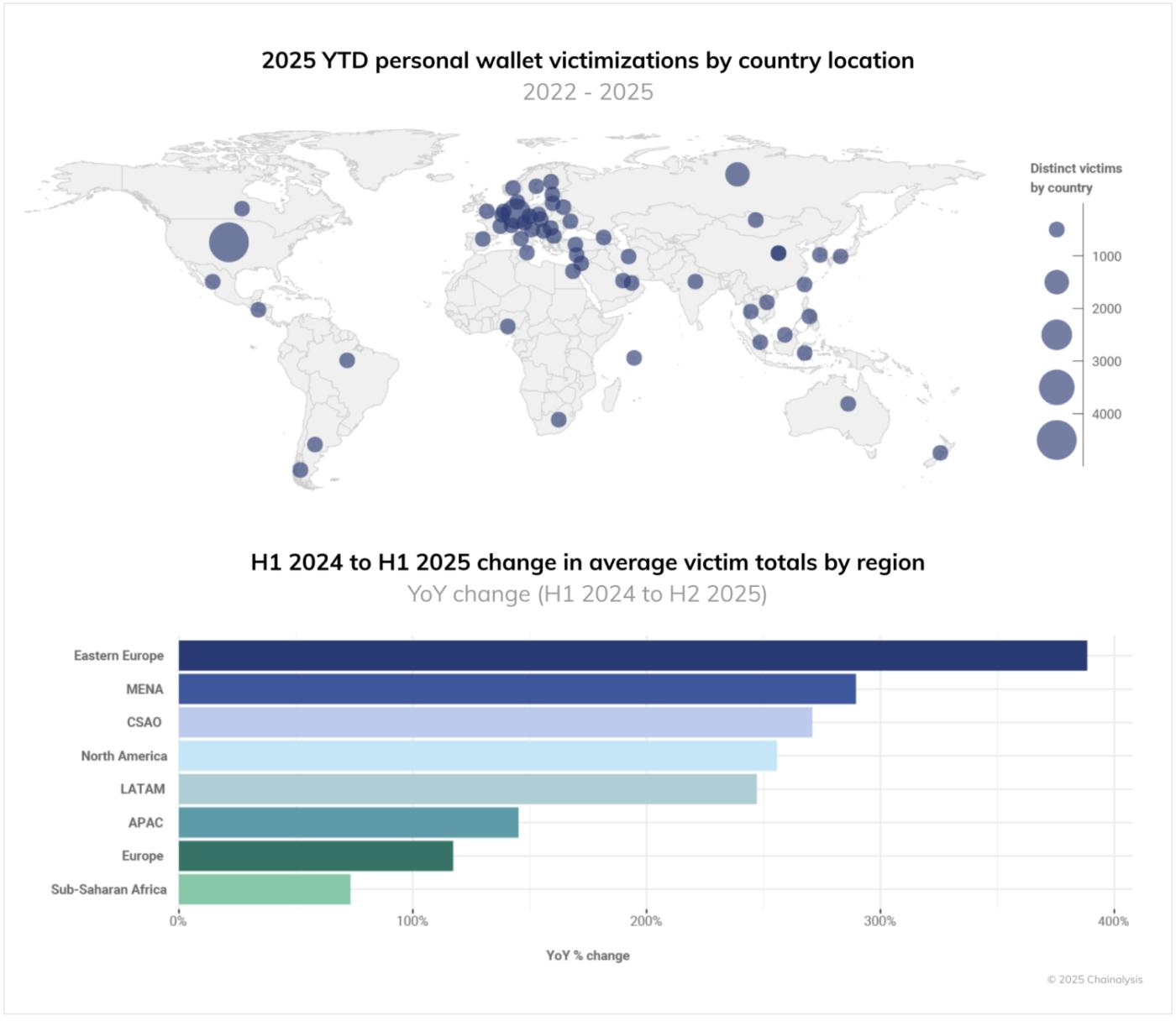

Stolen fund victimization surges YoY in all regions of the world

Personal wallet victimizations increased significantly in all regions, with Eastern Europe, MENA, CSAO, and North America all recording greater than 200% YoY growth in victims. Through July 2025, the U.S., Germany, Russia, Canada, Japan, Indonesia, and South Korea topped the list of countries with the highest victim totals.

These numbers highlight the critical need for enhanced security measures and consumer education across all markets. The global nature of this threat demands coordinated cross-border efforts from financial institutions, regulators, and technology providers.

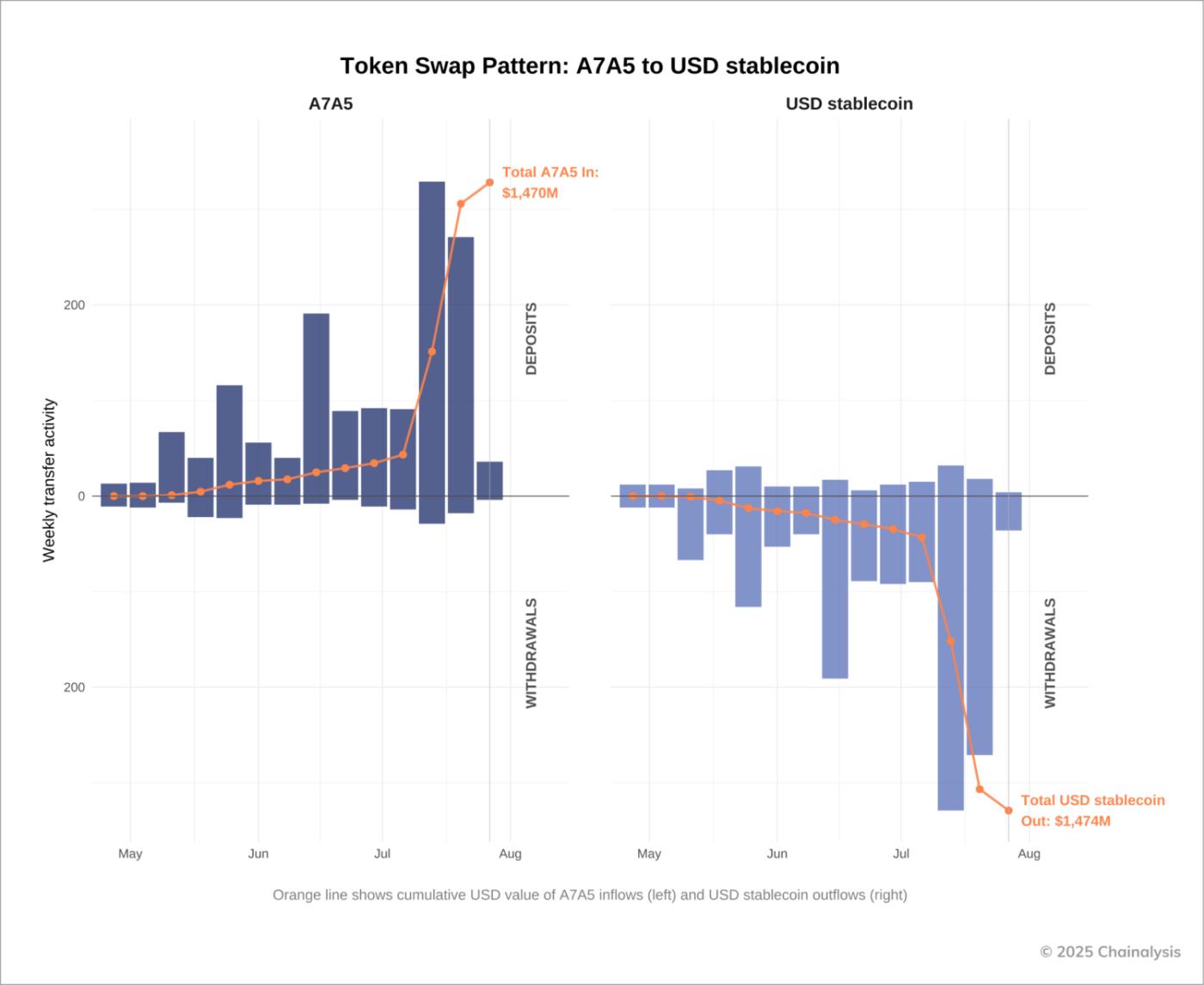

Ruble-backed A7A5 acts as a sanctions-evasion tool

OFAC sanctioned multiple entities involved in the Russian ruble-backed A7A5 token ecosystem. The A7A5 token, backed by deposits at the sanctioned Russian bank PSB, has processed over $51.17 billion USD in volume.

A DEX was explicitly facilitating the transfer of A7A5 into USD-denominated stablecoins. This DEX processed a total of $1.47B USD in cumulative inflows of A7A5, matched by a mirrored $1.474B in USD stablecoin outflows, and effectively created a bridge from sanctioned Russian banks to mainstream crypto. More broadly, trading patterns of A7A5 show business-hour activity (Monday through Friday), suggesting commercial use, and direct on-chain links connected sanctioned exchange Garantex to its successor Grinex. This represents an evolution in sanctions evasion tactics using crypto rails.

To learn more about our data capabilities, request a demo here.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

The post August 2025: Charts in Review appeared first on Chainalysis.