Ethereum (ETH) is approaching the long-awaited $5,000 mark but may face hurdles as on- chain signals point to difficulties ahead.

Data shows that ETH long-term investors (LTHs) are actively distributing their coins, creating selling pressure that could impact the market. At the same time, Dai negative sentiment among Futures Contract traders also adds a layer of caution, putting ETH's short-term upside at risk.

LTH profit-taking halts ETH breakout

ETH sideways price action for a month has created an opportunity for long-term investors (LTHs) to take profits after the record price surge in late August.

This trend is evident in the coin's Liveliness index, which, according to Glassnode, has risen to a yearly high of 0.704.

For Token News and Market Updates: Want more Token news like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

ETH Liveliness. Source: Glassnode

ETH Liveliness. Source: GlassnodeAn asset's Liveliness Index tracks the movement of previously inactive Token by measuring the ratio of coin-destroyed days to total coin-accumulated days. When this index falls, LTHs are moving their assets off exchanges, a sign that accumulation is occurring.

Conversely, when an asset's Liveliness index increases, more inactive coins are sold, signaling increased profit-taking by LTHs.

Therefore, the increase in ETH Liveliness indicates that LTHs are actively taking profits instead of waiting for the next price increase. This selling pressure could limit ETH ability to make a strong breakout to $5,000 in the short term.

Futures Contract traders maintain strong selling pressure

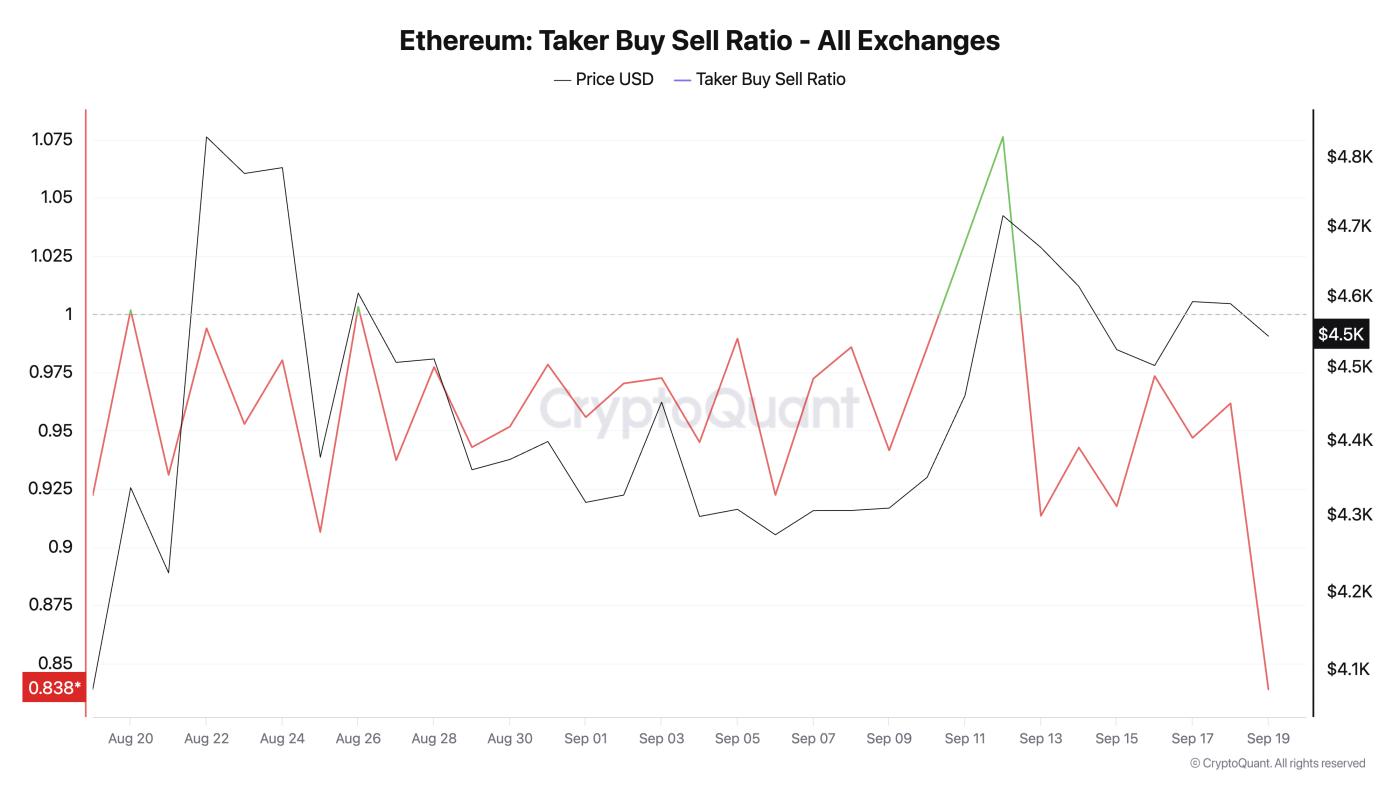

Dai negative sentiment in the Derivative market has added to this pressure. Data from CryptoQuant shows that the ETH Futures Contract market's buy-sell ratio has been largely in the red for much of the past month, indicating a sustained exodus of Futures Contract traders.

Ethereum buy-sell ratio. Source: CryptoQuant

Ethereum buy-sell ratio. Source: CryptoQuantThe buy-sell ratio of an asset measures the balance between buying and selling volume in the Futures Contract market. A value greater than one indicates stronger buying volume, while a value below one signals stronger selling activity.

As seen with ETH, the value below one has remained consistently for over a month. This indicates a Dai negative position among traders, which could further delay ETH 's rally to $5,000.

$5,000 breakout depends on demand recovery

At the time of writing, the top altcoin is trading at $4,542, holding above support at $4,211. If negative sentiment intensifies and the sell-off continues, the coin could retest this support line.

If it fails to hold, the price could fall further to $3,626.

Ethereum Price Analysis. Source: TradingView

Ethereum Price Analysis. Source: TradingViewHowever, if demand for ETH picks up again, this negative outlook could be invalidated. In that case, the coin's price could attempt to break above the resistance at $4,957. If successful, it could push the price to new highs above $5,000.