By arndxt , Crypto KOL

Compiled by Felix, PANews

This year's "January Barometer" research has been surprisingly accurate, suggesting a market reversal is imminent. The risk/reward ratio looks unbalanced: the probability of a correction after the FOMC meeting is high.

It is recommended to lock in profits before the last wave of rise.

Image source: Rambo Jackson

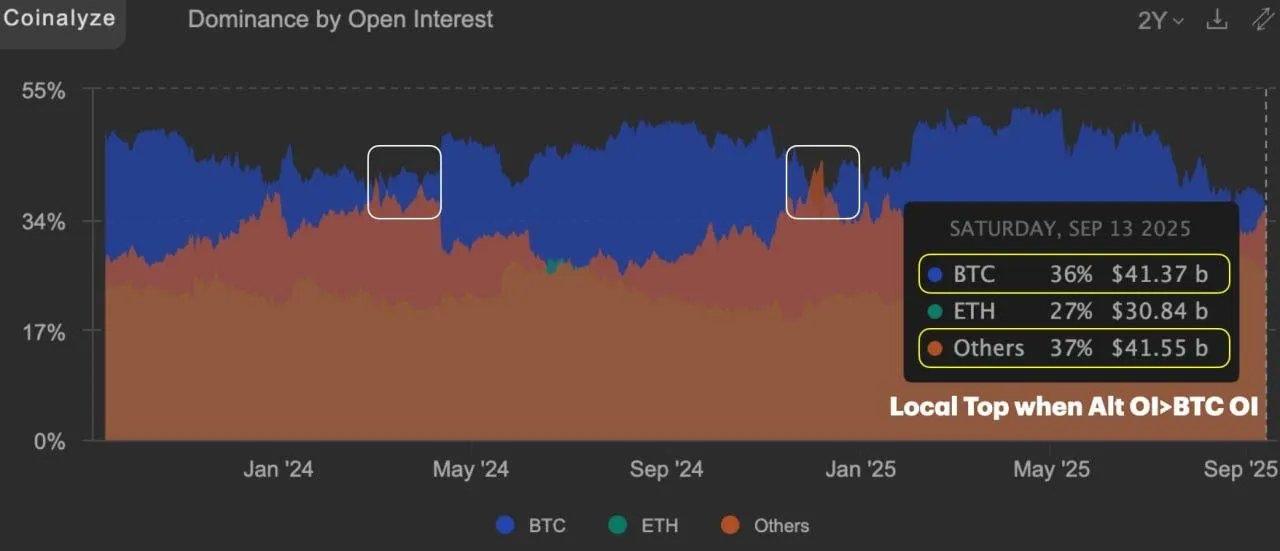

This is the first time since December that Altcoin open interest has surpassed Bitcoin’s, with the previous two times this occurred following local highs.

Perhaps only 1% of participants can feel truly excited. For everyone else, the winners will be those who hold assets that can still pay attention when liquidity is low.

Liquidity is selective, the macro environment is unfavorable, and fiat currencies are depreciating. Despite the unfavorable environment, assets are still rising.

The biggest cycle difference: 2021 is a liquidity-driven cycle. Credit costs are low, liquidity is abundant, and risk assets are "smooth sailing."

2025 is different. Interest rates are high and liquidity is tight. Yet, risk assets, from Bitcoin to gold, are slowly rising.

Interest rates are high, credit is tight, and yet assets from Bitcoin to gold are still climbing. The driver is the devaluation of fiat currencies: Investors are hedging against the devaluation of cash.

This has changed the market's tempo, with a broad-based risk-on rally giving way to selective inflows into quality and risk-resistant assets. The rules of the game have shifted from chasing everything to timing, patience, and discipline.

The reason? Because fiat currencies themselves are weakening. Investors are looking not only for growth but also for protection against the devaluation of cash.

- 2021: Growth driven by liquidity expansion → Risk assets outperform.

- 2025: Growth driven by fiat currency devaluation → Hard and high-quality assets perform strongly.

This makes the game tougher: you can’t rely on “money that’s everywhere.” But it also creates more favorable opportunities for those who adapt.

Liquidity status test

Despite positive signals (declining BTC dominance, Altcoin holdings > BTC holdings, CEX token rotation), liquidity remains scarce. The influence of memes and celebrity coins has caused post-traumatic stress disorder (PTSD) in the market.

Image source: Jukov

Traders suffering from PTSD chase the next hot project, leaving little ongoing funding for builders.

As a result, liquidity is concentrating towards higher market capitalization assets with loyal communities that can sustain attention and capital inflows.

The Federal Reserve and Bonds

The bond market has already priced in a downward trend. The probability of the Fed observing a 25 basis point rate cut is about 88%, while the probability of a 50 basis point rate cut is about 12%. The subtle differences are:

Historically, the first 50 basis point rate cut = recession signal, leading to a slow drain on the market.

A 25 basis point interest rate cut = a signal of a soft landing, which is conducive to economic growth.

We are approaching a critical juncture. Based on seasonal indicators (such as the January Barometer), the risk of market volatility following the FOMC meeting has increased significantly.

The key is:

- Stability beats hype.

- Patience trumps FOMO.

- Timing trumps alpha.

Last week's market overview

Dogecoin ETF Milestone: REX Shares and Osprey Funds' DOJE ETF marks the first U.S. fund directly tied to Dogecoin. This demonstrates the memecoin's acceptance within traditional markets, though retail investor demand is likely to dominate given Dogecoin's lack of utility.

The Chicago Board Options Exchange (Cboe) plans to launch continuous futures contracts for Bitcoin and Ethereum: The proposed Bitcoin and Ethereum contracts would have maturities of up to 10 years and be cash-settled daily. This could reduce rollover costs, expand institutional derivatives strategies, and increase liquidity—pending regulatory approval.

Ant Digital Asset Tokenization: By connecting $8.4 billion in renewable energy assets to Ant Chain, Ant Digital introduced real-time production data and automated revenue distribution. This institution-first model highlights the role of blockchain in large-scale infrastructure financing.

Forward Industries’ Solana Treasury: A $1.65 billion private equity investment led by Galaxy and Jump Crypto makes Forward Industries a significant holder of Solana. This is one of the first major institutional treasury investments outside of Bitcoin and Ethereum, and could reshape Solana’s capital markets narrative.

Related Reading:Trading Time: Central Bank Week Kicks Off, Bitcoin Needs to Consolidate $114,000 Support, Ethereum Strives to Hold $4,600