It’s September 4th again. How many people still remember the events in the crypto on September 4th in 2017?

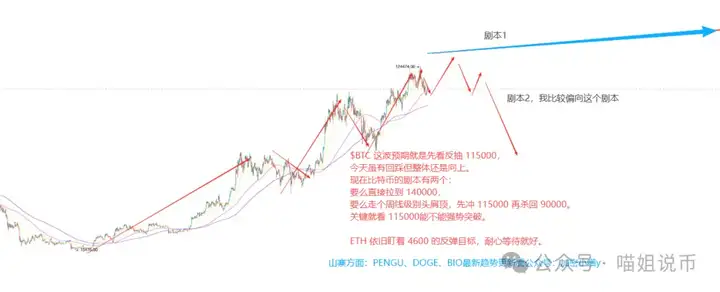

The trend of BTC in the past few days has actually given a lot of signals.

Looking at the daily chart, we see three consecutive declines, with the volume and magnitude of each decline decreasing, and the momentum behind breaking previous lows becoming weaker and weaker, indicating that the bulls are running out of steam. The price has now retraced to the previous high-volume trading area, providing strong support. Coupled with the bullish engulfing pattern, it seems bulls are poised to strike back.

However, the head and shoulders top at the weekly level may indicate a downward trend. Of the two scenario patterns, I prefer scenario 2. If we follow scenario 1, the market situation will be unhealthy. Experienced investors will understand this.

Looking at Ethereum, it failed to hold above $5,000 on the 24th, but the pullbacks have become increasingly weaker, with both the candlestick body and the amplitude shrinking. It has also been rapidly pulled back several times below $4,300, demonstrating strong support. Combined with the trend since the 13th surge, the overall highs and lows are shifting upwards, and the bearish trend is essentially exhausted, suggesting a strong upward trend.

Currently, based on the 4H market, the only options for entering a long position are to chase the price after it breaks through 4500 or wait for a pullback. Alternatively, wait for a rebound above 4210 before entering a range-bound market. If it falls below 4210, short the short or wait for the rebound to falter.

In the Altcoin space, the market is thriving, with many established and emerging projects experiencing significant rebounds. This is driven by both a return of retail investors and a rotation of institutional funds. Coupled with new narratives, a bull market is brewing. We established a position in our first target the day before yesterday and will continue to seize opportunities to expand.

#ONDO: The leading coin in the RWA track

The one I gave to Mima on Tuesday is showing improvement. Communicate +📬V: Mixm5688

Ondo led the RWA sector with a 6% gain this week, with its own TVL exceeding 1.5 billion. Its ambitions are significant, as it targets the $64 trillion US stock market. More notably, it will issue USDY on Sei. Combined with Sei's high-performance settlement layer, this partnership will both meet institutional needs and open up traditional capital access channels.

The landscape of the RWA market may be about to undergo a qualitative change. Ondo’s stock tokenization market has also launched.

#SSV 's current trend is similar to that of most altcoins, forming a bottom triangle convergence pattern. Once it breaks through with large volume, there will be considerable room for upward movement.

At the same time, the three circles marked in the figure are key pressure areas. Only by breaking through step by step will the market have the opportunity to open up higher space.

OKB has been online for years without a contract, yet after all the positive news from the burn, upgrade, and Boost, it's suddenly available. This operation smacks of conspiracy, like a celebrity saying, "If you don't like it, short it. Let's see who can hold up. " Crypto veterans know—what else can we do? It's bound to go up, haha.

People in the market have been saying these days that OKB around 160 is a good buying point and suitable for long-term holding.

Looking at the situation on the chain, I have only one feeling: the liquidity is really, really poor.

On the Sol side, Useless only has 150 million left, and the addresses that made huge profits in the early stage have basically not left; Luanchcoin still has 59 million left, and the main players have not completely withdrawn; $WLFI was originally thought to be able to hold 0.2, but when I woke up, it was already at 0.18.

As expected, don't rush into new listings like #WLFI. First, see who wins. Shorts are currently in the ascendancy, so focus on the 0.2 level. Shorting on rebounds is a safer strategy. Don't blindly buy the dips. A short-term long position is fine, but the key is to go short at high levels for safety.

On the BSC side, some established projects are struggling. #CDL's liquidity nearly dried up on the third day. The market sentiment is that the presale is going strong, but no one's willing to buy in. Of the several new projects announced by Fourmeme, only those with high market control are barely holding up. The #EGL1 Foundation even liquidated the coins it had previously purchased through partnerships, exchanging them for its own tokens. The other trapped projects have practically lost value, with only #U still making a profit, only to find itself in a deep hole. Liquidity is abysmal. As for other chains, with fewer participants and less capital, and constant diversion, there's honestly not much to discuss.

Finally, let’s make up for the follow-up of the altcoins:

PEPE: It is teetering on the edge of the triangle, with weak buying, so it would not be surprising if it drops to 0.0000085;

SEI: If it breaks through the trend line and can hold the gray support, it is a good long position;

CRV: Suppressed by EMA9 and SMA50. If support is lost, 0.70 is beckoning.

ENA: Stuck at 0.69 resistance, only a breakthrough can hope to touch 0.75+;

MANTA: It is oscillating on the edge of the descending triangle. A break below this is a bearish signal. The overall bullish and bearish divergence is evident. Don't be impatient and wait for confirmation before making any moves.

Recommended Articles: Bitcoin Turns Upward, Is the Selloff Over? ETH Sees New Capital Investment! Is BGB Following OKB's Successful Path? BSC Chain large MC memecoin, Are You Following?

Markets fluctuate in waves, and it's easy to get lost traveling alone. If you want to seize the next opportunity to double your money, join my community and watch the market, discuss, and buy the dips with a group of old friends! Together, we'll avoid detours and outperform the next bull market! 📬 V: Mixm5688