Redstone's acquisition of on-chain credit rating firm Credora has ignited competition in the oracle market. The plan is to increase transparency in the decentralized finance (DeFi) market by combining real-time price data with risk assessment.

Related articles

- Chainlink: "Evolving Beyond an Oracle Solution into a Comprehensive Computing Platform" [Decenter Interview]

- Hashed CEO Kim Seo-jun: "The US has already experienced a major upheaval... We must expedite the development of a won-based RWA ecosystem." [Decenter]

- Establishing a KRW stablecoin and RWA trading platform to become Asia's virtual asset hub.

- [Doyeri's DeFi Radar] Apollo, one of the top four private equity funds in the US, has its sights set on Plume's RWA experiment.

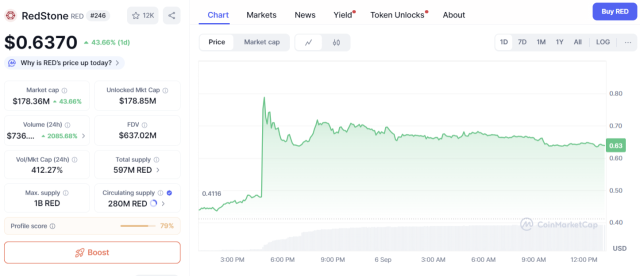

As of 1:10 PM on the 6th, Redstone (RED) was trading at 895 won on Upbit, down 3.97% from the previous day. RED, which had soared to 1,600 won immediately after its listing on the Korean Won market at 5 PM the previous day, has now reversed course. At the same time, according to CoinMarketCap, RED was trading at $0.6370, up 43.68% from the previous day. This is due to the price surge following the Upbit listing announcement at 4:45 PM the previous day.

Redstone is expanding its market presence through acquisitions. The company announced on the 4th (local time) that it will acquire on-chain credit rating company Credora and launch "Credora by Redstone." Credora possesses a credit rating model used by major DeFi protocols, including Morpho. It assigns scores based on collateral structure, operational transparency, and volatility. Recognized for its growth potential, Redstone secured investments from global investors such as Coinbase Ventures and Standard & Poor's (S&P) in 2023. Through this acquisition, Redstone aims to become the first oracle to provide price data and risk assessment in one place.

Oracles serve as inputs for external data into blockchains. Launched in 2017, Chainlink has dominated the oracle market, but competition is intensifying with the emergence of next-generation oracle solutions like Redstone in 2023.

With the recent expansion of the real-world asset (RWA) market and the rise of institutional investors, demand for oracles is skyrocketing. Tokenizing real-world assets requires accurately reflecting collateral value and market prices on the blockchain. This is why oracles are considered a key infrastructure for the proliferation of RWA. According to Artemis, a virtual asset data provider, oracles have seen the highest price growth over the past month, with an average increase of 21.5%.

"Assessment is a natural extension of oracles," said Marcin Kazimierzak, co-founder of Redstone. "We need to move beyond simple data transmission to information that can be directly utilized for investment decisions and risk management." He added, "As institutional adoption of on-chain assets like stablecoins, bonds, and private credit accelerates, risk assessment will become essential."

- Reporter Do Ye-ri

< Copyright ⓒ Decenter. Unauthorized reproduction and redistribution prohibited >