CeFi’s subsidies are unsustainable, and the threshold for DeFi is too high, while CeDeFi is trying to provide an intermediate solution.

Written by Kean

Whether you’re familiar with Web3 or not, you’ve probably seen similar promotions recently: “USDC offers a 12% annualized current return.”

This isn't just a gimmick. While it's just a short-term, one-month interest subsidy offered by Circle, it also reflects the growing penetration of on-chain profit-making into a wider range of financial scenarios. For a long time, high-yield on-chain financial management was a niche activity reserved for "DeFi geeks," requiring users to connect their wallets, delve into complex protocol nesting, and constantly monitor yield curves, making it difficult for the average person to truly master it.

Today, with the integration of wallet products and CeDeFi architecture, these complex links have been gradually polished away, and a number of stablecoin financial products with simplified operations and annualized returns of 8%/10% or even higher have begun to emerge:

Their operational experience is no different from Yu'e Bao, but the profit logic is completely different - funds obtain real interest through on-chain DeFi protocols (such as Aave), and combined with platform subsidies, they eliminate the layers of commission collection in the traditional financial system. The final returns given to users are far higher than the bank's 1%-2% interest rate, which is a clear difference.

Objectively speaking, this is also a "Web2 & Web3 integration" trend that is taking shape, that is, on-chain financial management is gradually moving from a niche "DeFi geek gameplay" to a more universal mass wealth management tool that siphons off incremental traditional financial users.

1. The Current State of On-Chain Financial Management: From CeFi, DeFi, to CeDeFi

Broadly speaking, crypto financial products can be divided into two categories.

One type is centralized finance (CeFi) wealth management, which is hosted by exchanges and other platforms and has a friendly user experience, but is mainly structured products. There are fewer high-yield stablecoin wealth management products and they rely more on subsidies. The other type is decentralized finance (DeFi) wealth management, where returns are driven by on-chain protocols, funds are transparent, interest rates are real, and there are many high-yield leverage options, but for ordinary users, the operations are complicated and the threshold is relatively high.

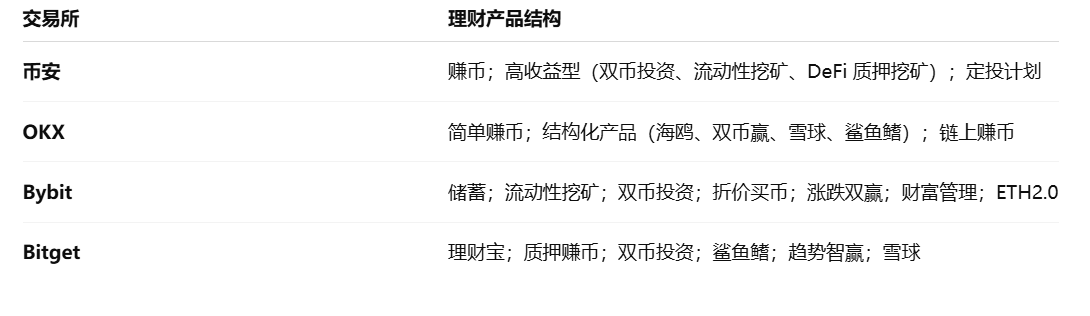

In the CeFi camp, in addition to traditional spot trading, high-risk contract trading, and high-threshold options trading, almost all leading exchanges have built distinctive financial management matrices, covering coin-earning savings, structured products, and on-chain/off-chain integrated asset management services.

Despite its dazzling array of product lines, it logically continues the path of traditional finance, with returns mostly relying on subsidies or structured designs. For professional users, it is a relatively diversified investment tool, but for ordinary retail investors, the most interesting "stablecoin wealth management" category has returns mostly maintained in the range of 1.74%-5.5%, and is not only subject to subsidy time limits and handling fee constraints. Although "easy to use", it is not attractive enough.

Relatively speaking, DeFi is more competitive in this regard. In addition to mainstream lending protocols such as Aave providing a long-term stablecoin benchmark interest rate of 4%-6%, emerging applications such as Nook, Stable, and Fuse also amplify returns through the "packaging" mechanism. This year, on-chain stablecoin wealth management products are subtly recreating the prosperous scene of DeFi Summer in 2020, attracting a considerable number of traditional Web2 users to join.

(Note: Comparison of USDC financial management on mainstream exchanges)

However, user experience has always been the biggest obstacle to DeFi. Connecting wallets, paying gas, understanding complex protocol logic and risk management, etc. These links make most ordinary investors discouraged . Although the returns are high, it is difficult for them to be passed on to the general public.

Because of this, the CeDeFi model is becoming an intermediate form worthy of attention. For example, the short-term subsidy activities of Circle and exchanges provide a phased high-interest experience, and Bitget Wallet's newly launched 10% stablecoin investment Plus further institutionalizes it and becomes a more representative case:

Long-term high interest rates: This isn't a one-time subsidy, but rather a combination of "agreed interest + platform-based permanent subsidies" that converts 10% returns into a regularized level. Extreme liquidity: Deposits and withdrawals are available anytime, with funds arriving within seconds. Even subsidies are settled simultaneously on a T+0 basis, offering a deposit and withdrawal experience similar to Yu'e Bao, while offering returns far exceeding those of traditional finance.

When users actually use Bitget Wallet's 10% Stablecoin Investment Plus, they will find that the front-end interface of this type of product is almost the same as a bank APP. Just click "Subscribe" to get a high interest rate close to DeFi, without having to worry about protocol interactions such as Aave and contract risk management, thus achieving both "ease of use" and "high returns".

In other words, the CeDeFi model is not a simple compromise, but provides a new path worth observing: traditional CeFi is difficult to meet users' demand for high returns on stablecoins, and native DeFi is difficult to popularize due to its high threshold. The balanced approach of CeDeFi makes it an important entry point to attract ordinary retail investors in Web3 and even traditional financial Web2 users.

2. Panorama of CeDeFi Stablecoin Income Sector

If the emergence of CeDeFi has made on-chain financial management closer to the public, then stablecoin financial management is undoubtedly the most core and most universal track.

The reason is simple: stablecoins, with their price pegged to fiat currencies and low volatility, are naturally suitable as underlying assets for wealth management. Even for Web2 users in the traditional financial system, USDT/USDC is often their first point of contact with on-chain assets. Therefore, stablecoin wealth management can almost be considered the "basic foundation" of on-chain wealth management.

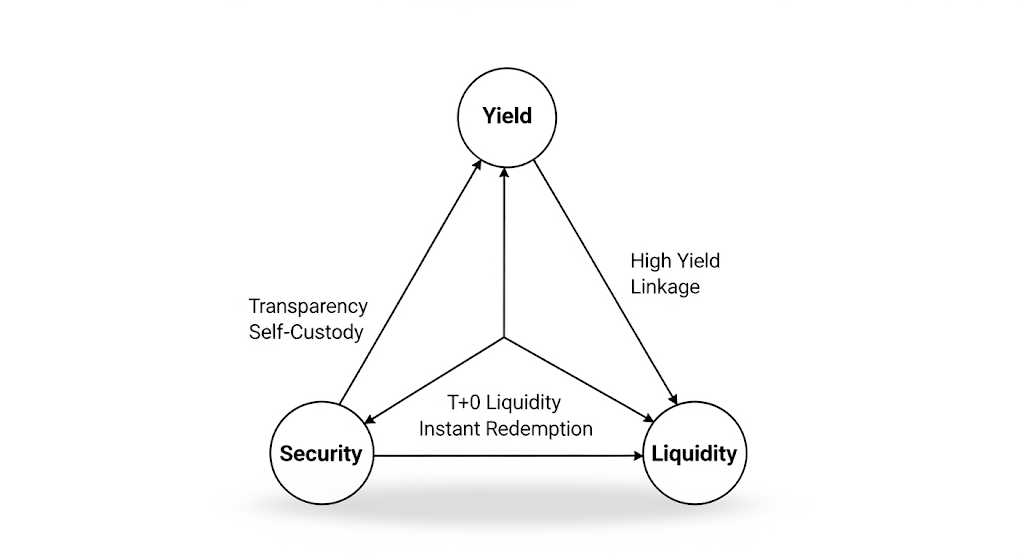

Compared with traditional finance, I believe that CeDeFi stablecoin investment should have at least three distinct characteristics:

Self-custody: Funds are always held in the user's wallet, without relying on centralized custody; 24/7 continuous income: Agreement interest accrues in real time, unlike traditional finance, which is usually bound by business days; Instant redemption, no lock-up period: Interest and principal can be redeemed at any time, a true "T+0" system;

To put it bluntly, the core logic of CeDeFi must be to combine the user experience of a bank account with the high-yield logic of the DeFi protocol.

(Note: Comparison of USDC financial management in mainstream Web3 wallets)

Judging from the current market situation, the returns of mainstream CeDeFi stablecoin wealth management products such as Trust Wallet and OKX Wallet generally remain at around 5%, and most of them are "fixed income" solutions based on US Treasury bonds on the chain. The returns are stable, but it is difficult to break through double digits.

In contrast, Bitget Wallet's newly launched stablecoin wealth management product has chosen a new path - directly connecting to mainstream DeFi protocols such as Aave to obtain real interest, and then adding a platform subsidy mechanism to stabilize the yield at 10%, making it a controversial but highly worthy case in the current CeDeFi model.

The key to this model is that it does not simply rely on short-term subsidies, but institutionalizes "DeFi interest + platform subsidies", and emphasizes transparency and sustainability. Users only need 1 USDC to subscribe: part of the overall income comes from the real on-chain lending interest generated by funds deposited in the Aave protocol, and the other part is provided by the platform to a certain extent. Profit subsidies ensure that the final annualized rate is not less than 10%.

The interest is paid out in the form of "hourly settlement" and the payment is made in the form of "synchronous settlement upon redemption". When the user redeems the principal, the corresponding subsidy income will be directly airdropped to the wallet in proportion. In this way, the flow of funds is clearly visible and the source of income is transparent and traceable.

So from a structural point of view, it is not a high-yield promise "out of thin air", nor is it the subsidy-driven model commonly seen in CeFi. Instead, through an institutionalized income model, it guarantees an annualized return of 10% while taking into account transparency and user experience, providing a reference paradigm for the standardization of CeDeFi products.

Of course, whether these products can become key examples for CeDeFi's breakthroughs remains to be seen. But one thing is certain: when high returns, sustainability, and ease of use converge in stablecoin products, on-chain financial management will truly have the potential to become popular.

3. "Deposit and Withdraw at Any Time, Long-Term High Interest": From Crypto Native to Democratization

From this perspective, whether it is the 12% short-term subsidy of Circle and exchanges, or Bitget Wallet's representative 10% stablecoin wealth management Plus, the potential customer base is no longer limited to crypto-native users who are deeply engaged in Web3, but covers Web2 and Web2.5 users who are interested in stablecoins but have not yet fully entered the chain.

As mentioned above, for these users, they may have heard of high returns on the chain, but were discouraged by aspects such as wallet connection, gas fees, and contract logic. However, when stablecoin financial management began to have the features of "deposit and withdraw at any time", "visible returns", and "redemption in seconds", they saw for the first time a financial management form similar to banks or Yu'ebao, but with significantly higher returns.

This also explains why CeDeFi products such as Bitget Wallet actively focus on the experience of "deposit and withdraw at any time, and long-term high interest rates", in order to go beyond the crypto-native group and actively embrace a wider user group - from a longer-term perspective, this is part of the evolution of on-chain finance.

Their competitiveness lies in finding a new balance in the triangle of "high returns", "liquidity" and "security".

(The "Blockchain Trilemma" of Web3 Financial Management)

The first is "high yield" which is linked to the interest rate environment.

The traditional financial system has inevitably entered a cycle of interest rate cuts, and financial management returns have declined. Domestic bank current account interest rates have generally fallen to the 1%-2% range. Even the yields of many money market funds are already lower than the inflation level. In sharp contrast, the demand for lending in the on-chain market continues to grow.

Taking mainstream protocols such as Aave as an example, the interest rate of stablecoins has been maintained in the range of 4%-6% for a long time. Coupled with the subsidies from the CeDeFi platform, the annualized return eventually increased to 10% is not groundless. Therefore, Bitget Wallet's Stablecoin Wealth Management Plus is theoretically sustainable and has competitiveness far exceeding traditional finance in terms of returns.

The second is the compatibility of "liquidity" with user habits.

If returns determine the appeal of financial products, then liquidity determines their practicality. Traditional financial products generally have redemption waiting periods, with T+1 and T+2 being the norm. For the internet generation accustomed to instant deposits, this delay seems increasingly out of place.

The T+0, second-level payment model of on-chain financial management solves this pain point. For example, Bitget Wallet allows users to redeem their principal not only to recover the principal immediately, but also to have the interest income airdropped proportionally to the account, achieving true "instant payment".

This ultimate liquidity experience not only makes fund management more flexible, but also makes on-chain financial management more in line with the daily financial habits of Internet users, thereby lowering the entry threshold.

Finally, there is the improvement of "security" and transparency.

For a long time, Dark Forest has been the weak point of on-chain finance. Many investors are worried about smart contract vulnerabilities, hacker attacks, and even keep their distance from on-chain financial management due to the Rug Pull incident.

The transparency of CeDeFi is actually better than the black box operations of CeFi. For example, in the Bitget Wallet wealth management product mentioned above, users can clearly see that the assets are composed of three parts: principal, agreement interest and subsidy income, avoiding the "black box model" commonly seen in CeFi.

In theory, leading DeFi protocols represented by Aave have been running stably for many years without any major security incidents. Combined with the transparent flow of funds on the chain, their security is even better than most CeFi platforms in some dimensions. Funds are still self-hosted in users' wallets and cannot be misappropriated by the platform. The subsidy mechanism attracts user participation, but does not change the transparent nature of fund flows, which makes CeDeFi products easier to gain user trust in terms of security.

When visibility of high returns, immediacy of liquidity, and transparency of security are all realized in one product, CeDeFi stablecoin investment is no longer just an option for the Web3 native group, but has the potential to cross over to Web2.5 users.

Final Thoughts

Over the past decade, internet finance has used Yu'e Bao and Lingqian Tong to educate users into the habit of "saving and withdrawing at any time and seeing the returns"; and in the next decade, on-chain financial products may build on this foundation and provide higher returns and greater transparency.

From CeFi to DeFi, and then to CeDeFi, they are essentially answering the same unsolved question: Can high returns, strong liquidity and security be truly achieved at the same time?

The CeDeFi stablecoin investment we see today may just be a preliminary attempt to find the answer. Whether it’s the 12% short-term subsidy campaign between Circle and exchanges, or the long-term 10% return plan offered by Bitget Wallet, in the final analysis, they are all different solutions to this problem.

As to which model can survive the cycle and become the "on-chain financial management portal" that the general public truly trusts, it still needs time and market testing.