- Continuous upgrades to technical infrastructure, including EIP-4844 and future sharding implementation

- Institutional adoption rates are increasing, and traditional financial products are constantly innovating and integrating.

- DeFi and NFT ecosystems expand, driving real demand growth

ETH Price Prediction

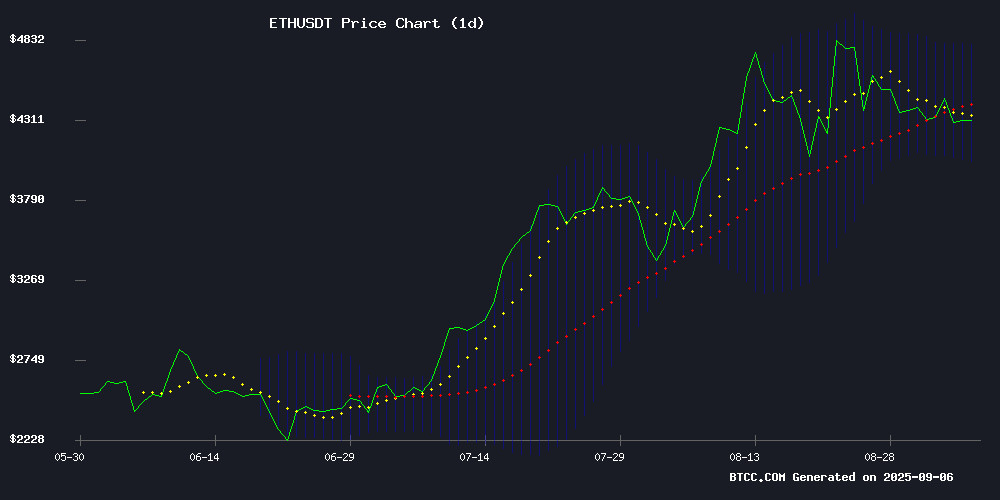

Technical Analysis: ETH faces key resistance level in the short term

Current ETH technical indicators show that the price of $4,317.95 is slightly below the 20-day moving average of $4,423.78, indicating weak short-term momentum. The MACD indicator is positive at 102.85, but the signal line is at -24.68, suggesting that while the long-term trend remains bullish, short-term correction pressure may be a possibility. Bollinger Bands indicate that the price is nearing its middle band, with the upper and lower bands at $4,802.84 and $4,044.71, respectively, forming the current trading range.

William, a financial analyst at BTCC, pointed out: "From a technical perspective, ETH needs to break through the 20-day moving average resistance of $4,423 to re-establish an upward trend . If it falls below the support of $4,044, it may test lower levels."

Market sentiment: Whale movements and institutional layout coexist

The recent market phenomenon of whale transferring large amounts of ETH to exchanges, coupled with Grayscale's launch of an Ethereum options ETF, demonstrates institutional optimism about ETH's volatility. FG Nexus Inc. has also changed its name and expanded its holdings, further strengthening its Ethereum holdings.

William, a BTCCC financial analyst, commented: "Whale taking profits may lead to short-term selling pressure, but the innovation of institutional products and increased corporate holdings indicate that medium- and long-term confidence remains. Market sentiment is showing a diverging trend between short-term caution and long-term optimism."

Factors affecting ETH prices

A whale deposited 2,074 ETH into Kraken, generating a profit of $6.07 million.

A major Ethereum holder transferred 2,074 ETH to the Kraken exchange, locking in $6.07 million in profits. The whale holds a total of 3,289 ETH, purchased between September 2021 and December 2024 at an average price of $6.43 million.

Market observers note that such large-scale capital movements often signal strategic asset reallocation. The timing of these deposits coincides with Ethereum's recent price rebound, suggesting that professional investors are taking profits.

Ethereum whale transfers $15.11 million in ETH to OKX, potentially facing losses

A major Ethereum ICO whale has deposited 3,500 ETH (worth approximately $15.11 million) into OKX over the past three days. The whale initially accumulated 2,000 ETH on September 2nd at an average price of $4,396.23 per ETH. If this transfer represents a sale, the entity would realize a loss of approximately $155,000 based on current market prices.

On-chain analyst Aunt Ai (@ai9684xtpa) flagged the move, highlighting the whale's activity during ETH price fluctuations. Such large-scale transfers often signal strategic portfolio rebalancing or liquidity management by major holders.

FG Nexus Inc. Completes Name Change and Share Expansion to Strengthen Ethereum Holdings

Fundamental Global Inc., the Nasdaq-listed Ethereum treasury company, has officially changed its name to FG Nexus Inc., effective following the approval of the Nevada Secretary of State through an amendment to its Articles of Incorporation. The restructuring includes a significant increase in the number of authorized common shares from 1.3 million to 35.4 million.

This share structure adjustment directly supports the company's strategy of increasing its ETH reserves. This move demonstrates institutional confidence in Ethereum's long-term value proposition, especially in the context of publicly traded companies building cryptocurrency treasury positions.

Grayscale launches Ethereum options ETF to capture ETH volatility opportunities

Grayscale Investments has expanded its cryptocurrency ETF product line with the launch of the Ethereum Options Income ETF ( ETCO ), which allows investors to participate in ETH price fluctuations through call options. The fund strategically avoids directly holding digital assets, instead generating income through options on Grayscale's existing Ethereum Trust ETF (ETHE) and Ethereum Mini Trust ETF (ETH), with bimonthly dividend distributions.

This launch follows Grayscale's similar Bitcoin options ETF, launched in April. ETCO's listing comes as Ethereum has seen strong monthly gains. Despite a recent pullback, it has still risen 20% over the past month, briefly reaching an all-time high of $4,946 in late August. The product carries a 0.66% management fee and currently manages $1.4 million in assets.

What will be the trend of ETH in the next 10 years?

From a ten-year perspective, ETH's development trajectory will be driven by three core drivers: technological upgrades, institutional adoption, and ecosystem expansion. BTCC financial analyst William stated, "Ethereum's long-term value proposition is built on its dominant position as a decentralized application platform. As Layer 2 solutions mature and ETH 2.0 is fully implemented, transaction efficiency and scalability will be significantly improved."

| Timeframe | Key catalyst | Expected impact |

|---|---|---|

| 2025-2027 | Full Sharding Implementation | Transaction processing capacity increased 10-100 times |

| 2028-2030 | Large-scale institutional adoption | Tokenization of traditional financial assets is accelerating |

| 2031-2035 | A clear global regulatory framework | Compliance drives mainstream capital inflows |

Although short-term price fluctuations are affected by market sentiment and macroeconomics, the long-term trend points to a stage of value accumulation, and technological innovation and the expansion of practical application scenarios will provide fundamental support for prices.