Hyperliquid

This generation of Perp DEX is fundamentally different from the "GMX, DYDX" generation of Perp DEX. Since it is still Perp DEX, the title will still use Perp DEX to discuss it.

Starting with "Perp DEX", it quickly rose to prominence and became known to everyone.

Hyperliquid is a Layer 1 public chain, similar to Ethereum and Solana. Hyperliquid has a grand vision: to be a blockchain that supports all financial services and a high-performance on-chain financial transaction infrastructure . Hyperliquid offers both perpetual contract trading and spot trading, and has recently been developing the USDH stablecoin.

Further reading: The Hyperliquid bidding war is over. Why did Native Markets win the USDH stablecoin?

Its development path can be glimpsed through the HIPs, from HIP-1, HIP-2, to HIP-3, and most recently, the community proposed HIP-4. HIP-4 aims to create "Event Markets" similar to Polymarket, further expanding Hyperliquid's product boundaries. Simply put, it's a binary market traded on HyperCore. Unlike traditional perps, events don't rely on continuous oracles or funding; prices are determined entirely by trading behavior. This proposal has also been endorsed by Jeff (I won't discuss HIPs in detail here; a dedicated research article will be written later).

Hyperliquid is affectionately referred to by the community as " Binance on Chain ," a name that has caused some anxiety among Binance executives. Alternatively, Hyperliquid could be called the " AWS of Liquidity ," a more sexy name.

Hyperliquid L1 Technical Architecture and Performance

Working from first principles, the Hyperliquid team has developed a high-performance Layer-1 blockchain specifically designed for transactions to address issues such as poor liquidity, poor trading experience, opacity, and fraud in the crypto market. The architecture consists of two components: HyperCore and HyperEVM .

HyperCore is an on-chain matching engine responsible for placing orders, matching, margining, and clearing on the Central Limit Order Book (CLOB), all performed on-chain. Hyperliquid's choice of CLOB over an AMM was a good decision, as the previous AMM, Perp DEX, was a poor experience. CLOB is also a common choice among mainstream Perp DEXs. (Aster, Lighter, and edgeX also use CLOB, with Aster offering both AMM and CLOB.)

HyperEVM is a general-purpose smart contract layer that shares consensus with HyperCore, maintaining compatibility with the Ethereum EVM and facilitating integration with other applications to exchange state. This consensus utilizes a modified HyperBFT (Proof of Stake) algorithm from HotStuff, ensuring consistent transaction order across the entire network without relying on off-chain matching.

This tightly coupled sharding design delivers speeds approaching those of centralized exchanges: median transaction latency is approximately 0.2 seconds (99% of transactions are < 0.9 seconds), with peak throughput reaching 200,000 transactions per second (according to HyperLiquid's official data). Hyperliquid's block generation and confirmation speeds are exceptional, achieving sub-second finality. Thanks to its fully on-chain order book and matching, Hyperliquid boasts high transparency while maintaining exceptional performance, truly achieving " on-chain CEX speeds ." Currently, Hyperliquid has not explicitly adopted EigenLayer's AVS (Active Verification Service) solution, relying primarily on its own chain and consensus to ensure performance and security. These performance and security are provided directly by its own chain , independent of the ETH restaking network. As of September 2025, Hyperliquid L1 has 24 active nodes.

User Experience and Interface

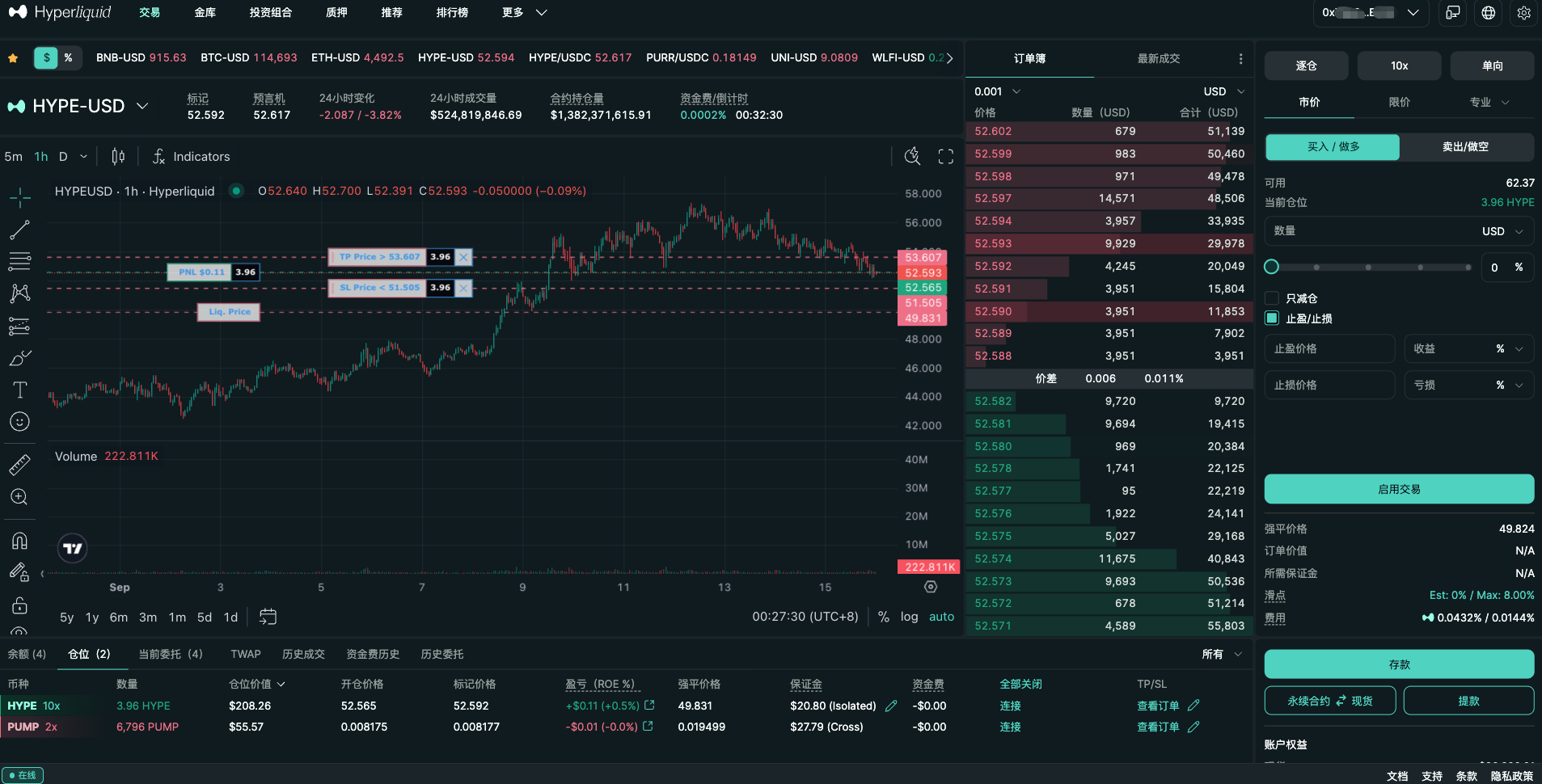

Hyperliquid offers a trading experience consistent with leading CEXs. The user interface features a traditional order book and candlestick chart design, supports advanced limit orders, stop-loss orders, and other advanced order types, and includes professional trading tools. Trade settlement is almost instant (sub-second), and the interface offers smooth, lag-free operation. It caters to both professional and retail traders. The "click" notification sound for opening and closing positions is also very pleasant.

Users can use a web3 wallet for permissionless access and non-custodial transactions , but their assets must be bridged to Hyperliquid L1. Currently, USDC can only be deposited via the Arbitrum chain. An agent wallet is then generated (with only trading permissions, not transfer permissions, and the private key is stored locally). Opening and closing positions does not require signatures, ensuring a smooth overall experience.

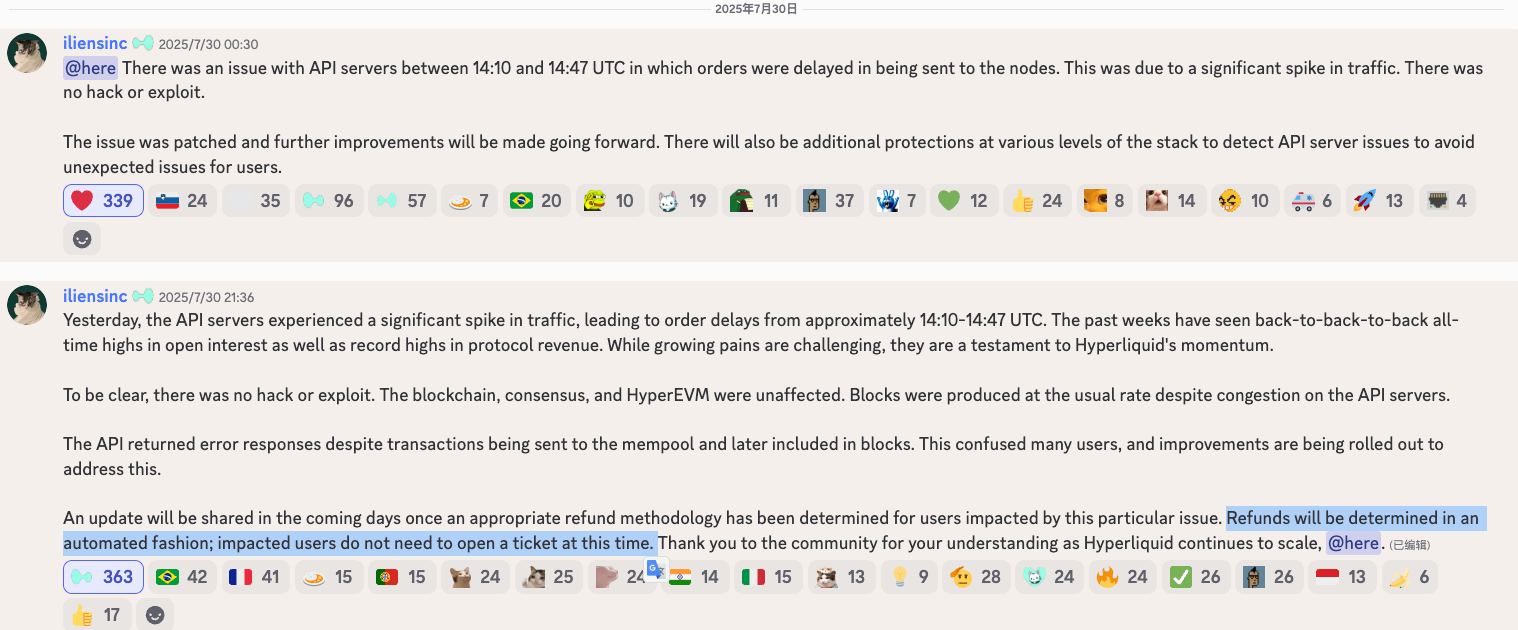

Hyperliquid maintains a strong community connection and a responsive approach. For example, in July 2025, after an API outage caused a brief outage, the team quickly compensated users for approximately $2 million in losses, demonstrating a commitment to rapid response and accountability. This experience has been positive for users and the community.

Liquidity and Trading Depth

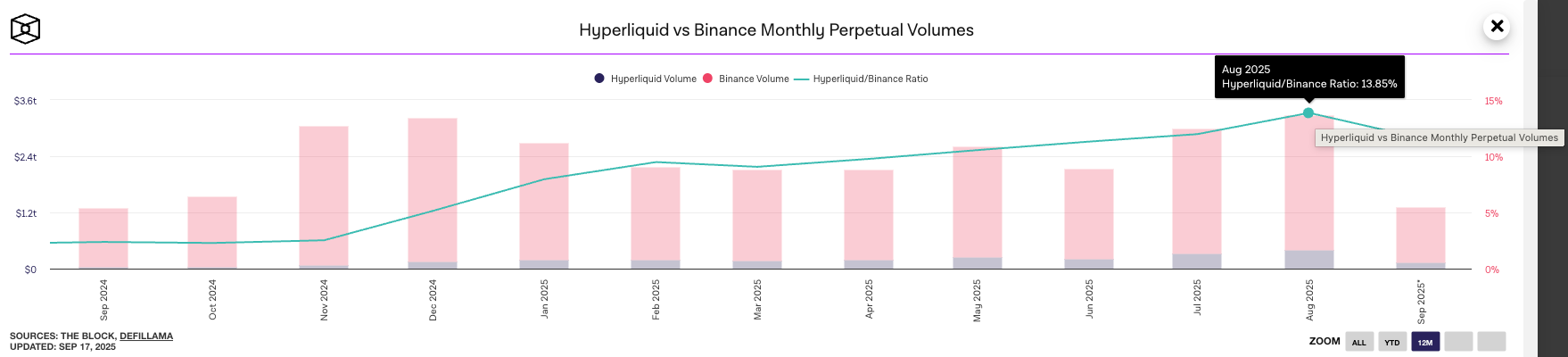

As a leading provider of perpetual swaps, Hyperliquid boasts deep liquidity and trading volume. Its daily trading volume often reaches billions of dollars. In July 2025, perpetual swaps trading volume reached approximately $319 billion, pushing the total perpetual swap volume for the month to a new high of $487 billion. Hyperliquid alone accounted for approximately 65% of this volume.

By mid-2025, Hyperliquid's market share had stabilized between 75% and 80%, far exceeding its competitors. In August 2025, its perpetual swap volume accounted for 13.85% of Binance's total futures trading volume, a record high. (Data from The Block)

The platform supports over 100 trading pairs, covering both mainstream and long-tail assets, with rapid listing response times. Its on-chain order book model provides transparent visibility into user order depth and matching results. Coupled with the onboarding of professional market makers and the introduction of the HLP market-making pool, Hyperliquid achieves exceptionally low spreads on mainstream cryptocurrencies and minimal slippage for large trades.

Its total locked value (TVL) is also significantly higher than its competitors: as of September 2025, the platform's TVL is approximately $2.7 billion. This massive amount of capital and depth enables Hyperliquid's contract market to have trading depth and stable funding rates similar to Binance for most currencies.

The fee structure and incentive mechanism are similar to those of CEXs. Hyperliquid's base transaction fee is 1.5bps for Maker and 4.5bps for Taker , which is slightly lower than mainstream CEXs overall. Currently, users who stake HYPE tokens can enjoy fee discounts of up to 40% (requires staking over 500,000 HYPE), similar to Binance's VIP tier, where BNB holdings are tied to VIP status.

Vaults

Hyperliquid's treasury consists of three parts: AF, HLP, and user treasury.

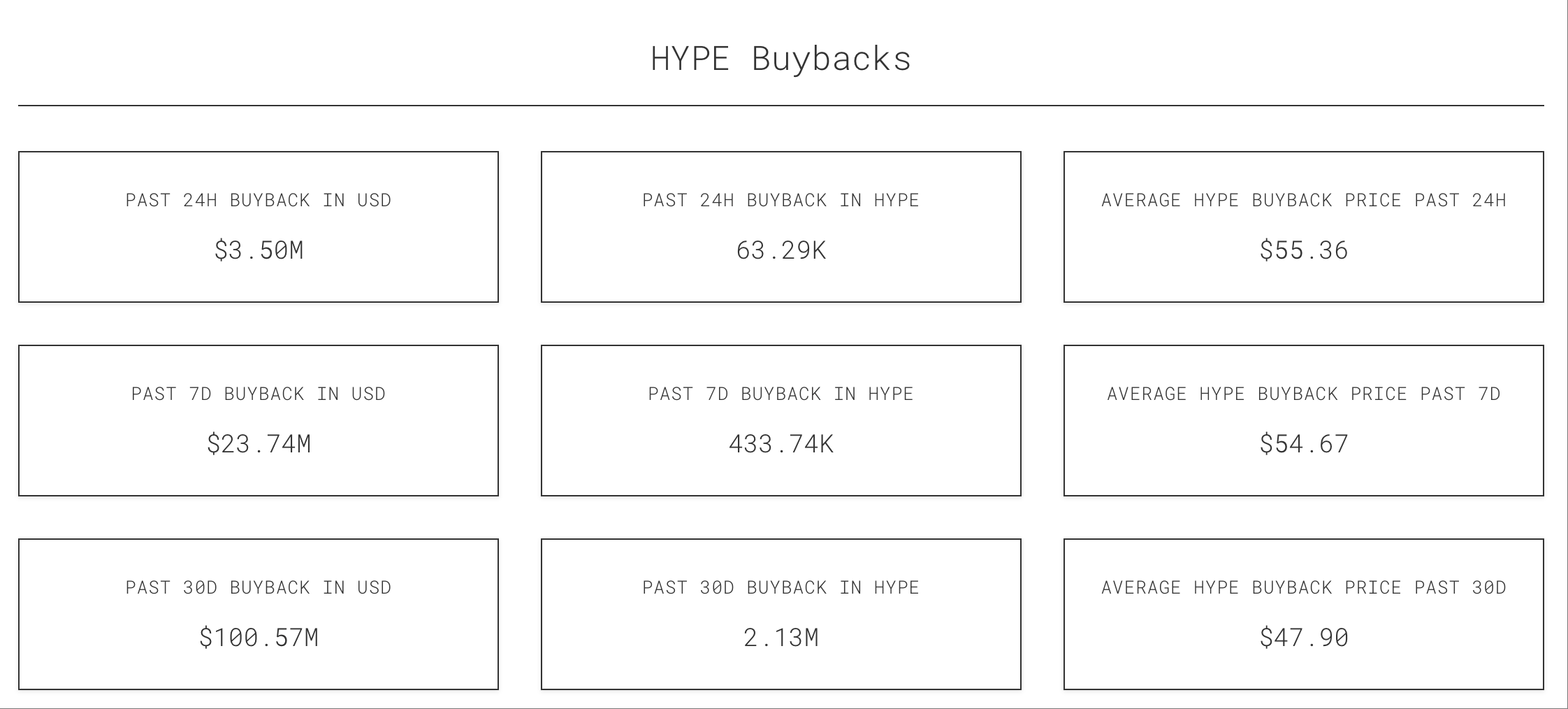

Protocol Treasury A: Assistance Fund (AF) AF serves as the protocol's "treasury" and buying engine. It is primarily used to repurchase (and often burn) HYPE tokens; it is also used to compensate users in special events (approximately 2 million USDC was automatically compensated following the API outage on July 29, 2025). AF's assets are primarily HYPE, reducing slippage and execution complexity during large transactions and compensation.

Approximately 93% of platform fees are injected into the fund to repurchase and burn HYPE tokens, with an additional 7% allocated to the HLP market-making pool. This design creates a positive flywheel: increased trading volume → increased fee revenue → more tokens are repurchased and burned (increasing token value) and the market-making pool benefits → attracting more users and liquidity .

數據來源asxnProtocol Vault B: HLP (Hyperliquidity Provider)

HLP is positioned as a protocol-level market-making platform with a liquidation backup (including the Liquidator component). Anyone can deposit USDC to participate in HLP's PnL distribution, with a current annual interest rate of approximately 6.7% and no management or performance fees (unlike user vaults). Deposits are redeemable four days after deposit. The HLP mechanism ensures open and transparent market-making liquidity, reducing the reliance on private agreements with market makers in traditional markets.

User Vaults

It consists of a Vault Leader (a manager who trades with their own strategy) and a Depositor (a contributor who deposits funds and shares the PnL). This system is similar to copy trading systems used by secondary funds and CEXs. The Leader takes a 10% commission (only on profitable trades), while the protocol vault does not take a commission.

Community Development and Team

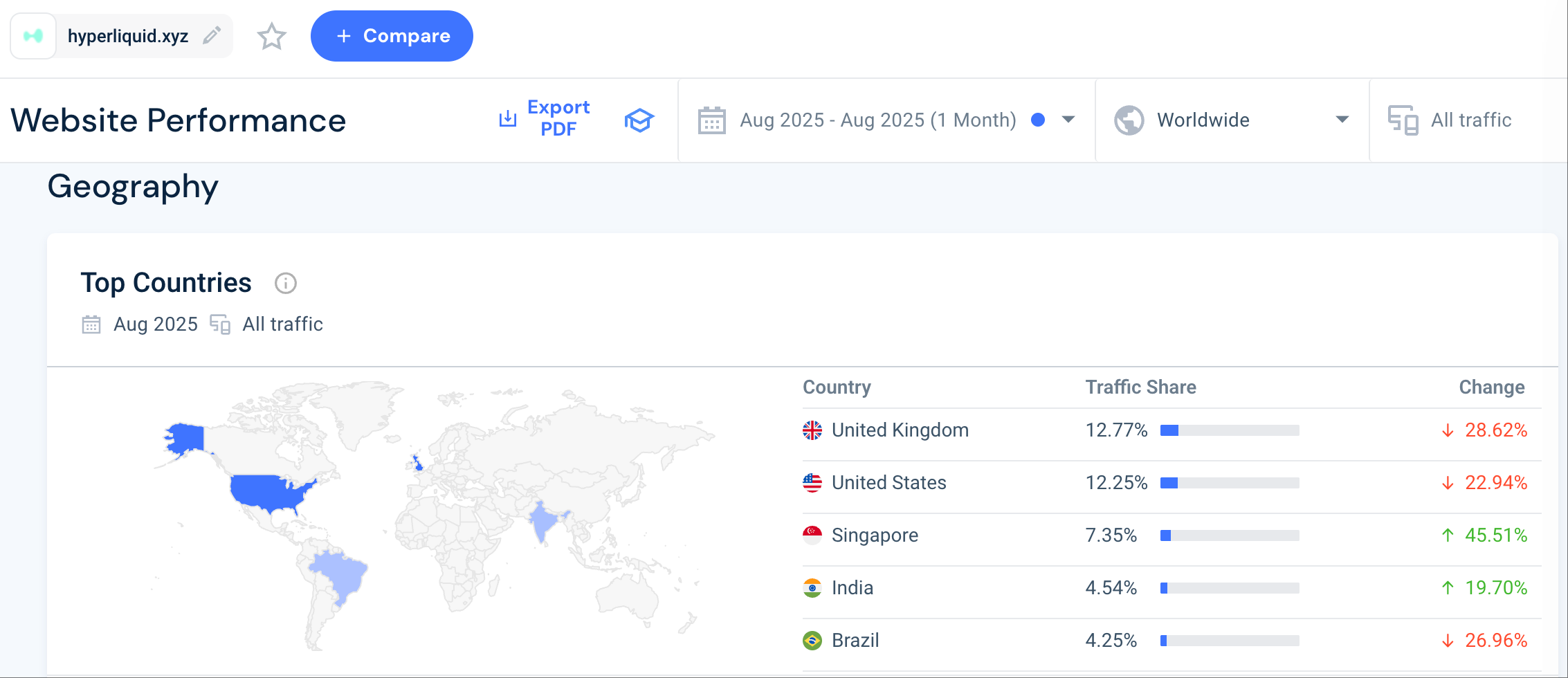

Community Development: Hyperliquid boasts a highly active global community, with a stronger presence in Europe and the United States than in the Chinese-speaking region. The company is highly active on social media platforms like Twitter, maintaining a consistently high market share and creating a network effect within the perp DEX space.

The heated community discussion is also reflected in the token's value. In November 2024, Hyperliquid airdropped its genesis token, HYPE, totaling 310 million (31% of the total supply) to early adopters. Following the airdrop, HYPE's total market capitalization reached billions of dollars, reaping rich rewards for early community participants and establishing a positive reputation within the decentralized community. User growth is primarily driven by word-of-mouth and superior product acquisition, rather than excessive marketing. This is somewhat similar to Tesla.

Team Background and Funding: Hyperliquid was founded by Jeff Yan, a Harvard graduate who previously worked at Hudson River Trading, a traditional financial high-frequency trading firm. The core team consists of only approximately 11 people and is known for its small, elite team's rapid iteration. According to Jeff, the project has been entirely self-funded since its inception, rejecting venture capital investment to ensure independent decision-making and prioritize user interests.

This " no VC, no private placement " approach has fostered community trust and enabled the team to focus more on its technology and product. Most team members hail from world-renowned universities and leading tech and financial institutions, and reportedly have attracted several senior executives from traditional finance to serve as advisors (including a former major bank CEO serving on the board). However, market sources suggest Hyperliquid may have raised funds through affiliated listed entities, demonstrating its substantial financial strength (the platform's treasury holds over $500 million in reserves). Overall, the Hyperliquid team is low-key and pragmatic, leveraging their deep technical and transactional background to achieve industry-leading status within two years. This background also explains their meticulous pursuit of product refinement and user experience.

The fundamental reason for rapid growth

There's been much discussion about the reasons for Hyperliquid's success. Beyond the aforementioned factors of a well-thought-out team, exceptional product technology, and user experience, we can also consider the "principle" and "technique" aspects of Hyperliquid's success, examining what they achieved at different stages.

First, let’s look at it from the perspective of “ technique ”.

Phase 1: Airdrop Incentives

Before the HYPE TGE, there was anticipation for an airdrop, with most users seeking to boost their trading volume to earn points and airdrops. At this time, Hyperliquid wasn't gaining much attention from mainstream CEXs and wasn't considered a competitor. Many assumed it would follow the example of GMX and DYDX, fading into obscurity and lacking trading activity after the TGE.

Phase 2: Compliance and Regulatory Dividends

After HYPE's TGE, Hyperliquid's trading volume increased instead of decreasing, signaling a shift in sentiment. The consensus is that regulatory compliance pressures are hindering mainstream CEXs, such as Binance, in the European and American markets. These lost users were taken over by Hyperliquid (as evidenced by the visitor distribution on the Hyperliquid website). Furthermore, some money exchanges that struggled with KYC have also found a suitable tool.

At this point, Hyperliquid was already considered a competitor by Binance, OKX, Bitget, and others, and they took action to target Hyperliquid. (Traces of this can be found in the community, but I won't elaborate here.)

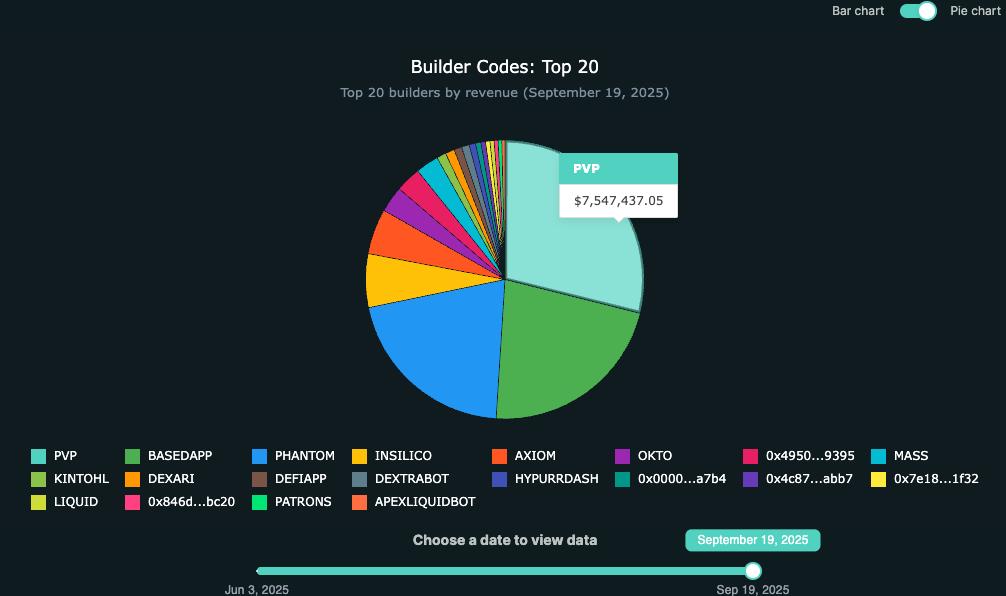

Phase 3: Build Codes – Channel Distribution is King

KOL rebates and affiliate programs are common user acquisition methods for CEXs. Beyond branding, PR, community development, SEO, and campaign development, BD-driven KOL rebates are a crucial growth path for CEXs.

The percentage of users brought in by KOL rebates varies across CEXs, ranging from around 50% for Binance to around 70% for Bitget. Furthermore, smaller CEXs offer higher KOL rebates, as do their user and trading volume share. Many small CEXs even offer 90%-100% rebates, driving growth through a "flywheel" of " eating customer losses and subsidizing rebates ."

Hyperliquid's commission rebate is only 10%, and it's limited to the first 1 billion in trading volume. Based on an average fee rate of 3bps, if someone you invite contributes 300,000 in fees, you'll only receive 30,000. Rebate invitations aren't the focus of Hyperliquid; Build Codes is.

Few people realize the true power of Build Codes; it's a distribution strategy with truly exponential potential. Developers no longer need to build high-performance order books or attract liquidity, as Hyperliquid provides the necessary infrastructure. Hyperliquid no longer needs to manage product promotion, user acquisition, or even product innovation, as all of this is delegated to the Builder Network. It's a bit like the Perp DEX, a Swiss team I previously worked for (with a UBS background) that spun out. It adopted a white label approach, which was the right direction, but unfortunately the product wasn't very strong. Previously, Binance Broker and OKX's cloud exchanges/nodes were similar solutions. The essential difference with Build Codes lies in its ease of access, low barriers to entry, and on-chain transparency.

Currently, Phantom Wallet, Axiom, UXUY, and PVP.trade have all integrated this solution. Phantom has already contributed approximately 40,000 new users , and PVP.trade has generated $7.5 million in daily revenue. I've also completed the development of a basic version of a perp DEX and plan to leverage my previous experience and channel resources to drive growth. If you're interested, please feel free to discuss.

In addition to Build Codes, there are also the killer CoreWriter and HIP-3, but the threshold is slightly higher, so I will not elaborate on them here due to space limitations.

"Tao" - Those who have the Tao have many supporters

While the above analysis of the reasons for Hyperliquid's success is quite detailed, it doesn't get to the heart of the matter. Many interpretations of Hyperliquid's success remain superficial.

But the essence can be summed up in one sentence: Hyperliquid embodies the " blockchain spirit "—openness, transparency, decentralization, and user sovereignty. Much like Binance's early days of carrying this banner against traditional finance, BTC maximalists, industry veterans, and ordinary crypto users alike are all on Binance's side. It's the true blockchain spirit that truly unites people.

From a user's perspective, many current CEXs do suffer from issues like centralized black boxes, customer losses, and trading against their users. CEX owners also face increasingly stringent regulatory compliance challenges. Consequently, many CEXs are turning to DEXs.

Thus, Binance’s crown prince, Aster , was born. We will discuss this in detail in the next article.