One of the fiercest battles in stablecoin history is taking place on Hyperliquid: the fight for control of the USDH token, a prize pool worth billions of dollars.

As Paxos, Frax, Agora, and even Hyperliquid’s Native Markets team join the race, the community faces the ultimate question: Who will shape the future of this stablecoin?

Four contenders and a $5.5 billion prize

USDH is a new stablecoin in the Hyperliquid (HYPE) ecosystem, a decentralized exchange that is gaining a lot of attention. Notably, the “USDH” ticker — the official label to identify the stablecoin on the platform — has become the target of fierce competition. This competition is between major players.

Stablecoin USDH from Hyperliquid. Source: Hyperliquid

Stablecoin USDH from Hyperliquid. Source: HyperliquidHyperliquid’s validators will directly vote to decide which pool will own the USDH token. This is completely different from traditional stablecoins, which are usually issued by a single company. Here, control is democratized through community voting, making crypto one of the most transparent and competitive races ever seen.

Four formal proposals have been submitted: Paxos Labs, Frax Finance , Agora, and Native Markets as of this week. The scale of the competition for the USDH token has stunned the market, with more than $5.5 billion worth of stablecoins in circulation. According to Gauthamzzz , about $220 million in annual revenue is tied to who wins the USDH token. This isn’t just a matter of branding — it’s control of a critical piece of financial infrastructure.

From a security token to the future of stablecoins

While many are calling this “the biggest stablecoin bidding war in crypto history,” skepticism remains. Analyst Ryan Watkins argues that the real question isn’t whether a “large institution” or a “native team” will win. Instead, the winner needs to ensure it aligns with Hyperliquid’s long-term vision.

Others have expressed concern that the current proposals are “quite disturbing.” They warn that they could reduce transparency and pave the way for greater centralization. On the contrary, the enthusiasm of the community is undeniable. According to Zach , the momentum behind the vote shows that people “see the opportunity and are excited about the control it brings.” Some have even described the event as “the height of crypto” — a rare moment when traditional finance and native DeFi collide in an open, chaotic, yet groundbreaking contest.

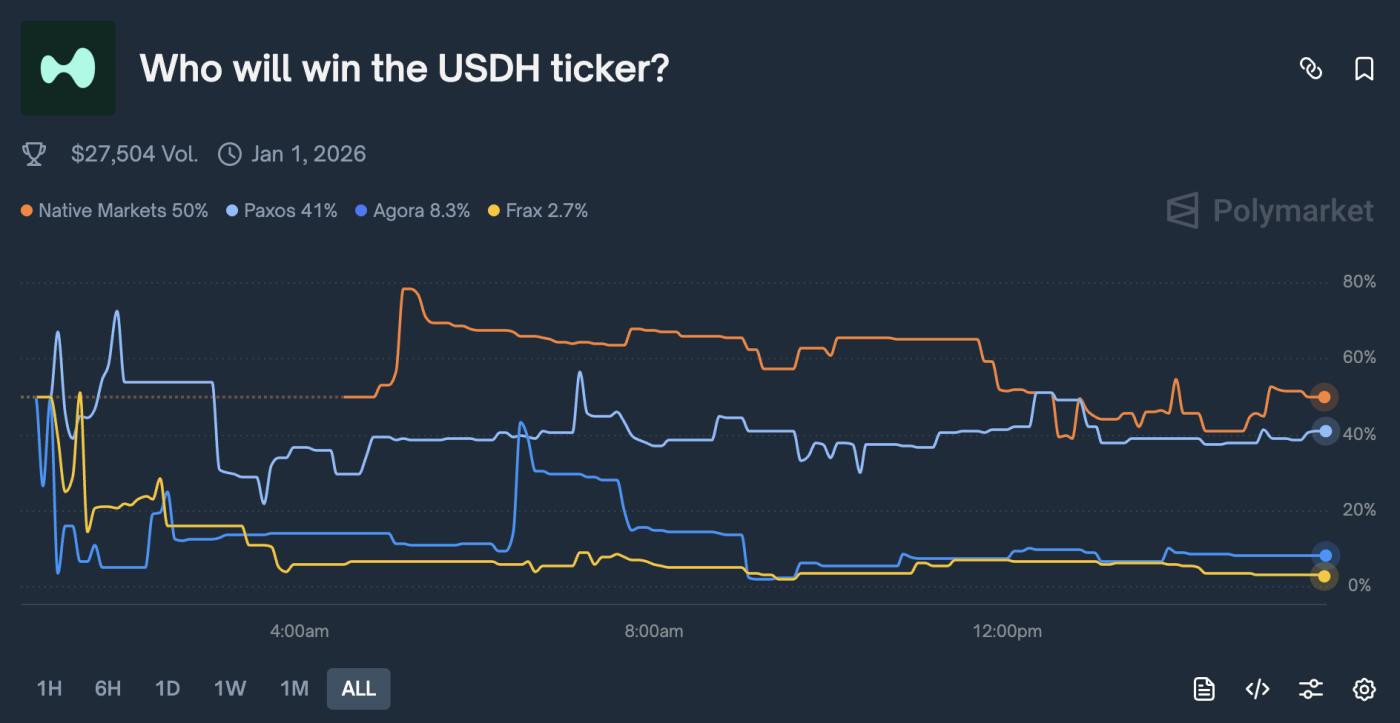

The excitement has even spilled over into prediction markets . Polymarket has opened a bet on “Who will win the USDH token?” This underscores that USDH is not just a token, but a symbol of the shifting balance of power in the stablecoin space.

Native Markets is predicted to be the winner. Source: Polymarket

Native Markets is predicted to be the winner. Source: PolymarketThe outcome will set an important precedent. Will deep-pocketed traditional financial institutions dominate stablecoins, or will they remain in the hands of native, community-driven teams? Either way, the USDH battle will become a case study in how DeFi can democratize financial control. It will also XEM how much the community truly values decentralization.