Today, American Bitcoin Corp. ( ABTC ), a US-based Bitcoin company, officially listed on the Nasdaq. Co-founder and Chief Strategy Officer Eric Trump, who holds close ties to the Trump family, staged a thrilling "capital roller coaster" on its first day of trading.

ABTC Pump & Dump

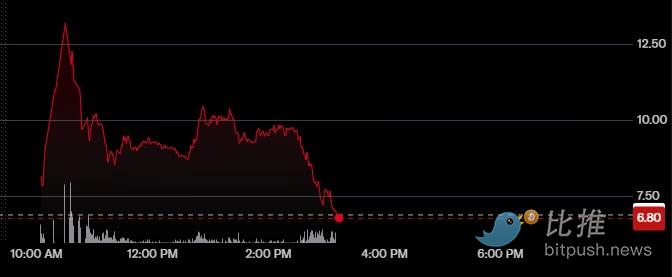

Market data showed that ABTC surged by more than 110% at its opening, but ultimately closed up about 17%.

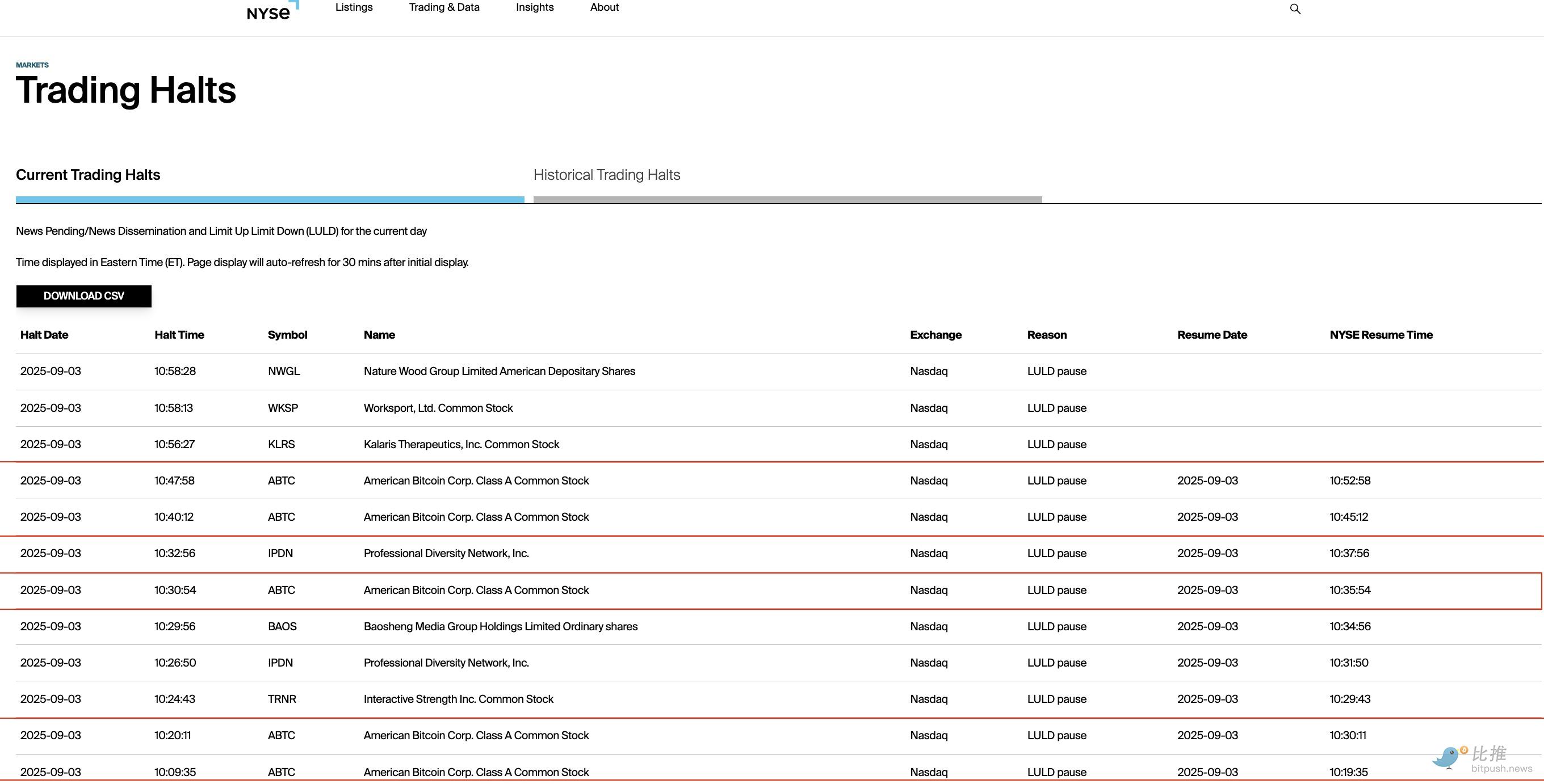

ABTC was suspended five times by Nasdaq within an hour of opening due to violent fluctuations. It surged to $14 several times and then fell back to around $9.50, retracing more than half of its gains.

This trend is a typical example of the "Pump and Dump" model: first, use political exposure and capital market enthusiasm to raise stock prices, and then take the opportunity to cash in profits, leaving ordinary investors to take over and suffer losses.

“Bitcoin dream” or capital game?

Behind American Bitcoin's IPO was a merger of its shares with Gryphon Digital Mining. This merger not only served as a path to listing, but also served as a catalyst for its $210 million fundraising plan and its accumulated 2,443 Bitcoin reserves (a corporate treasury strategy).

In his first public statement, Eric Trump said: "Our Nasdaq listing marks a historic milestone for Bitcoin's entry into the core U.S. capital market. Our mission is to make the United States the undisputed leader of the global Bitcoin economy." Donald Trump Jr. emphasized that the company "symbolizes the core values of freedom, transparency and independence."

However, the reality is that the core of all narratives is ultimately a cash-out tool - disguised as a belief in Bitcoin, what is hidden underneath is not national rejuvenation, but capital arbitrage.

WLFI : Another script for wealth harvesting

Just days before ABTC's listing, World Liberty Financial (WLFI), another crypto bet of the Trump family, went online for trading. Its WLFI token briefly surged to $0.46, but then plummeted by approximately 50%, closing at around $0.22.

On its initial public offering, WLFI boosted the Trump family's paper wealth by approximately $5 billion. Trading volume reached $1 billion in the first hour, bringing the token's market capitalization to nearly $7 billion. Reuters also reported that the project has generated approximately $500 million in actual profits for the family to date.

WLFI's listing is not a simple issuance, but through a voting mechanism, early investors agreed in July to unlock their tokens for trading. The governance attributes of WLFI are more intriguing than its economic value - the official has not even stated whether it includes equity or dividend distribution.

Political halo + retail investor enthusiasm = arbitrage magic weapon

The following table intuitively shows the difference in returns for investors of different identities on the first day of WLFI:

| Identity/Group | Cost price | Listing price (approx.) | Revenue |

|---|---|---|---|

| Retail investors (secondary market buyers) | $0.30–0.46 | $0.22 | Losses of 20%–50% |

| Ordinary early-stage investors | $0.05 | $0.22 | About 4 times the profit |

| Core Insiders/Privileged Investors | $0.015–0.05 | $0.22 | Nearly 4–14 times the return |

It is not difficult to see from this:

Retail investors, as "high-level buyers", become the main losers;

Although ordinary early investors made money, they were not the biggest winners;

The privileged camp obtains overwhelming returns at extremely low costs and cashes out easily.

The core logic of this wave of hype is:

Narrative packaging: From "America's Bitcoin Economic Leader" to "Freedom and Transparency", each project is given a grand meaning;

Identity Revealed: The endorsement of Eric Trump and Donald Trump Jr. will undoubtedly increase the project's attention and buying;

Building hype: Social media and mainstream media collaborate to create hype, stimulating retail investors’ FOMO (fear of missing out);

Cashing in: The sales are completed under a wave of high heat, but retail investors are left at high levels and continue to bear pressure.

This is a highly institutionalized "sickle-cutting" process, and the person who actually wields the knife is always the one who holds the lowest-cost power resources.

The Trump family's crypto journey isn't accidental; rather, it's leveraging their political capital to establish a multi-cycle wealth portfolio. For example, WLFI, in addition to its tokens, also offers supporting assets like the stablecoin USD1 to further expand its capital base. Furthermore, internal control of the project represents as much as 60–75%, demonstrating a significant degree of conflict of interest.

Coupled with billions of dollars in cooperation with allies such as Abu Dhabi and Justin Sun, this capital deployment across political cycles and asset classes is not just arbitrage but also an "institutional ATM."

The Trump family's "capital sickle" is swinging towards the market with unprecedented precision: from the violent fluctuations in ABTC's Nasdaq debut to the crash of WLFI tokens, a wealth transfer combining political resources and financial games has been completed.

In this game, privileged individuals enter the market under the guise of compliance, using narrative as a scythe and retail investors as leeks. And when the carnival ends, the only ones left are ordinary investors holding onto their remaining chips and watching the K-line charts—they become the show's sole "paying audience."

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush