Written by Gui Ruofei, Cheryl, and Queenie

"Having escaped the shadow of the SEC lawsuit, Ripple is continuing its long-standing payment strategy amidst the controversy. Compliance efforts, such as cross-jurisdictional regulation and disclosure obligations, remain the underlying constraints on Ripple's operations and financing. Furthermore, Ripple's "payment (traffic) - custody (assets) - stablecoin (settlement)" flywheel is also gradually unfolding."

On August 7, 2025 , the SEC officially announced the withdrawal of its appeal, along with Ripple and two executives, and confirmed that the final judgment and relief arrangements remain in effect . After approximately five years, this significant regulatory saga has finally come to a close. This ruling fundamentally changes Ripple's compliance approach to issuing and operating XRP , and also establishes a new standard for determining the securities nature of cryptocurrencies . Over the past five years, the entire XRP ecosystem has continued to evolve and evolve, poised to thrive in the next cycle. This article will delve into the details of the litigation between Ripple and the SEC, as well as provide a detailed analysis of the XRP token and the vast ecosystem behind it.

1. What details are worth paying attention to in the long-running lawsuit between Ripple and SEC?

(I) Detailed review of litigation process and timeline

First of all, to deeply analyze the legal battle between Ripple and the SEC, it is necessary to sort out the timeline of the development of the lawsuit and the main progress.

On December 22, 2020 , the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple and two executives in the United States District Court for the Southern District of New York (SDNY), accusing them of raising more than $1.3 billion through unregistered digital asset securities issuance and seeking relief such as injunctions, disgorgement, and civil penalties.

On July 13, 2023 , Judge Analisa Torres granted partial summary judgment :

- With respect to XRP sold through institutional sales , the court held that, given the existing facts and contractual arrangements, the investment contract criteria under the Howey test were met.

- Regarding XRP’s “programmatic sales/secondary market trading on exchanges,” the court held that the SEC failed to demonstrate the reliance of retail buyers without specific counterparties on Ripple’s management efforts and their expectation of profits .

- Regarding XRP in “Other Distributions,” the court held that it lacked the element of “invested money,” or consideration, and therefore did not constitute an investment contract.

(The above picture shows the final conclusion of the summary judgment in July 23)

On October 3, 2023 , the court denied the SEC's request to appeal the portion of the ruling in favor of Ripple. On October 19, 2023 , the SEC voluntarily dismissed its remaining claims against the two executives, thereby avoiding the scheduled jury trial.

After entering the relief phase, the court issued a final judgment and permanent injunction on August 7, 2024 :

- The judgment does not order the disgorgement of XRP (disgorgement) nor the calculation of interest;

- assessed civil penalties of approximately $125 million ;

- Imposing a permanent ban on institutional sales of XRP

At the same time, in June 2025, the court rejected the two parties' request for an "indicative ruling" to settle for a lower amount.

This protracted tug-of-war finally came to an end recently. On August 7, 2025 , the SEC announced that it, along with Ripple and two executives, had withdrawn their appeal, confirming that the final judgment and relief arrangements remained in effect .

2. What is the core dispute in the SEC vs. Ripple lawsuit?

The core of the dispute in this case cannot be simply understood as "whether XRP is a security", but whether Ripple's specific issuance/sales of XRP constitute an investment contract within the meaning of the Securities Law.

The U.S. Supreme Court’s classic definition of an “investment contract” in Howey is: “ A contract, transaction, or arrangement whereby one person invests money in a common enterprise with the expectation of returns derived primarily from the efforts of others. ”

(“an investment of money in a common enterprise with profits to come solely from the efforts of others.”)

This judgment standard can be expanded into the following four elements:

- an investment of money ;

- in a common enterprise ;

- with a reasonable expectation of profits to be derived from the efforts of others

- Profits are derived solely from the managerial or entrepreneurial efforts of the promoter or a third party.

(The above figure is a detailed analysis of the Howey test in the summary judgment in July 2023)

In the SEC's framework of charges, Ripple's institutional sales of XRP were accompanied by negotiations, information exchanges, and contractual commitments to institutions. The court therefore determined that these institutional buyers had more obvious expectations of profits from XRP and attributable management efforts to Ripple, meeting the investment contract criteria in the Howey test.

However, programmatic trading of XRP is essentially secondary trading in the open market, conducted through a centralized counterparty . The SEC struggled to prove that such buyers had reasonable profit expectations that could be identified by the court. Therefore, the Southern District Court of New York determined that the SEC's evidence regarding such transactions was insufficient.

As for XRP in other distribution channels , since this portion of XRP is primarily used for Ripple employee incentives or ecosystem subsidies, holders of this type of XRP typically do not pay a corresponding price when acquiring XRP . Therefore, these buyers lack the core element of "capital investment" and therefore do not trigger the Howey Test.

In summary, the court made a detailed distinction between XRP based on the type of behavior . The fact that the same token, in different trading scenarios, can lead to vastly different securities law conclusions is precisely the reference value of this case's ruling.

(3) What impact will this lawsuit have on the Ripple and XRP ecosystem?

For Ripple, this lawsuit effectively demarcates the line between compliance and business operations. Fundraising and distribution of XRP to institutional or private investors must comply with the securities issuance compliance framework or fully meet the requirements for exemptions. While the risks associated with XRP's market circulation have not been fully mitigated, the Howey test framework significantly limits SEC oversight. For the XRP ecosystem, the majority of XRP circulating in the secondary market is safe from being classified as a "security," objectively mitigating direct compliance risks for trading platforms and market makers. However, all scenarios involving private financing, over-the-counter agreements, placements, and lock-up activities involving XRP still require rigorous compliance design and risk management.

More broadly, this case further shifts the industry's discussion paradigm regarding the "essential attributes of tokens"—the application of securities law to cryptocurrencies should be categorized based on "transactional behavior," rather than a one-size-fits-all approach based on "token nature ." This is likely to have long-term structural implications for the design of subsequent cryptocurrency token economics (e.g., utility tokens, incentive-based distribution, and ecosystem subsidies) and the specific scope of information disclosure .

Overall, Ripple achieved a key victory in the most sensitive secondary market circulation level, but accepted SEC regulatory requirements at the "fund-raising-issuance" level for institutions.

2. How does Ripple’s business empire operate and develop?

The official conclusion of the legal dispute not only clears the way for Ripple to expand into the global market, with the United States as a key node, but also rekindles the attention of investors worldwide for this controversial company and its closely associated token, XRP. Among well-known, established cryptocurrencies, XRP has always been a formidable presence. It once created a frenzy of wealth creation, yet was also widely delisted by top-tier exchanges. It boasts a vast following, consistently experiencing surges in market fluctuations, both large and small. However, it has also drawn widespread criticism, with accusations ranging from bubbles to centralization, a lack of an on-chain ecosystem, and unclear value capture mechanisms. This article will provide a preliminary introduction to Ripple's extensive product portfolio, its underlying public chain, the XRP Ledger (XRPL), and XRPL's native token, XRP. By focusing on Ripple's product portfolio, business model, development opportunities, and risks, we aim to provide readers with a preliminary understanding of this complex project and the underlying value proposition.

1. What exactly is Ripple?

Ripple , also known as Ripple Labs , is a comprehensive institutional-oriented fintech company that integrates cross-border payments, institutional-grade digital asset custody, stablecoin issuance, and blockchain infrastructure .

Ripple was originally founded in 2012 by developers Ryan Fugger and Jed McCaleb, aiming to leverage decentralized, highly efficient ledger technology to establish a trust-based payment network. However, it was the involvement of Chris Larsen, a Wall Street financial elite and founder of the US online lending platform E-Loan, that truly laid the foundation for the company's business empire. Unlike many believers in decentralization, Larsen's background as a prominent Wall Street financial expert enabled him to see a new potential for Ripple and the broader blockchain technology. Larsen envisioned Ripple not as a new system to replace the centralized financial system represented by banks, but as an excellent tool that would provide the underlying technical support for a radical upgrade in banks' cross-border payment capabilities. Larsen's ideas were fiercely criticized at the time by decentralization believers like McCaleb, but today, judging by the widespread use of stablecoins and Ripple's vast payment business, they are undoubtedly prescient.

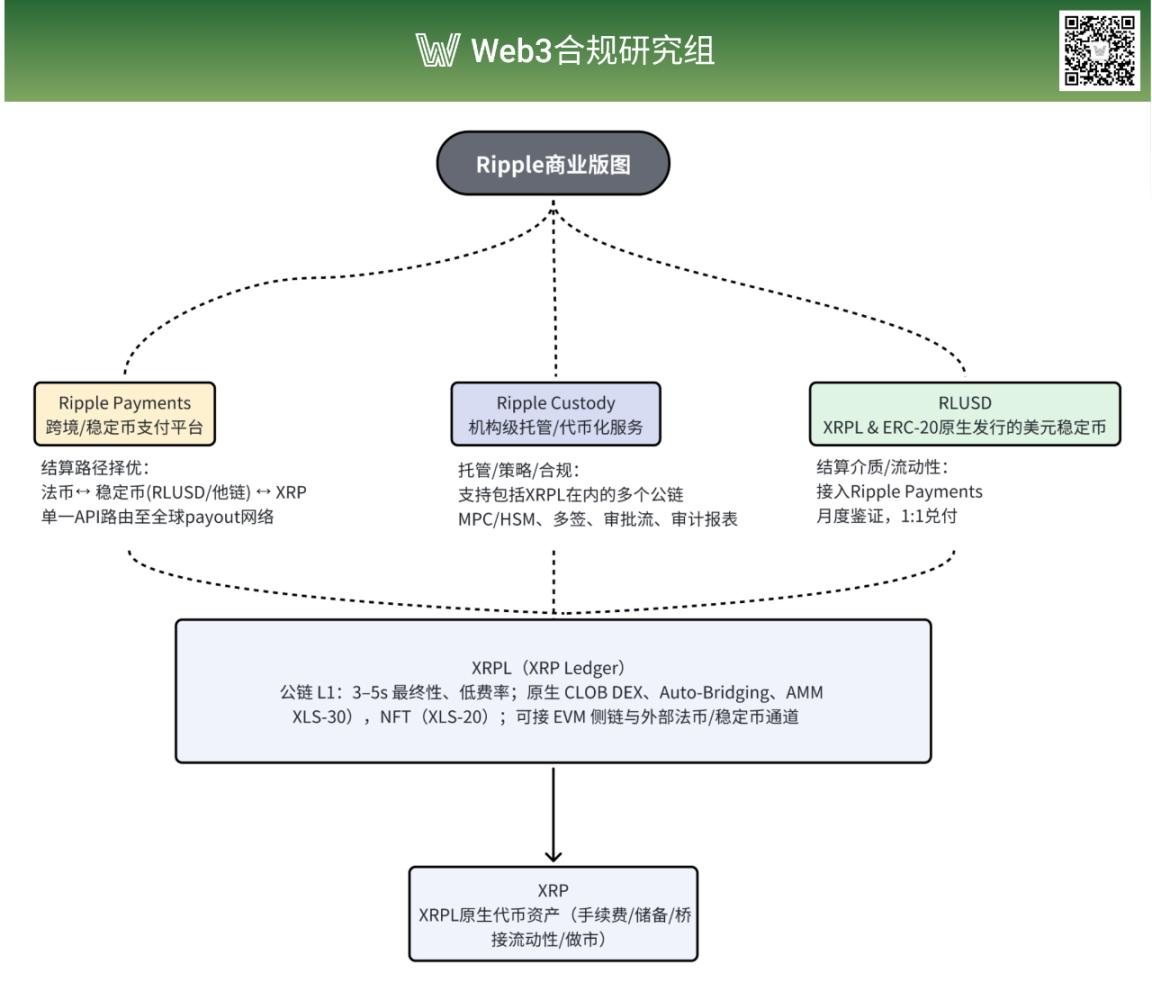

Today, Ripple, with the XRP Ledger public chain (XRPL) as its underlying technology stack and XRP as the native liquidity and fee asset of XRPL , provides comprehensive and systematic financial services including Ripple Payments cross-border payment settlement, Ripple Custody digital asset custody and tokenization, and the stablecoin RLUSD .

(II) Detailed Explanation of Ripple’s Product Portfolio

1. Ripple Payments cross-border payment platform

Ripple Payments provides cross-border payment services to payment providers, banks, multinational corporations, and other institutions worldwide. Ripple Payments offers three payment paths: fiat currency, stablecoins (including its own stablecoin, RLUSD, and other third-party stablecoins), and XRP. Ripple selects the optimal routing among these three paths in real time based on compliance, cost, and liquidity factors, enabling real-time cross-border payments. It also features built-in KYC/AML/sanctions screening and reconciliation auditing. Typical delivery scenarios include B2B/platform merchant settlement, remittances, cross-border payroll, and USD access for corporate treasuries.

As a global payment platform, Ripple Payments currently covers over 90 markets and 55+ currencies . Regarding compliance, Ripple Payments currently holds licenses and MTL certificates in 64 jurisdictions, including the United States and the United Arab Emirates , and is in the process of applying for compliance licenses from authorities in jurisdictions such as the European Union, the United Kingdom, and Singapore. Furthermore, Ripple Payments has obtained internationally recognized security certifications such as SOC 2 Type II and ISO 27001 , and has joined the American Bankers Association (ABA) and several national payment industry associations . This has helped establish a global payment trust mechanism encompassing data security, operational compliance, and industry collaboration, significantly enhancing its accessibility. As of June 2025, Ripple Payments has processed over $70 billion in settlements.

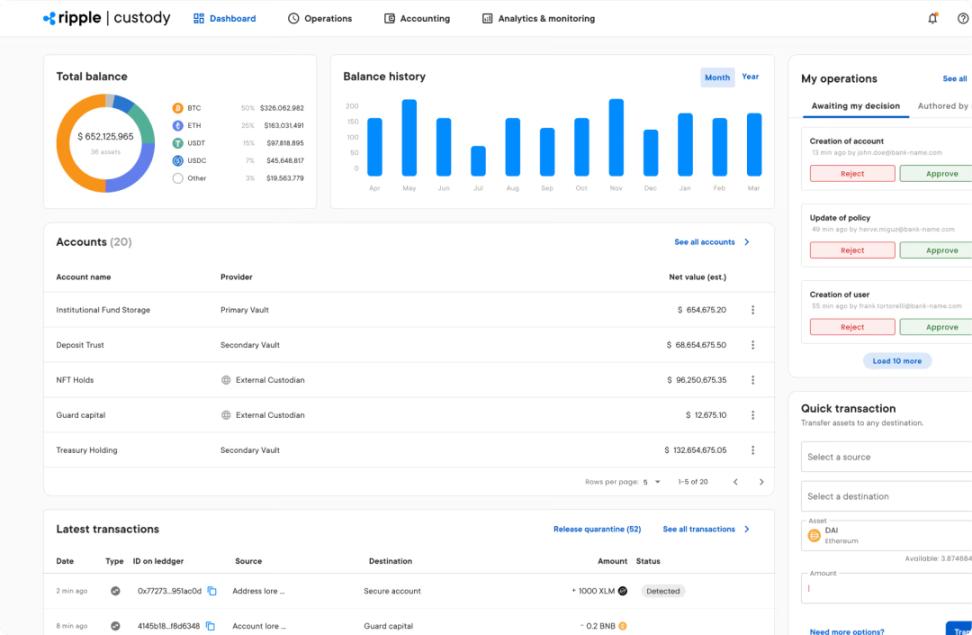

2. Ripple Custody Digital Asset Custody Solution

Ripple Custody is an institutional-grade digital asset custody solution for banks, custodians, exchanges, and large enterprises. Custody is the foundation of digital asset businesses, providing underlying security support for institutional use cases such as tokenization, stablecoin issuance, and digital asset management. Ripple Custody combines MPC/HSM key management, tiered hot and cold wallets, strategic approvals/authorizations, audit reporting, and compliance modules . Deployable on-premises or in the cloud , it offers customized custody services for institutions.

In addition to core digital asset custody capabilities, Ripple Custody also provides users with stablecoin issuance and management, as well as unified corporate back-end governance orchestration . Using Ripple Custody, institutions can mint/burn stablecoins and manage reserves on the XRP Ledger and any EVM-compatible chain, facilitating payment, settlement, and staking scenarios. (Existing use cases include SocGen FORGE issuing EURCV on XRPL and South Korea's BDACS custodying RLUSD.) Furthermore, institutions can use Ripple Custody to automate back-end processes such as settlement, reconciliation, and reporting on-chain, connecting public/private blockchains with core banking systems. Configurable policies and approval workflows ensure regulatory compliance and internal controls. These features demonstrate that Ripple Custody is not content to be a single digital custody service provider, but rather aims to build a one-stop digital asset operations platform covering the entire lifecycle of a company's tokenization and payments.

Ripple's ability to provide this integrated service stems from its partnerships with established brokers with extensive custody experience. By acquiring established brokers such as Metaco, a Swiss custody technology provider serving renowned institutions such as HSBC, Citibank, BNP Paribas, and SocGen FORGE, and Standard Custody & Trust (SCTC), which holds a NYDFS trust license , Ripple has not only introduced bank-grade custody and tokenization technology capabilities but also strengthened its product's regulatory compliance in various markets, including the US. Currently, Ripple Custody has achieved FIPS 140-2 Level 4 certification and complies with SOC 2 Type II and ISO 27001 standards . In April of this year, Ripple announced the acquisition of Hidden Road for $1.25 billion, marking one of the largest acquisitions in the cryptocurrency industry's history. This substantial acquisition will make Ripple the first crypto company to independently own and operate a global, multi-asset prime broker . The acquisition is currently pending regulatory approval and closing.

3. RLUSD Stablecoin

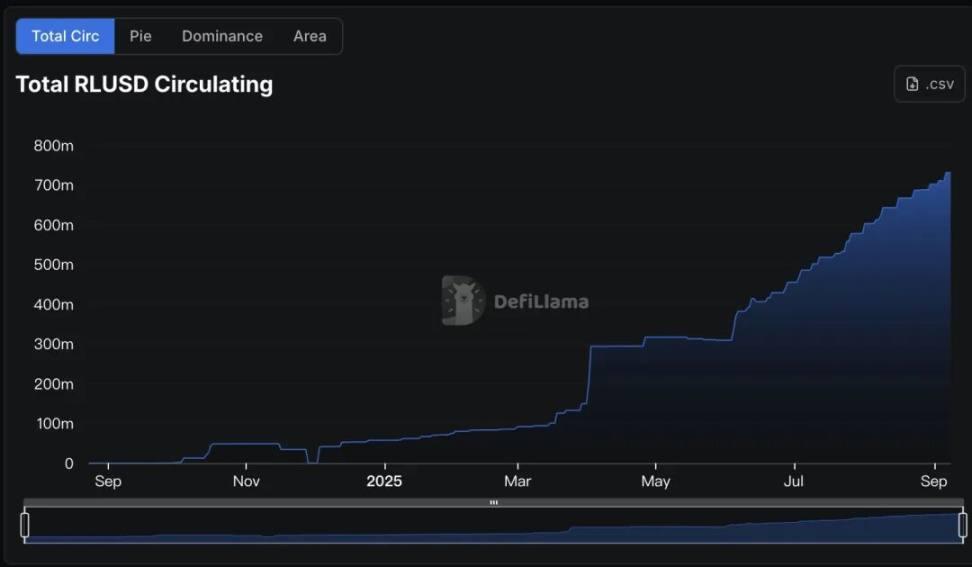

RLUSD is a USD stablecoin natively issued on the XRPL and ERC-20 blockchains by SCTC , a regulated entity within the Ripple ecosystem, under a New York limited trust license . It promises a 1:1 redemption ratio, with reserves held in cash and equivalents and verified monthly. Currently, RLUSD is integrated into Ripple Payments and connected to numerous deposit and withdrawal platforms and global exchanges, including Kraken, Gemini, Bitget, BitMEX, and Alchemy Pay. As of September 9th, over $730 million of RLUSD has been issued and in circulation.

(3) Ripple's technology stack: XRP Ledger and its native currency XRP

As the technical foundation of Ripple products, the XRP Ledger (XRPL) public chain has been optimized for financial scenarios since its inception:

- It can process over 1,000 transactions per second, with blocks closed in approximately 3–5 seconds . There is no long wait for “blocks being rolled back,” and the time it takes for funds to arrive is more predictable.

- The transaction fee is extremely low (basic 10 drops = 0.00001 XRP, which increases elastically with load and is destroyed to prevent spam), making it suitable for high-frequency, small-amount transactions. It will not experience peak surges like competitive gas transactions.

- Protocol upgrades require support from >80% of trusted validators for two consecutive weeks before they will be activated . Combined with the supporting Negative UNL, this means that "change management and fault tolerance" are written into the protocol layer, reducing the risk of forks/rollbacks and improving the predictability of SLAs and compliance launches.

XRPL's low cost, high efficiency, and controllability make it a natural fit to become the technical foundation for Ripple's full product line.

- In Ripple Payments, XRPL can handle a large number of payment settlement needs with a deterministic settlement time of approximately 3-5 seconds and extremely low, predictable fees. It also automatically finds optimal routes between fiat currency IOUs, stablecoins (including RLUSD/USDC on XRPL), and XRP through built-in DEX/AMM + Auto-Bridging , completing the "currency exchange + transfer" in one go.

- On the RLUSD side, the RLUSD stablecoin is natively issued on the XRPL chain and can directly participate in ledger-level trading pairs and liquidity pools, serving as a stable settlement medium for payments;

- On the Ripple Custody side, XRPL's native control primitives , such as multi-signature, account/object reserves, escrow/checks, authorization and freezing (IOU level), provide a programmable governance and reconciliation path for institutional custody, tokenization and compliance audits.

In addition to the mainnet, XRPL also launched the XRPL EVM Sidechain in June of this year. This sidechain, fully compatible with Mainnet and running in parallel with the mainnet, aims to bring EVM smart contract capabilities to the XRPL ecosystem while enabling value exchange via a bridge to the Ethereum mainnet. This allows complex business logic to be hosted on the sidechain, while the XRPL mainnet focuses on low-latency clearing and settlement, thus integrating the " payment (traffic) × stablecoin (settlement) × custody (governance) " closed loop within a single technology stack. This initiative further fills a long-standing gap in XRP's on-chain use cases. While the XRPL EVM Sidechain is still in its early stages, with user scale, liquidity depth, and protocol maturity still to be proven, as of September 9th, it has attracted over 30 dApps to build on it.

XRP is the native asset of XRPL, minted entirely at the genesis of the XRPL network. Its total supply is capped at 100 billion and cannot be further issued. XRP is used to pay XRPL network fees (and is burned for anti-spam purposes), as collateral for accounts and ledger objects, and as a bridging liquidity provider within XRPL's built-in DEX/AMM and auto-bridging, enabling swaps and transfers between different tokens or fiat gateway assets in a single transaction. It can also be used as gas to pay contract execution fees on the XRPL EVM Sidechain, connecting to a more general EVM application ecosystem. However, it's important to note that XRP does not represent Ripple equity and does not entitle it to a share of Ripple's profits or the RLUSD reserve spread. Its value depends more on factors such as XRPL's actual usage (payments/exchanges/market making), liquidity and supply arrangements (fee burning, reserves, and escrow releases), and macro-risk appetite.

(IV) Market and competition faced by Ripple

Unlike other crypto projects that focus on internal communication, Ripple has from the outset focused on the vastly larger cross-border settlement market beyond the crypto market. According to an IMF report, the global cross-border payments market will reach $100 trillion in 2024, of which only $2.5 trillion will be settled in cryptocurrencies like USDT, USDC, BTC, and ETH. This means that cryptocurrency settlement is still in its early stages, with numerous challenges to overcome. First, cross-jurisdictional licensing, Know Your Customer (KYC), Anti-Money Laundering (AML ), and the "Travel Rule" differ significantly, resulting in uncertain compliance availability and hindering banks and large enterprises from achieving a unified global rollout. Second, the first-to-last mile (fiat deposits and withdrawals, beneficiary-side payment processing, and refund processing) remains a bottleneck, with local clearing and reconciliation processes in many corridors incomplete. Third, on-chain liquidity and market making depth are concentrated in a small number of coins and platforms, making it difficult to consistently meet the high-volume, low-slippage needs of mainstream currencies like the US dollar, euro, pound, and yen. Fourth, enterprise-level internal controls and accounting audits (multi-signature, segregation of duties, accounting and tax processing, and audit trails) are more mature in the traditional payment system, while the on-chain and stablecoin systems still need time to adapt. Meanwhile, traditional cross-border payment systems are continuously improving in speed and reducing friction (SWIFT gpi/ISO 20022, and the interconnection of international instant payment systems), raising the "usability baseline." Most institutions prefer cryptocurrencies/stablecoins as supplementary rather than primary channels.

At the 2025 APEX Summit in Singapore, Ripple CEO Brad Garlinghals stated that XRP is expected to replace 14% of SWIFT's settlement volume within the next five years. As the world's leading transaction settlement network, SWIFT handles tens, if not hundreds, of times more transactions than the total volume of cryptocurrency transactions. Even if SWIFT's 14% of the system's volume were limited to $20 trillion, cryptocurrency payment platforms like Ripple would need to achieve a compound annual growth rate exceeding 51% to replace this portion of settlement volume, a challenging growth curve. Therefore, Ripple's growth outlook is more of a "visionary goal." Before competing for market share with traditional payment systems like SWIFT, Ripple still needs to address a series of pre-requisites, including regulatory approvals, access to deposits and withdrawals, and liquidity depth.

For Ripple, a more realistic growth path is to achieve phased breakthroughs in specific corridors and customer segments (crypto-native businesses, platform economies, and emerging markets where traditional financial settlement is underdeveloped), operating alongside traditional channels. As compliance (especially in the US and EU) and stablecoin governance become clearer, and custody and market-making capabilities become more sophisticated , Ripple can then gradually expand its penetration. A key characteristic of the cross-border payments market is that these payments often cannot bypass regions like the US, EU, and UK, which have mature financial systems, robust regulation, and greater compliance challenges. For Ripple, which primarily serves institutions, compliance in major jurisdictions around the world must be a primary concern.

(V) What is Ripple’s moat? Compliance, public sector endorsement, and capital accumulation

Compliance is not only a primary issue for Ripple, but also a crucial opportunity for it to seize market momentum and establish a competitive edge in cross-border cryptocurrency payments. As of April 2025, Ripple has secured over 55 money transmitter licenses (MTLs) worldwide, covering 33 US states and locations such as Dubai. Ripple and its subsidiaries have obtained the MAS Major Payment Institution (MPI) license in Singapore, completed VASP registration in Ireland, and obtained a DFSA license in the Dubai International Financial Centre (DIFC). Furthermore, Ripple's stablecoin, RLUSD, is issued by a NYDFS restricted trust entity, backed by 100% cash and equivalents and subject to monthly verification. It has been designated a Recognized Crypto Token by the DFSA , with reserves held in custody by BNY Mellon. This creates a closed loop of "regulatory framework, transparent reserves, and a first-tier custodian bank," significantly reducing onboarding friction and compliance uncertainty for corporate clients.

What truly makes Ripple's compliance efforts effective is its proactive efforts to engage the public sector and absorb the potential of other crypto assets. For Ripple, compliance is simply an entry point into the global cross-border payments market. Expanding access channels and earning the trust of global institutions, which is costly, difficult, and extremely scarce, are perhaps the biggest challenges Ripple faces now and in the future. Currently, Ripple's response is to promote government-business collaboration, introduce public sector projects, and provide intangible endorsement for its products . Through Ctrl Alt, Ripple provides institutional-grade custody for the Dubai Land Department's (DLD) real estate tokenization project and serves as a supporting platform for public sector CBDC projects in countries such as Georgia, Bhutan, and Palau . In addition, Ripple has also connected mainstream stablecoins to XRPL (including the native listing of USDC), which together with RLUSD form a deeper stablecoin liquidity pool, feeding back the accessibility and success rate of cross-border settlement paths; externally, Ripple Payments uses a single API to connect to the exchange network of 90+ markets/55+ currencies, taking over the real traffic of banks, PSPs and crypto companies, forming a positive cycle of "scenario-liquidity-compliance".

Ripple's confidence stems from its strong capital accumulation. XRP is one of the largest cryptocurrencies by market capitalization. Despite ongoing controversy surrounding its price and functionality, it's undeniable that XRP provides Ripple with a significant amount of capital. Unlike other crypto projects that generally pursue decentralization, the Ripple team holds a significant number of XRP tokens. Its CEO has openly stated that the sale of XRP tokens is a key source of revenue for Ripple. In its first-quarter financial report this year, Ripple disclosed that its corporate wallet holds 4.56 million XRP, valued at approximately $10.27 billion. Additionally, Ripple holds 371 million XRP in escrow accounts, valued at $83.5 billion. These funds will be gradually unlocked over the next few years. The "endogenous" nature of capital and channels has further strengthened Ripple's ability to attract investment: SBI Holdings, a long-standing strategic shareholder, continues to increase its cooperation with Ripple and plans to distribute RLUSD in Japan (targeting early 2026), transforming the shareholder relationship into a landing channel; at the same time, Ripple repurchased its Series C shares in 2022 at a valuation of approximately US$15 billion, demonstrating strong capital resilience and self-generating capabilities, providing flexibility for subsequent mergers and acquisitions, license expansion, and ecological investment.

3. What is the difference between XRP and other similar tokens?

(1) XRP vs. XLM: Design Differences and Implementation Paths of Similar Payment and Settlement Networks

1. Positioning and Origin

Although both XRP and XLM focus on cross-border payments and financial infrastructure, they have fundamental differences in their concepts and target markets.

XRP is developed by Ripple and is mainly aimed at banks and traditional financial institutions. It aims to emphasize compatibility and regulatory compliance with the traditional financial system, and aims to become a digital and intelligent upgrade solution for traditional interbank settlement.

XLM, developed by the Stellar Development Foundation, is an inclusive blockchain platform designed to provide financial services to ordinary people around the world. As such, the Stellar network prioritizes financial inclusion, supporting native issuance and trading of multiple assets and incorporating a built-in decentralized exchange.

2. Consensus and Network Structure

The two sides chose different consensus mechanisms for positioning.

XRPL utilizes a Byzantine Fault Tolerant consensus based on the UNL (Unique Node List) and a Negative UNL fault tolerance mechanism. Protocol upgrades require support from over 80% of validators for two weeks to activate. This mechanism creates a highly controllable network environment, ensuring institutional-grade stability and predictability . However, this comes at the cost of concentrating governance in the hands of a small number of trusted nodes, creating a permissive ecosystem more suitable for traditional financial institutions.

XLM utilizes the Federated Byzantine Agreement (SCP) consensus and a "quorum slice" structure. This design unleashes the network's autonomy and inclusiveness, allowing any node to participate and build trust relationships without permission . This creates a truly decentralized global payment network that can adapt to the diverse needs of participants of different regions and sizes, but it also introduces greater complexity and uncertainty.

3. Functional Components and Programmability

XRPL has a more mature native trading infrastructure - the native CLOB+DEX has existed since 2012. In 2024, the XLS-30 AMM was launched on the mainnet and continued to be optimized. The EVM sidechain mainnet launched in 2025 allows XRP to be used as gas fees, and multi-chain interoperability is achieved through the Axelar bridge, forming a complete ecosystem from native transactions to EVM compatibility.

In contrast, Stellar has chosen a more radical smart contract route. In 2024, Protocol 20 activated the Soroban smart contract platform, and the SDF official supporting ecological fund promoted developer adoption.

4. Token Economy and Supply Governance

In terms of token economics, XRP utilizes a pre-mined model, with a fixed total supply of 100 billion . The current circulating supply is 594.8. Ripple holds nearly one-third of all XRP and, starting in 2017, has placed 55 billion in on-chain escrow, releasing it monthly. Any unused portion of the token is rolled back and re-locked. This model provides stable funding for the network, but also raises concerns about centralized control. XRP's destruction mechanism is implemented through transaction fees, with each transaction destroying a small amount of XRP, theoretically resulting in deflationary properties.

XLM also uses a pre-mining model. In 2019, 55 billion XLM were destroyed , reducing the total supply to 50 billion . The current circulating supply is 31.73 billion, and the original annual inflation mechanism has been completely eliminated. The current fee model uses a destruction mechanism—all transaction fees are no longer distributed to validating nodes, but instead accumulate in a fee pool (a non-circulating pool). Theoretically, the use of the fee pool can be changed through governance.

5. Ecosystem and Implementation

In terms of its ecosystem, RippleNet has established partnerships with over 300 financial institutions worldwide, including renowned institutions such as Santander, American Express, and Standard Chartered Bank. The launch of the XRPL EVM sidechain in 2025 marks a significant expansion of the XRP ecosystem into the DeFi sector. Currently, over 160 tokens have been launched on the mainnet, with over 17,000 unique wallet addresses participating. Regarding the regulatory environment, XRP reached a settlement with the SEC in 2025, paying a $50 million fine, clearing a significant obstacle for its development in the US market. Several XRP ETF applications are currently awaiting SEC approval.

The XLM ecosystem is evolving towards practical application. The Stellar network currently boasts a TVL of $139.8 million, primarily comprised of DEX trading and lending protocols. Stellar's native USDC/EURC issuance makes it a key node in the stablecoin infrastructure. Cash deposit and withdrawal partnerships with MoneyGram Ramps and humanitarian payment pilot programs with organizations like the United Nations High Commissioner for Refugees (UNHCR) directly bring fiat currency to the masses. These initiatives have established practical application scenarios for Stellar in the payment and remittance sectors.

6. Conclusion

- Similarities : Targeted at payment and settlement, low fees, and account retention requirements; both are improving "smart contract" capabilities (XRPL uses "AMM+EVM sidechain" and Stellar uses "L1 Soroban").

- Differences : XRPL emphasizes "native market infrastructure (DEX/AMM) + sidechain expansion," while Stellar emphasizes "wide coverage of fiat currency deposits and withdrawals and stablecoin circulation." On the compliance side, XRP has gained secondary market clarity due to precedents, while XLM has long pursued payment network expansion led by a non-profit foundation.

(II) XRP vs. LINK: Comparison of “Value Capture Models” in Different Sectors

1. Product and Network Functions

The core functions of the XRPL network are ledger settlement, payment, issuance, and matching . As the native token of the XRPL network, XRP's value primarily stems from network-effect driven payment demand, its institutional liquidity bridging function, and its deflationary burn mechanism for transaction fees. Following the launch of the XRPL EVM sidechain mainnet in June 2025, XRP will serve as the native gas token within the sidechain, fueling the DeFi ecosystem and enabling cross-chain interoperability with over 100 blockchains through the Axelar bridge.

Chainlink, the leading decentralized oracle network , provides price oracles for over 3,000 assets, handles over $166 million in daily throughput through the Cross-Chain Communication Protocol (CCIP), and provides proof of reserves. Furthermore, Chainlink is currently pursuing landmark partnerships with SWIFT, SBI Group, and even the Federal Reserve. This deep integration elevates the value capture of the $LINK token from a single service payment to a multi-dimensional token for node staking and network economic security .

2. Token Usage and Value Capture

The value capture of XRP is mainly achieved through the following dimensions: First, the liquidity demand as a bridge currency. Financial institutions need to hold a certain number of tokens when using XRP for cross-border transfers; second, the payment of network fees . Although the single transaction fee is extremely low (0.00001 XRP), the cumulative effect under large-scale application is significant; third, institutional reserve demand . As more companies include XRP in their asset allocation, reserve demand drives up prices.

LINK's value capture mechanisms are more diverse and sustainable. Oracles pay LINK tokens for every data query . The staking mechanism requires node operators to lock up LINK as a service guarantee, reducing the circulating supply. The launch of the Cross-Chain Interoperability Protocol (CCIP) requires users to pay LINK for cross-chain asset transfers. Furthermore, Chainlink's revenue sharing mechanism allows LINK holders to participate in network revenue sharing .

3. Ecosystem and institutional collaboration signals

Chainlink is establishing its leadership in institutional collaboration through deeper strategic value. It is collaborating with SBI Group to jointly develop tokenized asset standards in the Asia-Pacific region, and is also collaborating with the US Department of Commerce to become the first platform to provide blockchain data services to the government . Furthermore, by obtaining enterprise-grade security certifications such as ISO and SOC2, Chainlink is clearing key compliance barriers for mass adoption by traditional financial institutions, demonstrating the market's unwavering trend toward standardized adoption of its services.

At the same time, with the historic settlement with the SEC in 2025, XRP has finally broken free from regulatory constraints and entered a new phase of multi-dimensional expansion. Its core banking partnership network is accelerating from concept to scale-up . Integration testing with SWIFT, as well as ETF applications and custody services in the Asia-Pacific region, demonstrate its growing regulatory acceptance. More importantly, through the combination of the RLUSD stablecoin and the EVM sidechain, XRP's strategic narrative is expanding from a single "cross-border payment" platform to a comprehensive "multi-chain programmable finance" platform. This momentum has been initially verified by the active development of over 75 testnet DApps and the asset allocation of listed companies.

4. “Is XRP like LINK, overvalued?” — The correct way to compare

Simply comparing the market capitalizations of XRP and LINK often yields a misalignment. We recommend using three sets of quantifiable indicators to cross-validate the strength of value capture:

Cash flow/expense side

LINK and XRP have completely different cash flow models. LINK generates real fee revenue through oracle data requests and CCIP cross-chain messaging. Within 30 days, oracle service fees reached $400.22K, and CCIP cross-chain service fees totaled $603.07K. With a historical total revenue of $1.08M, approximately 32% of fees are converted into protocol revenue. Active paying customers range from DeFi protocols to traditional financial institutions. More importantly, the $1.01B in staked TVL provides security for the network, and staking coverage demonstrates that fees are sufficient to support the network security budget.

XRP's network fees are directly destroyed rather than distributed as dividends. Although there are payment settlement and DEX/AMM activities on XRPL, and Ripple Payments also handles cross-border remittances, the key lies in demand elasticity - how much users are willing to pay for fast settlement . The actual circulation and payment use of stablecoins such as RLUSD on the chain are the core of value capture, rather than traditional cash flow dividends.

Supply and unlocking side

XRP faces pressure from the continued release of tens of billions of tokens held by Ripple through the escrow mechanism . Although there is a rhythm of lock-up, the total amount is huge. Any large changes in the Ripple wallet will affect market expectations.

In comparison, LINK’s annual release rate is about 7% of the total, which is relatively controllable and transparent. The usage of the team and the treasury is clearly disclosed. More importantly, the newly launched staking and locking mechanism has begun to hedge some of the release pressure.

This difference in supply structure directly impacts the price elasticity of the two tokens and the confidence of long-term holders.

Adoption and network effects

In terms of adoption and network effects, the two are following completely different paths. LINK has become the standard for cross-chain infrastructure, with the number of connected public chains continuing to grow and CCIP cross-chain message volume increasing exponentially. Its productization progress with SWIFT, major custodian banks, and exchanges has established an irreplaceable moat in traditional finance. While XRP boasts the grand vision of a payments network, actual data shows that its EVM sidechain's TVL of $96.80M and the number of active contracts are still limited . Its native DEX/AMM liquidity and routing share are also low. While the number of actual fiat deposits and withdrawals and stablecoin payments on XRPL is growing, it still has a long way to go before becoming a global payment infrastructure. The depth of its network effects determines the width of its moat, which is why market capitalization rankings shouldn't be used as a simple indicator of investment value.

IV. Conclusion

Having escaped the shadow of the SEC lawsuit, Ripple is continuing its controversial journey into the payment market, where it has been building for years. Compliance with regulations and disclosure obligations, including cross-jurisdictional regulations, remains a fundamental constraint on Ripple's operations and financing. Furthermore, Ripple's "payment (traffic) - custody (assets) - stablecoin (settlement)" flywheel is gradually unfolding. However, Ripple's goal of achieving widespread, even "alternative-level" penetration still depends on three key factors:

(1) Regulatory clarity : The institutionalization of stablecoins and on-chain settlement in major jurisdictions;

(2) First-to-last mile and liquidity : Market making depth, failure rate, and in-transit position management indicators in core corridors such as USD/EUR meet bank-level SLAs ;

(3) Unit Economics : Can the difference between Ripple Payments' take-rate/failure rate/operating costs and RLUSD's reserve income-compliance cost difference "leave room" for both customers and companies in the long term? If Ripple can make significant progress in the above three aspects, then we can expect Ripple to take advantage of the momentum of asset tokenization and take the lead in forming scalable and replicable unit economics in several corridors. However, at this stage, Ripple's cross-border payment business will play a supplementary role and coexist with the traditional rail for a long time.

Compared to other projects often mentioned together, XRP and XLM have chosen different paths within the same space. XRP pursues "institutional compliance + native market infrastructure (CLOB/AMM) + sidechain expansion," while XLM pursues "inclusive access + fiat currency deposits and withdrawals + wide stablecoin coverage." XRP and LINK, on the other hand, are essentially separate platforms. XRP's value is anchored in "settlement scale and turnover of XRP routing + supply/burn constraints," while LINK's is anchored in "paid usage and security budget" (oracle/CCIP fees and staking). Therefore, using the same multiple to assert overvaluation or undervaluation is inappropriate . A more pragmatic approach is to track: XRP's routing share and depth, net escrow changes; LINK's paid revenue and staking coverage, and so on. Whichever platform first achieves a sustained upward trend in its core KPIs will be more deserving of a valuation premium .