The cryptocurrency market is bracing for increased volatility as more than $4.6 billion in Bitcoin and Ethereum options expire today. This key event could determine the short-term price action for both leading assets.

Analysts warn that the September expiry carries additional weight, which is often associated with weaker performance and lower liquidation across digital assets.

Bitcoin, Ethereum Options Expiration Coming With $14.6 Billion at Stake

Bitcoin (BTC) dominated this options expiry, with a notional value of $3.38 billion. According to Deribit, the total open interest was 30,447 contracts.

The maximum pain point, where the number of options expiring worthless is the highest, is $112,000. Meanwhile, the put-call ratio is 1.41, indicating an advantage for bearish positions and a market tilted towards caution.

Bitcoin options expire. Source: Deribit

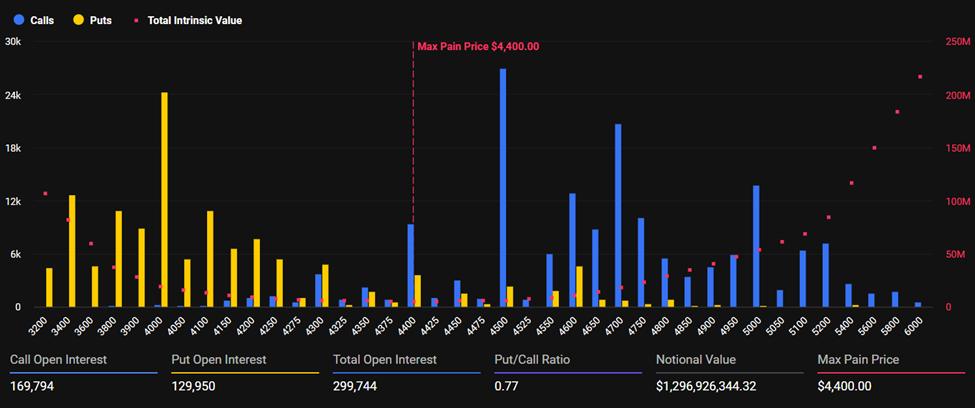

Bitcoin options expire. Source: DeribitEthereum also faces a major expiry with a notional value of $1.29 billion. Open interest is 299,744 contracts, with a maximum pain of $4,400.

The put-call ratio of 0.77 indicates stronger demand for calls (buys), although analysts observe significant accumulation above $4,500. Deribit has highlighted this skew.

“…flows are more balanced, but calls accumulate above $4.5K, leaving upside options,” Deribit noted .

Ethereum options expire. Source: Deribit

Ethereum options expire. Source: DeribitAnalysts at Greeks.live highlighted Ethereum’s implied volatility (IV), showing that the short-term IV has increased to around 70%. This indicates increased expectations for price volatility after Ethereum’s price corrected more than 10% from its recent high.

“Weakness in US stocks and the WLFI index has added to market skepticism,” analysts at Greeks.live wrote .

Similarly, the IV on Bitcoin futures has recovered to around 40% after a month of correction. Notably, this correction has taken Bitcoin price down more than 10% fromits All-Time-High .

However, analysts see a defensive stance among traders. Evidence of this is the acceleration in block trading in puts, which accounted for nearly 30% of options volume today.

Analysts warn of weakness in September

However, market sentiment is changing rapidly. Greeks.live notes that September has been a challenging month for cryptocurrencies. Institutional transitions and quarterly settlements often reduce Capital flows.

“The options market, in general, lacks confidence in September performance,” the analysts added.

The current bearish trend and decline in crypto-related stocks make risk-off the main theme.

As options near expiration, Bitcoin and Ethereum prices tend to pull back to their maximum pain levels. For Bitcoin, trading at $111,391 at the time of writing would mean a slight increase to $112,000. The same goes for Ethereum, trading at $4,326 at the time of writing .

With the third quarter delivery month today, liquidation models and shifting activity could amplify volatility in both directions.

As a result, defensive sentiment may prevail as traders prepare for extended weakness or a potential breakout at expiry. However, the market tends to stabilize after 8:00 UTC when options expire on Deribit.

The key question remains whether the expiry will keep Bitcoin and Ethereum near their current levels or act as a catalyst for a recovery.

Options momentum could create short-term magnetic pressure, with maximum pain just above current prices for both BTC and ETH.

If history repeats itself, September could continue to challenge bullish investors, but the market's increasingly defensive stance suggests any unexpected upside could be met with similarly sharp repositioning.