Solana price has burst back into the spotlight after Galaxy Digital moved more than $536 million into SOL within just 24 hours. The aggressive accumulation, paired with a $1.65 billion investment into a Solana-focused treasury company, is fueling fresh talk of a “Solana Season.” On-chain data, corporate adoption, and regulatory momentum are converging at the same time Solana’s price chart shows a clear bullish breakout. The question now is whether this surge in institutional interest is setting the stage for Solana’s next major rally.

Solana Price Prediction: Corporate accumulation sparks Solana momentum

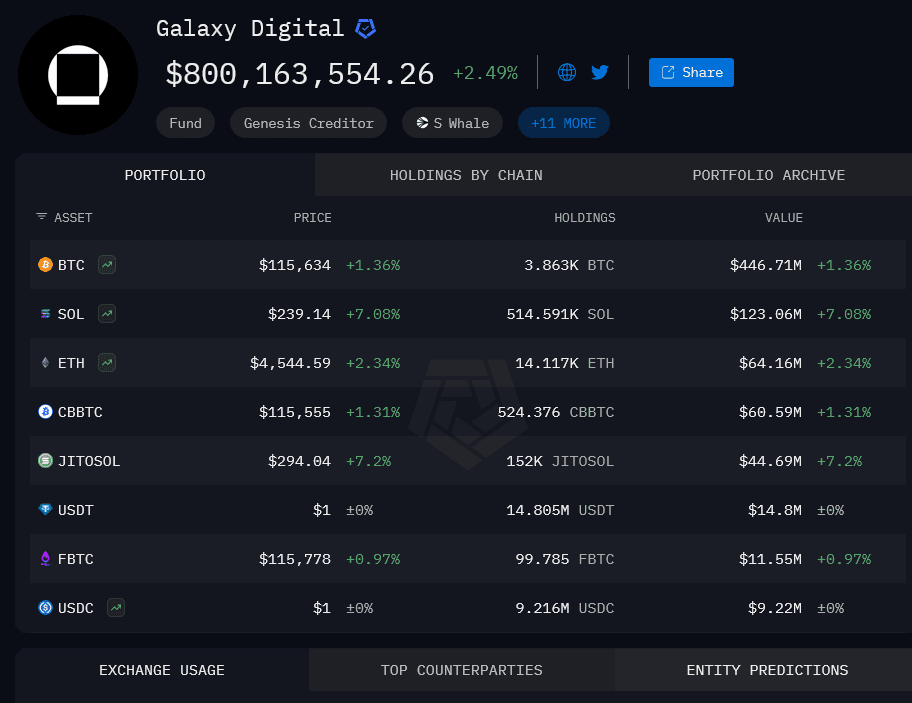

Galaxy Digital has made headlines by receiving over 2.31 million SOL (roughly $536 million) in just 24 hours, spread across transfers from Binance, Coinbase, and Bybit wallets. This comes right after Galaxy, alongside Jump Crypto and Multicoin Capital, led a $1.65 billion private placement in Forward Industries, which is now pivoting into a Solana treasury strategy.

The timing is significant. Corporate accumulation at this scale adds legitimacy to the growing narrative of Solana as an institutional-grade asset. CEO Mike Novogratz described the coming months as a “season of Solana,” while Bitwise CIO Matt Hougan pointed to treasury purchases and ETF prospects as strong tailwinds.

The combination of direct on-chain buys and corporate treasury adoption effectively shifts the supply-demand balance in Solana’s favor. Public treasuries already hold 4.67 million SOL, and more inflows are likely as Forward Industries begins accumulating.

Solana Price Prediction: SOL Price action on the chart

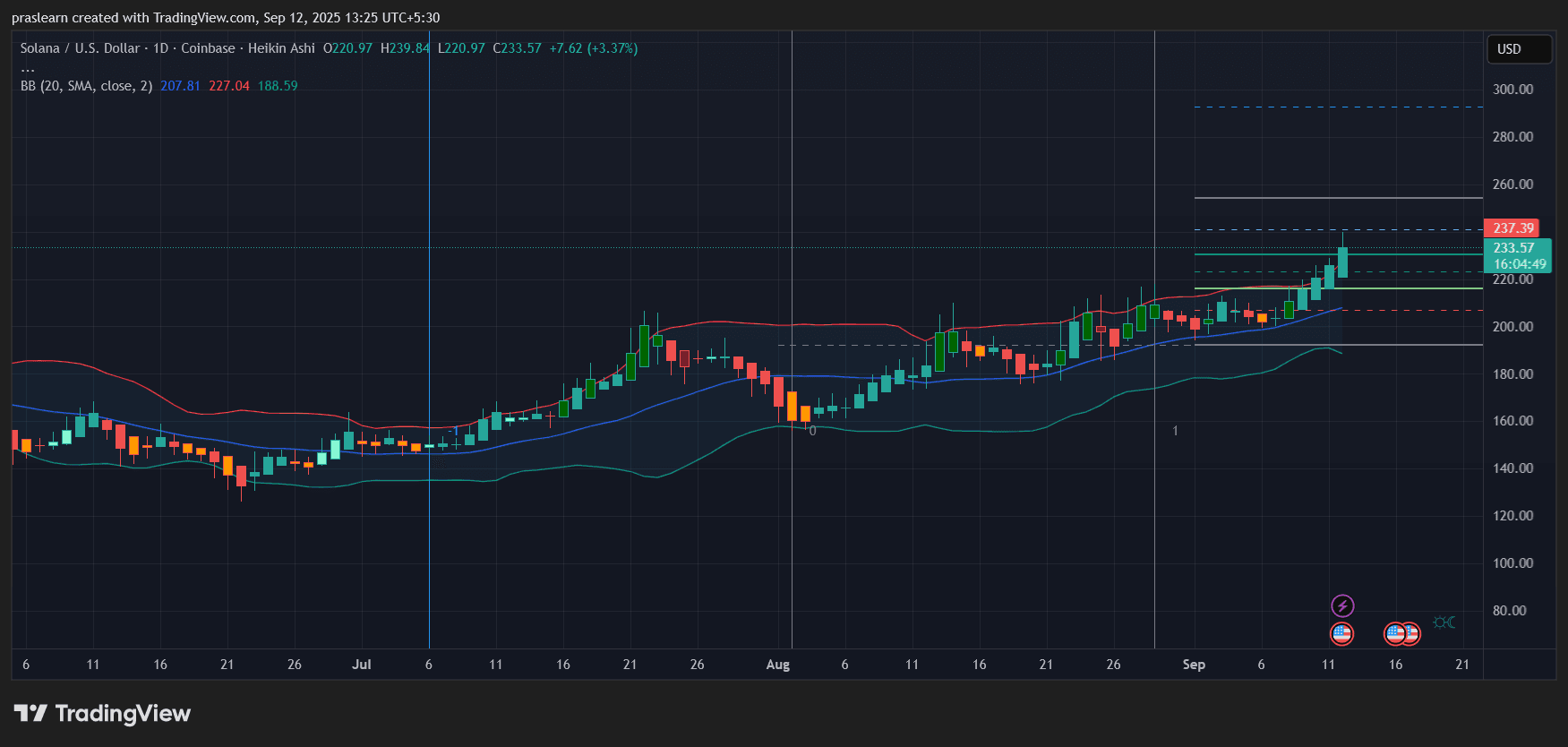

Looking at the daily SOL/USD chart, Solana has broken above the $220 resistance zone, closing near $233 with strong bullish candles. Heikin Ashi shows continuous green momentum, confirming trend strength. The Bollinger Bands are expanding, and price is hugging the upper band, which is a textbook bullish continuation signal.

The middle band around $207 is acting as solid support, while the red band at $227 has now flipped into a support/resistance pivot. As long as SOL stays above $220, the bullish structure remains intact.

Upside levels to watch:

- Immediate resistance is at $237–240, marked by the recent Bollinger and Fibonacci extensions.

- A clean breakout above $240 could open a path toward $260, with a psychological round number at $250 acting as an interim test.

- Longer term, the Fibonacci extension points toward $300 if buying pressure sustains.

Downside risk is relatively contained in the near term, with $207 as the critical support. A breakdown below this level would weaken the bullish case and likely send SOL back toward $188.

Solana Season: Market psychology and positioning

Institutional-scale purchases tend to create a snowball effect: retail traders front-run treasuries, whales tighten supply further, and short sellers face liquidations. With Galaxy and its partners signaling confidence, market psychology has tilted strongly bullish.

At the same time, the pace of accumulation matters. If Galaxy’s inflows continue aggressively, short-term overbought conditions could emerge, creating volatility. However, the bigger picture is clear: Solana is positioning itself as the primary alternative to Ethereum for both retail and institutions.

Solana Price Prediction: What’s next for SOL price?

Given the corporate inflows, favorable regulatory narratives, and bullish chart structure, Solana looks poised for further upside. The next week will be critical in confirming whether $237–240 breaks cleanly. If so, $260 could be reached within weeks, with $300 not out of reach if momentum continues into October.

The risk to this thesis lies in macro shocks (rate decisions, Bitcoin volatility) or if institutional buying pauses after the recent burst. Even then, the growing footprint of Solana treasuries suggests pullbacks may be shallow and quickly absorbed.

$Solana is no longer just a high-beta altcoin. With Galaxy Digital and other major players entering the treasury game, it is being reframed as an institutional-grade Layer 1. The price chart supports this narrative with a strong breakout setup. If the $237–240 zone gives way, $SOL could be entering the kind of bull run that Novogratz calls the true “Solana Season.”