BlackRock has quietly turned its initial foray into the crypto market into a lucrative business, earning more than $260 million in annual revenue from digital asset products in less than two years.

The gains were largely driven by the rapid success of its Bitcoin and Ethereum spot ETFs, which dominated their markets and are now among the most profitable products in the company's portfolio.

How BlackRock Quietly Built One of Its Most Profitable Businesses Through Crypto ETFs

BlackRock’s iShares Bitcoin Trust (IBIT) generated about $218 million in fees at a 0.25% commission in its first year, according to data from Dragonfly partner Omar Kanji. Its Ethereum fund, ETHA, added $42 million under the same fee structure.

Kanji emphasized that this milestone is notable not only because of the size of the revenue. He noted that achieving this within a year of launching shows how quickly BlackRock has established itself in crypto finance.

The success of these funds reflects a broader trend: investors are paying significantly more for access to crypto products than traditional ETFs.

While IBIT and ETHA charge 0.25% annually, most of BlackRock's established ETFs —including its flagship IVV fund—charge between 0.03% and 0.1%.

This disparity highlights how institutional demand for Bitcoin and Ethereum has translated into high pricing power for asset managers.

Meanwhile, this strategy has coincided with investor enthusiasm for this type of market.

Launched in January 2024, IBIT has become the largest crypto ETF globally and currently ranks as the 22nd largest ETF by assets, according to VettaFi .

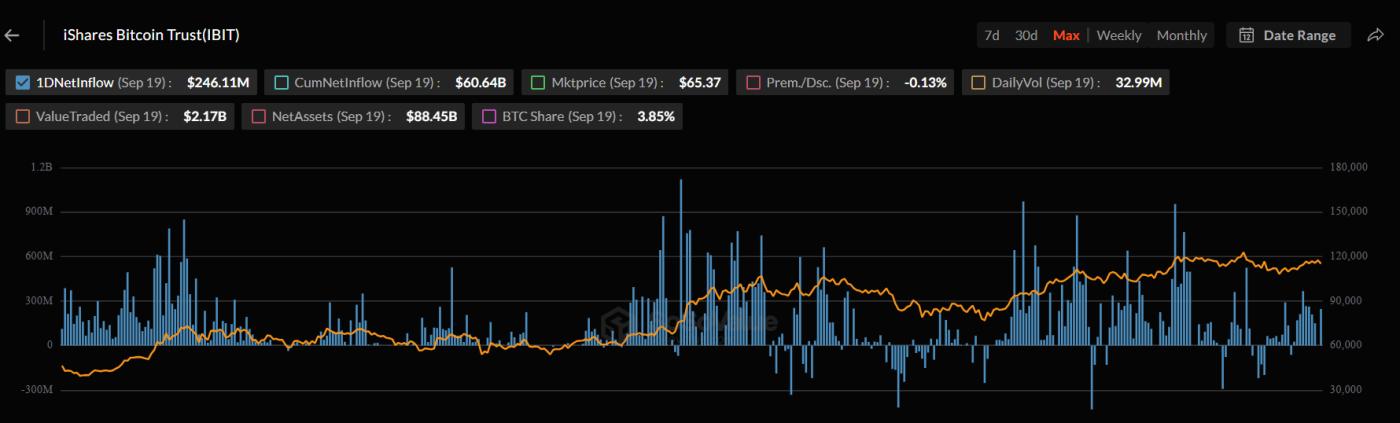

Additionally, data from SoSo Value shows that IBIT has attracted $60.6 billion in net Capital , accounting for nearly three-quarters of all Bitcoin ETF Capital in the U.S. It now manages more than $88 billion in assets, cementing Vai as an industry leader.

BlackRock's IBIT Capital Flows. Source: SoSo Value Data

BlackRock's IBIT Capital Flows. Source: SoSo Value DataOn the other hand, BlackRock's Ethereum product, ETHA, has also become a force in its portfolio.

Since its launch in July 2024, ETHA has attracted $13.4 billion in net Capital , accounting for 72.5% of total ETH ETF Capital in the US.