#XRP

- Technical indicators show XRP is approaching key resistance at $3.1255 with current price at $2.839

- Market sentiment is boosted by ETF decision timeline and Ripple's expansion of payment infrastructure

- Short-term pressure exists from whale sell-offs, but long-term targets remain bullish at $4.39 and beyond

XRP Price Prediction

Technical Analysis: XRP Approaches Key Resistance Level

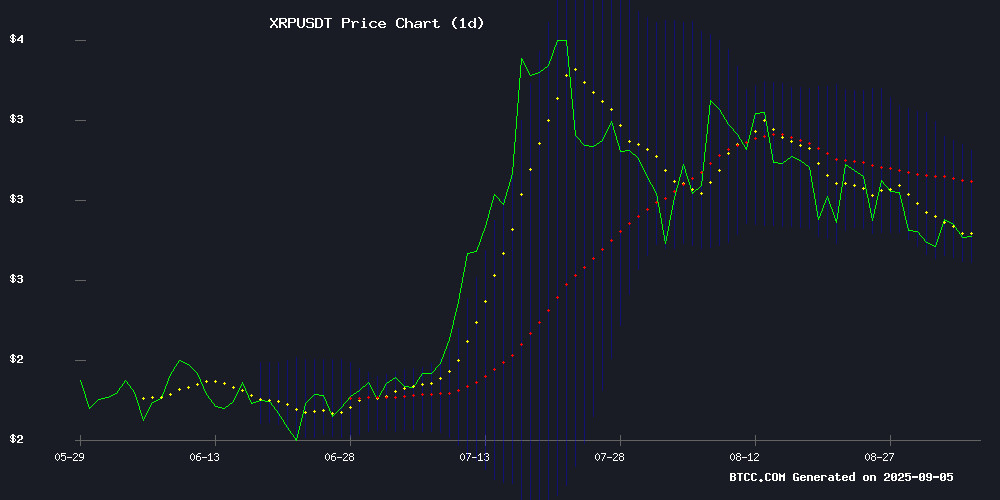

XRP is currently trading at $2.839, slightly below its 20-day moving average of $2.914, indicating potential consolidation. The MACD shows a slight bearish crossover with the signal line at 0.1172 above the MACD line at 0.1088, suggesting short-term momentum weakness. However, the Bollinger Bands reveal the price is trading closer to the middle band, with support at $2.7025 and resistance at $3.1255. According to BTCC financial analyst Michael, 'The proximity to the upper Bollinger Band at $3.1255 suggests a breakout above $3 is technically plausible if buying pressure increases.'

Market Sentiment: Bullish Catalysts Offset by Short-Term Pressure

Market sentiment for XRP is mixed with strong fundamental catalysts facing near-term headwinds. Positive developments include the impending XRP ETF decision, Ripple's expansion of RLUSD stablecoin access in Africa, and the acquisition of Rail for $200M to strengthen payment infrastructure. However, rising exchange reserves and whale sell-offs are creating short-term pressure. BTCC financial analyst Michael notes, 'While long-term prospects remain strong with analysts targeting $4.39 and beyond, the current whale activity suggests some consolidation before the next major move higher.'

Factors Influencing XRP's Price

XRP ETF Decision Looms: Potential for Major Gains as SEC Deadline Approaches

The cryptocurrency market braces for a pivotal moment as the SEC's October 18, 2025 deadline for an XRP spot ETF decision approaches. Bloomberg analysts assign a 95% approval probability, drawing parallels to Bitcoin's post-ETF surge that delivered 160%+ gains. At $2.81, XRP stands at a critical technical juncture—breaching $3 could propel it toward $3.40.

XRP's fundamental case strengthens as the XRP Ledger hosts $131.6M in tokenized real-world assets, including U.S. Treasuries. Platforms like RWA.XYZ streamline institutional access, positioning XRP as bridge infrastructure between crypto and traditional finance. "This isn't speculative altcoin territory anymore," observes a market strategist. "We're seeing tangible financial utility emerge."

WinnerMining's cloud-based platform offers an alternative to direct exposure, promising daily XRP payouts through flexible contracts. The service emphasizes operational simplicity—no mining rigs or energy costs—while allowing immediate withdrawals or reinvestment. As regulatory clarity nears, institutional adoption pipelines may soon validate XRP's hybrid financial role.

Ripple Expands RLUSD Stablecoin Access in Africa Through Key Partnerships

Ripple is broadening the reach of its RLUSD stablecoin across Africa via strategic collaborations with Chipper Cash, VALR, and Yellow Card. The USD-backed stablecoin, which launched in late 2024 under New York regulatory oversight, has already surpassed $700 million in market capitalization.

The African fintech partners will integrate RLUSD into their platforms for cross-border payments, settlements, and institutional services. Pilot programs in Kenya are testing the stablecoin's utility in drought insurance and agricultural risk management—a move that could redefine financial resilience in vulnerable markets.

This expansion signals Ripple's ambition to position RLUSD as a compliant bridge between traditional finance and blockchain-based solutions. The partnerships leverage Africa's rapidly growing crypto adoption rates, particularly for remittances and dollar-denominated transactions.

XRP Wave 4 Correction Complete, Analyst Eyes $4.39 Target

XRP appears poised for a significant rally after completing a corrective phase, according to analyst Dark Defender. The cryptocurrency, which has been trading below $3 amid bearish market sentiment, shows technical signs of a rebound.

Dark Defender's analysis suggests XRP has finished its fourth-wave Elliott Wave correction, typically preceding a strong fifth-wave advance. The token dipped 26% from its July peak of $3.66 to $2.697 on September 1, but has since rebounded slightly above $2.85.

The bullish case hinges on maintaining support at $2.85, the 23.6% Fibonacci retracement level. If this level holds, Fibonacci projections indicate potential upside to $4.39 during the anticipated fifth-wave movement.

XRP Price Could Reach Triple Digits by 2033 if Ripple Captures $18.9 Trillion Tokenization Market

XRP may surge into triple-digit territory by 2033 if Ripple successfully taps into the projected $18.9 trillion tokenization market. This bullish scenario stems from Ripple's partnership with the Blockchain Association of Singapore and aligns with Boston Consulting Group's research on real-world asset tokenization.

Market analyst Brad Kimes projects XRP could hit $10.40 by 2026, $54.20 by 2029, and potentially $189 by 2033. The forecast assumes Ripple captures the full value of the tokenization opportunity across trade finance, payments, and capital markets.

Institutional confidence appears to be growing, with 71% of APAC financial firms reporting increased crypto asset optimism. Over half plan to implement custody solutions within three years—a critical infrastructure component for mass adoption.

AI Chatbots Predict XRP Price Trajectory Amid Key Ripple Developments

Google Gemini and ChatGPT project bullish December 2025 targets for XRP as Ripple advances regulatory milestones and ecosystem expansion. The cryptocurrency currently trades at $2.80 with a $166.9 billion market capitalization.

Regulatory catalysts dominate the outlook. Polymarket assigns 91% odds for a US XRP ETF approval by year-end, while Ripple's pending national bank charter decision from the OCC could materialize by October. These developments coincide with accelerating adoption of Ripple's RLUSD stablecoin, now exceeding $700 million in market capitalization.

African payment corridors through Chipper Cash, VALR and Yellow Card demonstrate growing utility for XRP Ledger infrastructure. Market observers note the compounding effect of institutional adoption and regulatory clarity as primary price drivers through 2025.

XRP Price Prediction: Key Metrics Suggest Potential Breakout to Record Highs

XRP has weathered a 20% correction over six weeks, now consolidating near $2.80 within a descending triangle formation. The pattern suggests growing tension between buyers and sellers, with technical analysts eyeing $3.30 as the decisive breakout level that could propel the token toward historic highs.

Market dynamics reveal a healthier derivatives landscape, with open interest plunging from $11 billion to $7.5 billion as excessive leverage unwound. The reset positions XRP for more sustainable moves, reducing risks of cascading liquidations that plagued earlier rallies.

Dark Defender's Elliott Wave analysis paints an ambitious roadmap. The current Wave 2 accumulation phase could give way to a powerful Wave 3 advance upon clearing $3.30 resistance. Such a breakout would open technical targets between $4.80 and $5.90, potentially challenging all-time peaks.

Regulatory tailwinds strengthen the bullish case, with the SEC reviewing dozens of XRP ETF applications. The agency's recent approval of leveraged crypto futures ETFs sets a precedent that could accelerate institutional adoption pathways for XRP products.

XRP Ecosystem Shows Strong Recovery as ETHRANSACTION Launches Cloud Mining Plan

The XRP ledger is witnessing a resurgence, with on-chain data revealing over 100,000 active addresses and 3 million daily transactions—a peak not seen since 2024. Ripple's expanding cross-border payment partnerships in the Middle East and Southeast Asia are further solidifying XRP's role in real-world asset (RWA) settlements.

Amid fluctuating prices, XRP holders are shifting strategies from passive accumulation to active value generation. ETHRANSACTION's cloud mining platform has emerged as a preferred solution, offering a $70,550 daily profit contract plan slated for 2025. The platform distinguishes itself through regulatory compliance, renewable energy integration, and flexible contract terms.

XRP May Hit $10, Yet Ozak AI’s Early Backers See Life-Changing ROI Ahead

Crypto markets are buzzing as XRP captures attention with bold price targets. Trading at $2.86, the token's cross-border payment utility and institutional adoption fuel optimism. Analysts forecast a climb to $10, with key resistances at $4.50, $6.50, and $8.00. Support zones at $2.50 and below provide stability during market pullbacks.

Meanwhile, early investors are pivoting to Ozak AI, a presale project touting 100x ROI potential. While XRP's resilience shines through regulatory scrutiny, Ozak AI's speculative appeal highlights the market's appetite for high-growth opportunities. Institutional adoption of RippleNet may ultimately determine whether XRP reaches its $10 milestone.

XRP Price Struggles Amid Rising Exchange Reserves and Whale Sell-Offs

XRP's price recovery remains stunted as exchange reserves swell and selling pressure intensifies. Binance's XRP holdings alone surged from 2.92 billion to 3.6 billion tokens in early September, reflecting a broader trend of accumulation across nine major trading platforms. This buildup typically precedes heightened volatility, as traders position for potential downside.

Whale activity has turned decisively bearish, with large holders liquidating positions rather than accumulating. The lack of institutional support compounds the asset's challenges—uncertainty around a potential XRP ETF approval continues to dampen speculative interest. Technical charts show the token trapped below critical moving averages, with $2.80 acting as a stubborn resistance level.

Market dynamics contrast sharply with the broader crypto rally. While Bitcoin and Ethereum benefit from macroeconomic tailwinds, XRP faces idiosyncratic headwinds. Exchange inflow metrics, though currently muted, suggest the selling spree may not be exhausted. For now, the asset remains a laggard in the digital asset space.

Ripple Acquires Rail for $200M to Strengthen Payment Infrastructure and Boost XRP, RLUSD Adoption

Ripple has acquired Canadian fintech firm Rail for $200 million in a strategic move to enhance its payment infrastructure. The deal aims to accelerate the adoption of XRP and its upcoming stablecoin RLUSD across global financial systems.

Rail's technology specializes in bridging stablecoins with traditional fiat systems through a single API solution. The acquisition gives Ripple immediate capabilities to reduce cross-border payment costs and expand USD payment support in key corridors.

Founded in 2021 by Bhanu Kohli and Tarun Mistry, Rail brings critical infrastructure that complements Ripple's existing network. The purchase signals Ripple's intensified focus on stablecoin development as it prepares to launch RLUSD.

XRP Price Prediction: SWIFT's Ripple Concerns Seen as Bullish Signal

XRP's meteoric 400% rally over the past year has market participants divided. While some view current prices above $3 as overextended, proponents point to Ripple's growing foothold in global payments infrastructure as justification for further upside. Technical patterns suggest a breakout toward $4 could materialize if key resistance at $3 is decisively breached.

Notably, SWIFT's public apprehension about Ripple's competitive threat inadvertently validates XRP's disruptive potential. Institutional catalysts including ETF approvals and regulatory clarity remain critical for the next leg higher. Market technicians highlight the $2.50 level as crucial support—a failure here could trigger profit-taking after the coin's parabolic advance.

Will XRP Price Hit 3?

Based on current technical indicators and market developments, XRP has a strong possibility of reaching $3 in the near term. The price is currently at $2.839, just 5.7% away from the $3 target. Technical analysis shows resistance at the upper Bollinger Band of $3.1255, which aligns closely with the psychological $3 level.

| Indicator | Current Value | Significance for $3 Target |

|---|---|---|

| Current Price | $2.839 | 5.7% away from target |

| 20-day MA | $2.914 | Price trading below average |

| Bollinger Upper | $3.1255 | Key resistance level |

| MACD Signal | 0.1172 | Short-term momentum weak |

BTCC financial analyst Michael suggests that 'The combination of technical positioning and upcoming catalysts like the SEC ETF decision creates favorable conditions for a push toward $3, though traders should monitor whale activity which could cause temporary pullbacks.'