Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debate about its impact on Ethereum, Solana , and existing payment-focused chain .

While many experts see this as an opportunity to expand user adoption and strengthen chain infrastructure, others remain skeptical of Stripe’s claimed “neutrality” and true motives. Tempo could become a major catalyst for the stablecoin market, but it also risks changing the competitive landscape of cryptocurrencies.

Tempo like Libra v2?

Stripe and Paradigm drew a lot of attention from the market when they announced the concept of a payments-first blockchain called Tempo . The announcement immediately sparked discussions around the “payments-first” model — a design that prioritizes stablecoin transfers and payment experiences rather than focusing on general-purpose smart contracts like Ethereum.

At a macro level, a payments-first blockchain provides a direct path for new users (Stripe merchants and customers) to access stablecoins and on- chain payments without having to go through multiple bridges or complex Layer-2 (L2) solutions. This may explain why fintech giants often favor Layer-1 (L1) over L2 .

Interestingly, many have compared Tempo to Libra, the failed project spearheaded by Meta (formerly Facebook). However, Tempo may have a better chance, as the cryptocurrency now has greater political and institutional backing.

“Stripe's Tempo Chain is Libra v2 but with a political climate that doesn't stifle it in the bud,” commented Ryan Adams from Bankless.

However, Tempo's true value depends on whether it can attract significant payment volume or just become “another chain ” in the ecosystem.

Many doubts

Although Tempo is labeled as “Libra v2,” some argue that its technical foundation may not be suitable for the current market situation, as other platforms already offer more than what Tempo proposes.

“There may be a business case for a Stripe L1, but IMO the technical motivations cited are somewhat questionable in 2025,” commented the CEO/CTO of Mysten Labs.

Other experts have expressed concerns about the project’s claim of “neutrality” regarding stablecoins and gas Token in the Tempo ecosystem. Regulatory risks remain, as stablecoin issuers may face conflicts of interest or lack of trust in the chain’s framework.

“There is a reason why successful L1s only accept their native Token for gas. The counterparty risk of doing otherwise is high and only increases if the chain succeeds…” Chia one X user.

Tempo's Impact on the Crypto Market

Some argue that “ chain Shard ” could benefit chain interoperability protocols, as the need for bridges and/or oracles increases. As such, infrastructure providers such as bridges , oracle providers like Chainlink (LINK), and on- chain payment service providers could benefit the most, as their services become essential for transferring value between ecosystems.

However, while stablecoin growth is typically a positive sign for cryptocurrencies, and Stripe's new users can still access Ethereum DeFi, analyst Ignas cautions that it's hard to see this as a bullish signal for ETH.

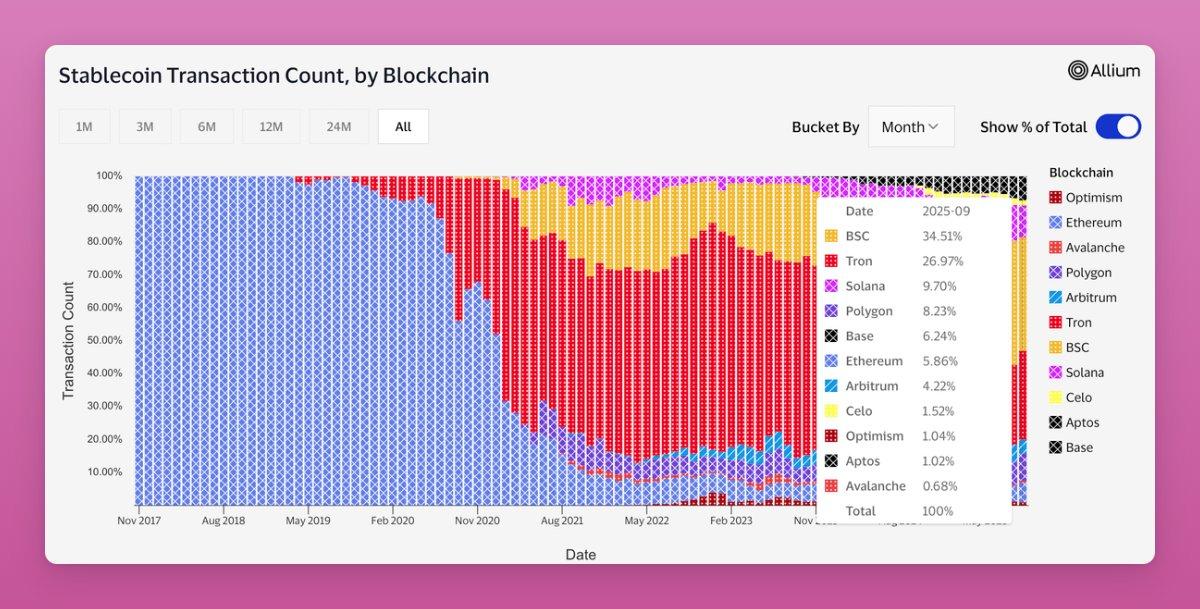

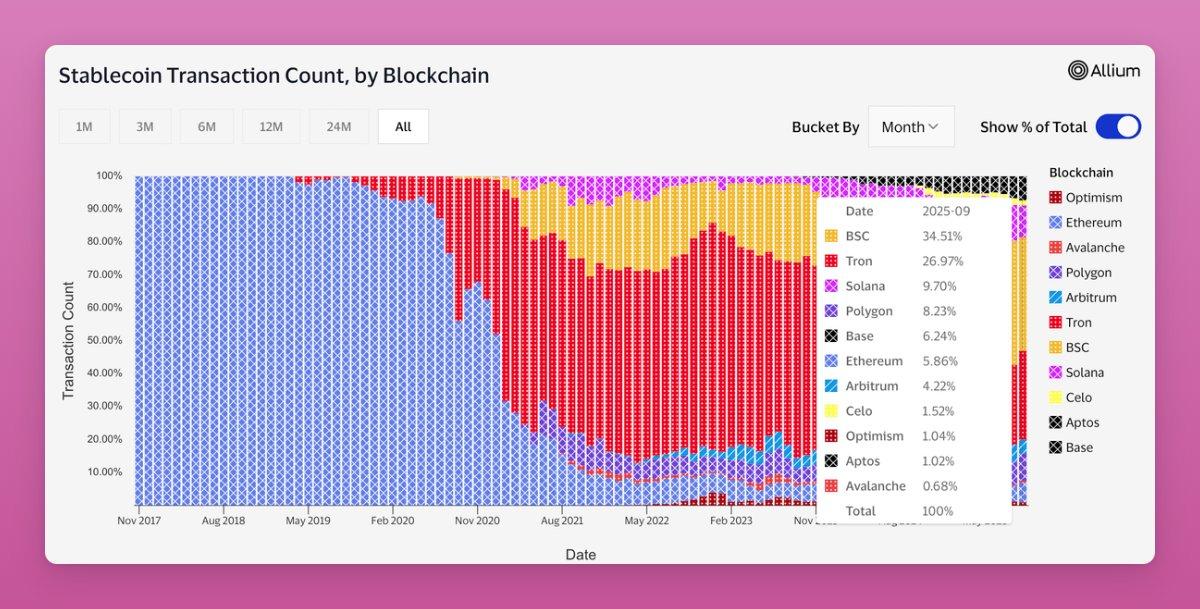

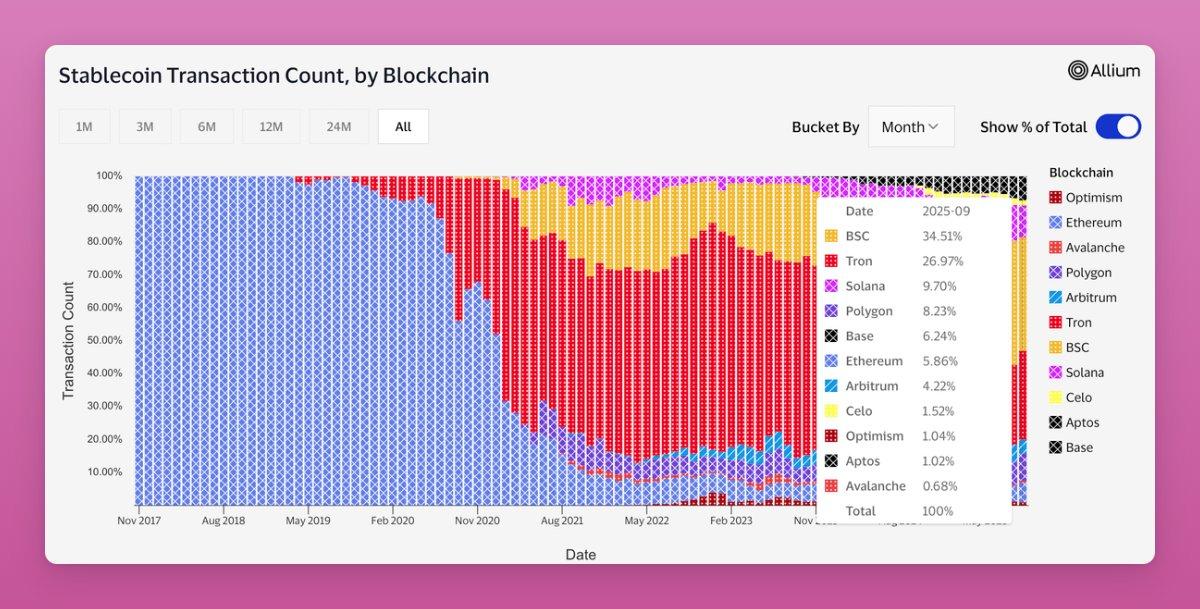

Most stablecoin transactions take place on TRON, Solana, Polygon , and L2 networks. Tempo’s emergence could directly compete with these ecosystems. However, experts predict Ethereum will be the big winner in the new stablecoin economy.

Stablecoin trading on the blockchain. Source: Ignas on X

Stablecoin trading on the blockchain. Source: Ignas on XChia this view, Blockworks CEO Jason Yanowitz argues that Tempo could become a serious competitor to Tether, Circle, Ethereum, and Solana in the payments space. If Tempo succeeds in attracting liquidation and retail adoption, the flow of stablecoins could be significantly diverted.

Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debate about its impact on Ethereum, Solana , and other existing payment chain .

While many experts see this as an opportunity to expand user adoption and strengthen chain infrastructure, others remain skeptical of Stripe’s claimed “neutrality” and true motives. Tempo could become a major catalyst for the stablecoin market, but it also risks changing the competitive landscape of cryptocurrencies.

Tempo like Libra v2?

Stripe and Paradigm attracted significant market attention when they announced the concept of a payments-first blockchain called Tempo . The announcement immediately sparked discussions around the “payments-first” model — a design that prioritizes stablecoin transfers and payment experiences rather than focusing on general-purpose smart contracts like Ethereum.

At a macro level, a payments-first blockchain provides a direct path for new users (retailers and Stripe customers) to access stablecoins and on- chain payments without having to go through multiple bridges or complex Layer-2 (L2) solutions. This may explain why fintech giants often favor Layer-1 (L1) over L2 .

Interestingly, many have compared Tempo to Libra, the failed project spearheaded by Meta (formerly Facebook). However, Tempo may have a better chance, as the cryptocurrency now has greater political and institutional support.

“Stripe's Tempo Chain is Libra v2 but with a political climate that doesn't stifle it in the bud,” commented Ryan Adams from Bankless.

However, Tempo's true value depends on whether it can attract significant payment volume or just become “another chain ” in the ecosystem.

Many doubts

Although Tempo is labeled as “Libra v2,” some argue that its technical foundation may not be suitable for the current market situation, as other platforms already offer more than what Tempo proposes.

“There may be a business case for a Stripe L1, but IMO the technical motivations cited are somewhat questionable in 2025,” commented the CEO/CTO of Mysten Labs.

Other experts have expressed concerns about the project’s claim of “neutrality” regarding stablecoins and gas Token in the Tempo ecosystem. Regulatory risks remain, as stablecoin issuers may face conflicts of interest or lack of trust in the chain’s framework.

“There is a reason why successful L1s only accept their native Token for gas. The counterparty risk of doing otherwise is high and only increases if the chain succeeds…” Chia one X user.

Tempo's Impact on the Crypto Market

Some argue that “ chain Shard ” could benefit chain interoperability protocols, as the need for bridges and/or oracles increases. As such, infrastructure providers such as bridges , oracle providers like Chainlink (LINK), and on- chain payment service providers could benefit the most, as their services become essential for transferring value between ecosystems.

However, while stablecoin growth is generally a positive sign for cryptocurrencies, and Stripe's new users can still access DeFi on Ethereum, analyst Ignas cautions that it's hard to see this as a bullish signal for ETH.

Most stablecoin transactions take place on TRON, Solana, Polygon , and L2 networks. Tempo’s emergence could directly compete with these ecosystems. However, experts predict Ethereum will be the big winner in the new stablecoin economy.

Stablecoin trading on the blockchain. Source: Ignas on X

Stablecoin trading on the blockchain. Source: Ignas on XChia this view, Blockworks CEO Jason Yanowitz argues that Tempo could become a serious competitor to Tether, Circle, Ethereum, and Solana in the payments space. If Tempo succeeds in attracting liquidation and merchant adoption, the flow of stablecoins could be significantly diverted.

Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debate about its impact on Ethereum, Solana , and other existing payments-focused chain .

While many experts see this as an opportunity to expand user adoption and strengthen chain infrastructure, some remain skeptical of Stripe’s claimed “neutrality” and true motives. Tempo could become a major catalyst for the stablecoin market, but it also risks reshaping the competitive landscape of cryptocurrencies.

Tempo like Libra v2?

Stripe and Paradigm attracted significant market attention when they announced the concept of a payments-first blockchain called Tempo . The announcement immediately sparked discussions around the “payments-first” model — a design that prioritizes stablecoin transfers and payment experiences rather than focusing on general-purpose smart contracts like Ethereum.

At a macro level, a payments-first blockchain provides a direct path for new users (Stripe merchants and customers) to access stablecoins and on- chain payments without having to go through multiple bridges or complex Layer-2 (L2) solutions. This may explain why fintech giants often favor Layer-1 (L1) over L2 .

Interestingly, many have compared Tempo to Libra, the failed project spearheaded by Meta (formerly Facebook). However, Tempo may have a better chance, as the cryptocurrency now has greater political and institutional support.

“Stripe's Tempo Chain is Libra v2 but with a political climate that doesn't stifle it in the bud,” commented Ryan Adams from Bankless.

However, Tempo's true value depends on whether it can attract significant payment volume or just become “another chain ” in the ecosystem.

Many doubts

Although Tempo is labeled as “Libra v2,” some argue that its technical foundation may not be suitable for the current market situation, as other platforms already offer more than what Tempo proposes.

“There may be a business case for a Stripe L1, but IMO the technical motivations cited are somewhat questionable in 2025,” commented the CEO/CTO of Mysten Labs.

Other experts have expressed concerns about the project’s claim of “neutrality” regarding stablecoins and gas Token in the Tempo ecosystem. Regulatory risks remain, as stablecoin issuers may face conflicts of interest or lack of trust in the chain’s framework.

“There is a reason why successful L1s only accept their native Token for gas. The counterparty risk of doing otherwise is high and only increases if the chain succeeds…” Chia one X user.

Tempo's Impact on the Crypto Market

Some argue that “ chain Shard ” could benefit chain interoperability protocols, as the need for bridges and/or oracles increases. As such, infrastructure providers such as bridges , oracle providers like Chainlink (LINK), and on- chain payment service providers could benefit the most, as their services become essential for transferring value between ecosystems.

However, while stablecoin growth is generally a positive sign for cryptocurrencies, and new Stripe users can still access Ethereum DeFi, analyst Ignas cautions that it is difficult to see this as a bullish signal for ETH.

Most stablecoin transactions take place on TRON, Solana, Polygon , and L2 networks. Tempo’s emergence could directly compete with these ecosystems. However, experts predict Ethereum will be the big winner in the new stablecoin economy.

Stablecoin trading on the blockchain. Source: Ignas on X

Stablecoin trading on the blockchain. Source: Ignas on XChia this view, Blockworks CEO Jason Yanowitz argues that Tempo could become a serious competitor to Tether, Circle, Ethereum, and Solana in the payments space. If Tempo succeeds in attracting liquidation and merchant adoption, the flow of stablecoins could be significantly redirected.