A token that soared from its lowest point of $0.046 to $14.03, creating a myth of more than 300 times return in just over three months, MYX is announcing the arrival of a new era with its amazing market performance.

On September 9, 2025, market data showed that MYX broke through the $14 mark, currently trading at $14.03, a 24-hour increase of 310%. From its lowest point of $0.046 on May 6, 2025, when it was listed on Binance Alpha, MYX has risen over 300-fold in just over three months.

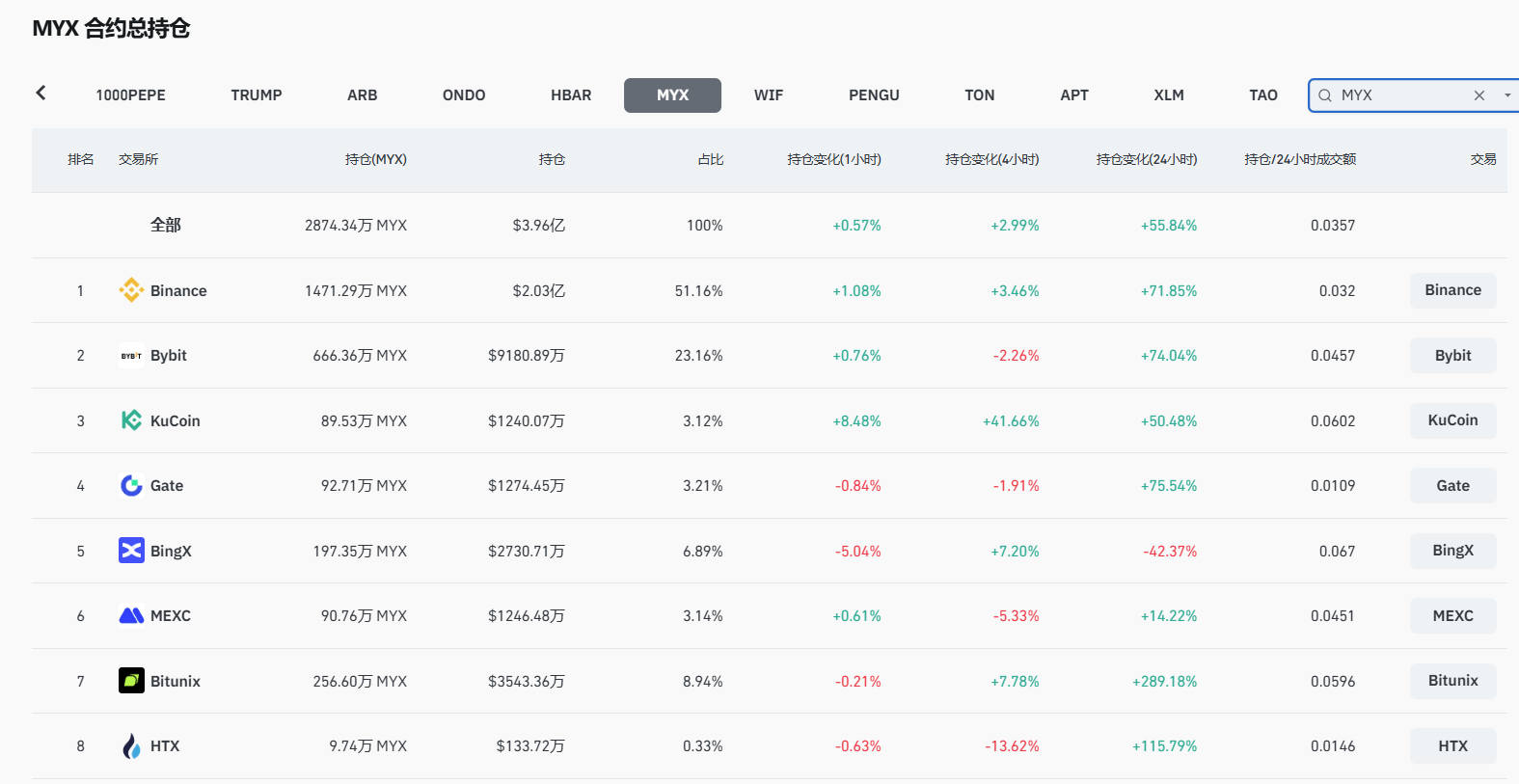

Binance data shows that the trading volume of MYX contracts reached US$6.3 billion in the past 24 hours, second only to Bitcoin and Ethereum. The current contract holdings on the entire network are US$396 million, and MYX's fully diluted market value has reached US$14.5 billion.

Phenomenal performance, MYX's market surge

The cryptocurrency market is full of surprises, but MYX Finance (MYX) has shown remarkable performance in just over three months. From its Token Generation Event (TGE) on May 6, 2025, to the present day, MYX's price has risen from an initial price of $0.096 to a peak of $2.09, an increase of over 1,600%. It has subsequently continued its upward climb to its current price of $14.

MYX's IDO on BN Wallet on May 6, 2025, achieved a record-breaking 30,296% oversubscription, subsequently listing on major DEXs and CEXs such as BN Alpha and Gate.io. Initially, MYX's price fluctuated between $0.05 and $0.1. Starting on August 3, its price skyrocketed from $0.113 to $2.1, an increase of over 1,800%. However, within just 24 hours, the price plummeted 60% to $0.8237 before recovering to $1.44.

This volatility didn't halt MYX's upward momentum, but instead attracted more attention. Its 24-hour trading volume increased by 110% to over $301 million, bringing its weekly volume to over $2.4 billion.

Strong team background, favored by capital

Founded in February 2024, MYX Finance is a decentralized exchange (DEX) focused on perpetual contracts and derivatives trading. The project is backed by a team with a combined background in traditional finance and crypto finance.

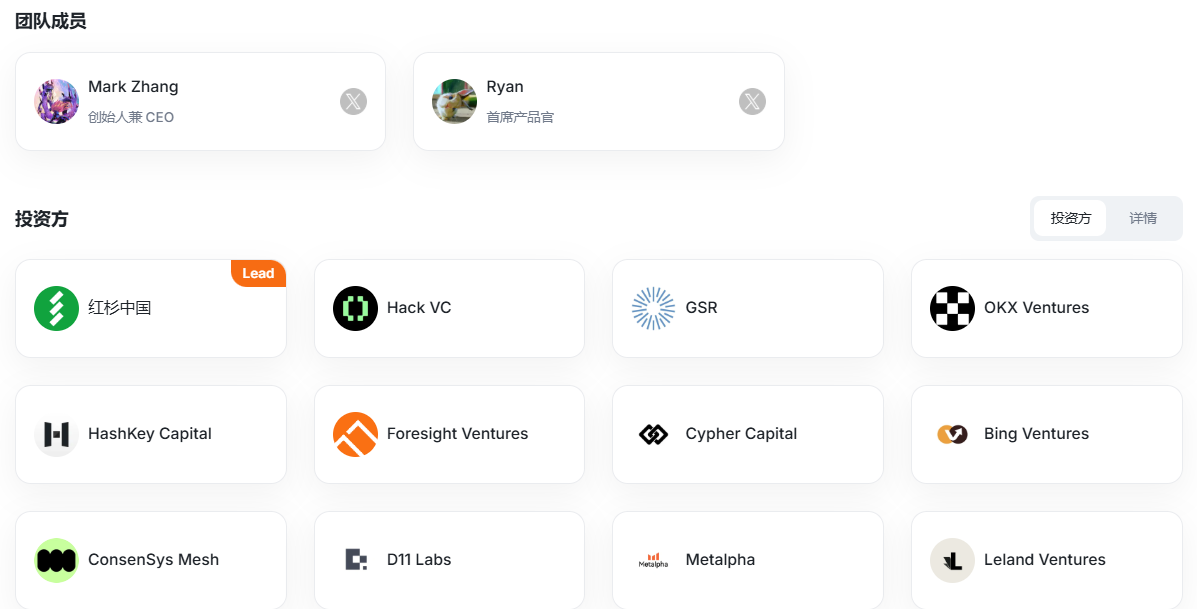

Mark Zhang, founder and CEO of MYX, previously worked at HTX. Ryan, co-founder and CPO, once said, "Our goal is to enable everyone to participate equally in the Alpha game, breaking down the barriers that have limited access to institutions or a select few."

MYX Finance has secured strong backing from top investment institutions in the industry. In November 2023, MYX completed a $5 million seed round at a $50 million valuation. This round was led by HongShan (formerly Sequoia China), with participation from renowned institutions such as Consensys, Hack VC, OKX Ventures, and Foresight Ventures.

On March 8, 2025, MYX Finance once again announced the completion of a US$5 million strategic financing, attracting participation from investment institutions such as FL Foundation, Woyong, D11-Labs, HashKey Capital, and Metalpha.

Technological product innovation to solve industry pain points

MYX Finance’s core positioning is “a chain-based perpetual DEX built specifically for on-chain democratized alpha,” allowing anyone to trade perpetual contracts on any token — from blue-chip assets to the latest meme coins.

Unlike traditional DEX, MYX Finance solves the liquidity fragmentation problem of the blockchain ecosystem through multiple technological innovations:

Matching Pool Mechanism (MPM)

MYX's proprietary Matching Pool Mechanism (MPM) effectively addresses the inefficiencies of traditional decentralized exchanges (DEXs), enabling zero-slippage trading and up to 125x capital efficiency.

Chain abstract unified account

MYX introduces a chain-abstracted unified account, successfully addressing the issues of blockchain fragmentation and interoperability. With a single account, users can easily trade cross-chain, multi-asset derivatives without switching wallets, cross-chain bridging, or incurring gas fees.

Permissionless listing and seamless user experience

In 2025, MYX plans to launch the world's first permissionless "Chain Abstraction Perp DEX", which will support the permissionless listing of any new assets, including early MEME projects and small-cap long-tail tokens.

Users can easily conduct long and short transactions on new tokens without a wallet, gas, or signature, and the transaction speed is extremely fast, with zero slippage and extremely low fees.

Token economics design empowers value capture

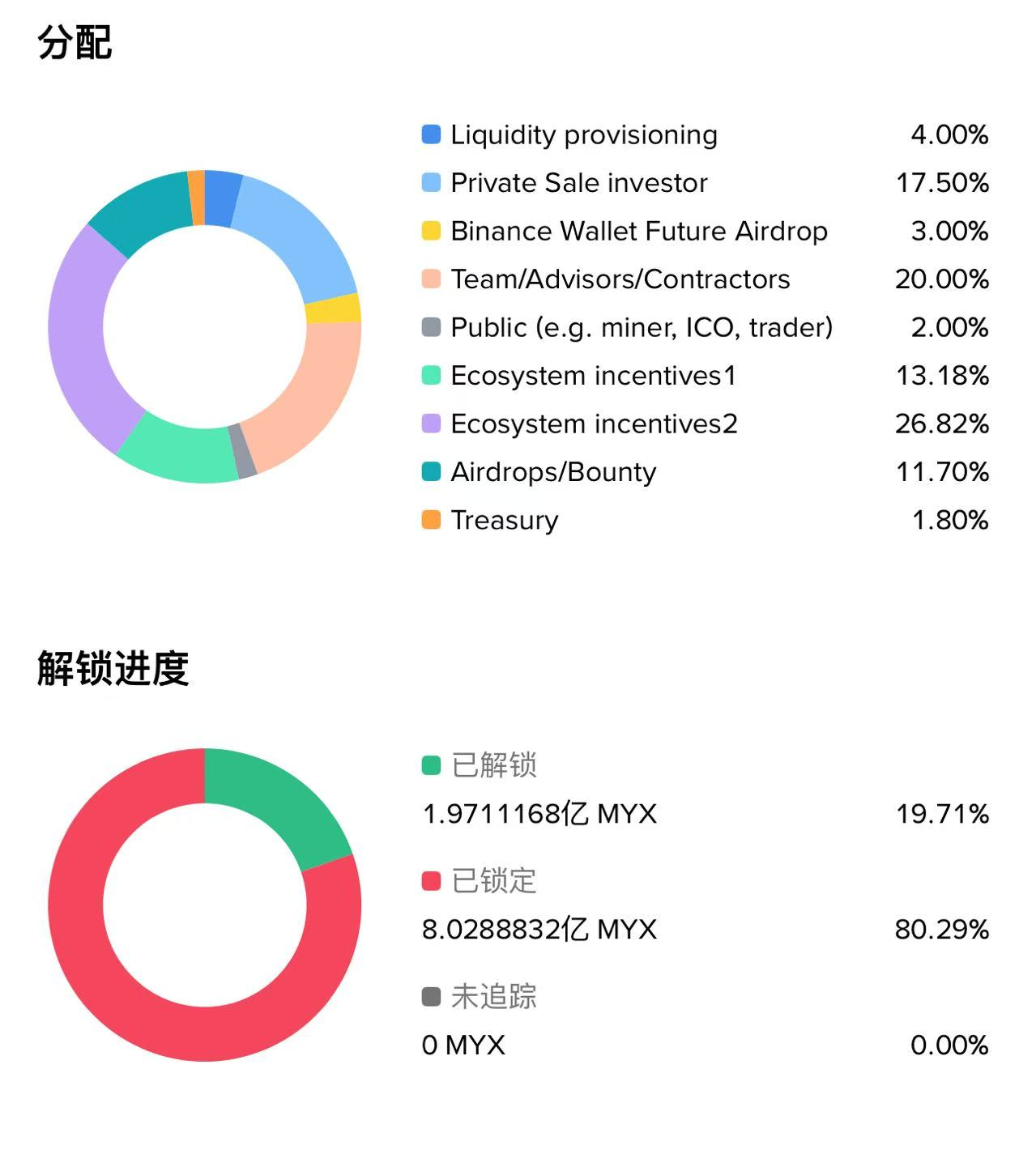

The MYX token, the core of the MYX Finance ecosystem, has a fixed supply of 1 billion, with its distribution carefully designed to drive ecosystem growth.

Community Rewards (45%): Incentivize traders and liquidity providers through airdrops and rewards, ensuring that community participation and contributions are rewarded.

Team and Advisors (20%): Align the team’s interests with the long-term success of the project and ensure the team has ongoing motivation to drive the project forward.

Institutional Investors (20%): Support strategic partnerships and growth, bringing more resources and support to the project.

Initial liquidity (10%): Ensure smooth trading after the TGE and provide sufficient market liquidity for the token.

Future Reserve (5%): Provides funding for future development and expansion, ensuring the project has sufficient resources for continued innovation.

The MYX token plays multiple roles in the ecosystem: it serves as a governance token, a core asset for platform functionality, and incentivizes long-term holders through a staking rewards mechanism.

On May 12, 2025, MYX Finance announced the official launch of two core function upgrades: the Keeper System staking node system and a new VIP tier system.

Through the Keeper Network staking node system, users can stake MYX to 21 Keeper nodes selected by the community. The nodes are responsible for publicly executing transaction tasks to ensure efficient and secure transactions.

The platform also simultaneously launched a fee repurchase mechanism, using net income transaction fees to repurchase MYX and distribute it to staking nodes, continuously increasing node income and token value.

MYX Finance also introduced a "Hold Coin, Get VIP" mechanism. Users only need to hold 10 MYX to automatically qualify for the basic VIP level, with no lock-up or trading volume requirements. The more MYX held, the higher the transaction fee discounts, far exceeding the cumbersome mechanisms of traditional CEXs.

Ecological data shows strong growth momentum

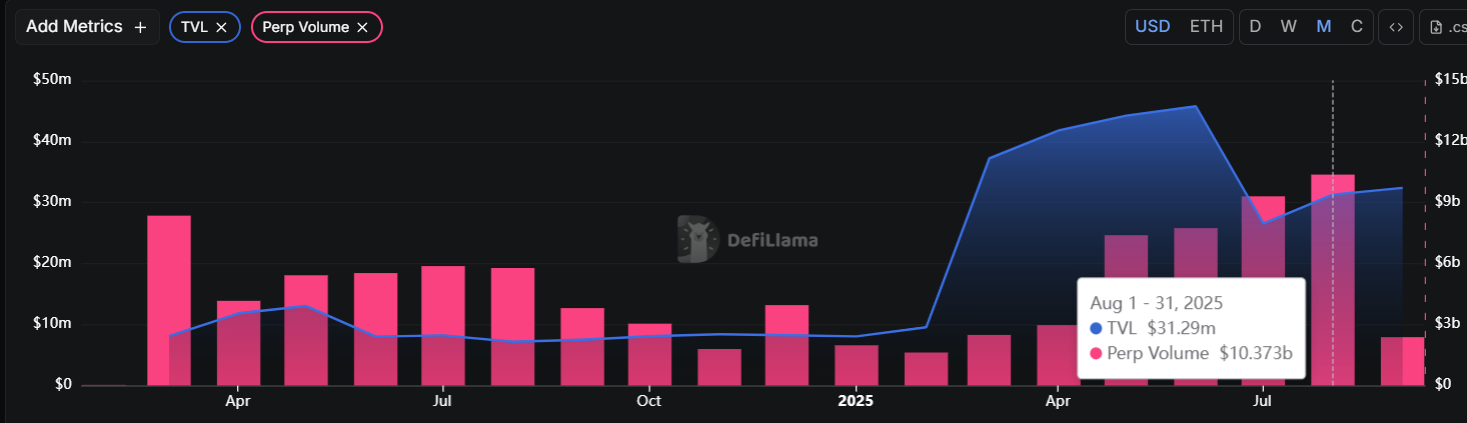

Since its mainnet launch in February 2024, MYX Finance has seen impressive growth. According to DefiLlama data, as of September, its total value locked (TVL) exceeded $31 million, with 30-day perpetual contract trading volume reaching $10.3 billion.

The official website shows that the total transaction volume has exceeded US$84 billion and the number of users exceeds 170,000.

Meanwhile, the official website shows that the total income of MLP liquidity providers continues to climb, rising from $35,000 on April 1, 2025 to over $5 million per month today. These figures serve as a footnote to the vibrant ecosystem.

Market drivers, multiple favorable factors boost

The surge in MYX’s price is not accidental, but the result of multiple factors:

Surge in transaction volume and activity

MYX's trading volume increased 110% over the past 24 hours, reaching over $301 million. Within a week, its trading volume exceeded $2.4 billion. Over 6,700 transactions were conducted on the platform, with a total value locked exceeding $25 million.

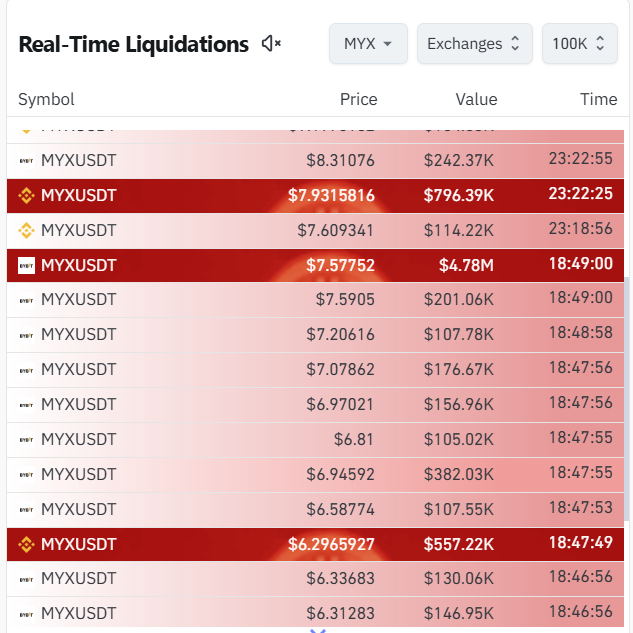

Short sellers are liquidated

Another factor contributing to the MYX price surge is short-selling. Many traders are betting on a decline in MYX. According to Coinglass data, over $51 million in short positions were liquidated in the past 24 hours, including by large traders with accounts exceeding $1 million. The forced liquidation of short positions further increased buying pressure and pushed the price higher.

FOMO and market sentiment

As prices continued to rise, more and more people flocked to MYX out of fear of missing out (FOMO). MYX's Fear and Greed Index reached 64, indicating a strong sense of greed in the market.

Future potential prospects: opportunities and risks coexist

Market analysis presents two possible scenarios for the future development of MYX:

From a longer-term perspective, MYX Finance, with its technological innovation and ecosystem development in the decentralized derivatives sector, is poised to become a focal point of the crypto market in 2025. MYX Finance boasts strong financing support, and its innovative P2Pool2P model and community-led incentive mechanism lay a solid foundation for MYX's long-term development.

However, investing in MYX coins also comes with several major risks:

MYX's current FDV has reached $14 billion, placing it among the top 20 cryptocurrencies by market capitalization. However, its circulation rate is only a little over 9%. A large number of tokens have yet to be released, which could lead to selling pressure once they are unlocked.

Regulations on derivatives are becoming increasingly stringent around the world, and the changing regulatory environment poses a significant risk. DeFi projects are frequently hacked, and protocol security issues cannot be ignored. Many new projects ultimately fail to take off, creating the risk of project development falling short of expectations.