Last night, Bitcoin staged another "heart-pounding coaster", first testing the support level, but finally stabilizing its footing around 110,000.

Next, we'll have to wait and see what the data shows. If it's weak, a September rate cut is almost certain, giving the market a chance to rally. However, if it's strong, hopes for a rate cut will be discounted, and the market could revert to a wait-and-see mode. If BTC can break back above 112,400, the outlook for this trend is quite positive, and it could even reach new highs this month on the back of expectations for a rate cut.

Contact us: +Q: 3806326575. From a technical perspective, the daily chart shows a rebound after a breakout, while the hourly chart maintains a volatile downward trend, testing support again. While everyone hopes for a reversal, it often aborts mid-sentence. For short-term trading, long positions should be taken profit at resistance levels. Resistance areas are often more suitable for short: either a false breakout at a minor high or weak consolidation. Only a complete breakout can lead to a true bullish turn.

ETH is even more frustrated, having plummeted below 4350 yesterday, only to hit 4280 before finally stopping. Tonight, it remains to be seen whether it can rebound alongside BTC, or else a spike to 4200-4250 is a possibility. Upward pressure will initially focus on 4400-4450, with the key being whether it can hold above 4600.

Communication + V: Mixm5688 reported today that Sun Ge transferred out # WLFI and was blocked by the Trump family. I really don’t know what’s going on. It turns out that the coins of the two big transfer kings cannot be controlled.

As for altcoins, their fate is entirely tied to ETH. If Bitcoin (BIN) doesn't rise, the leading altcoins can forget about it. There aren't many promising assets on the blockchain right now. Cards, the once-popular meme project, is also retreating, with both trading volume and user numbers cooling. The overall market can only be described in one word: wait and see, until a new story emerges.

I have had a good experience in the primary market these days. This week, the circle recommended #GRDM, which increased by 100%, and #EMMM, which increased by 50%. The day before yesterday, they recommended #CDL, which increased by 50%.

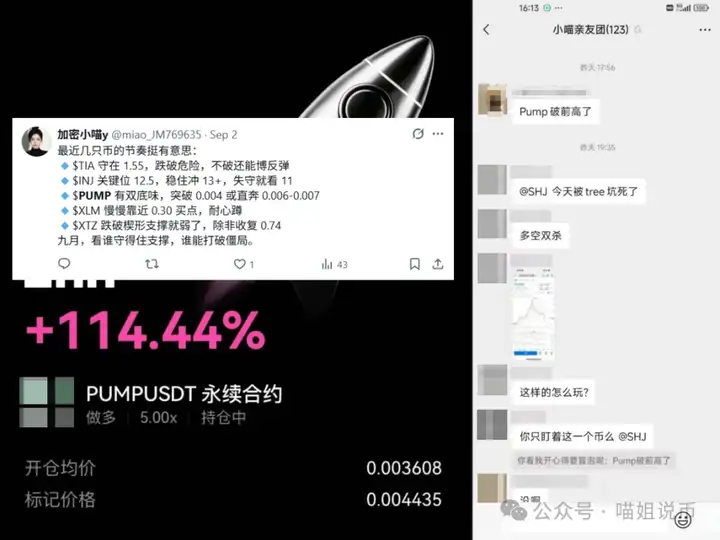

#PUMP, recommended by No. 2 Xiao Miao on X, has also seen a good rise.

Let’s take a look at the highlights of the copycat aspect!

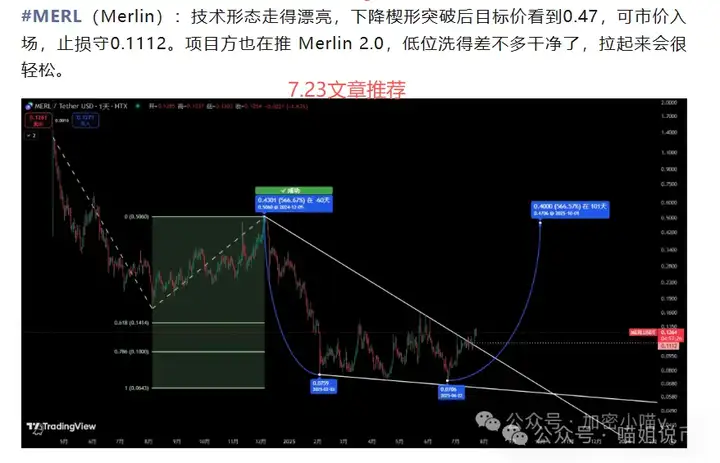

#MERL has been a constant presence at every market turning point. This time, they've partnered with Nasdaq-listed CIMG to launch a $55 million Bitcoin treasury. The first 500 BTC have been put on-chain and are now running Merlin's HODL+ model. This marks the first time traditional finance has used M-BTC to manage assets. The trend has steadily risen, with increasing volume. After sideways fluctuations, a gradual rise has begun. As long as a pullback doesn't fall below 0.133, this represents a good opportunity. My target price remains at 0.47.

#SUI has formed a particularly large center after a period of volatility and bottoming out. The bottom has basically stabilized. After experiencing a second bottoming out last night, it was basically the same as I expected. The bottom is gradually rising. The market in September should not be too bad. Let's wait and see.

Yesterday, I shared #ONDO in the RWA sector. Those who followed along should continue to hold on. Moving forward, the market's focus can be on the RWA sector. A bull market for RWAs is likely already underway.

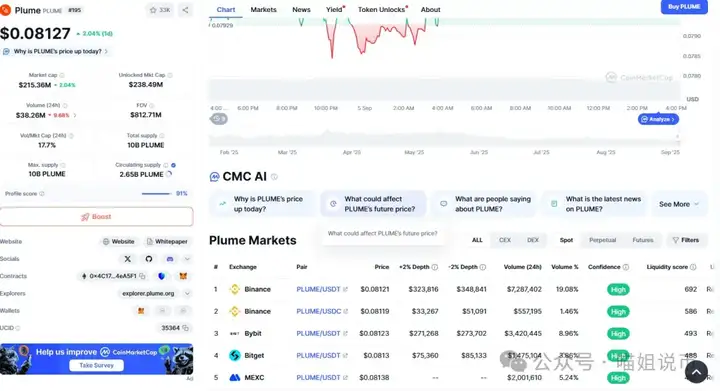

It has a new project worth keeping an eye on: #Plume. It's already listed on most major exchanges, has its own public blockchain up and running, and is now partnering with Circle, the issuer of USDC, to issue native USDC directly on the blockchain.

This collaboration, expected to launch at the end of September, is of great significance to Plume: on the one hand, it no longer relies on bridge tokens such as USDC.e, improving security and efficiency; on the other hand, Circle also brings the latest cross-chain transfer protocol CCTP V2, making the flow of USDC between multiple chains smoother, cheaper, and more secure.

Plume's CBO stated that this is a milestone event and will serve as a catalyst for the widespread adoption of RWA. Since its mainnet launch in June of this year, Plume has experienced rapid growth, attracting over 180,000 holders and over 200 applications. In the future, users will be able to mint pUSD stablecoins using native USDC for RWA collateralization and settlement, providing security for institutional-level capital flows.

Currently, Plume is using Stargate to bridge USDC.e, but soon all applications in the ecosystem will migrate to native USDC. From this perspective, Plume's story has only just begun.

Recommended Article: ETH Pulls Back, Is Altcoin Season Yet? Don't Panic! FOMO Aren't Over Yet, MERL Has Been Gathering Momentum, Are UNI, LOKA, and ARB About to Take Over?

Plume In-Depth Observation: The "Infrastructure Maniac" of RWA on the Chain is Here!

The market moves in waves, and it’s easy to get lost if you go it alone.

If you want to seize the next wave of doubling opportunities, welcome to join my circle and watch the market, communicate, and buy the dips with a group of old friends! Together we can avoid detours and outperform the next bull market!

📬V: Mixm5688

Q: 3806326575

Follow the official account: Miao Jie Talks about Coins