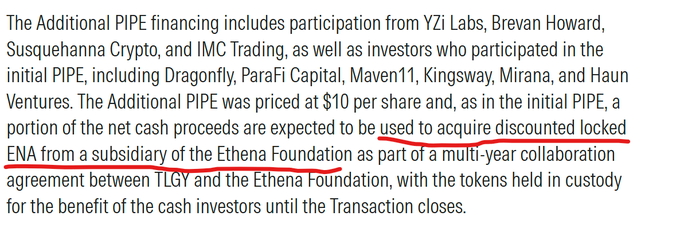

Here’s how the $ENA DAT play really works: The Ethena Foundation sits on billions of $ENA, which they can't sell in a traditional sense - other foundations often do predatory OTC sales. So, how do you make these funds productive? They offer a significant discount to institutional investors (around 30% in the first DAT raise) and build a construct that benefits everybody. Instead of pocketing the $360 million they buy back from the market. Result: The token price goes up. 1. Foundation is happy (productive treasury). 2. Token holders are happy (VCs & retail). 3. DAT investors are happy (30% paper profits on equity). Everyone’s a winner. So who loses? TradFi. They pay the premium compared to PIPE investors. But that’s how TradFi always works — IPO allocations go to insiders first. The idea behind this setup is: TradFi can’t yet buy $ENA directly, so they need Ethena equity. If you assume there’s real demand for the company at the current valuation (and you should), then this setup is net positive for all players.

Jester

@JesterTrades

09-06

This whole $ENA DAT play feels like a massive IQ test that many are failing.

The $ENA DAT ticker is $TLGYF and all these PIPEs are funded by Ethena Seed investors/VCs.

Now ask yourself why these investors would want to invest into ENA via $TLGYF which has a total daily volume x.com/Evan_ss6/statu…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content