Entering the second week of September, the altcoin market Capital has yet to show a clear breakthrough, with the TOTAL3 index (excluding Bitcoin and Ethereum) continuing to fluctuate around the $1 trillion mark.

However, the liquidation map reveals strong bullish expectations from short-term Derivative traders, who are betting big on a bullish scenario this week. If the prediction is wrong, the liquidation wave could explode in significant size. Here are the altcoins that are in the high-risk zone.

1. XRP

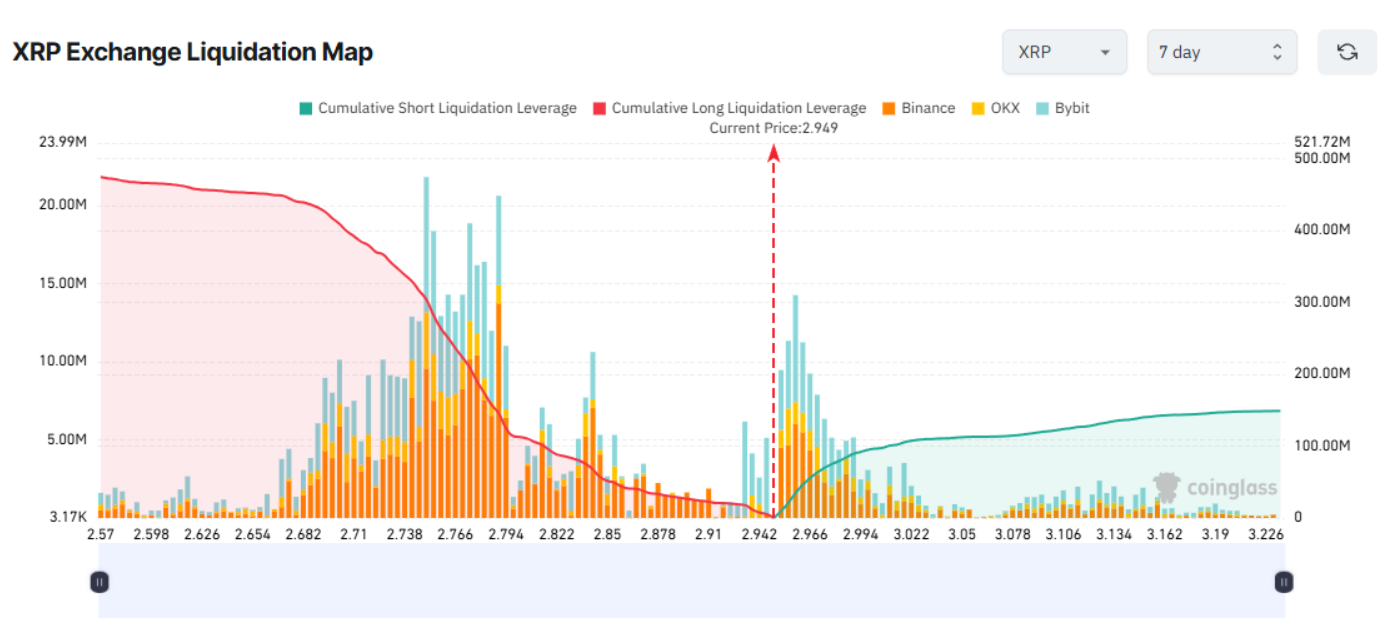

The 7-day liquidation map shows that the XRP market is witnessing a clear disparity between Longing and Short positions. This means that if the price drops this week, Longing will suffer heavier losses.

The recent bullish sentiment has been bolstered by a number of factors. Notably, Wetour, Air China’s loyalty program partner, has just announced plans to accept XRP as payment. In addition, the coin also recorded an 8% recovery in September. While the figure is not too impressive, it is enough to confirm the signal of a breakout of the downtrend line, thereby sparking short-term profit expectations.

However, XRP ’s growth prospects still face many obstacles. A new report from Bitcoin Magazine points to three major risks: XRP reserves on Binance have skyrocketed to record levels, activity in the XRPL ecosystem has weakened, and interest on Google Trends has plummeted.

In this scenario, if the price goes against expectations, the Longing side could face liquidation of up to $467 million when XRP falls below $2.6. On the other hand, if the price rises to $3.2, the Short side could face losses of about $148 million.

2. Dogecoin (Doge)

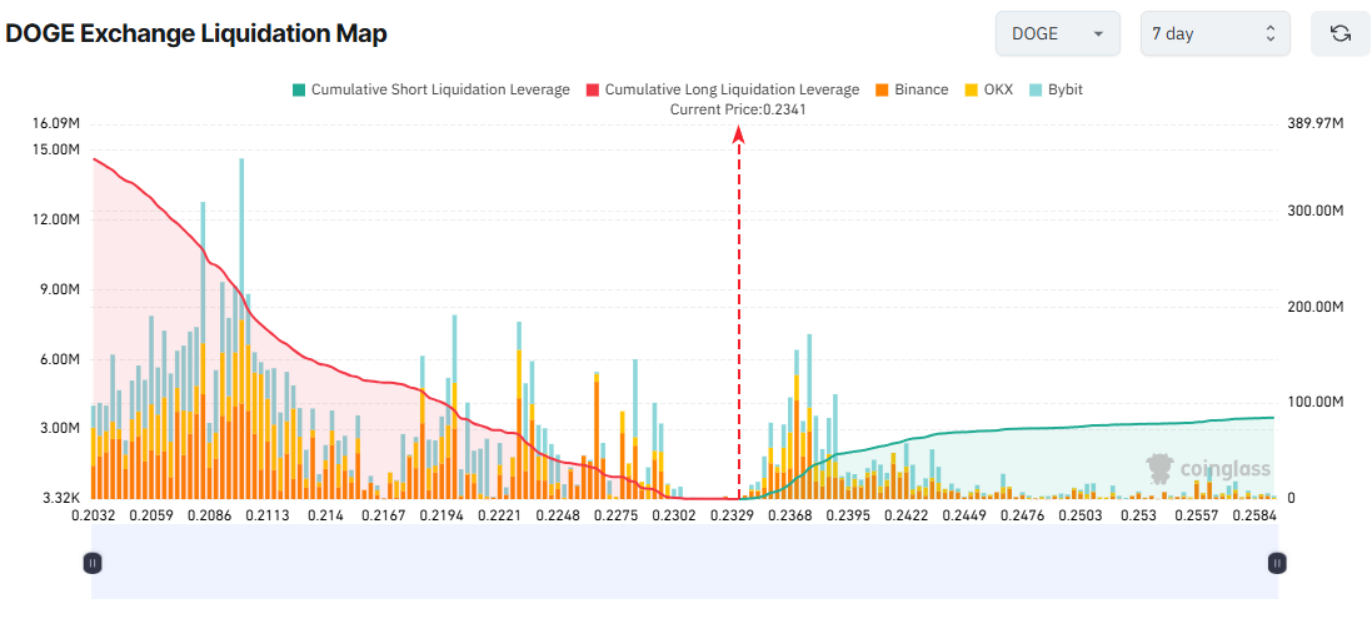

Similar to XRP, Dogecoin ’s liquidation map also shows a clear imbalance, reflecting the bullish sentiment of short-term traders.

Currently, bulls are pouring money into Doge in anticipation of a breakout this week. However, the high level of leverage exposes them to great risk: if Doge turns down to $0.20, the volume of Longing positions could be “blown away” by $354 million. On the other hand, if Doge rebounds to $2.55, the total value of Short liquidations will only stop at $80 million.

The bullish sentiment is partly fueled by expectations that the first Doge ETF could launch as early as September, which is expected to add further momentum to the price. At the same time, on-chain data also shows that retail Capital is starting to enter the market, albeit in a modest way.

However, the altcoin market still faces challenges from major macro events this week. Specifically, the PPI report released on September 10 and CPI on September 11 are often the “catalysts” that cause Bitcoin and altcoins to fluctuate strongly in the short term, putting the bulls in a fragile position.

3. Hyperliquid (HYPE)

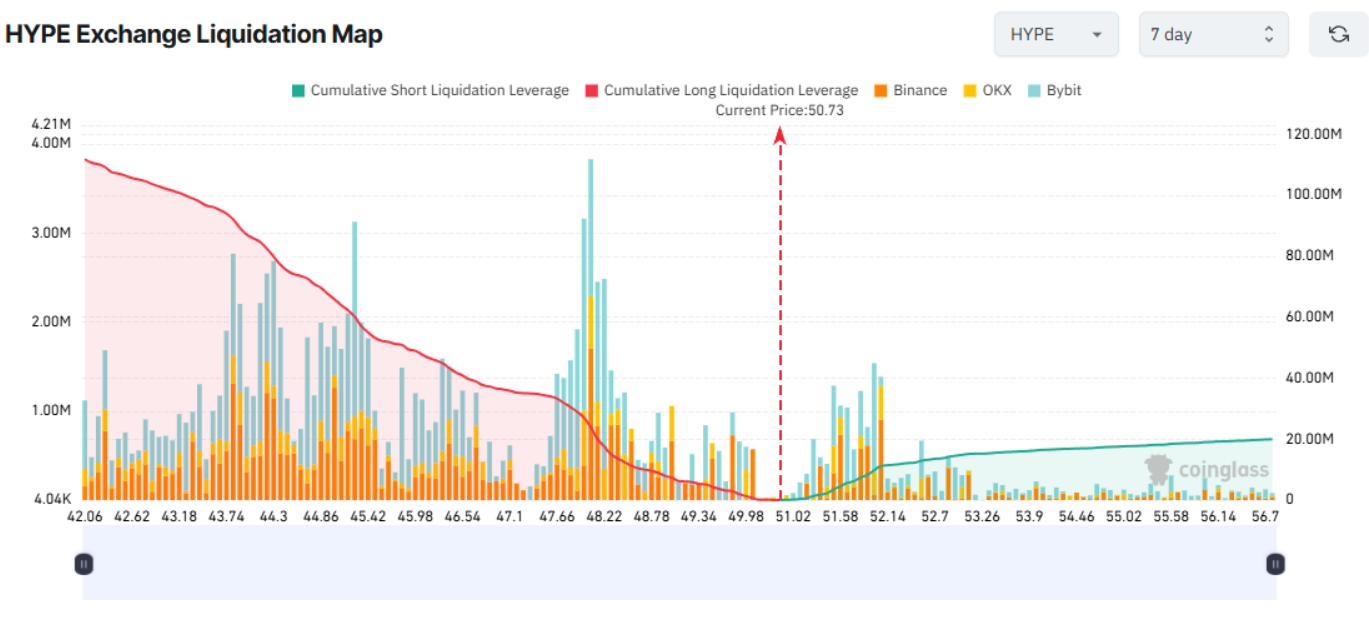

Hyperliquid (HYPE) is currently maintaining a price above $50, approaching its all-time high (ATH) and is expected to set a new record this week.

On social media X, most of the technical analysis on HYPE is bullish. Notably, the planned launch of its native stablecoin USDH in September has attracted interest from big names like Paxos and Frax Finance, further strengthening the bullish outlook of many traders.

However, the risks remain. If HYPE corrects to $42, Longing positions could face liquidations of over $111 million. On the other hand, if the price breaks to $56, Short would only be liquidated for about $19 million.

In fact, the market doesn’t always turn against the bulls – and they may be right this time. But it’s worth noting that whenever a cryptocurrency breaks past its previous high to set a new ATH, profit-taking pressure often spikes. If investors holding Longing HYPE positions fail to secure their profits in time, they could suffer heavy losses when the price suddenly reverses after the peak.

- Hyperliquid (HYPE) Aims for New ATH as Bullish Momentum Continues

- Dogecoin Price Surge Incoming? Analyst Suggests $4 Target

- 3 Warning Signs XRP September Could Hinder 2025 Bull Run

SN_Nour