By Prathik Desai

Compiled by: Block unicorn

September 9, 2024

Sol Strategies, then still operating under its original name, Cypherpunk Holdings, had not yet rebranded. It was still traded on the Canadian Securities Exchange, a market typically reserved for small and micro-sized companies. Just a few months earlier, the company had hired former Valkyrie CEO Leah Wald as its new CEO. At the time, Cypherpunk was little-known and received minimal investor attention.

Meanwhile, Upexi focused on promoting consumer products for direct-to-consumer brands, specializing in categories like pet care and energy solutions on Amazon. In this crowded market, competition for clicks was fierce. DeFi Development Corp (DFDV), then still operating under its old name, Janover, was preparing to launch a marketplace connecting real estate syndicators and investors. Sharps Technology, on the other hand, produced specialized syringes for healthcare providers, a niche medical tech sector that attracted little investor attention.

These companies were small in size and ambition at the time. Their combined Solana (SOL) holdings were less than $50 million.

A year later, the situation has changed dramatically.

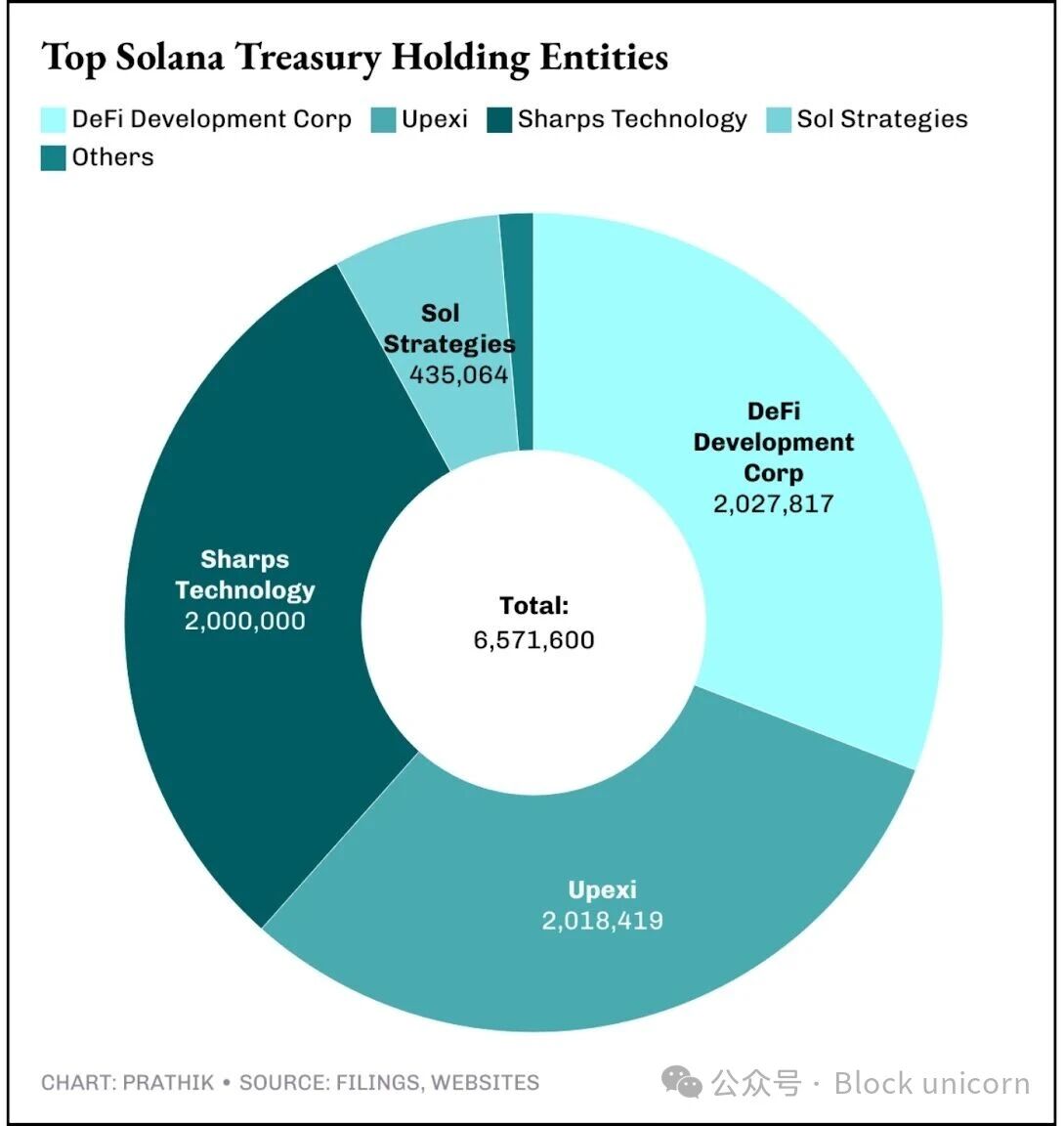

Today, they proudly list on Nasdaq, the world’s second-largest stock exchange, and hold over 6 million Solana tokens, valued at $1.5 billion. This represents 30 times the value of their Solana token holdings from a year ago.

Last week, the ringing of the Nasdaq bell in New York wasn't the only milestone marking Sol Strategies' listing on the exchange. A virtual bell also rang, marking the same milestone: STKE officially began trading.

The company invites community members to participate in the ceremony by visiting stke.community and "ringing the bell" through a Solana transaction. This action will permanently record their participation in this historic moment. In many ways, this marks a graduation for Sol Strategies, which previously listed on the Canadian Securities Exchange (under the symbol "HODL") and on the OTCQB Venture Exchange (under the symbol "CYFRF"), a stock market for mid-cap companies.

I call it "graduation" because gaining access to the Nasdaq Global Select Market, known for its stringent standards and typically reserved for blue-chip companies, is no easy feat. Passing this ordeal gave Sol Strategies something most crypto companies dream of but rarely achieve: legitimacy.

This is also an important reason for Sol Strategies to go public, although institutional investors seeking to invest in Solana on Wall Street already have Upexi and DeFi Development Corp to invest in.

Unlike Upexi and DeFi Development Corp, both of which were already public companies before their move to Solana Money Management and each held over 2 million SOL, Sol Strategies chose the slow path. It established a validator operation, won institutional authorizations like ARK Invest’s 3.6 million SOL, passed a SOC 2 audit, and strategically positioned itself on the Nasdaq Global Select Market, the exchange’s top market.

While other firms simply hold SOL, Sol Strategies actively operates the infrastructure that supports it, turning those holdings into viable businesses.

I dug deeper into Sol Strategies' balance sheet to understand the story behind the numbers.

For the quarter ending June 30th, Sol Strategies reported revenue of $2.53 million Canadian dollars (approximately $1.83 million USD). While this figure itself may seem ordinary, the real story lies in the details. This revenue was generated entirely from the approximately 400,000 SOL staked and from operating validators securing the Solana network, rather than from selling traditional products. While Upexi's non-cryptocurrency secondary commerce business has been a drag on its growth, DFDV relies heavily on ongoing fundraising to fuel growth, and still derives 40% of its revenue from its non-cryptocurrency real estate business.

By offering validators as a service, Sol Strategies has created a new revenue stream from its Solana treasury management business. This approach provides ongoing income without the burden of growing debt or traditional overhead.

Sol Strategies delegates SOL on behalf of its institutional clients, including a 3.6 million SOL mandate from Cathie Wood's ARK Invest in July. Commissions from these delegations generate a steady stream of revenue. Call it income or fees, but from an accounting perspective, it's income—something many cryptocurrency fund managers fail to capture.

Solana validators typically collect around 5%-7% in staking rewards commissions. With the base staking yield hovering around 7%, these delegated tokens generate approximately 0.35%-0.5% in notional value per year for validators. At 3.6 million SOL (over $850 million at current prices), this translates to over $3 million in annualized fee revenue, not including any price appreciation or gains from Sol Strategies' own capital. This represents an additional revenue stream, exceeding half of the 400,000 SOL staking rewards it holds, which are generated entirely with other people's money.

Sol Strategies’ net profit for the third quarter showed a loss of 8.2 million Canadian dollars (about 5.9 million U.S. dollars). However, excluding one-time expenses such as amortization of acquired validator intellectual property, stock-based compensation, and listing costs, its operations are cash flow positive.

What truly sets Sol Strategies apart from its competitors is its perspective on Solana. For the firm, the product isn't just the Solana token, but the entire Solana ecosystem. This unique perspective, both innovative and strategic, sets Sol Strategies apart in the space.

The more delegators Sol Strategies attracts, the more secure the network becomes. As its validators are perceived as reliable, this attracts even more delegation. Every user who stakes to a Sol Strategies node is both a customer and a co-creator of its revenue, transforming community participation into a measurable driver of shareholder value. This approach ensures that every participant feels invested in the company's success.

This is likely the most important factor that gives Sol Strategies an edge over its peers who hold more Solana tokens.

Currently, at least seven listed companies control 6.5 million SOL, with a total value of approximately US$1.56 billion, accounting for approximately 1.2% of the total supply.

In the Solana fund management race, each firm is vying to become the preferred agent for investors seeking Solana exposure. Each firm has a slightly different strategy: Upexi acquires Sol at a discount, DFDV is betting on global expansion, and Sol Strategies is focusing on a diversified reserve of assets. The goal is the same: accumulate Sol, stake it, and sell a packaged product to Wall Street.

Bitcoin's path to Wall Street was paved by companies like MicroStrategy, which transitioned from a software business to a leveraged BTC fund manager, achieving this through a highly successful spot ETF. Ethereum has followed a similar path, through companies like BitMine Immersion, Joe Lubin's SharpLink Technologies, and, more recently, a spot ETF. For Solana, I expect adoption to primarily occur through operating companies within the network. These companies not only hold the assets but also operate validators, earning fees and staking rewards, and publishing quarterly returns. This model is closer to active management than an ETF.

It’s this combination of NAV appreciation and real cash flow that may well convince investors to invest in this way. If Sol Strategies succeeds, it could become Solana’s answer to BlackRock.

The relationship between Wall Street and Solana will become closer in the future.

Sol Strategies is already exploring the possibility of tokenizing its own shares on-chain. Imagine STKE shares not only existing on Nasdaq but also as Solana-based tokens, exchangeable in DeFi pools and instantly settled alongside USDC. Having a Nasdaq-listed stock that also trades on-chain would be a bridge too far for an ETF. While this is still speculative, it's a step toward blurring the lines between public equity and crypto assets.

However, this was not an easy task. Graduating from Nasdaq brought new challenges and greater responsibilities for Sol Strategies.

Poor validator performance or missing governance steps could trigger immediate investor backlash. Sol Strategies' decision to bet on the Solana ecosystem, rather than just the Solana token itself, could present greater risk and corresponding rewards. Solana itself faces network failures and competition from emerging blockchains. If stock investors find the stock trading far below net asset value, arbitrageurs may sell, ignoring fundamentals.

Nonetheless, I believe Sol Strategies’ Nasdaq listing represents Solana’s best chance at a front-row seat on Wall Street. Can you package on-chain funds into packaged investment products and then integrate them onto Nasdaq? Sol Strategies now shoulders that daunting responsibility.