The crypto market is seeing strong gains on Thursday, as a number of altcoins are breaking out. MemeCore (M) is the standout, posting double-digit gains over the past 24 hours, followed by Four (FORM), the project formerly known as BinaryX, and Ethena (ENA), which is also recovering.

This trend shows growing interest in altcoins and reflects a gradual shift of money from leading coins to emerging projects. Technically, the outlook for many altcoins is tilted to the upside as momentum strengthens.

MemeCore Holds Above $1, Aims for New High

MemeCore continued to show its strength, posting a 37.7% gain on Thursday, marking chain sixth consecutive session of gains. Despite a slight correction after hitting a record high of $1.15 at press time, the Token remains firmly above the psychologically important $1 level, a development that shows that market confidence in MemeCore’s bullish trend is still solid.

MemeCore is currently approaching the resistance zone of $1.07 (R1 on the 4-hour chart). If the price can decisively close above this level, the bullish momentum will likely continue, opening the door to the next target at $1.47 (R2). This is an important resistance level that can determine the medium-term uptrend of the Token.

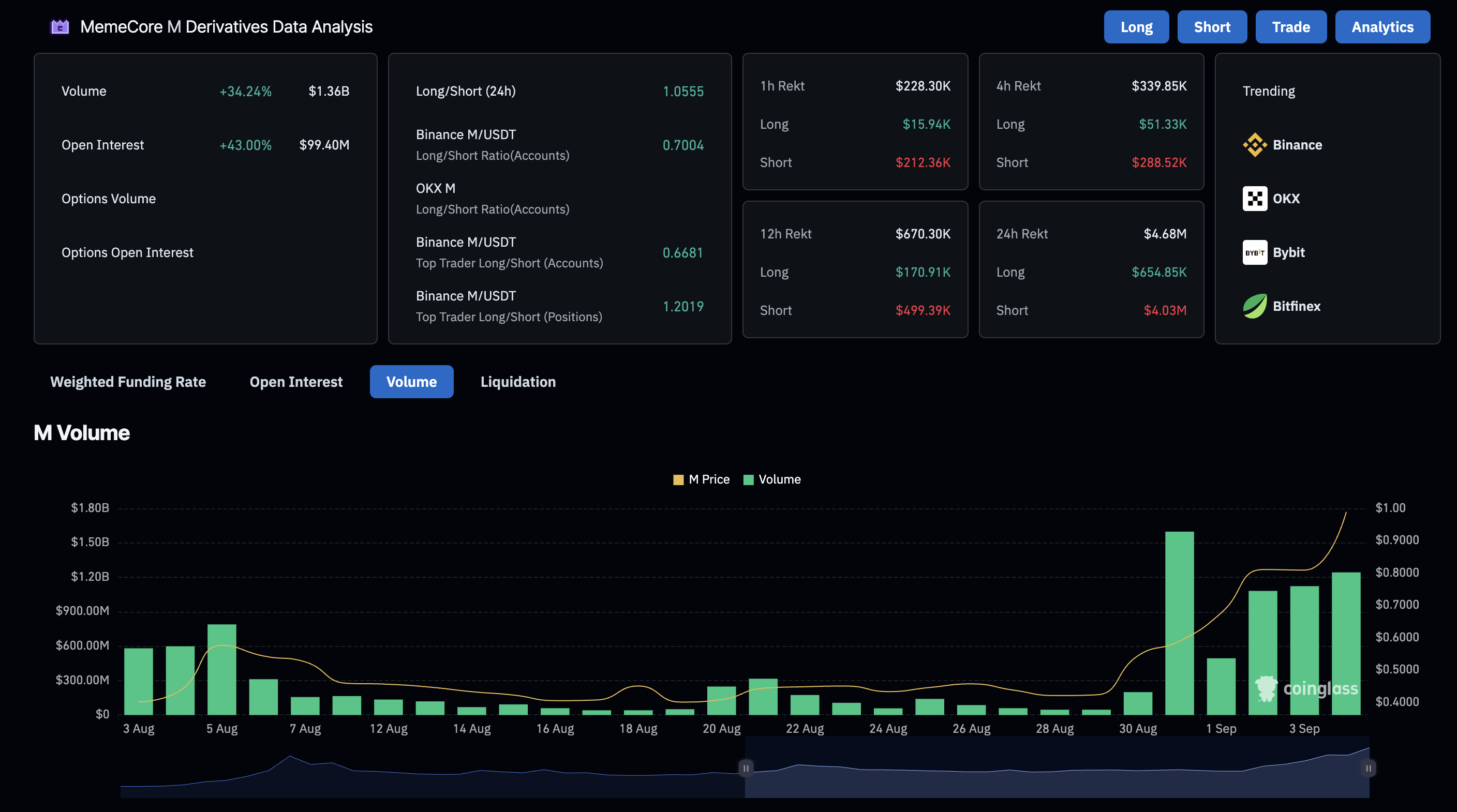

Notably, data from CoinGlass shows that interest in MemeCore is exploding. In just 24 hours, open interest (OI) increased by 43% to a record high of $99.4 million. At the same time, volume has also remained above $1 billion for three consecutive days, clearly reflecting the strong participation of new money in the market and showing that MemeCore is becoming the focus of investors' attention.

Technical indicators also reinforce the optimistic outlook. The MACD and the signal line are widening their gap, indicating that the bullish momentum continues to consolidate. Meanwhile, the RSI on the 4-hour chart reached 77, deep into the overbought zone, reflecting that buying pressure is still very strong and the uptrend has not shown any clear signs of weakening.

However, the risk of a correction cannot be completely ruled out. In the event that selling pressure suddenly increases and causes the price to break below $1, MemeCore’s nearest support zone would be at $0.89, which previously Vai as short-term resistance. This would be an important support point to protect the uptrend if the market experiences negative volatility.

Four eyes $4 mark after V-shaped recovery

Token Four (FORM) is currently trading around $3.60, marking its fourth consecutive day of gains with a 10.2% increase on Thursday. Notably, just a few days ago, FORM experienced a sharp 18% drop on Sunday. However, the GameFi Token quickly regained momentum, forming a V-shaped recovery, indicating that demand is clearly returning to the market.

If the buying pressure continues and the price can break through the $3.75 level, FORM is fully capable of extending the uptrend, heading towards the important psychological milestone of $4. This will be an important test of the strength of the buyers in the short term.

The current technical indicators are also supporting the bullish scenario. On the daily chart, the RSI is at 53, above the neutral level, indicating that buying pressure is gradually gaining the upper hand. In addition, the MACD is converging with the signal line, reflecting a positive shift in momentum and a possible reversal to the upside.

However, the bearish scenario still needs to be taken into account. If the recovery momentum weakens and selling pressure increases, FORM could turn around and retest the support zone of $3.42 – the closing level recorded on August 25. This would be an important defensive zone to maintain the medium-term uptrend.

Ethereum struggles to keep gains above $0.70

Ethena (ENA) is showing signs of slowing down compared to two other prominent altcoins. ENA continued to increase by 3.5% in Thursday trading after gaining 6% the previous day. This development shows that buyers are determined to hold the price above the $0.70 mark, continuing the recovery that has lasted for the past two days.

However, if the bulls fail, ENA is likely to retreat to the $0.69 area – a level that Vai as important resistance during Wednesday’s session. This would be the nearest support area that could be retested in the short term.

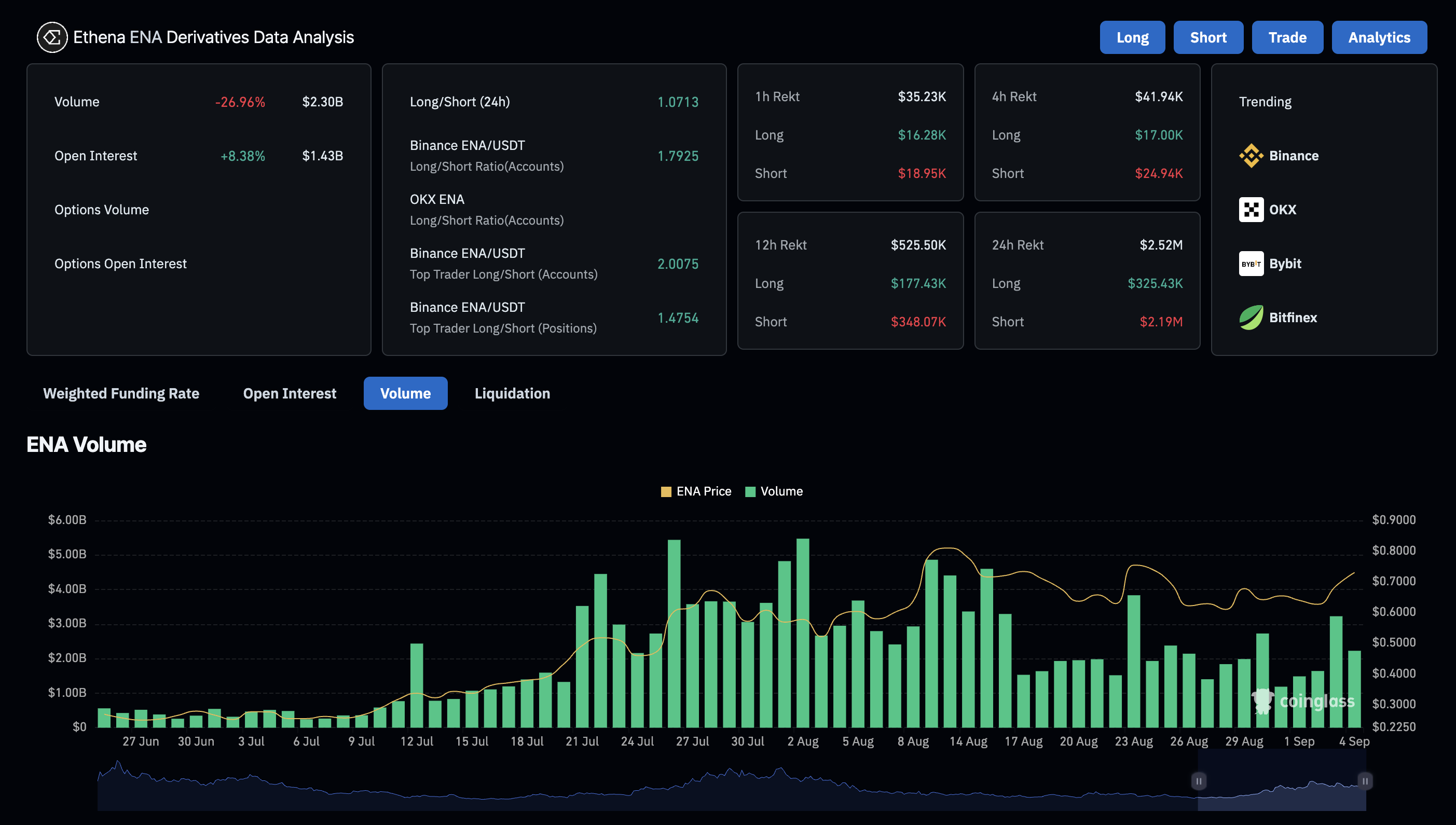

Data from CoinGlass shows that ENA's open interest has increased by more than 8% in 24 hours to $1.43 billion. However, volume has decreased compared to last month, indicating a slow accumulation sentiment and reflecting investor caution in the face of recent volatility.

Technically, the indicators are giving mixed signals. On the 4-hour chart, the RSI is at 56 and has started to turn down, indicating that buying pressure has weakened. If the indicator continues to slide below the neutral level, the risk of a downside correction will become more pronounced. Conversely, the MACD and the signal line are approaching a state of convergence, indicating that the downside momentum has slowed significantly. If the green histogram reappears above the zero line, this could signal a possible bullish reversal in the near term.

In a positive scenario, if the bulls reclaim the $0.75 resistance zone (last tested on August 23), ENA could extend its uptrend and head towards a higher target zone at $0.85. This would help the cryptocurrency regain momentum and attract more attention from investors.

MemeCore's breakout, Four's recovery, and Ethena's attempt to maintain the uptrend reflect a significant shift in Capital flows in the crypto market. Altcoins are attracting strong attention amid strengthening bullish momentum.

However, each Token has its own technical and market psychology characteristics. Investors need to closely monitor important support and resistance zones, because current signals both open up opportunities and pose risks if the trend suddenly reverses.

- Ethena (ENA) Set to Unlock Nearly 3% of Supply – How Will the Market React?

- Altcoins Ready to Take Off? This Chart Shows the Same Scenario as 2021

Annie